Blood/IV Warmers Market Research, 2033

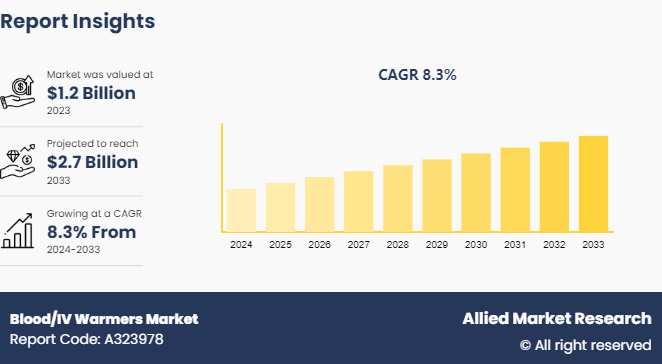

The global blood/IV warmers market size was valued at $1.2 billion in 2023, and is projected to reach $2.7 billion by 2033, growing at a CAGR of 8.3% from 2024 to 2033. Key drivers for the blood/IV warmer market include the rising incidence of hypothermia during surgeries and trauma cases, increased prevalence of chronic diseases necessitating IV treatments, and advancements in portable and efficient warming technologies.

Market Introduction and Definition

A blood/IV warmer is a medical device designed to heat blood, intravenous fluids, or other infusions to body temperature before administration to a patient. These devices are crucial in preventing hypothermia, a condition where the body's core temperature drops below the required threshold, which can occur during surgeries, trauma care, and in patients requiring large volumes of transfusions or infusions. Hypothermia can lead to various complications, including coagulopathy, increased infection rates, and cardiovascular problems.

By warming fluids to a safe and physiological temperature, blood/IV warmers help maintain normothermia, improve patient outcomes, and enhance the overall efficacy of medical treatments. They are commonly used in emergency rooms, operating rooms, intensive care units, and during transport in ambulances. Blood/IV warmers come in various types, including dry heat warmers, counter-current heat exchangers, and more advanced models that use infrared technology or electromagnetic waves to ensure the precise and consistent warming of fluids.

Key Takeaways

- The blood/IV warmer market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major blood/IV warmers industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The blood/IV warmers market size is driven by several key factors, including the increasing prevalence of surgical procedures, trauma cases, and chronic diseases that require intravenous fluid administration. The rise in the geriatric population, who are more prone to hypothermia during medical treatments, also fuels the demand for blood/IV warmers. Technological advancements in medical devices, such as the development of portable and battery-operated warmers, have expanded their usage in emergency medical services and military applications. For example, portable warmers are essential in ambulances and remote locations where immediate warming of fluids can be life-saving.

However, the market faces restraints such as the high cost of advanced blood/IV warmers and the stringent regulatory requirements for medical devices. These factors can limit the adoption of newer technologies, especially in developing regions with limited healthcare budgets. Additionally, concerns about the potential risks of overheating and the need for regular maintenance and calibration can hinder blood/IV warmers market growth.

Despite these challenges, there are significant opportunities in the blood/IV warmer market. The growing emphasis on patient safety and the development of innovative warming technologies offer substantial growth potential. For instance, the integration of smart technologies and wireless connectivity in blood/IV warmers can improve monitoring and control, enhancing their effectiveness and safety. Furthermore, increasing investments in healthcare infrastructure in emerging markets and the rising awareness about the benefits of using blood/IV warmers in medical treatments present lucrative opportunities for expansion during blood/IV warmers market forecast.

Market Segmentation

The Blood/IV warmers industry is segmented into product type, application, end-user and region. On the basis of product type, the market is bifurcated into portable and non-portable. Based on application, the market is divided into, surgery, acute care, new born care, and homecare. Based on end user, the market is divided into hospitals and clinics, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has largest blood/IV warmers market share and is primarily driven by the high prevalence of surgical procedures and trauma cases, necessitating the frequent use of intravenous fluid administration. The region's well-established healthcare infrastructure and the presence of numerous advanced medical facilities contribute to the widespread adoption of blood/IV warmers. The increasing aging population, which is more susceptible to hypothermia during medical treatments, further propels the demand for these devices. Additionally, the rising incidence of chronic diseases, such as cancer and cardiovascular disorders, which often require frequent and prolonged infusion therapies, boosts the blood market.

