Brake Chamber Market Research, 2033

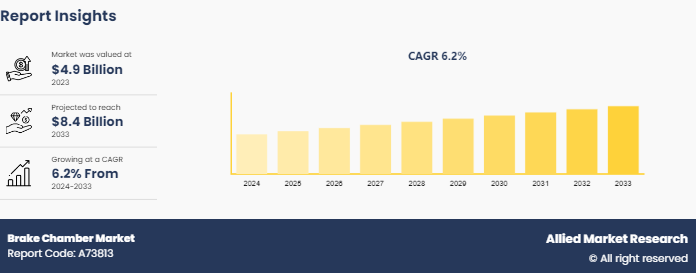

The global brake chamber market was valued at $4.9 billion in 2023, and is projected to reach $8.4 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

Market Introduction and Definition

A brake chamber is a vital component in air brake systems, primarily used in commercial vehicles such as trucks and buses. It converts compressed air into mechanical force to apply the brakes. The brake chamber consists of a metal housing, a diaphragm, a push rod, and various springs and seals. When the driver presses the brake pedal, compressed air enters the chamber, pushing against the diaphragm. This action extends the push rod, which, in turn, actuates the brake mechanism, typically by engaging the brake shoes with the brake drum or rotor. Proper maintenance of brake chambers is crucial for vehicle safety and effective braking performance.

Rise in demand for commercial vehicles directly correlates with an increase in sales for brake chambers. As industries expand and logistics operations escalate, there is a heightened need for reliable commercial transportation solutions. This surge necessitates robust braking systems essential for the safety and efficiency of these vehicles. Consequently, the escalation in vehicle production drives the demand for high-quality brake chambers, integral for maintaining vehicle performance and compliance with safety regulations. This trend not only boosts the brake chamber industry but also stimulates innovations in durability and performance, ensuring alignment with the evolving demands of the transportation sector.

Key Takeaways

- The brake chamber market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major brake chamber industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- In May 2020, ZF Group finalized the acquisition of WABCO, marking the culmination of a comprehensive regulatory approval process. With this milestone, ZF has initiated the integration of WABCO into its operations. The amalgamation of ZF and WABCO positions the combined entity as a preeminent global provider of integrated systems for commercial vehicle technology. WABCO will transition into ZF's Commercial Vehicle Control Systems and braking system, facilitating seamless collaboration and synergy.

- In November 2021, Bendix Commercial Vehicle Systems LLC inaugurated its new North American headquarters in the U.S. This modern structure, nestled amidst a lush 56-acre campus, boasts abundant natural light and a striking architectural design. Adding to its accolades, the facility has been awarded LEED Silver certification, thus highlighting Bendix's commitment to sustainability and environmental stewardship.

Key Market Dynamics

The global brake chamber market size is experiencing growth due to increase in demand for commercial vehicles, rise in adoption of air brake systems, growth in focus on vehicle safety, and increase in aftermarket sales. However, volatility in raw material prices, slow adoption of advanced technologies, and competitive pricing pressure hinder the market growth. Moreover, integration of advanced sensors and electronics, rise in electric and autonomous vehicles, and aftermarket services and solutions offer lucrative opportunities for the expansion of the global brake chamber market share.

The escalating adoption of air brake systems across the commercial vehicle sector significantly propels the sales of brake chambers. Air brakes, favored for their reliability and efficiency in heavy vehicles, rely on brake chambers to convert air pressure into the mechanical force needed for safe stopping. As industries invest more in transportation solutions that promise safety and durability, the integration of air brakes becomes increasingly common, thereby boosting brake chamber market opportunity. This rise in air brake system installations supports the brake chamber market growth, mirroring broader trends towards enhanced vehicular safety and performance standards.

Increased emphasis on vehicle safety acts as an important driver for brake chamber market forecast. As regulatory standards tighten and consumer awareness increases, the demand for reliable braking systems to enhance road safety increases. Brake chambers, an integral part of the air brake system, play an important role in the quick and efficient application of brakes. Recognizing this increased attention to safety is forcing manufacturers to innovate and deliver superior brake housings that meet stringent safety requirements. As a result, the brake chamber market is on the rise, driven by a collective commitment to raising automotive safety standards across the industry.

The integration of advanced sensors and electronics into brake chambers is expected to significantly boost their sales. Modern sensors enhance the precision and responsiveness of braking systems, leading to improved safety and performance. By incorporating electronic controls, brake chambers can offer real-time monitoring and diagnostics, reducing maintenance costs and downtime. These innovations meet the growing demand for smarter, more efficient braking solutions in commercial vehicles. As fleet operators prioritize safety and efficiency, the enhanced capabilities of sensor-equipped brake chambers make them an attractive investment, driving market growth and setting new industry standards for vehicle braking systems.

Market Segmentation

The brake chamber market is segmented by type, vehicle type, sales channel, and region. On the basis of type, the market is divided into spring brake chambers, and service brake chambers. As per vehicle type, the market is segregated into heavy-duty trucks, medium-duty trucks, and light-duty trucks. Based on sales channel, it is divided into OEM, and Aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Technology Insights Overview

The new IBV (internal breathing valve) technology from Wabco enables the brake chamber to breathe using clean air from the service side, unlike most competitor chambers that utilize Open-Hole Technology with external holes in the rear housing. These external holes often let in contaminants like dirt and salt, which can degrade the parking spring over time. By introducing a fully sealed parking spring, IBV effectively protects it from such contaminants, significantly extending the life of the brake chamber.

