Blood Stream Infection Testing Market Research, 2030

The global blood stream infection testing market size was valued at $5.17 billion in 2021, and is projected to reach $10.54 billion by 2030, growing at a CAGR of 8.3% from 2022 to 2030. Any bacterial, fungal, or some other sort of infection found in the blood is known as a blood stream infection. Once the pathogen enters the bloodstream of any part of the body, the disease becomes apparent as it starts spreading the infection in the body. Blood stream infection testing is used to identify the bacteria or other organisms that cause blood infections. There is a significant danger to human health in densely populated areas due to very minimal hygiene is followed, which promotes the spread of several infectious diseases. Bloodstream infections are challenging to self-diagnose due to their widespread symptoms, such as chills, a cold, fever, diarrhea, and vomiting.

Key Market Dynamics

Increase in the number of bloodstream infections globally is expected to drive the blood stream infection testing market. According to the U.S. National Library of Medicine, world’s largest medical library, Bloodstream Infections (BSIs) are a leading global cause of disease and mortality. The incidence of BSIs has grown over time and the rates ranges from 122 to 220 cases per 100,000 people. The need for rapid diagnosis and recent advancement in bloodstream infection testing are expected to boost the market growth. The increasing incidences of bloodstream infection in elderly population who are susceptible to infection due to low immunity is anticipated to drive demand for bloodstream infection testing and boost revenue growth of the market.

The high cost of ownership and high maintenance costs might limit the market development as technology advances and automated devices such as MALDI-TOF and DOT are introduced. The costly testing methods can further hinder the market growth. The lack of insurance and reimbursement policies is also projected to limit the market expansion.

In the analysis timeframe, it is anticipated that the market will experience tremendous growth and investment opportunities due to the ongoing research and development to introduce technological advancements in the field of bloodstream infection testing. The latest technological developments like bloodstream infection tester, also tracks antibiotic resistance markers in bacteria and also diagnose sepsis. Thus, giving more safety to the patients. In addition, the ageing population, which is more prone to infectious diseases, is anticipated to accelerate the global bloodstream infection testing market growth. Moreover, diagnosis of the disease is quite confusing. This reason makes testing mandatory for the detection of the infection in the bloodstream. Thus, in future there are huge investment opportunities owing to the developments in global blood stream infection testing market.

The major key players in the global bloodstream testing industry are Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Abbott, BD, BIOMÉRIEUX, Cepheid, Luminex Corporation, Accelerate Diagnostics Inc., AdvanDX, and Bruker.

