Bridal Jewelry Market Research, 2032

The global bridal jewelry market size was valued at $112.1 billion in 2022, and is projected to reach $216.4 billion by 2032, growing at a CAGR of 6.8% from 2023 to 2032. Bridal jewelry encompasses a range of intricately crafted ornaments specifically designed for brides as they embark on one of the most special occasions, which is the marriage. Beyond being mere adornments, the bridal jewelry pieces carry cultural and religious significance. For instance, in South Asian weddings, such as Hindu ceremonies, the role of bridal jewelry transcends mere aesthetics. The bridal jewelry worn by the bride goes beyond glamour and vibrancy as they serve as symbols that are deeply rooted in the tradition and culture.

The growing popularity of gold in weddings is predicted to boost the bridal jewelry market size in the upcoming years. The popularity of gold in bridal jewelry is driven by deeply rooted cultural norms and traditions. Gold holds immense significance in various cultures, where it is considered not just an adornment but a symbol of heritage, tradition, and prosperity. For instance, India, was the second largest consumer of gold in 2021, according to the report by World Gold Council, the leading gold organization.

Also, this report stated that particularly 22-carat gold accounted for 80-85% of the bridal jewelry share in India in 2021. Also, the demand for 18-carat gold jewelry is experiencing significant growth in India. Hence, the jewelers can expand their offerings to include more designs and styles in 18-carat gold, catering to evolving consumer preferences.

Changing fashion trends with the growing popularity of artificial jewelry that is competing with bridal jewelry sector is anticipated to restrain the bridal jewelry demand during the forecast period. For instance, gold, being a precious metal, often lacks the versatility to be worn with casual dresses. In contrast, artificial jewelry offers more flexibility in terms of style and can be easily paired with a wider range of outfits. This versatility becomes a restraint for the demand of authentic bridal jewelry. Also, the artificial jewelry's ability to keep up with ever-changing fashion trends is a significant restraint for traditional bridal jewelry. The rapid evolution of fashion preferences is predicted to create a challenge for the bridal jewelry market demand during the forecast period.

The growing popularity of diamond jewelry in the bridal segment is anticipated to drive bridal jewelry market opportunities in the coming years. For instance, a variety of styles, designs, and personalization in diamond earrings, diamond necklaces, diamond pendants, diamond bracelets, and others is boosting the market opportunities. Diamond earrings offer brides a timeless and versatile accessory. The diversity in styles, sizes, and finishes of diamond necklaces presents an opportunity for customization. Bridal jewelry designers can capitalize on creating personalized diamond necklaces that cater to individual styles and preferences. From simple and understated designs to elaborate and luxurious pieces, customization enhances the appeal for a wide range of brides. In addition, diamond pendants offer an opportunity to infuse symbolism and personalization into bridal jewelry.

Jewelers can explore creating diamond lockets with intricate designs or incorporating meaningful symbols that hold sentimental value for the bride. Also, capitalizing on the trend of customization, online platforms have become quite popular that allow brides to personalize their jewelry. These platforms offer user-friendly interfaces where brides can mix and match earrings, necklaces, pendants, and bracelets to visualize their unique bridal look. Online customization platforms enhance engagement and provide a convenient shopping experience. All these factors are anticipated to drive the bridal jewelry expansion in the upcoming years.

The key players profiled in this report include Pandora, Chow Tai Fook, Tiffany & Co., Louis Vuitton SE, Richemont, Signet Jewelers Limited, H. Stern, Malabar Gold & Diamonds, Swarovski AG, and Cartier. Product launch, partnership, and business expansion are the key strategies adopted by the market players. For instance, on January 12, 2024, Reliance Jewels, renowned jewelry brand in India, introduced its new collection of jewelry, which will significantly influence the bridal jewelry sector by enhancing cultural relevance.

Brides in India often seek jewelry that reflects their cultural identity, and this collection, inspired by spring harvest festivals and astrological mandala patterns, resonates deeply with the cultural sentiments of the Indian population. The use of pure gold in crafting the collection enhances its appeal in the bridal jewelry sector. This is because, gold holds traditional significance in Indian weddings, symbolizing prosperity and auspicious beginnings.

