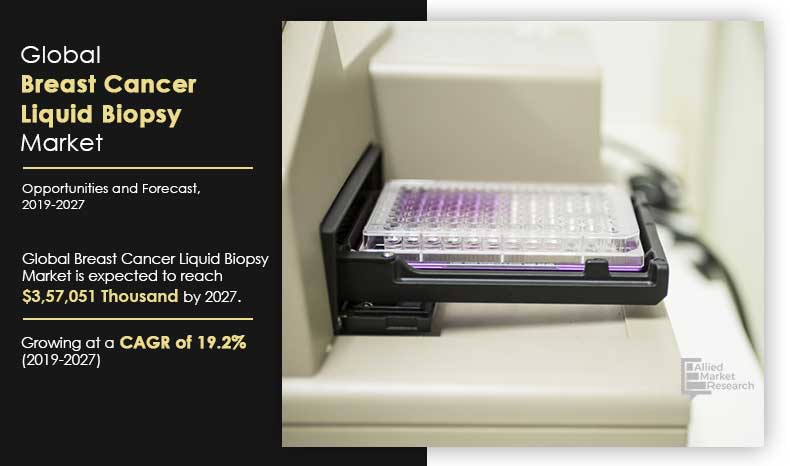

The global breast cancer liquid biopsy market size was valued at $87,641 thousand in 2019, and is projected to reach $357,051 thousand by 2027, registering a CAGR of 19.2% from 2019 to 2027.

The breast cancer liquid biopsy is a noninvasive alternative technique that makes use of blood as a sample and is chosen more than surgical tissue biopsy. There are various biomarkers that are used as a tool for detection of breast cancer such as circulating tumor cells (CTC), extracellular vesicles, and circulating tumor DNA. Breast cancer liquid biopsy aids to monitor progression of breast cancer disease based on heterogeneity of tumor cells in advanced stages of breast cancer. Moreover, breast cancer liquid biopsy test detects epidermal growth factor receptor (EGFR) gene mutations that support clinicians to choose the right breast cancer treatment at the right time.

Rise in prevalence of breast cancer, increase in demand for non-invasive breast cancer treatment, technological advancements in breast cancer liquid biopsy, availability of funding for liquid biopsy R&D, and increase in breast cancer liquid biopsy reagent approvals are the major factors that drive growth of the breast cancer liquid biopsy market. In addition, increase in patient awareness toward breast cancer treatment, advantages of breast cancer liquid biopsy tests over traditional tests, rise in adoption of liquid biopsy tests, surge in pre-screening programs for breast cancer detection, easy accessibility and high adoption of polymerase chain reaction (PCR) and next-generation sequencing (NGS) among healthcare professionals, and surge in demand for breast cancer liquid biopsy reagent kits are some other factors that contribute toward growth of the market. However, limitations associated with liquid biopsy testing and lack of access and awareness regarding breast cancer liquid biopsy in underdeveloped countries are expected to hinder growth of the market.

The World Health Organization (WHO) on January 30, 2020 declared COVID-19 outbreak a public health emergency of international concern. COVID-19 has affected around 210 countries across the globe. The breast cancer liquid biopsy manufacturing and distributing companies have been affected by COVID-19 to a limited extent, owing to shutdowns in various COVID-19 affected countries and rise in number of healthcare workers falling ill in the wake of the COVID-19 pandemic, leading to short supply.

Breast Cancer Liquid Biopsy Market Segmentation

The global breast cancer liquid biopsy market is segmented on the basis of product & service, circulating biomarker, application, and region. By product & service, the market is categorized into reagent kits, instruments, and services. By circulating biomarker, it is segregated into circulating tumor cells, extracellular vesicles, and circulating tumor DNA. Depending on application, it is classified into diagnostics, prognostics, and risk assessment. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product & Service

Reagent Kit segment holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Segment review

Presently, on the basis of product & service, the reagent kits is the major revenue contributor, and is projected to grow significantly during the forecast period. Increase in number of breast cancer liquid biopsy test procedures, surge in demand for reagent kits, increase in breast cancer liquid biopsy reagent kit approvals, and advent of novel liquid biopsy reagents that execute circulating biomarker analysis and target enrichment are the key factors that boost growth of the segment.

Depending on application, the diagnostics segment is the major shareholder in the global breast cancer liquid biopsy market, owing to technological advancements in liquid biopsy systems, and increase in patient awareness toward safe and non-invasive liquid biopsy testing procedures. Moreover, rise in trend of developing personalized therapeutics and increase in number of patients suffering from breast cancer across the globe are other factors that contribute toward growth of the market.

By Application

Diagnostics segment is projected as one of the most lucrative segment.

Snapshot of Asia-Pacific breast cancer liquid biopsy market

Asia-Pacific presents lucrative opportunities for key players operating in the breast cancer liquid biopsy market, owing to increase in number of patients suffering from breast cancer, increase in public awareness toward breast cancer liquid biopsy procedures, development of the R&D sector; rise in healthcare reforms; and increase in adoption of breast cancer liquid biopsy. Moreover, increase in demand for breast cancer liquid biopsy reagent kits, and rise in preference for noninvasive test procedures contribute toward growth of the market. Furthermore, surge in focus of leading manufacturers on expanding their geographical presence in emerging Asia-Pacific countries to capture high market share is expected to drive growth of the breast cancer liquid biopsy market in the region.