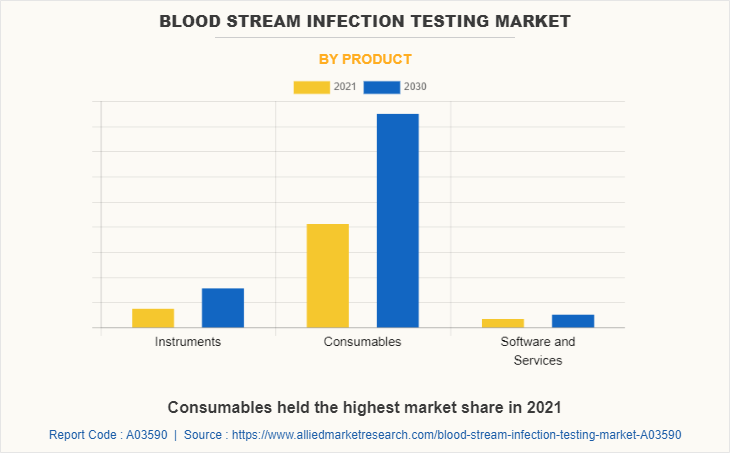

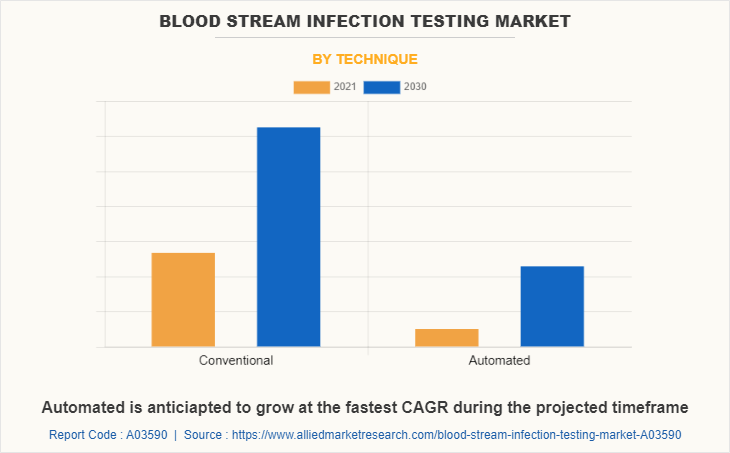

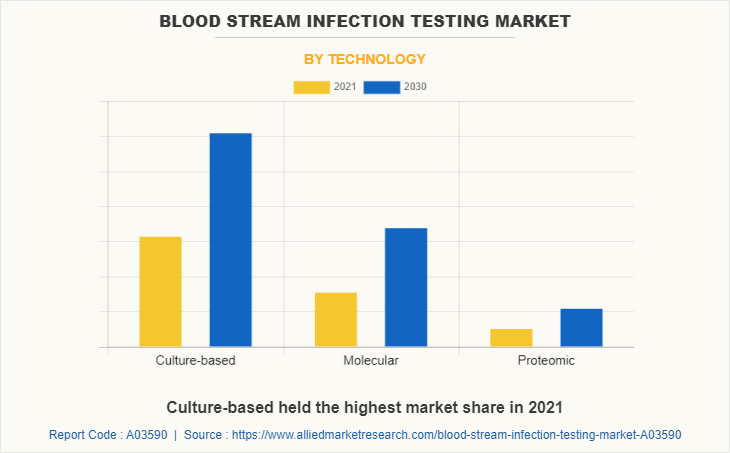

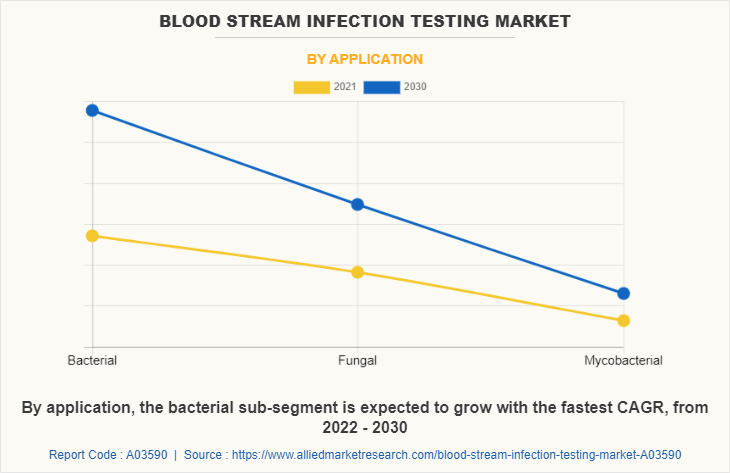

The global bloodstream infection testing market analysis is segmented by product, technique, technology, application, end-user, and region. By product, the market is sub-segmented into instruments, consumables, and software & services. By technique, the market is sub-segmented into conventional and automated. By technology, the market is sub-segmented into (culture-based, molecular, and proteomic. By application, the market is sub-segmented into bacterial, fungal, and mycobacterial. By end-user, the market is sub-segmented into hospitals, independent diagnostics centers, and others. By region, the market is sub-segmented into North America, Europe, Asia-Pacific, and LAMEA.

The blood stream infection testing market is segmented into Technology, Product, Technique, Application and End-users.