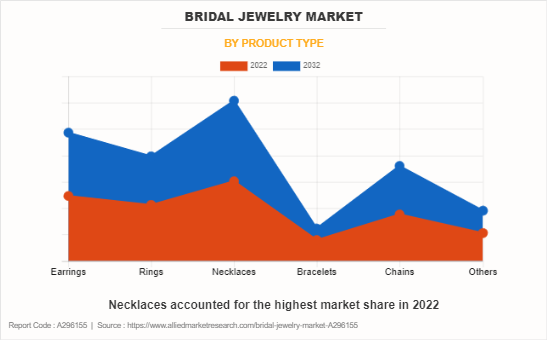

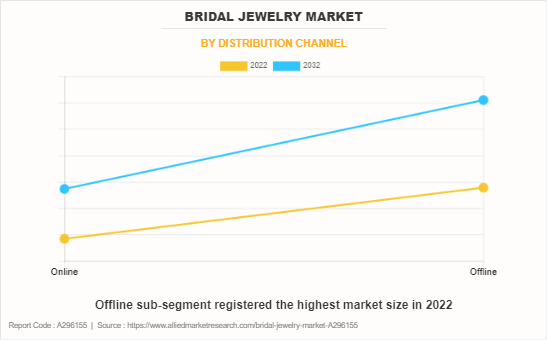

The bridal jewelry market is segmented on the basis of material, product type, distribution channel, and region. By material, the market is bifurcated into gold, diamond, silver, and others. By product type, the market is classified into earrings, rings, necklaces, bracelets, chains, and others. By distribution channel, the market is classified into online and offline. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The bridal jewelry market is segmented into Material, Product Type and Distribution Channel.

By material, the gold sub-segment dominated the global bridal jewelry market statistics in 2022. Gold jewelry is widely preferred by brides owing to its versatility, intricate designs, longevity, hypoallergenic nature, and other properties. Some of the most popular gold jewelry worn by brides are necklaces, rings, maang tikkas, earrings, bangles, waistbands, chains, rings, and others. Gold jewelry, whether coins or intricate bridal pieces, can withstand the test of time without rusting or deteriorating. Brides value gold for its ability to be treasured as timeless pieces, often passed down through generations. In addition, gold's hypoallergenic nature, resulting from its inert properties, makes it a preferred choice for bridal jewelry.

Brides can confidently wear gold pieces without concerns about skin reactions, even during the healing process of ear piercings. This attribute adds to the comfort and desirability of gold jewelry for brides. Brides appreciate the traditional craftsmanship and unique designs found in vintage gold pieces. The ability of gold jewelry to hold its value and be recycled over time makes it a sought-after investment, contributing to its popularity in bridal collections. Also, gold‐™s malleability allows artisans to shape it into intricate designs, making it a versatile material for crafting bridal jewelry. The malleability also allows for the creation of various styles, from delicate filigree work to bold statement pieces. Goldsmiths can showcase their skills by creating unique and personalized bridal jewelry, meeting the diverse preferences of brides. These factors are anticipated to have a positive impact on the gold bridal jewelry market during the forecast years.

By product type, the necklaces sub-segment dominated the global bridal jewelry market share in 2022. Necklaces are versatile and most important jewelry for brides. They are available in different designs and looks ranging from simple designs to heavy designs that can match the bridal attire. For instance, classic necklaces, such as pearl strands, diamond necklaces, and gold neckpieces, exhibit timeless elegance. Brides opt for these styles due to their versatility, seamlessly complementing various ensembles like lehengas and sarees. The enduring appeal of classic necklaces lies in their ability to enhance the bride's overall look with sophistication and grace. Also, layered necklaces, representing an evergreen trend, provide options for both maximalist and minimalist looks.

For those seeking a subtle look, layering single- or double-strand necklaces achieves a minimal yet striking effect. Furthermore, choker necklaces emerge as an excellent option for brides aiming for bold and ornate bridal styling. Worn close to the neck, chokers make a striking impact, enhancing the overall appearance of lehengas and sarees. Brides choose choker necklaces for their ability to add a touch of glamouring their bridal look.

By distribution channel, the offline sub-segment dominated the global bridal jewelry market share in 2022. People usually visit offline stores to purchase bridal jewelry as they can try different jewelries that will look good on their bridal attire. Also, offline purchase is linked with a sense of reliability and security with physically visiting jewelry stores, especially for high-value purchases like wedding jewelry.

