Global Bolts Market Overview

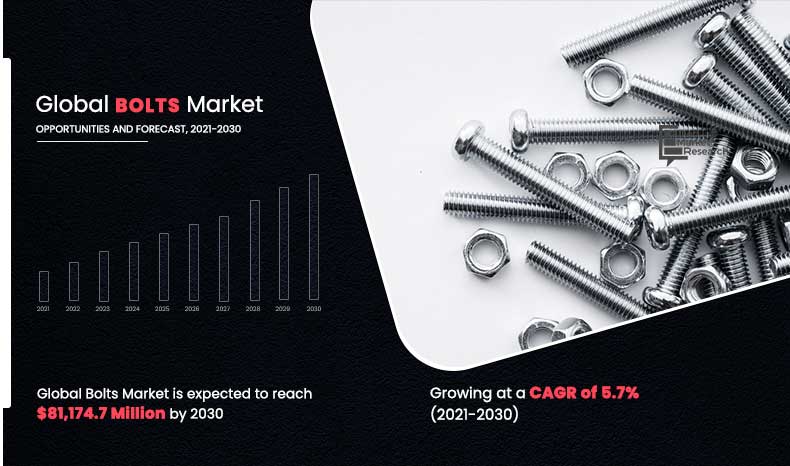

The global bolts market size was valued at $46,854.3 million in 2020, and is projected to reach $81,174.7 million by 2030, registering a CAGR of 5.7% from 2021 to 2030. This market is driven by rising demand across construction, automotive, and industrial sectors. Growing infrastructure projects, machinery production, and automotive manufacturing fuel market expansion. Technological advancements in materials and design, along with increased emphasis on durability and safety standards, further contribute to the steady growth of the global bolts market.

Market Dynamics & Insights

- The bolts industry in Asia-Pacific held a significant share of over 54.5% in 2020.

- The bolts industry in U.S. is expected to grow significantly at a CAGR of 3.8% from 2021 to 2030

- By type, half screw bolt segment is one of the dominating segments in the market and accounted for the revenue share of over 67.3% in 2020.

- By end-user, industrial machinery segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $46.8 Billion

- 2030 Projected Market Size: $81.1 Billion

- CAGR (2021-2030): 5.7%

- Asia-Pacific: Largest market in 2020

- Asia-Pacific: Fastest growing market

What is Meant by Bolts

Bolts are a type of threaded fastener which are used to hold objects in their position. Bolts typically consist of a head and a cylindrical body with threads either throughout or along a portion of its length.

The rising number of construction activities across the globe has fueled the use of steel construction components, thereby increasing the use of metal fasteners as they are extensively used for joining various steel components. Properties of bolts such as high shear strength and ability of bolted joints to reduce temperature stresses in steel connections, fuels the use of bolts in the construction industry. In addition, bolts are used in automotive industry for connecting various components of engine, drivetrain and body panels. Thus, rapid growth of automotive industry in developing countries has boosted the demand for bolts market.

Increasing population in developing economies such as India, China, Mexico, Brazil, and others has resulted in rapid urbanization. According to the United Nations (UN), around 68% of the world population is expected to live in urban areas by 2050. This rapid urbanization will increase the demand for infrastructure such as metro rails and airport, thereby boosting the construction industry. For instance, in India, 10 cities have an operational metro rail systems as of 2020, and 15 more cities are planned to have an operational metro rail system in the next few years. This rapid increase in construction activities is expected to increase the demand for bolts. Furthermore, the automotive industry in developing countries witnesses rapid growth. For instance, China has emerged as the world’s largest automotive market in the last few years and Mexico is emerging as an automotive manufacturing hub in the Latin America region. However, factors such as fluctuation in prices of raw materials such as steel and increase in energy prices can hinder the bolts market growth.

The novel coronavirus has rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic has halted the production of many products in the bolt business due to the lockdown. Furthermore, the number of COVID-19 cases are expected to reduce in the near future as the vaccine for COVID-19 is introduced in the market. This has led to the reopening of bolt manufacturing companies at their full-scale capacities. This will help the market to recover by the start of 2022. After COVID-19 infection cases begin to decline, bolt manufacturers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Furthermore, growth of manufacturing industry is anticipated to increase the use of bolts as they are used for joining various manufacturing assemblies and machineries. In addition, growth of aviation industry fueled by increasing passenger air traffic, is anticipated to boost the use of bolts in aerospace industry.

By Type

Full screw bolt segment is projected to grow at a highest CAGR

Bolts Market Segment Overview

The global bolts market is segmented on the basis of type, material, end user, and region. By type, the market is categorized into half screw bolt and full screw bolt. Depending on material, it is fragmented into plastic and metal. On the basis of end user, it is categorized into automotive, aerospace, construction, industrial machinery and other. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the market in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to increase in population, urbanization, and industries.

Asia-Pacific is one of the fastest growing regions around the globe attributed to its large population and low-cost manufacturing sector. China and Japan are leading manufacturers of automobiles and construction machines. Furthermore, the construction and manufacturing industries in countries such as India, Indonesia, Vietnam and Bangladesh are experiencing significant growth. In addition, the automotive industry in the region is also witnessing significant growth fueled by increasing purchasing power of the masses. These factors positively influence the growth of bolts market share in the region.

By End User

Autootive segment holds dominant position in 2020

Government initiative such as ‘Make in India’ and ‘Made in China 2025’ have positively influenced the manufacturing sector in the region. Such initiatives are expected to boost the manufacturing sector, thereby fueling the use of bolts in industrial machineries.

By Region

Asia-Pacific holds a dominant position in 2020 and is expected to grow at a significant rate during the forecast period.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging bolts market trends and dynamics.

- In-depth bolts market analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the bolts market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global bolts market forecast analysis from 2021 to 2030 is included in the report.

- The key players within bolts market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the bolts industry.

Bolts Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Material |

|

| By END USER |

|

| By Region |

|

| Key Market Players | ELGIN FASTENER GROUP, A.B. STEEL WORK, FASTENAL COMPANY, BRUNNER MANUFACTURING CO., INC., REYHER Nchfg. GmbH & Co. KG, FABORY, B&G MANUFACTURING CO. INC., KELLER & KALMBACH GMBH, KD FASTENERS, INC., BIG BOLT NUT |

Analyst Review

The bolts market has witnessed significant growth in past few years, owing to increase in construction activities and physical properties of bolts such as high strength and durability.

The world is witnessing an increase in construction activities owing to increasing population and importance of infrastructure in the overall development of a country. Steel sections such as I-sections, C-sections, plates and hollow elements are being extensively used for constructing components such as roofs, girders and columns. Thus, increase in construction activities has led to rise in demand for bolts, as they are extensively used in connecting steel components such as trusses and roof components. In addition, bolts are used in automotive industry for connecting various components of vehicles, thus the rapid growth of automotive industry in developing economies positively influences the bolt market.

Moreover, increase in government and private investment in construction and automotive industry provides lucrative opportunities for the growth of the bolts market.

The bolt market size was valued at $46,854.3 million in 2020.

Based on type, the half screw bolt segment holds the maximum market share of the bolt market in 2020.

The bolt market is projected to reach $81,174.7 million by 2030.

Growth in construction sector and manufacturing sector are the key trends in the bolt market.

The product launch is key growth strategy of bolt industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Fluctuating cost of raw materials and less accuracy of bolted connections are the effecting factors for bolt market.

The end user of bolts includes automotive, aerospace, construction, industrial machinery and others.

Loading Table Of Content...