The key players profiled in this report include Biocept, Inc., F. Hoffmann-La Roche Ltd. (Foundation Medicine, Inc.), Fluxion Biosciences, Inc., Menarini Group (Menarini Silicon Biosystems, Inc.), Myriad Genetics, Inc., NeoGenomics Laboratories, Inc., Qiagen N.V., Sysmex Corporation, and Thermo Fisher Scientific Inc.

By Region

Asia-Pacific region would exhibit the highest CAGR of 20.1% during 2019-2027.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the breast cancer liquid biopsy market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers breast cancer liquid biopsy market analysis from 2019 to 2027, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis of four regions is provided to determine the prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook and global breast cancer liquid biopsy market growth.

Breast Cancer Liquid Biopsy Market Report Highlights

| Aspects | Details |

| By Product Services |

|

| By Circulating Biomarker |

|

| By Application |

|

| By Region |

|

| Key Market Players | BIOCEPT INC., GUARDANT HEALTH, INC., F. HOFFMANN-LA ROCHE LTD. (FOUNDATION MEDICINE, INC.), QIAGEN N.V., MENARINI GROUP (MENARINI SILICON BIOSYSTEMS, INC.), FLUXION BIOSCIENCES, INC., MYRIAD GENETICS, INC., SYSMEX CORPORATION, NEOGENOMICS LABORATORIES, INC., THERMO FISHER SCIENTIFIC, INC. |

Analyst Review

Breast cancer liquid biopsy tests have gained popularity as a simple, efficient, non-invasive alternative to solid tissue biopsies for breast cancer treatment. Moreover, breast cancer liquid biopsy tests are used for diagnostic and molecular characterization of tumor fragments and agents released in blood of breast cancer patients.

Rise in prevalence of breast cancer, surge in demand for breast cancer liquid biopsy reagent kits, rise in R&D activities and product innovations, and surge in pre-screening programs for breast cancer detection are expected to drive growth of the breast cancer liquid biopsy market. Moreover, increase in awareness among the population regarding breast cancer, rise in adoption of liquid biopsy tests, and rise in need for prognostic and diagnostic tests propel the market growth. However, limitations associated with liquid biopsy testing and lack of access and awareness regarding breast cancer liquid biopsy in underdeveloped countries are expected to hinder growth of the market.

North America is expected to remain dominant during the forecast period, owing to increase in demand for breast cancer liquid biopsy, rise in prevalence of breast cancer, and presence of major key players along with R&D centers. Moreover, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to key players during the forecast period, owing to increase in patient awareness toward breast cancer treatment.

Rise in prevalence of breast cancer, increase in preference for noninvasive procedures, technological advancements in breast cancer liquid biopsy instruments, advantages of over solid tumor biopsy, and increase in patient awareness toward minimally invasive breast cancer liquid biopsy procedures are the key factors that fuel growth of the breast cancer liquid biopsy market. In addition, rise in funding for breast liquid biopsy R&D, favorable initiatives undertaken by governments and global health organizations, and increase in breast cancer liquid biopsy reagents approvals are another factor that contributes toward the growth of the market

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India with a CAGR of 21.7%. This is due to increase in preference for noninvasive procedures, technological advancements to detect breast cancer at early stage, increase in government initiatives to surge awareness about genome-based diagnostic procedures, and high adoption of polymerase chain reaction (PCR) and next-generation sequencing (NGS) among healthcare professionals.

Top companies such as F. Hoffmann-La Roche Ltd. (Foundation Medicine, Inc.), Biocept Inc., Menarini Group (Menarini Silicon Biosystems, Inc.), Qiagen N.V., Myriad Genetics, Inc., and NeoGenomics Laboratories, Inc. held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in different regions.

Reagent kits segment is the most influencing segment owing to advent of novel liquid biopsy reagents that execute circulating biomarker analysis and target enrichment; increase in breast cancer liquid biopsy reagent kits approvals; and increase in funding for breast cancer liquid biopsy R&D are anticipated to drive the growth of the market. In addition, surge in demand for reagent kits, rise in number of breast cancer liquid biopsy test procedures, and increase in prevalence of breast cancer across the globe are other factors that contribute toward growth of the market.

The total market value of Breast Cancer Liquid Biopsy market is $87,640.8 thousand in 2019.

The forcast period for Breast Cancer Liquid Biopsy market is 2019 to 2027

The market value of Breast Cancer Liquid Biopsy market in 2020 is $83,468.5 thousand .

The base year is 2019 in Breast Cancer Liquid Biopsy market

Breast cancer liquid biopsy is a non-invasive blood test that detects tumor DNA fragments and circulating tumor cells (CTCs), which are released into the blood from primary tumors and metastatic sites

Breast cancer liquid biopsy provides a real-time method for treatment of breast cancer. It is used for collection & analysis of a blood sample taken from patients. It analyses the presence of tumor cell-derived biomarkers such as circulating tumor cells, extracellular vesicles, and circulating tumor DNA.

Loading Table Of Content...