By product, the consumables sub-segment is predicted hold the maximum market share in 2021. Consumables include needle, syringes, bandage, test tubes, reagents, and others are consumed while performing lab test. Rising awareness regarding importance of blood infection testing in disease diagnosis among people and an increasing number of laboratories in various countries such as Brazil, India, and China are the main factors driving demand for consumables in the global blood stream infection testing market trend in the projected period.

By technique, the conventional sub-segment is predicted to hold the maximum market share in 2021 and the automated sub-segment is expected to grow over the forecast period. Automated instruments are more efficient and provide reliable results in a short time. Moreover, with the help of this technique results are more reproducible and operational errors are reduced thereby fueling blood stream infection testing market demand for the automated techniques in the coming years.

By technology, the culture-based sub-segment is predicted to have a high market share in 2021 throughout the analysis period and the molecular sub-segment is predicted to grow in the estimated timeframe. The molecular technology has potential of providing a faster, reliable, more sensitive, and direct identification of causative pathogens without prior need for cultivation thereby driving global blood stream infection testing market outlook.

By application, the bacterial sub-segment is predicted to have the maximum share as well as highest growth rate in the estimated period. Bacteria can enter the bloodstream as a severe side effect of infections (such as pneumonia or meningitis), during surgery (especially when involving mucous membranes like the gastrointestinal tract), or as a result of catheters. Bacterial infections in blood can have a number of serious health effects. Sepsis and septic shock, which have high mortality rates, can be brought on by the immune system's reaction to the bacteria. Thus, treating them becomes extremely essential. Furthermore, increasing cases of sepsis among the population across the globe is predicted to be the major driving factor for the bloodstream infection testing market opportunity in the estimated period.

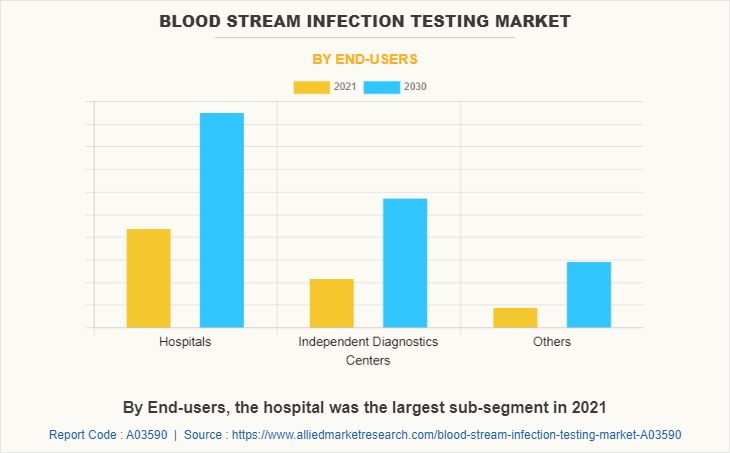

By end-user, the hospitals sub-segment held maximum market share during the forecast period. Hospitals become the primary contact in case of diagnosis of disease. The patient with symptoms of bloodstream infection first gets in touch with the hospitals. Further the doctors in the hospitals provide the next treatment and when in a doubt of bloodstream infection, they instruct to get them tested. Moreover, the improving healthcare facilities in developing countries along with increasing number of independent laboratories is the main factor driving bloodstream infection testing market demand in the forecast period.

