Boxboard Packaging Market Research: 2032

The Global Boxboard Packaging Market was valued at $74.4 billion in 2022, and is projected to reach $132.9 billion by 2032, growing at a CAGR of 5.9% from 2023 to 2032. Boxboard packaging refers to the use of a certain type of paperboard or cardboard to create various boxes, cartons, and packaging options. Boxboard is a thick, rigid material that is mostly made of layers of compressed paper pulp. It is extensively used in the retail, cosmetics, pharmaceutical, electronic, and food & beverage sectors. It provides a versatile and economical choice for displaying and protecting goods.

Demand for boxboard packaging has increased as a result of the growth of online shopping and the necessity for dependable packaging solutions. In addition, the e-commerce industry has grown dramatically over the past 10 years and is expected to keep growing in the years to come, especially the platforms that offer perishable commodities such as prepared food and groceries. The ease of purchasing and the accessibility of a broad range of goods at discount prices are two factors that contribute significantly to rise in penetration of e-commerce platforms.

According to the Census Bureau of the Department of Commerce of the U.S., the quarterly U.S. retail e-commerce sales as a percent of total quarterly retail sales was below 6% in 2013, and it went above 14% in 2022. Moreover, in July 2020, Uber acquired Postmates, an online food delivery service provider, for $2.65 billion to expand its Uber Eats network. In addition, Zomato Limited, an online food delivery service provider, reported an increase in the average monthly transacting customers from 9.8 million in Q4 of the financial year 2021, to 15.7 million in Q4 of the financial year 2022.

Furthermore, according to Lavu, a technological solutions provider for restaurants, in 2022, the growth rate for online food ordering and restaurant delivery has been over 20% in the last five years. Boxboard packaging is used for the shipping of perishable goods such as groceries, prepared foods, beverages, pharmaceuticals, and other items offered by online platforms such as Amazon Fresh, Zomato, Spencers, 1mg, Pharmeasy, Swiggy, and Uber Eats. This is attributed to the fact that ineffective temperature-controlled packaging can create an environment that is favorable for preventing the growth of bacteria in the items and keeping them fresh for a longer period. Therefore, the expansion of the e-commerce industry is driving the growth of the boxboard packaging industry.

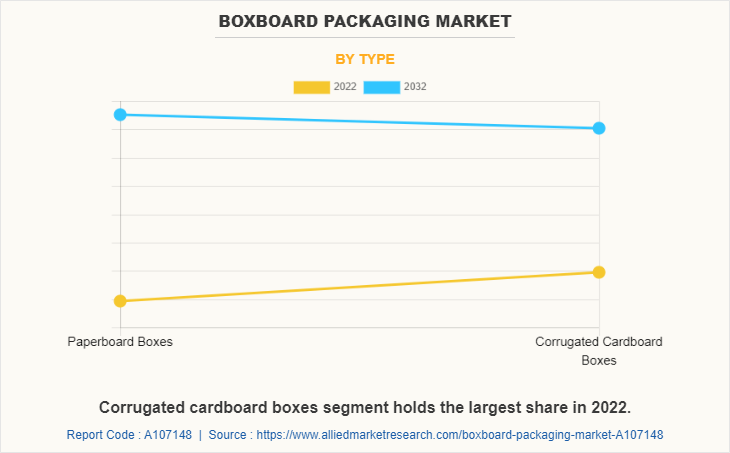

By Type:

By type, the market is bifurcated into paperboard boxes and corrugated cardboard boxes. The corrugated cardboard boxes segment is expected to serve as the largest revenue contributor during the forecast period. packaging market during the forecast period. Cardboard boxes is frequently used in packaging. The main component is wood pulp, which is used to make it. The fluting medium in corrugated cardboard boxes acts as a shock absorber, protecting protected goods from external impact.

The varying layers and thicknesses of the flutes offer benefits, including cushioning to protect packaged items, and these containers can withstand high pressure. In addition, Paperboard boxes are expected to exhibit the highest CAGR share during the forecast period. The paperboard boxes are largely used in the packaging of food & beverages, medicines, durable and non-durable goods, industrial goods, and cosmetics. In addition, corrugated cardboard boxes are made of pulp and paper; therefore, they are extremely recyclable compared to plastic packaging.

However, cost fluctuations that occur frequently can impede the boxboard packaging market growth. In addition, boxboard packaging can be expensive to produce and manufacture, especially when compared to packaging alternatives such as plastics. Boxboard packaging's entire cost structure can be impacted by raw material price volatility, such as shifting pulp costs, which can reduce its competitiveness in some market areas. Furthermore, paperboard, which comes from trees, is frequently used to make boxboard packaging.

