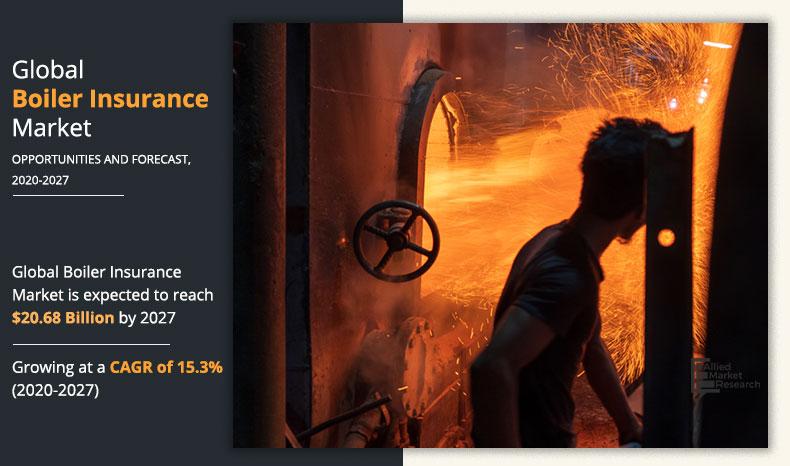

Boiler Insurance Market Overview

The global boiler insurance market size was valued at $8.86 billion in 2019, and is projected to reach $20.68 billion by 2027, growing at a CAGR of 15.3% from 2020 to 2027. Rising awareness in industrial and commercial sectors, increasing demand to reduce repair and maintenance costs, and the introduction of new services by market leaders are contributing to the growth of the market.

Market Dynamics & Insights

- The boiler insurance market in North America accounted for the highest market share in 2019.

- By coverage type, the boiler & central heating cover segment accounted for the highest market share in 2019.

- By boiler type, the water-tube segment accounted for the highest market share in 2019.

- By boiler fuel, the natural gas segment accounted for the highest market share in 2019.

- By end user, the chemicals segment accounted for the highest market share in 2019.

Market Size & Future Outlook

- 2019 Market Size: $8.86 Billion

- 2027 Projected Market Size: $20.68 Billion

- CAGR (2020-2027): 15.3%

- North America: dominated the market in 2019

- Asia-Pacific: Fastest growing market

Market Dynamics

The key objective of boiler insurance is to cover the physical damages occurred to boiler as well as it also covers the cost of repairing or replacing the damaged equipment, motors, computers, telephones, and electrical equipment. In addition to this, various commercial and industrial end users are adopting boiler insurance to reduce their spending on cost incurred due to damage of the boiler. Furthermore, the boiler insurance providers are executing different rules & regulations related to insurance of various countries and are developing their existing offering by implementing advanced technologies that addresses a variety of customized coverages in the market, which is expected to fuel the boiler insurance market growth.

The key factors that drive the growth of the global boiler insurance market trends include increase in awareness about the boiler insurance among the industrial and commercial sectors across the globe and rise in need to reduce the repairing and maintenance cost of the boiler among the end users. In addition to this, new services offered by major players of the market propels the growth of the market. However, lower awareness about boiler insurance among the general public of emerging countries in Asia-Pacific and LAMEA and increase in stringent regulations by the government hamper the boiler insurance market growth. Furthermore, surge in small & medium-sized enterprises expanding their businesses and rise in demand for third-party liability coverage in emerging economies is expected to offer remunerative opportunities for the expansion of the global boiler insurance market during the forecast period.

By Coverage Type

Boiler & central heating cover is projected as one of the most lucrative segments.

By coverage type, the boiler insurance market share was led by the boiler & central heating cover segment in 2019, and is projected to maintain its dominance during the forecast period. Rise in adoption of boiler & central heating cover insurance policies among the common people and industries for fixing various boiler issues such as annual service & maintenance, repairing of the boiler and other service charges drives the growth of the market in this segment. However, the boiler central heating, plumbing & wiring cover segment is expected to grow at the highest rate during the forecast period, owing to rising adoption of this coverage plans among the end users due to its various benefits and major players of the market introducing new schemes for this plan.

Region wise, the boiler insurance market was dominated by North America in 2019, and is expected to retain its position during the forecast period. This is attributed to increase in adoption of advance technologies by insurers to improve traditional boiler insurance policies and index solutions are becoming some of the major trends in the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, as rise in demand for boiler insurance is expected to gain momentum owing to majority of individuals buying new boilers for various household and commercial uses in the Asian countries.

By Boiler Type

Water-Tube is projected as one of the most lucrative segments.

The report focuses on growth prospects, restraints, and trends of the global boiler insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on global boiler insurance market.

Boiler Insurance Market Segment Review

The global boiler insurance market is segmented into boiler type, end user, boiler fuel, coverage type and region. On the basis of boiler type, it is categorized into fire-tube and water-tube. According to end user, it is classified into chemicals, refineries, metal & mining, food& beverages and others. Depending on boiler fuel, it is divided into natural gas, coal, oil and others. In terms of coverage type, the market is fragmented into boiler cover, boiler & central heating cover and boiler, central heating, and plumbing & wiring cover. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Boiler Fuel

Natural Gas is projected as one of the most lucrative segments.