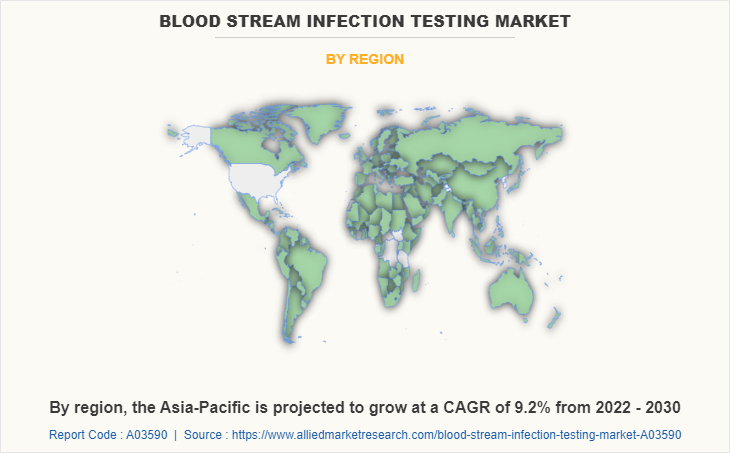

By region, North America held leading share in 2021 in the global blood stream infection testing market. Increase in the geriatric population and existence of large number of healthcare facilities across the region is predicted to be the major factor for revenue growth of the blood stream infection testing market. In addition, major companies are investing more in research and development of blood stream infection testing devices, which is predicted to create opportunities in the blood stream infection testing market share during the forecast period.

Highlights of the Report

- The report provides exclusive and comprehensive analysis of the global bloodstream infection testing market trends along with the global bloodstream infection testing market forecast.

- The report elucidates the global bloodstream infection testing market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building

- The report entailing the global blood stream infection testing market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the global bloodstream infection testing market size.

Impact of COVID-19 on the Global Bloodstream Infection Testing Industry

- In 2020, the COVID-19 outbreak caused global public health emergency and brought the world to a halt, affecting every other sector. COVID-19 impacted negatively on the global bloodstream infection testing market share.

- However, a blood culture test is considered as the standard for diagnosis of the infection or pathogen thus, the demand for BSI testing has increased rapidly. The rise in cases in the U.S. and Europe increased the demand for blood stream infection testing market size.

- The incidence rate of blood stream infection in COVID patients was found to be 0.863% compared to patients without COVID having 0.437%. The requirement for diagnosis of pathogens or microbes witnessed a great rise. As the coronavirus has been undergoing mutation, it is likely that the blood stream infection testing will rise in near future.

Blood Stream Infection Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 10.5 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2021 - 2030 |

| Report Pages | 180 |

| By Technique |

|

| By Technology |

|

| By Product |

|

| By Application |

|

| By End-users |

|

| By Region |

|

| Key Market Players | Bruker Corporation, Luminex Corporation, Accelerate Diagnostics Inc., F. Hoffmann-La Roche Ltd., AdvanDx, Thermo Fisher Scientific, Inc., cepheid, bioMérieux SA, becton dickinson medical devices co. ltd., suzhou, Abbott Laboratories |

Analyst Review

Increasing awareness regarding chronic diseases such as AIDS and cancer and rising global population are factors expected to boost the market growth. Average life expectancy of humans has increased as a result of improvements in healthcare technology and introduction of life-saving medications in both developed and developing countries. As a result, the elderly population is increasing rapidly. Due to their weakened immune systems, they are more vulnerable to various illnesses. In the coming days, it is anticipated that the rising older population would increase demand for bloodstream infection tests. The key factors such as high diagnosis cost and lack of medical reimbursement will most likely hamper the market growth during the forecast period. As far as opportunities in the market are concerned, the extensive R&D activities have created ample of investment opportunities for the major players.

Among the analyzed regions, the North America region holds the most lucrative position in the global bloodstream infection testing market in 2031. Increase in number of geriatric population and presence of advanced healthcare facilities owes to the large market share of the region.

The increasing geriatric population rising number of sepsis cases are fueling revenue growth of the market. Additionally, enhanced R&D activities have resulted into creating excellent investment opportunities for key players in the market.

Product development is the key strategy opted by the operating companies in the bloodstream infection testing market.

North America will provide more business opportunities for the global bloodstream infection testing market in future.

The major key players in the global bloodstream infection testing market are Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Abbott, BD, BIOMÉRIEUX, Cepheid, Luminex Corporation, Accelerate Diagnostics Inc., AdvanDX, and Bruker.

The hospitals sub-segment of the end-user acquired the maximum share of the global bloodstream infection testing market in 2021.

Hospitals and independent diagnostics centers are the major customers for the bloodstream infection testing market.

The report provides an extensive qualitative and quantitative analysis of the current trends and the future estimations of the global bloodstream infection testing market from 2022 to 2030 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...