Environmental concerns have increased the need for sustainable packaging alternatives, which has caused a move toward greener choices such recycled material or biodegradable packaging. This can pose a challenge to traditional boxboard packaging manufactures who need to adopt to meet changing consumer preferences and regulations. Hence, fluctuation in the cost of raw materials and implementation of stringent regulatory compliances restrain the market growth.

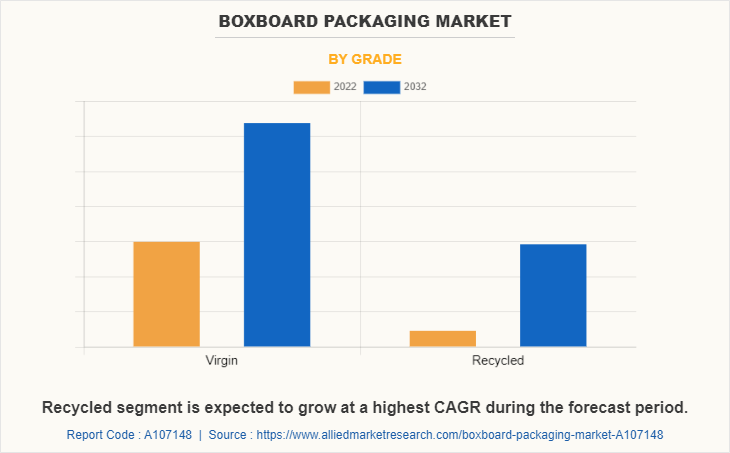

By Grade:

On the basis of grade, the market is classified into virgin and recyclable. The virgin segment is expected to be the largest revenue contributor during the forecast period. Surge in demand for sustainable packaging solutions acts as the key driver of the global market. This is attributed to the fact that consumers and businesses are increasingly concerned about environmental issues and are seeking packaging materials with reduced environmental impact. This has opened opportunities for alternative materials, such as biodegradable, compostable, and recyclables packaging, which propels the growth of the market.

However, the recyclable segment is expected to exhibit the highest CAGR share during the forecast period. Many governments and regulatory bodies worldwide are implementing regulations and incentives to promote the use of recycled packaging. These policies aim to increase recycling rates, reduce waste generation, and encourage the adoption of more sustainable packaging practices. Compliance with present regulations presents opportunities for growth of the recycled packaging sector. Thus, implementation of government regulations supports the growth of the market which is further helping in expansion of boxboard packaging market size.

Moreover, packaging is becoming into a necessary component of modern life as a result of its convenience of storage, transportation, and customer preference for safe and secure packaging. To safeguard and transport cosmetics & personal care, electronics items, the demand for smart packaging solutions such as boxboard packaging is increasing significantly. In addition, organizations are heavily investing in cutting-edge packaging solutions to achieve prospective results. For instance, in April 2021, Mauser Packaging Solutions acquired the Global Tank Srl through Joint Venture NCG-Maider in Italy. Via this acquisition, Mauser Packaging Solutions further plans to extend the offering of industrial packaging products and services in the Italian market while strengthening the company’s position as the global market player in reconditioning. Hence, such acquisition and business plan can propel the growth of market during the boxboard packaging market forecast period.

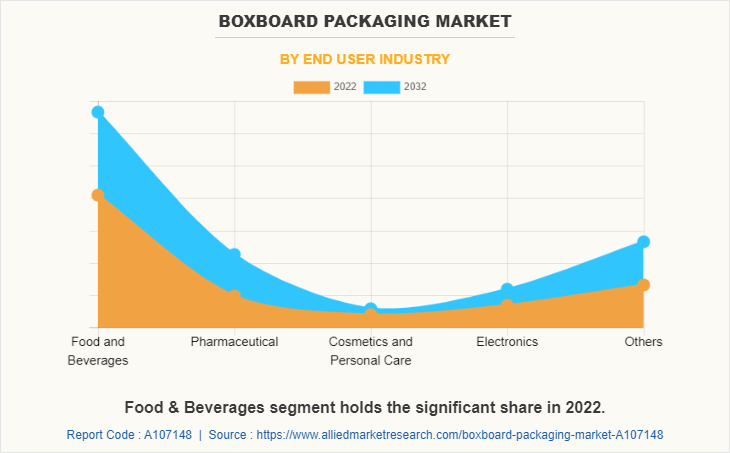

By End User:

By end-user industry, it is divided into food & beverages, pharmaceuticals, cosmetics & personal care, electronics, automotive, and others. The food & beverages segment is expected to be the largest revenue contributor during the forecast period. Increase in disposable income, hectic lifestyle, and the fact that both partners work fuel the demand for frozen, chilled, and hot food & beverages as well as ready-to-cook, heat-and-eat meals. Furthermore, COVID-19 boosted the demand for frozen foods and beverages, and this trend and change in the eating behavior of the masses is likely to continue in the coming years. In addition, expansion of the online food delivery companies is positively influencing the boxboard packaging market as they make extensive use of insulated packaging.

