Brazil And Mexico Oleochemicals Market Overview:

The Brazil and Mexico oleochemicals market was valued at $521.2 million in 2017, and is projected to reach $782.3 million by 2025, growing at a CAGR of 5.2% from 2018 to 2025.

Oleochemicals are majorly derived from natural raw materials based on plant sources or animal fat. Activated carbon is often used to purify, decolorize, and deodorize the fatty acids and derived chemicals. Oleochemicals are biodegradable and exhibit low toxicity, and thus are environment-friendly. These products are viewed as natural, green, organic, safe, renewable, and biodegradable by the scientists and consumers. A wide variety of food and beverages are composed of oleochemicals. Salad and cooking oils, salad dressings, margarines, deep frying oils, chocolate fats, fats for infant nutrition, and vegetable fats for dairy products are some of the widely available products that are based completely on fats and oils. Furthermore, the major application of oleochemicals has been making soaps and detergents. Lauric acid, which is used to produce sodium lauryl sulfate and compounds, is utilized to make soaps and detergents.

The major driving factor that is responsible for the growth of the Brazil and Mexico oleochemicals market is increase in demand for biodegradable products and sustainable solutions. Furthermore, government regulations for the use of environmental-friendly products and replacement of petroleum-based products by oleochemicals have fueled the market growth. However, volatile prices for important oil and fats have hindered the market growth. On the contrary, emerging applications of oleochemicals, such as the use of biopolymers and bio-lubricants, is expected to make future opportunities for the market growth.

The Brazil and Mexico oleochemicals market is segmented based on type and application. On the basis of type, Brazil and Mexico oleochemicals market is divided into fatty acid, fatty alcohol, glycerol, and others. By application, it is categorized into pharmaceutical, personal care & cosmetics, food & beverage, home care (soap & detergent), animal feed, and others.

The companies profiled in this report are IOI Group, BRAIDO, EMERY OLEOCHEMICALS, Musim Mas Holdings Pte. Ltd, Baerlocher GmbH, CREMER OLEO GmbH & Co. KG, MATERIA HNOS S.A.C.I.F, Wilmar International Ltd, QUIMIC, and Godrej.

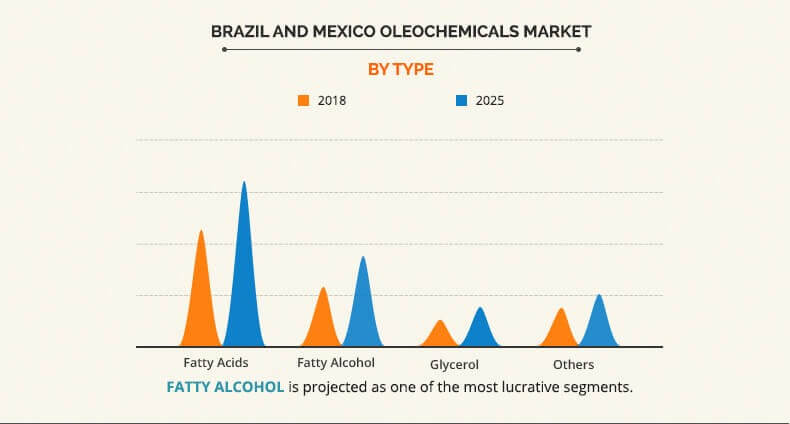

Brazil and Mexico oleochemicals market, by type

The fatty alcohol segment is projected to be the most lucrative segment, owing to increase in consumption of fatty alcohols in surfactant-based industries, such as cosmetics, soaps, detergents, and personal care products. In addition, pure & midcut fatty alcohols have been increasingly used in Mexico and Brazil to manufacture sodium laureth sulfate (SLS), linear alkylbenzene sulfonate (LAS), and sodium lauryl ether sulfate (SLES), which are the key ingredients in various personal care products, such as lotions, shampoos, dishwashing liquids, and others.