Also, face-to-face interactions with knowledgeable sales staff build confidence, providing customers with the assurance they need for substantial investments. The ability to inspect jewelry firsthand contributes to a higher level of trust, allowing customers to assess the quality and craftsmanship before making a purchase. As wedding jewelry holds significant sentimental value, the offline buying experience becomes memorable.

By region, Asia-Pacific dominated the global bridal jewelry market in 2022. The demand for jewelry especially gold, diamond, and silver jewelry is high in Asia-Pacific countries namely China, Japan, India, South Korea, Indonesia, and others. For instance, the share of bridal jewelry in the overall gems and jewelry market in India accounts for more than 50%. This is majorly owing to the cultural significance associated with gifting different pieces of jewelry to the bride during her wedding. For instance, according to Economic Times, the leading Indian news platform, in 2023, about 38 lakh wedding ceremonies were held across the country, with a massive flow of about $64.3 billion spent on wedding purchases including bridal jewelry.

Also, the significance of bridal jewelry in India is increased as the gold gifted to a woman during her wedding becomes her sole property, serving as a crucial form of financial security. The availability of different jewelry types such as studded jewelry is driving the demand for bridal jewelry. For instance, studded jewelry, such as Polki, Kundan, or Jadau, holds an estimated 15-20% market share, with a significant presence in North India where this share is notably higher. Also, India and China are the key markets for jewelry consumption in Asia-Pacific. For instance, in 2022, the jewelry consumption demand was 600 tons in India followed by China accounting for 571 tons.

Impact of COVID-19 on the Global Bridal Jewelry Industry

- The COVID-19 pandemic negatively impacted the bridal jewelry demand owing to cancellation or postponements of wedding ceremonies due to the fear of spread of coronavirus.

- In addition, the sudden closure of shops, halt in exhibitions, and restrictions on movement significantly disrupted the supply chain for the bridal jewelry industry. Manufacturing processes, largely dependent on skilled craftsmen, faced challenges due to lockdowns. For instance, the jewelry manufacturing process in India is manpower-driven, with a deep connection to traditions and passed through generations. The sudden lockdown forced many skilled workers to return to their hometowns, slowing down the overall jewelry-making process and affecting businesses.

- The pandemic led to a shift in consumer buying patterns, with consumers becoming more conscious regarding their spending. Luxury jewelry brands catering to high-end consumers experienced a decline owing to reduced spending on non-essential and luxury goods.

- However, the pandemic prompted a shift to more virtual ways of running a jewelry business. Virtual appointments, video calls, and digital media became essential tools for engaging with clients and showcasing collections. The industry adapted to the changing landscape by leveraging technology.

Key Benefits For Stakeholders

- The report provides exclusive and comprehensive analysis of the global bridal jewelry market trends along with the bridal jewelry market forecast.

- The report elucidates the bridal jewelry market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter‐™s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the bridal jewelry market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the bridal jewelry market growth.

Bridal Jewelry Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 216.4 billion |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 330 |

| By Material |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

The major growth strategies adopted by the bridal jewelry market players are partnership, business expansion, and product launch.

The bridal jewelry market size is expected to grow due to an increase in demand for different types of gold and diamond jewelries such as rings, necklaces, chains, and others that holds cultural significance in wedding ceremonies. In addition, there has been a rise in popularity of online jewelry stores that offer a wide range of traditional as well as modern jewelry designs. These factors are anticipated to generate excellent growth opportunities in the market.

Asia-Pacific will provide more business opportunities for the global bridal jewelry market in the future.

Pandora, Chow Tai Fook, Tiffany & Co., Louis Vuitton SE, Richemont, Signet Jewelers Limited, H. Stern, Malabar Gold & Diamonds, Swarovski AG, and Cartier are the major players in the bridal jewelry market.

The necklaces sub-segment of the product type segment acquired the maximum share of the global bridal jewelry market in 2022.

The potential customers of the bridal jewelry market are individuals or couples who are planning to get married and are in search of jewelry specifically designed for weddings.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global bridal jewelry market from 2022 to 2032 to determine the prevailing opportunities.

The growing demand for unique and personalized bridal jewelry pieces to drive the market growth.

Loading Table Of Content...

Loading Research Methodology...