Blockchain In Retail Banking Market Research, 2031

The Global Blockchain in Retail Banking Market was valued at $1.4 billion in 2021, and is projected to reach $40.4 billion by 2031, growing at a CAGR of 40.4% from 2022 to 2031.

A blockchain is a shared distributed database or ledger between computer network nodes. A blockchain serves as an electronic database for storing data in digital form. The most well-known use of blockchain technology is for preserving a secure and decentralized record of transactions in cryptocurrency systems like Bitcoin. The innovation of a blockchain is that it fosters confidence without the necessity for a reliable third party by ensuring the fidelity and security of a record of data. Furthermore, blockchain technology has been addressed as a disruptive force for the financial industry, particularly for the payment and banking processes.

Increase in adoption of blockchain in retail banking for online payments due to reduced transaction time & convenience acts as a major driver in the market. In addition, surge in penetration of smartphones coupled with fast internet connectivity, rise in demand among consumers for digitalization in retail banking, and massive adoptions of digital payment channel among merchants are accelerating the blockchain in retail banking market growth. However, difficulties and complexions in implementing blockchain technologies hampers growth of the market. On the contrary, developing economies offer significant opportunities for blockchain in retail banking companies to expand their offerings, owing to factors such as rapid urbanization, rise in literacy level, and increase in tech-savvy youth generation. Moreover, growth in developments & initiatives toward digitalization of banking industry is anticipated to provide a potential growth opportunity for the market.

The report focuses on growth prospects, restraints, and trends of the blockchain in retail banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the blockchain in retail banking market outlook.

The blockchain in retail banking market is segmented into Deployment Mode, Enterprise Size, Component and Application.