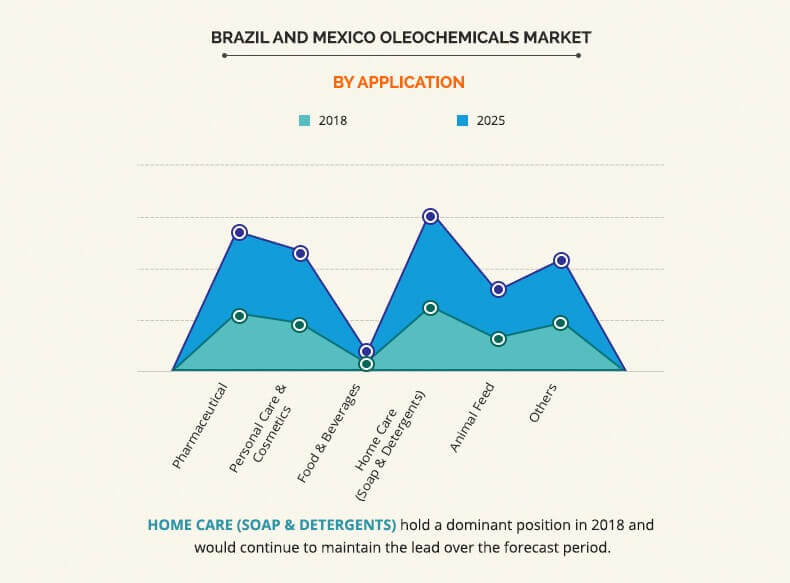

Brazil and Mexico oleochemicals market, by application

The home care (soap & detergent) segment by application holds a dominant position during the forecast period, owing to development of the textile industry, and rise in penetration of washing machines is expected to fuel the demand for soaps and detergents in Brazil and Mexico. Furthermore, rise in healthcare awareness boosts the demand for soaps and detergents, as essential sanitizing products. As a result, the demand for oleochemicals is predicted to increase, thereby supplementing the growth of the market.

Key Benefits

- This report provides an extensive analysis of the current and emerging market trends and dynamics of the Brazil and Mexico oleochemicals market.

- An in-depth analysis of Brazil and Mexico is conducted by constructing the market estimations for key segments between 2017 and 2025 to identify the prevailing opportunities.

- The report assists to understand the strategies adopted by the companies for market expansion.

- This study evaluates the competitive landscape to understand the market scenario across various regions.

- An extensive analysis is conducted by following key player positioning and monitoring the top competitors within the market framework.

Brazil And Mexico Oleochemicals Market Key Segments:

By type

- Fatty acid

- Fatty alcohol

- Glycerol

- Others

By application

- Pharmaceutical

- Personal care & cosmetics

- Food & beverages

- Home care (soap & detergent)

- Animal feed

- Others

By Country

- Brazil

- Mexico

Brazil and Mexico Oleochemicals Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By COUNTRY |

|

| Key Market Players | Musim Mas Holdings Pte. Ltd, Baerlocher GmbH, Godrej, BRAIDO, QUIMIC, Wilmar International Ltd, IOI Group,, MATERIA HNOS S.A.C.I.F, EMERY OLEOCHEMICALS, CREMER OLEO GmbH & Co. KG |

Analyst Review

Oleochemicals are the chemicals derived from plant and animal fats, such as palm kernel oil, coconut oil, rapeseed oil, tallow, and lard. They are non-toxic, and their production requires less energy, thus minimizing pollution. Moreover, they are widely used as a viable alternative to non-renewable fuels, owing to increased environmental awareness, rise in prices of petroleum, and strong initiatives by the government to enable sustainable economic growth. Furthermore, they are widely adopted in manufacturing many consumer goods and industrial products, owing to their functional benefits and beneficial environmental profiles.

Furthermore, increase in demand for biodegradable products and sustainable solutions, government regulations initiating use of environmental-friendly products, and replacement of petroleum-based products with oleochemicals accelerate the growth of the Brazil and Mexico oleochemicals market.

Upsurge in use of oleochemicals in plasticizers, textile, and leather auxiliaries acts as a major driving factor of the market. As demand for plastics in packaging applications for use in food and beverages, pharmaceuticals, and chemicals has been increasing, the requirement for oleochemicals is expected to rise further. Moreover, development of leather and textile industries is projected to boost the demand for oleochemicals in the market.

Loading Table Of Content...