Blood Gas and Electrolyte Analyzers Market Insight (2021-2030)

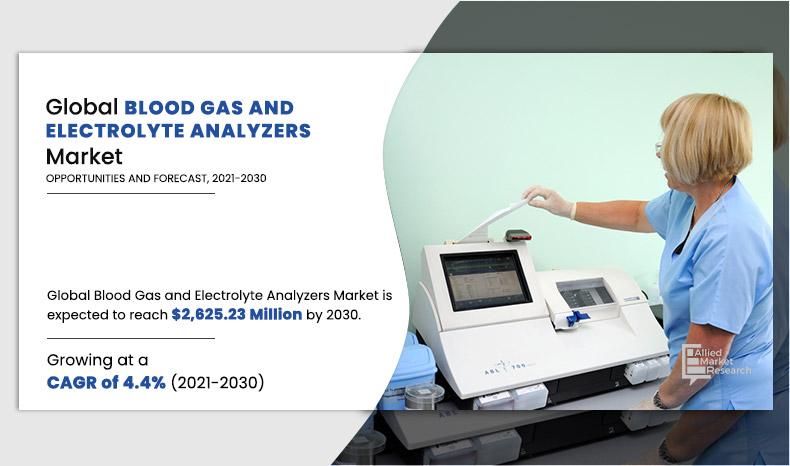

The global blood gas and electrolyte analyzers market size was valued at was valued at $1,698.7 Million in 2020, and is estimated to reach $2,625.23 Million by 2030, growing at a CAGR of 4.4% from 2021 to 2030. Blood gas and electrolyte analyzers are used to measure different parameters from whole blood samples such as arterial gases, including oxygen (pO2), carbon dioxide (pCO2), pH, electrolytes, and metabolites. The pH value of blood and serum or plasma is an indicator of the balance between the blood, kidney, and respiratory systems, whereas the pCO2 value of arterial blood is used to assess efficient elimination of carbon dioxide from the body, a byproduct of metabolism; and the pO2 value of arterial blood is a measure of oxygen absorbance by the body in lungs.

Electrolytes and metabolites provide additional information about the body's metabolism. These analyzers measure ion concentrations include potassium, sodium, bicarbonate, chloride, calcium, glucose, lactate, and magnesium from the blood. This blood sample analysis aids in the detection of medical conditions such as kidney failure, heart failure, uncontrolled diabetes, haemorrhage, chemical poisoning, a drug overdose, shock, asthma, and chronic obstructive pulmonary disease (COPD).

The growth of the blood gas and electrolyte analyzers market is majorly driven due to rise in prevalence of chronic disorders, rise in global geriatric population, increase in the number of patients treated in ICUs, NICUs, and emergency departments, technological advancements in blood gas and electrolyte analyzers, and increase in the number of product approvals globally.

In addition, the integration of blood gas analyzers with electronic medical records and laboratory information systems offer a lucrative opportunity for market expansion. These integrated systems not only allow for accurate monitoring of patients' health, but they also help to streamline workflow. Moreover, the rise in demand for technology-integrated combined systems and point-of-care devices is expected to significantly boost the blood gas and electrolyte analyzers market during the forecast periods.

Furthermore, the availability of various portable, benchtop easy to use, with higher accuracy and rapid devices, increase in various initiatives and strategies by the government, key players of the market play a pivotal role in increasing awareness for diagnosis, further boosts the blood gas and electrolyte analyzers market growth.

Considerable rise in healthcare expenditure globally has further fueled the market. The major factors that are responsible for the increase in healthcare expenditure are rise in population, especially geriatric, and increase in medical service utilization. However, high cost of analyzers and complexity involved in the interpretation of blood analysis data are expected to impede the blood gas and electrolyte analyzers market growth.

What is the Impact of COVID-19 Pandemic on the Blood Gas and Electrolyte Analyzers Market?

In addition, the COVID-19 outbreak is anticipated to have a positive impact on the blood gas and electrolyte analyzers market. A huge number of clinics and hospitals across the globe were restructured to increase the hospital capacity for patients diagnosed with COVID-19. The non-essential procedures took a potential backlog due to the rapid rise in COVID-19 cases. The lockdown led to the disruption of manufacturing and transportation of healthcare essentials. Furthermore, other factors responsible for the impact on the market include limited availability of medical care, shortage of healthcare staff, and rise in burden of COVID-19-related hospitalization. However, increase in COVID-19 cases led to the rise in hospitalizations and further led to surge in blood gas testing as it is critical for COVID-19 patients that show signs of respiratory distress. Thus, this is expected to positively impact the market.

Untapped, emerging markets such as the developing countries in Asia-Pacific are expected to offer potential growth opportunities for key players to invest in the blood gas and electrolyte analyzers market, due to improved healthcare infrastructure, increase in unmet healthcare, and various technological advancements due to surge in healthcare investments.

Blood Gas And Electrolyte Analyzers Market Segmentation

The blood gas and electrolyte analyzers market is segmented into product type, end user, and region. On the basis of product type, the market is categorized into analyzers and consumables. The analyzers are further segmented into type and modality, where type comprises of blood gas analyzers, electrolyte analyzers & combined analyzers and modality comprises of laboratory, portable, and benchtop.