Technological advancements and innovations in medical devices, such as the development of portable and battery-operated warmers, also drive market growth. These advancements are particularly beneficial in emergency medical services and military applications, where immediate warming of fluids can be critical. For example, portable blood/IV warmers are essential in ambulances and remote locations, providing life-saving solutions in critical situations. The strong focus on patient safety and stringent regulatory standards in North America ensure the adoption of high-quality and effective warming devices, further supporting blood market growth.

Industry Trends

- In August 2022, HHS Announces New Campaign to Increase U.S. Blood and Plasma Donations. The campaign aims to increase awareness of the importance of donating blood and plasma and to encourage Americans to create new, regular donation habits. Every two seconds, someone in the U.S. needs blood for surgeries, cancer treatments, childbirth, anemia, serious injuries, and blood disorders. For many people, receiving a blood transfusion is lifesaving. Similarly, patients with rare diseases rely on medical treatments every day that are only available when people roll up their sleeves and give source plasma.

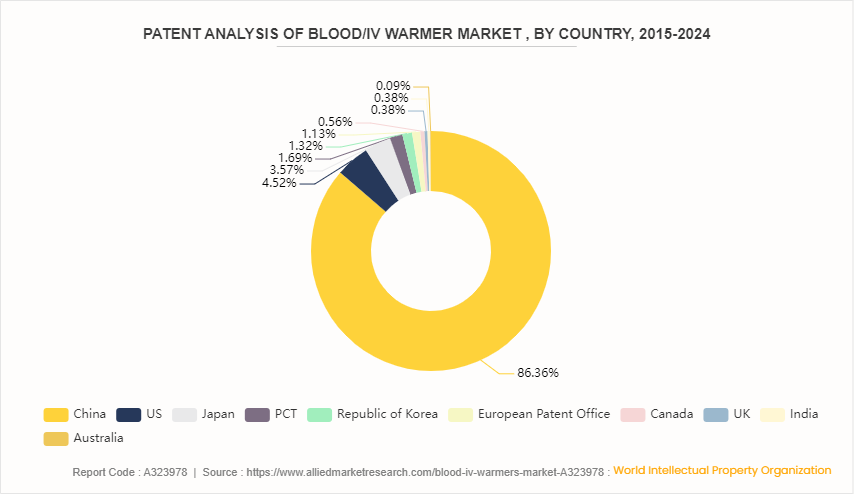

Patent Analysis, By Country, 2015-2024

China witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. US has 4.52% of the total number of patents, followed by Japan at 3.57% and PCT at 1.69%.

Competitive Landscape

The major blood/IV warmers market share players operating in the market include Stryker Corporation, Gentherm Medical, Belmont Medical, 3M, ICU Medical, Vyaire Medical, Inc., The Surgical Company, Life Warmer, MEQU, Estill Medical Technologies, Inc., Other players in Blood/IV warmer market includes Smisson-Cartledge Biomedical, and so on.

Recent Key Strategies and Developments

- In January 2022, QinFlow Inc. received a group buy agreement from Premier, Inc. for blood and fluid warming products. This arrangement will give healthcare organizations access to their next-generation blood warming technology, which has been fine-tuned to suit the stringent requirements of emergency departments, intensive care units, operating rooms, and trauma bays.

- In July 2021, MEQU received a public tender to supply portable blood and IV fluid warming devices (M Warmer System) to the Ministry of Defense, in collaboration with UK partner Fenton Pharmaceuticals (MOD) . In addition, in Australia and New Zealand, HKM Group easily formed partnerships and maintained connections with the military, EMS, police, hospitals, and specialty emergency providers. HKM's MilTac and emergency products are hand-picked and among the most cutting-edge innovations in patient care.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the blood/IV warmers market segments, current trends, estimations, and dynamics of the blood/IV warmers market analysis from 2023 to 2033 to identify the prevailing blood/IV warmers market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the blood/IV warmers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global blood/IV warmers market Statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global blood/IV warmers market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- Australian Bureau of Statistics

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

- GOV.UK

Blood/IV Warmers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.7 Billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Belmont Medical, 3M Company, MEQU, The Surgical Company, LLC, ICU Medical Inc., Estill Medical Technologies, Inc, Gentherm Medical, Life Warmer, Stryker Corporation., Vyaire Medical, Inc. |

The Stryker Corporation, Gentherm Medical, Belmont Medical, 3M, ICU Medical, Vyaire Medical, Inc. held a high market position in 2023.

The base year is 2023 in blood/IV warmers market.

The forecast period for blood/IV warmers market is 2024 to 2033.

The market value of blood/IV warmers market is projected to reach $2.7 billion by 2033.

The total market value of blood/IV warmers market was $1.2 billion in 2023.

Loading Table Of Content...