Segment Review

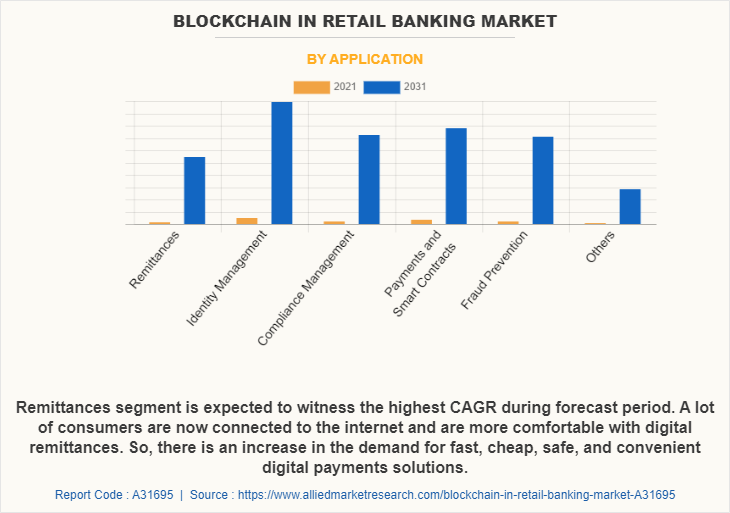

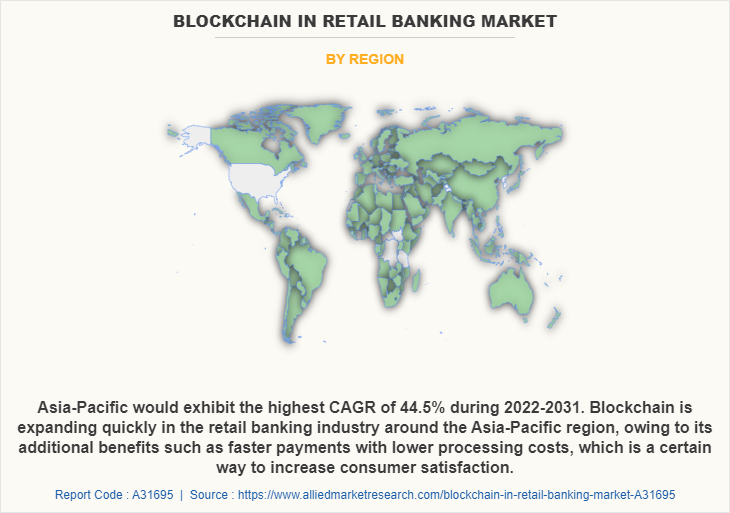

The blockchain in retail banking market is segmented into component, deployment mode, organization size, application, and region. By component, the market is differentiated into solution and services. By deployment, the market is segmented into on-premise and cloud. Depending on organization size, it is fragmented into large enterprises and small and medium-sized enterprises. The application segment is segmented into remittances, identity management, compliance management, payment & smart contracts, fraud prevention and others. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By application, the identity management segment is estimated to acquire the highest size of blockchain in retail banking market size in 2021. This is attributed to the fact that it enables decentralized public key infrastructure (DPKI), which creates a tamper-proof and trusted medium to distribute the asymmetric verification and encryption keys of the identity holders.

Region wise, North America dominated the blockchain in retail banking market share in 2021. This is attributed to the growing adoption of block chain technology for KYC/ID fraud prevention and risk scoring, as well as the growing internet penetration rate among the banking industry in the region.

The key players operating in the global blockchain in retail banking market include IBM Corporation, Amazon Web Services Inc., Microsoft, SAP SE, Goldman Sachs, Oracle, Bitpay, Cegeka, Bitfury Group Limited, and Intel Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the blockchain in retail banking industry.

Market Landscape & Trends

The retail banking industry witnesses millions of transactions every day where security, transparency, and cost-efficiency are a high priority. Most financial intermediaries such as payment networks, stock exchanges, and money transfer services suffer from cybercrime every year. Therefore, blockchain technology has gained tremendous adoption due to its intrinsic strengths to tackle secured, transparent and cost-efficient flow of transactions. Furthermore, this technology has improved payment transparency, efficiency, trust, and security as well as reduced the cost for financial services firms and users.

Moreover, a huge majority of transactions could be recorded using blockchain digital ledgers which would be unalterable and so prevent fraud. In addition, blockchain technology’s low costs give startups a chance to compete with major banks, promoting financial inclusion. Further, it stores information in a ledger with transaction information within each block, along with a unique hash that refers to the previous block. Every person within the network receives a copy of the transactions as well. Because of these features, blockchain technology is resistant to distributed denial-of-service attacks, hackers, and other types of fraud.

For instance, in October 2019, IBM announced a new blockchain banking solution that helps financial institutions address the processes of universal cross-border payments, designed to reduce the settlement time and lower the cost of completing global payments for businesses and consumers. Furthermore, using IBM Blockchain, and in collaboration with technology partners Stellar.org and KlickEx Group, the solution intended to improve the speed in which banks both clear and settle payment transactions on a single network in near real-time.

Furthermore, various companies across U.S. are planning to launch regulated banks for crypto industry using the blockchain technology. For instance, on September 2022, crypto services firm Abra announced that it is in the process of launching Abra Bank, a U.S. state-chartered institution and, potentially, the crypto industry's first regulated bank. It would allow customers in the U.S. to deposit and bank digital assets while also offering valuable access to fiat on- and off-ramps. Further, it also plans to launch Abra International, a fully regulated digital asset business that will deliver similar banking services for its customers outside the U.S. using blockchain technology.

Top Impacting Factors

Increase in Adoption of Blockchain Technology by Banks

The increasing adoption of blockchain in retail banking and the rise in use of cryptocurrency is propelling the growth of the blockchain in retail banking market. Further, major companies operating in the retail banking are adopting the use of blockchain to help reduce fraudulent transactions, such as the use of smart contracts, which allow the buyer and seller to create if/then contracts in which one step of the process won’t be fulfilled until the one before it has been verified completely. Blockchain also aids in confirming the legality of each step in the supply chain process, and it offers security due to its non-repudiation and deregulation of data storage, which aids in preventing the theft of corporate assets. For instance, in March 2021, IntellectEU, a US-based technology company focused on digital finance, collaborated with KPMG to develop the ClaimShare solution, which uses enterprise blockchain, R3 Corda, in combination with R3’s new software technology, Conclave. Conclave allows confidential computing, by which insurers can’t share detailed information about claims without the other insurer seeing them. Thus, the increase in adoption of blockchain technology by retailers is fueling the growth of blockchain in retail banking market.