The key players operating in the global boiler insurance market include AXA, AVIVA, British Gas, Domestic & General Group Limited, Future Generali, Homeserve, Tata AIG General Insurance Company Limited, The Hartford Steam Boiler Inspection and Insurance Company, Warranty People and Yourrepair. These players have adopted various strategies to increase their market penetration and strengthen their foothold in the boiler insurance industry.

COVID-19 impact analysis

Insurance industry plays a major role in economic growth by providing financial protection to people, assets, and businesses of a country against uncertain events. Hence, the business of insurance has become a massive contributor toward a country’s development. The pandemic has changed the prospects of every business sector, and the insurance industry is no exception. The boiler and machinery insurance industry has been negatively impacted by the outbreak of the COVID-19 pandemic, which has further led to economic instability. In addition to this, the situation created by COVID-19 being a health emergency is generating plenty of work for insurance companies, where customers are looking for answers and faster turnaround on insurance claims. It has led to many customers trying to get in touch with customer support teams of insurance firms across the world.

By End User

Chemicals is projected as one of the most lucrative segments.

What are the Top Impacting Factors in Boiler Insurance Market

New services offered by major players of the market propels the growth of the market

Various insurance companies across the globe are introducing new strategies to improve their market value and to upsurge their revenue as well as to enhance their customer experience. In addition to this, digitization in the insurance sector is playing a vital role in the COVID-19 pandemic situation across the globe. Some of the boiler insurance companies are providing applications and other technologically advanced services to their customers to keep their customer safe from the pandemic situation. For instance, in December 2019, British Gas, which is a UK-based home & energy insurance company developed new digital services, which allows customers to avail boiler insurance services via voice-activated Google Home. In addition, customers can request "OK Google, talk to Boiler Support" to further launch a voice-enabled troubleshooting service. Thus, such new advance digitalized services have become a major trend in the boiler and machinery insurance industry, which, in turn, boosts the market growth.

Rise in demand of third-party liability coverage in emerging economies

Boiler insurance providers have an immense potential to expand products and services in the market. Companies include third-party liability coverage, comprehensive coverage, bodily & property damage, and medical coverage of the third parties. Thus, insurers are expected to provide lucrative opportunities to innovate and expand their offerings by including specific coverages such as pay-as-you-drive policy. This covers the property damage claims, personal damages claims, fire and related other claims. Furthermore, these coverages are provided in a combination or bundled offerings, thus making it convenient for consumers to choose specific requirements from the plans. All these factors collectively are expected to provide remunerative opportunities for product expansion in the upcoming years.

By Region

Asia-Pacific would exhibit the highest CAGR of17.0% during 2019-2027.

What are the Key Benefits for Stakeholders

- The study provides an in-depth analysis of global boiler insurance market forecast along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on global boiler insurance market outlook is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the boiler insurance market share from 2020 to 2027 is provided to determine the market potential.

Boiler Insurance Market Report Highlights

| Aspects | Details |

| By Boiler Type |

|

| By End User |

|

| By Boiler Fuel |

|

| By Coverage |

|

| By Region |

|

| Key Market Players | BRITISH GAS, AXA, AVIVA, DOMESTIC & GENERAL GROUP LIMITED, WARRANTY PEOPLE, HOMESERVE MEMBERSHIP LTD., TATA AIG GENERAL INSURANCE COMPANY LIMITED, FUTURE GENERALI INDIA INSURANCE COMPANY LTD., YOURREPAIR, THE HARTFORD STEAM BOILER INSPECTION AND INSURANCE COMPANY (SUBSIDIARY OF MUNICH RE) |

Analyst Review

Boiler insurance service providers are looking forward to expand their offerings to provide customized coverages for their customers. In addition to this, regulatory bodies across several countries are introducing several favorable polices for upsurging the boiler insurance market in the developing nations of Africa and Middle East which is driving the growth of the market. In addition, the COVID-19 outbreak has a significant impact on the global boiler insurance market, owing to shutdown of various chemical and manufacturing companies and rising coverage claims by individual which is negatively impacting the growth of the market.

The key providers of boiler insurance such as AXA, AVIVA, British Gas, Warranty People, Future Generali, The Hartford Steam Boiler Inspection and Insurance Company, and Tata AIG General Insurance Company Limited. account for a significant share in the market. North America dominated the boiler insurance market, in terms of revenue in 2019, and are expected to retain their dominance during the forecast period.

However, Asia-Pacific is expected to experience significant growth in the future, owing to emerging economies, increase in government support toward trading globally, thereby accelerating the demand for global boiler insurance market. Furthermore, the boiler insurance market is particularly brisk in countries, such as India, Australia, China, Japan, Indonesia, Korea, Hong Kong, Taiwan, with high GDP growth and rise in per capita income. Major players of the market are introducing different strategies to increase their market share in the developing region and to upsurge their overall market value.

Loading Table Of Content...