Bromacil Market Research, 2033

Market Introduction and Definition

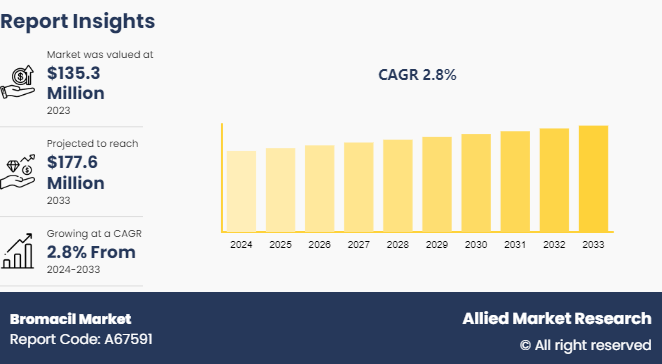

The global bromacil market size was valued at $135.3 million in 2023, and is projected to reach $177.6 million by 2033, growing at a CAGR of 2.8% from 2024 to 2033. A selective herbicide, bromacil is mostly applied on crops to control grasses and weeds. It is a member of the substituted uracil chemical class and works by preventing photosynthesis, which restricts the growth of plants. Since bromacil works well in pre-emergence and post-emergence applications, it can be used in both agricultural and non-agricultural contexts. It is frequently used in non-crop areas, industrial locations, and crops including sugarcane, pineapples, and citrus fruits. Since bromacil is an effective herbicide for controlling unwanted plants, it is marketed to land managers, local governments, and farmers. Its market dynamics and consumption habits are also influenced by environmental concerns and governmental regulations.

Key Takeaways

- The bromacil market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major bromacil industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious bromacil market growth objectives.

Key market dynamics

Several dynamic factors influence the bromacil market forecast period, an important part of the agrochemical sector. Bromacil, a selective herbicide that is mostly used to control weeds in a variety of crops and non-crop areas, has seen a consistent demand due to its broad applicability and effectiveness. Technological developments, shifting farming practices, and regulatory changes are important factors affecting this industry.

The bromacil market is significantly shaped by changes in regulations. The composition and application of Bromacil are impacted by the stringent insectiside usage laws that governments globally are enforcing. Adhering to these standards frequently necessitates modifying product formulas and safety protocols, which can affect production expenses and market accessibility.

Furthermore, another important factor is technological advancement. Bromacil's efficacy and safety are increased by advancements in chemical formulations and application technology. Herbicide effectiveness is increased while reducing environmental impact through the development of controlled-release formulations and precise application methods. By addressing consumer and environmental concerns, these developments aid in the expansion of the market.

Another factor driving the Bromacil market share is changing agricultural methods. The movement toward integrated pest management (IPM) methods that use Bromacil as a component of an overall strategy is due to the growing emphasis on sustainable farming practices. Herbicides that limit damage to crops and neighboring ecosystems while providing selective weed control are in high demand among farmers.

Moreover, the demand for Bromacil varies by region due to factors such as local weed species, crop types, and climate. Policies about agriculture and the economy also have an impact on market dynamics, influencing supply and demand. Thus, changes in agricultural methods, technological developments, and regulatory requirements all influence the Bromacil market, which grows and develops as a whole.

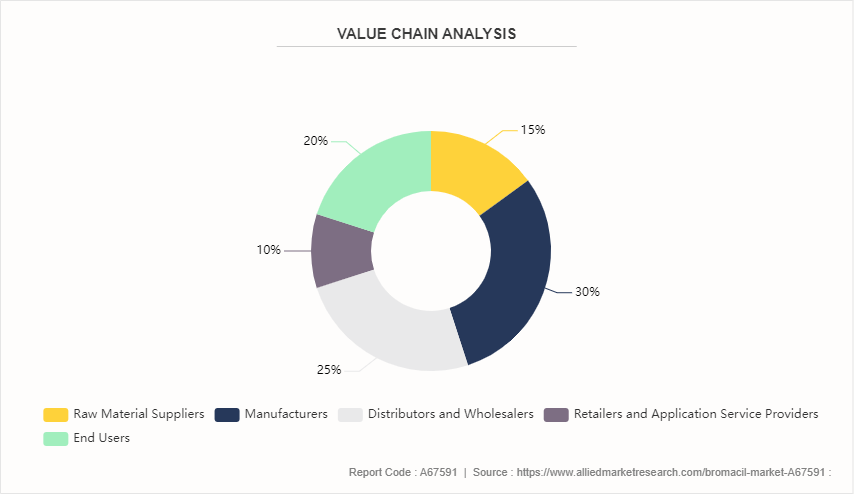

Value Chain Analysis of the Global Bromacil Market

Purchasing raw materials is the first step in the value chain of the global bromacil market, as suppliers of chemicals provide essential inputs. Then, using procedures for chemical synthesis and formulation, manufacturers develop bromacil while making sure all safety and legal requirements are met. The product is subsequently made available to agricultural companies, land managers, and local government agencies via a network of wholesalers and distributors. After distribution, the market entails end users applying products in a variety of locations, including industrial sites and farming fields. Finally, end-user feedback and ongoing regulatory compliance drive innovation and new product development. Bromacil is kept safe, effective, and compliant with shifting regulations and market needs using this cyclical process.