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, and others. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, India, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East and Africa).

By Product Type

Consumables holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Segment Review

On the basis of product type, the consumables segment dominated the blood gas and electrolyte analyzers market in 2020, and is expected to continue this trend during the forecast period owing to the increase in the number of patients suffering from chronic diseases, which increases the number of blood gas test performed. This further leads to increase in the demand for consumables.

On the basis of end user, the hospitals segment dominated the market in 2020, and is expected to continue this trend during the forecast period owing to surge in hospitalizations of patients as most of the critical care patients are treated in hospitals.

By End User

Hospitals segment is projected as one of the most lucrative segment.

North America accounted for a majority of the global blood gas and electrolyte analyzers market share in 2020, and is anticipated to remain dominant during the forecast period. This is attributed to increase in adoption of technologically advanced portable analyzers and combined blood gas and electrolyte analyzers in the hospitals, clinics, and emergency departments, presence of key players, and rise healthcare expenditure in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in geriatric population, unmet medical demands, and increase in investments in the healthcare sector in the region. Moreover, India and China are expected to grow at high CAGR in Asia-Pacific blood gas and electrolyte analyzers market.

The key players operating in the global blood gas and electrolyte analyzers market are Abbott Laboratories, Danaher Corporation (Radiometer), F. Hoffmann-La Roche AG, IDEXX Laboratories, Inc. (Opti Medical Systems, Inc.), Medica Corporation, Nova Biomedical, Sensa Core Medical Instrumentation Pvt. Ltd., Siemens AG (Siemens Healthineers), Transasia Bio-Medicals Ltd. (Erba Diagnostics Mannheim Gmbh), and Werfen Science SA.

By Region

Asia-Pacific is expected to experience growth at the highest rate, registering a CAGR of 5.9% during the forecast period.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the blood gas and electrolyte analyzers market, current trends, and future estimations to elucidate the imminent investment pockets.

- It presents a quantitative analysis of the market from 2021 to 2030 to enable stakeholders to capitalize on the prevailing blood gas and electrolyte analyzers market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the blood gas and electrolyte analyzers market.

Blood Gas and Electrolyte Analyzers Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Sensa Core Medical Instrumentation Pvt.Ltd., F.Hoffmann-La Roche AG, Abbott Laboratories, IDEXX Laboratories,Inc.(OptiMedicalSystems,Inc.), Nova Biomedical, Medica Corporation, Danaher Corporation(Radiometer), Siemens AG(Siemens Healthineers), Transasia Bio-Medicals Ltd.(Erba Diagnostics Mannheim Gmbh), Werfen Science SA |

Analyst Review

This section provides the opinions of the top level analyst’s in the global blood gas and electrolyte analyzers market. The use of blood gas and electrolyte analyzers is in demand for quick analysis of blood gases in the emergency care departments to decide on treatment options for the patient. These products are also used for diagnosing chronic diseases such as kidney failure, lung dysfunction, heart failure, uncontrolled diabetes, hemorrhage, shock, and others.

As per the analyst, the escalating number of chronic diseases and surge in the number of hospitalization, emergency unit patients are the major factors that drive the growth of the global blood gas and electrolyte analyzers market. Relevant factors, such as increase in geriatric population across the globe and technological advancements, are expected to have a significant impact on the growth of the market. However, availability of refurbished devices and complexity involved in the interpretation of blood analysis data act as a restraining factor for the market growth.

North America is expected to witness highest growth, in terms of revenue during the forecast period owing to rapid growth in geriatric population, increase in investments made by large medical diagnostic product manufacturing companies in research and development for advanced blood gas analyzers in this region, presence of key players, and advancements in healthcare investments. Moreover, well-equipped hospitals, clinics, for treating the increasing patients in the ICUs, NICUs and emergency departments in the region is one of the major reasons for the higher share of North America in the global blood gas and electrolyte analyzers market.

The total market value of blood gas and electrolyte analyzer market is $1,698.7 million in 2020.

The forecast period for blood gas and electrolyte analyzer market is 2021 to 2030

The market value of blood gas and electrolyte analyzer market in 2021 is $1,785.5 million.

The base year is 2020 in blood gas and electrolyte analyzer market

Top companies such as Abbott Laboratories, Danaher Corporation (Radiometer), F. Hoffmann-La Roche AG, IDEXX Laboratories, Inc. (Opti Medical Systems, Inc), Medica Corporation, Nova Biomedical, Sensa Core Medical Instrumentation Pvt. Ltd., Siemens AG (Siemens Healthineers), Transasia Bio-Medicals Ltd. (Erba Diagnostics Mannheim Gmbh) and Werfen Science SA. held a high market position in 2020.

Consumables segment dominated the global market in 2020, and expected to continue this trend throughout the forecast period due to increase in chronic diseases, which leads to rise in blood testings and thus there is more utilization of consumables is expected to drive the segment

Increase in prevalence of chronic diseases, rise in geriatric population and various product approvals is anticipated to drive the market in the forecast period.

North America is projected to account for a major share of the global blood gas and electrolyte analyzer market during the forecast period. U.S. dominated the North America blood gas and electrolyte analyzer market owing to increased adoption of analysis due to rising hospitalization in emergency departments and rise in disease load across the country.

Loading Table Of Content...