However, the pharmaceuticals segment is expected to exhibit the highest CAGR share in the end-user segment during the forecast period. Rise in health consciousness among consumers and surge in demand for convenience in the highly competitive pharmaceutical packaging business demand for brand building through the creation of distinctive packaging materials. In addition, the pharmaceutical packaging business benefits from rising environmental concerns and the adoption of new regulatory criteria for packaging recycling. Furthermore, the market is expanding rapidly due to the adoption and observance of regulatory standards for pharmaceutical packaging and recycling requirements.

Furthermore, several commodities, including food items, oil, and gas, witnessed surge in price due to the Russia–Ukraine conflict. Due to supply chain interruptions, there are now more expensive shipping costs, fewer available containers, and less warehouse space. Since there have been delays in shipments and congestion, certain ports have been closed, and orders are being retracted, which influences industry and consumers globally. The decline in investor confidence has increased stock market volatility. Economic instability has risen because of the strained commercial ties between Russia, Ukraine, and their different trading partners. Hence, all these factors collectively have reduced export possibilities.

The Global Boxboard Packaging System is segmented into type, grade, end-user industry, and region. By type, the market is bifurcated into paperboard boxes and corrugated cardboard boxes. On the basis of grade, it is classified into virgin and recyclable. By end-user industry, it is divided into food & beverages, pharmaceuticals, cosmetics & personal care, electronics, automotive, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Spain, Italy, Netherlands, and rest of Europe). Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Region:

The boxboard packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific held the highest revenue in boxboard packaging market share. Exponential growth in population and disposable income of masses in Asia-Pacific are anticipated to propel the growth of the pharmaceuticals and food & beverage industries, which propels the growth of the cold chain logistics market, eventually boosting the demand for boxboard packaging. Furthermore, the major countries, such as India and China, are involved in the manufacturing of pharmaceutical drugs. Howver, LAMEA is expected to exhibit the highest CAGR during the forecast period. The economic growth in countries such as Brazil, South Africa, and Argentina drives various industries such as cosmetics, pharmaceuticals, and food & beverages, which in turn increases the demand for boxboard packaging, as these industries use them extensively. Thus such factors are expected to offer lucrative boxboard packaging market opportunity.

Competition Analysis

The major players profiled in the boxboard packaging market include Stora Enso, Sappi, Nippon Paper Group, Mondi, Metsa Board, Mayr-Melnhof Group, ITC Limited, International Paper Co, Mondi Plc, and Smurfit Kappa Group.

Major companies in the market have adopted acquisition, product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the boxboard packaging market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the boxboard packaging market analysis from 2022 to 2032 to identify the prevailing boxboard packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the boxboard packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global boxboard packaging market trends, key players, market segments, application areas, and market growth strategies.

Boxboard Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 132.9 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 234 |

| By Type |

|

| By Grade |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Sappi Limited, Smurfit Kappa Group Plc, WestRock Company, Stora Enso Oyj, Metsa Group, International Paper Company, ITC Limited, Mayr-Melnhof Karton AG, Nippon Paper Industries Co., Ltd., Mondi Group |

Analyst Review

The boxboard packaging is gaining high traction in the e-commerce industry due to the rise in online shopping and the need for reliable packaging solutions. In addition, the e-commerce sector, particularly the platforms that provide perishable commodities such as prepared food and groceries, has developed significantly over the past 10 years and is anticipated to continue expanding in the years to come, which, in turn, is expected to foster the demand for boxboard packaging. Furthermore, consumers are being more conscious of packaging materials and their impact on the environment. This has created a demand for packaging solutions that are recyclable and minimize waste.

Surge in demand for innovative packaging technologies is expected to open new avenues for the expansion of the global boxboard packaging market in the coming years.

The global boxboard packaging market was valued at $74,421.0 million in 2022, and is projected to reach $132,882.8 million by 2032, registering a CAGR of 5.9% 2023 to 2032.

The forecast period considered for the global boxboard packaging market is 2022 to 2031, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global boxboard packaging market report can be obtained on demand from the website.

The base year considered in the global boxboard packaging market report is 2022.

The top companies holding the market share in the global boxboard packaging market report are Stora Enso, Sappi, Nippon Paper Group, Mondi, Metsa Board, Mayr-Melnhof Group, ITC Limited, International Paper Co, Mondi Plc, and Smurfit Kappa Group.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments

By type, the corrugated cardboard boxes segment is the highest share holder of boxboard packaging market.

Loading Table Of Content...

Loading Research Methodology...