Market Segmentation

The bromacil market is segmented into type, application, and region. On the basis of type, the market is divided into bromacil 40 herbicide, bromacil 80 herbicide, and others. On the basis of application, the market is bifurcated into non-crop areas and crop areas. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The use of bromacil is widespread in non-crop regions such as industrial sites and roadside areas in North America, especially in the U.S. Even though it works well as a pre-emergent herbicide, commercial expansion is being hampered by stringent regulations governing herbicide use and environmental protection. A campaign for sustainable agriculture and recent legislative actions are forcing companies to look at other alternatives.

In addition, bromacil is still widely used in Latin America, particularly in nations such as Brazil and Argentina where the region's intense agricultural activity drives demand. The herbicide's broad-spectrum weed-controlling ability in sugarcane and other crops makes it very popular. However, growing concern over the effects on the environment and the need for integrated weed control are driving shifts in the market, with a move toward more bio-based substitutes.

The market for bromacil in Europe is quite small due to strict regulations meant to minimize the use of chemicals in agriculture. The use of bromacil is decreasing as a result of stringent regulations on chemical herbicides being implemented in nations like France and Germany. The market presence of bromacil is being impacted by the gradual shift in the European market towards eco-friendly herbicides and integrated pest management strategies.

Furthermore, the use of bromacil varies greatly across Asia-Pacific. Bromacil is used in high-agricultural-intensity nations like China and India to control weed growth in extensive plantations. But the region is also seeing a gradual shift to more environmentally friendly methods, fueled by governmental regulations as well as rising public awareness of environmental concerns. Thus, even though bromacil is still an essential herbicide in many regions, the market is evolving globally to reflect changing regulatory environments and a move toward more environmentally friendly farming methods.

Industry Trends:

- In July 2024, the EPA began to closely monitor the use of bromacil owing to health and environmental concerns, which resulted in more stringent application standards and possible limitations.

- In July 2024, there is rise in the number of people using integrated pest management (IPM) techniques, with an emphasis on lowering the use of chemical herbicides like bromacil.

- In May 2024, herbicide producers' mergers and acquisitions affected the distribution of bromacil and the dynamics of the market.

- In June 2024, the government introduced new agricultural laws, such as limitations on the use of bromacil, to minimize the use of chemicals.

- In July 2024, there was an increasing need for bromacil as a result of growing agricultural industries and higher crop production needs.

- In April 2024, many market players created novel combinations and application techniques to maximize bromacil's effectiveness and reduce its negative effects on the environment.

- In May 2024, precision agriculture and advanced application technologies were adopted to maximize bromacil utilization and reduce waste.

- In June 2024, the shift toward more environmentally friendly options resulted from growing knowledge of the negative effects of herbicides on the environment and regulatory pressure.

Competitive Landscape

The major players operating in the bromacil market include Adama Agricultural Solutions, Corteva Agriscience, FMC Corporation, Syngenta Group, Alligare LLC, AMVAC Chemical Corporation, Chem China Ltd., Nufarm Limited, UPL Limited, Wilbur-Ellis Company, DuPont, and Bayer CropScience.

Recent Key Strategies and Developments

- In May 2023, Syngenta Crop Protection, a leader in agricultural innovation announced the purchase of Macspred Australia, a weed control expert for the forestry, roads, rail, utilities, and infrastructure sectors. This guarantees Syngenta's capacity to cater to both commercial plantation clients on a big scale and an expanding farm that aims to enhance both ecological biodiversity and financial sustainability.

- In June 2022, FMC Corporation said that it had successfully closed the purchase of BioPhero ApS, a pheromone research and production company based in Denmark. The acquisition is aniticipated to increase FMC Corporation's global customer base.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bromacil market analysis from 2024 to 2033 to identify the prevailing bromacil market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bromacil market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bromacil market trends, key players, market segments, application areas, and market growth strategies.

Bromacil Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 177.6 Million |

| Growth Rate | CAGR of 2.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | FMC Corporation, wilbur-ellis company, Corteva Agriscience, Syngenta Group, DUPONT, Nufarm Limited, Adama Agricultural Solutions Ltd., AMVAC Chemical Corporation, UPL Limited, Chem China Ltd., Bayer CropScience AG, Alligare LLC |

Upcoming trends in the global Bromacil market include increased focus on integrated weed management, regulatory changes on herbicide use, and advancements in formulation technologies to enhance effectiveness and safety.

The leading application of the Bromacil market is in agriculture, where it is primarily used as a herbicide for controlling broadleaf and grassy weeds in various crops and non-crop areas.

The largest regional market for Bromacil is typically North America. It is widely used in the U.S. for weed control in citrus and pineapple crops, driving substantial demand in the region.

The global bromacil market was valued at $135.3 million in 2023, and is projected to reach $177.6 million by 2033, growing at a CAGR of 2.8% from 2024 to 2033.

The major players operating in the bromacil market include Adama Agricultural Solutions, Corteva Agriscience, FMC Corporation, Syngenta Group, Alligare LLC, AMVAC Chemical Corporation, Chem China Ltd., Nufarm Limited, UPL Limited, Wilbur-Ellis Company, DuPont, and Bayer CropScience.

Loading Table Of Content...