Faster Transactions through Blockchain

The ability of blockchain technology to execute the transactions without the need for a central authority, and the increasing adoption of blockchain technology to facilitate faster, real-time cross-border payments are fueling the growth of the market. Further, the banks have started using blockchain protocol for cross-border payments. For instance, the banks have started to use the Ripple’s Blockchain Protocol for cross-border payments. Ripple promised that their technology could save up to 33% of operating costs and increase the speed of money withdrawals. Ripple’s system offers quick currency exchange and cross-border transactions. Banks are increasingly using it for payments in order to replace a lot of existing intermediaries. Furthermore, blockchain offers a digital fingerprint that can is typically used as a personal identifier. Fingerprint owners can use this technology to open a new account or prove their identity. By implementing digital fingerprints, retail banks could facilitate information exchange and share data once it is updated. Thus, faster transaction through blockchain is one of the major factors propelling the growth of blockchain in retail banking market.

Advantages of Blockchain Technology in Retail Banking

Blockchain usage in retail banking and financial services has expanded due to benefits like capital optimization, decreased operational costs for banks, enhanced transparency, and an increase in financial solutions. The distributed ledger function of blockchain in cryptocurrencies helps to record each transaction and removes the need for a central authority to maintain such data. For instance, in October 2020, JPMorgan Chase shared that its cryptocurrency, JPM Coin, was being used commercially for the first time to send payments around the world. Also, they announced the launch of a new business unit, Onyx, blockchain, and digital currency for financial systems. Thus, advantages of blockchain technology in retail banking is boosting the growth of blockchain in retail banking market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blockchain in retail banking market forecast from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities of blockchain in retail banking market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blockchain in retail banking market segmentation assists to determine the prevailing blockchain in retail banking market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blockchain in retail banking market trends, key players, market segments, application areas, and market growth strategies.

Blockchain In Retail Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 40.4 billion |

| Growth Rate | CAGR of 40.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 233 |

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | IBM, cegeka, BitPay, Oracle, Amazon Web Services, Inc., Goldman sachs, Bitfury Group Limited, Microsoft, SAP SE, Intel Corporation |

Analyst Review

Blockchain in retail banking can serve as the foundation for an evolution of RTGS by boosting the security of digital transactions and reducing the likelihood of mistakes, misunderstandings, double counting, and fraud in bookkeeping. In addition, the accounting and auditing sectors are the major contributors for blockchain disruption. Furthermore, the capacity to give transaction finality and immutability as well as the transparency that only a distributed and decentralized chain can provide can result in a wiser, more effective solution for major banks in democratic countries.

The COVID-19 outbreak has a significant impact on the blockchain in retail banking market, and has accelerated the adoption of the technology in retail banks. Moreover, the adoption of blockchain in retail banking technology increased among medium and small-sized retail banks, during this global health crisis. This, as a result promoted the demand for blockchain in retail banking, thereby accelerating the revenue growth.

The blockchain in retail banking market is fragmented with the presence of regional vendors such as IBM Corporation, Amazon Web Services Inc., Microsoft, SAP SE, Goldman Sachs, Oracle, Bitpay, Cegeka, Bitfury Group Limited, and Intel Corporation. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for blockchain in retail banking across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The blockchain in retail banking market is estimated to grow at a CAGR of 40.4% from 2022 to 2031.

The blockchain in retail banking market is projected to reach $40.39 billion by 2031.

Increase in adoption of blockchain technology by banks, faster transactions through blockchain and advantages of blockchain technology in retail banking majorly contribute toward the growth of the market.

The key players profiled in the report include IBM Corporation, Amazon Web Services Inc., Microsoft, SAP SE, Goldman Sachs, Oracle, Bitpay, Cegeka, Bitfury Group Limited, and Intel Corporation.

The key growth strategies of blockchain in retail banking market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...