Regional/Country Market Outlook

Canada offers a promising opportunity for funding and growth of brake chambers. With a stable financial system, favorable regulatory surroundings, and professional staff, Canada gives enough opportunities across diverse sectors. Additionally, recent authorities' initiatives, inclusive of the Clean Fuel Standard and investments in renewable power infrastructure, underscore Canada's dedication to sustainability and innovation.

With more models coming, incentives are seen as key to boosting Canada’s medium- and heavy-obligation electric powered truck transition. While more electric truck manufacturers are starting to roll out heavy-duty vehicles catered to meeting the needs of commercial fleets, purchase incentive programs for those vehicles from Canadian governments are scarce. Addressing this gap in incentives is crucial for accelerating the transition away from medium- and heavy-duty diesel trucks, ultimately contributing to Canada's emissions reduction goals and fostering a greener transportation sector.

- In May 2021, ZF unveiled its innovative Brake Actuator Platform, which marks a significant advancement in brake chamber technology. This platform revolutionizes braking maneuvers for trucks, buses, and trailers while optimizing cost efficiency for OEMs. By integrating this brake actuator technology, ZF reinforces its commitment to safety and performance in the commercial vehicle sector. This development not only enhances ZF's position as a leader in brake control technology but also offers potential synergies with brake chamber manufacturers.

- In December 2023, Knorr-Bremse unveiled its latest generation of the iTEBS X electronic trailer braking system, marking a significant advancement in trailer technology and its relationship to brake chambers. The launch of this iTEBS X system comes with innovative features to enhance trailer safety and performance. With major product innovations in the trailer's air suspension system, including POM and CSM components, the integration of the iTEBS X system to potentially influence the design and functionality of brake chambers within the trailer braking system.

Competitive Landscape

The major players operating in the brake chamber market include TSE Brakes, Inc., Bendix Commercial Vehicle Systems, WABCO Holdings Inc., Meritor, Inc., Haldex AB, Knorr-Bremse AG, Saf-Holland, Sealco Commercial Vehicle Products, ZF Friedrichshafen AG, and Vibgyor Automotive Pvt. Ltd.

Other players in brake chamber market includes Tectran Manufacturing Inc, Hangzhou Lozo Machinery Co., Ltd, Zhejiang T1ZC Automobile Parts Company, and so on.

Industry Trends:

- In August 2023, the Minister of Transport, Canada, unveiled plans to bolster clean energy adoption within the trucking sector. An investment totaling nearly $3 million was earmarked under the Zero-Emission Trucking Program to fuel three projects spanning Québec, British Columbia, and Nova Scotia. Aligned with Canada's ambitious goal of achieving 100% zero-emission vehicle sales for new medium- and heavy-duty vehicles by 2040, the initiative aims to provide direct support to industry stakeholders and provinces.

- In January 2021, the German transport ministry unveiled a program aimed at incentivizing the replacement of aging trucks with cleaner alternatives. The initiative offers immediate support for the purchase of new trucks compliant with Euro 6 emissions standards, providing incentives of more than $15, 000 when an old Euro 3, 4, or 5 truck is decommissioned simultaneously. Furthermore, subsidies of more than $5, 000 are available for the acquisition of 'intelligent trailer technology, ' including systems for tire pressure monitoring and aerodynamic enhancements.

Top 10 Heavy Truck Export Brands in China

Heavy Truck Builders | Exports in 2023 | Exports in 2022 |

SINOTRUK | 120,584 | 79,872 |

SHACMAN | 56,499 | 34,282 |

FAW Jiefang | 44,817 | 21,415 |

FOTON | 19,945 | 16,397 |

Dongfeng | 16,390 | 10,326 |

Hongyan | 4605 | 2637 |

JAC | 3996 | 262 |

XCMG | 3673 | 3384 |

Dayun | 3278 | 2202 |

CAMC | 1346 | 906 |

TOTAL | 275,133 | 171,683 |

Key Sources Referred

- Commercial Vehicle Brake Manufacturers Council

- Motor & Equipment Manufacturers Association

- Australian Trucking Association

- Automotive Industries Association Of Canada

- Commercial Vehicle Safety Alliance

- Truck Trailer Manufacturers Association

- Automotive Component Manufacturers Association of India

- China Association of Automobile Manufacture

- Automobile Association Of Singapore

- Japan Automobile Manufacturers Association

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the brake chamber market analysis from 2024 to 2033 to identify the prevailing brake chamber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the brake chamber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global brake chamber market trends, key players, market segments, application areas, and market growth strategies.

Brake Chamber Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.4 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Meritor, Inc., Sealco Commercial Vehicle Products, Vibgyor Automotive Pvt. Ltd., TSE Brakes, Inc., ZF Friedrichshafen AG, Bendix Commercial Vehicle Systems, WABCO Holdings Inc., Knorr-Bremse AG, Saf-Holland, Haldex AB |

Shift towards Lightweight and High-Performance Materials, Increased Adoption of Electric and Hybrid Vehicles, and Growth in Aftermarket Demand and Services are the upcoming trends of Brake Chamber Market in the globe

Service brake chambers is the leading type of Brake Chamber Market

North America is the largest regional market for Brake Chamber

The estimated industry size of Brake Chamber is $ 8.4 billion in 2033

Heavy-duty trucks is the leading vehicle type of Brake Chamber Market

Loading Table Of Content...