Bronchoscopy Market Research, 2030

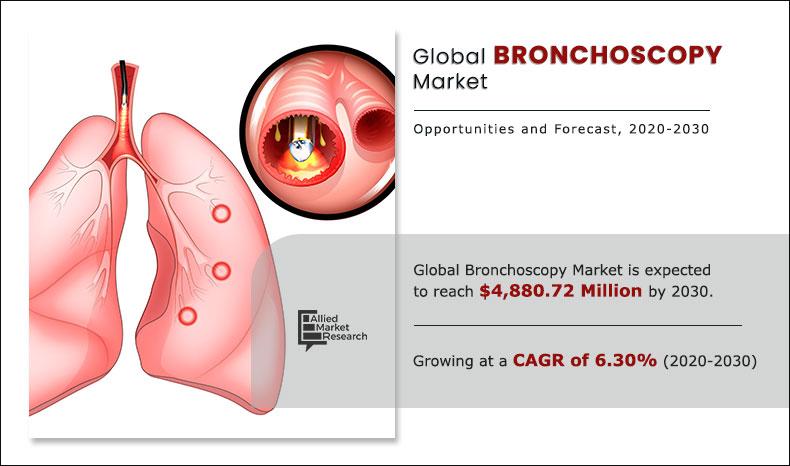

The global bronchoscopy market size was valued at $2,558.21 million in 2020, and is projected to reach $4,880.72 million by 2030, registering a CAGR of 6.30% from 2021 to 2030. Bronchoscopy is the most common interventional pulmonology procedures performed through the bronchoscope. Bronchoscopy can be performed through reusable bronchoscopes or single use bronchoscopes. Single use bronchoscope or reusable bronchoscope both are intended for use during endoscopic examination, diagnosis, and treatment of airways and tracheobronchial tree. The conditions such as COPD, tumors, lung cancer, airway stenosis, pneumonia, bronchitis, and other lung infections can be diagnosed through single use bronchoscope.

Factors such as increase in number of cases related to respiratory diseases, developments related to products improving reimbursement policies, and technological advancements will further drive the market growth. For instance, according to the World Health Organization (WHO), in 2018, around 2.09 million cases of lung cancer were reported. Furthermore, this might increase the demand for minimally invasive procedures; thereby, boosting the bronchoscope market growth. However, risk of contamination of devices may hinder the growth of the bronchoscope market. Conversely, growth opportunities in emerging markets are anticipated to provide opportunities for market.

The outbreak of COVID-19 has disrupted workflows in the health care sector across the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. However, there has also been a negative effect and surge in demand for various medical services, including bronchoscopy products such as visualization & documentation systems and endoscope.

Bronchoscopy is an aerosol-generating procedure with important diagnostic and therapeutic indications. However, in the era of the coronavirus disease 2019 (COVID-19) pandemic, airway procedures can put health care providers at an increased risk of exposure and transmission of COVID-19. Various societies of respiratory medicine to stratify the indications for bronchoscopy and optimize pre procedural, procedural, and post procedural preparation. Furthermore, appropriate measures can help decrease exposure to health care workers when performing this aerosol-generating procedure.

Bronchoscopy remains one of the highest risk procedures within this population of patients due to its detectible disruption of airway mucosa and the increased pressures utilized to oxygenate and ventilate patients during the procedure. Secondary to the close contact between the medical personnel involved in the bronchoscopy and the patient, coughing and suction can produce significant amounts of droplets or aerosols, contaminating indoor equipment, procedure room’s air, all personnel present, and even resulting in a higher risk of patient-to-patient cross-infection. Nevertheless, bronchoscopy remains an imperative and important method for the diagnosis and treatment of respiratory illnesses that in certain instances cannot be postponed pending further progression of disease and clinical deterioration. Therefore, it is critical to stratify the patients requiring prompt bronchoscopy intervention along with those patients who may benefit from a delayed procedure.

Bronchoscopy Market Segmentation

The global bronchoscopy market is segmented on the basis of product, usability, application, end user, and region. On the basis of product, the market is categorized into endoscope, visualization and documentation systems, accessories, and other products. By usability, it is classified into disposable equipment and reusable equipment. On the basis of application, it is segmented into bronchial diagnosis and bronchial treatment. Furthermore, by end user it classified into hospitals and ambulatory surgical centers & clinics. The hospitals segment is further classified into disposable equipment and reusable equipment. Moreover, ambulatory surgical centers & clinics segment is subdivided into disposable equipment and reusable equipment. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Product Segment Review

Based on product, the endoscopes segment accounted for the largest share of the bronchoscopy market in 2020. The large share of this segment can be attributed to be the high cost of bronchoscopes compared to the imaging systems and accessories, increasing prevalence of lung cancer, and technological advancements.

By Product

Endoscope Product segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

End User Segment Review

On the basis of end user, the bronchoscopy market is segmented into hospitals and ambulatory surgery centers (ASCs)/clinics. Hospitals commanded the largest share of the bronchoscopy market in 2020. The large share of this end-user segment can be attributed to be the high patient preference for hospital-based treatment & procedures, availability of skilled healthcare professionals, technologically advanced facilities, and favorable reimbursement scenario.

By Application

Bronchial Treatment Segment is projected as one of the most lucrative segment.

Snapshot of the North America Bronchoscopy Market

North America dominated the bronchoscopy market in 2020. The large share of North America in the global bronchoscopy market is attributed to increase the incidence and prevalence of chronic respiratory diseases, favorable reimbursement scenario in the U.S., and rise in incidence of lung cancer in Canada. On the other hand, Asia-Pacific is projected to register the highest growth during the forecast period, owing to factors such as increase in number of hospitals, developing healthcare infrastructure, surge in healthcare expenditure, growth in geriatric population, and the presence of a large patient population.

By Country

Asia Pacific region would exhibit the highest CAGR of 7.3% during 2020-2030.

Competition Analysis

The key bronchoscopy market players profiled in the report include Olympus Corporation, Karl Storz, Fujifilm Holdings Corporation, Ambu A/S, Boston Scientific Corporation, Medtronic, Johnson & Johnson, Hoyo Corporation, Richard Wolf GmbH, and Cook Medical

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global bronchoscopy market along with the current trends and future estimations to elucidate the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the bronchoscopy market growth is provided in the report.

- Comprehensive quantitative analysis of the industry from 2020 to 2030 is provided to enable the stakeholders to capitalize on the prevailing bronchoscopy market opportunities.

- Extensive analysis of the key segments of the industry helps understand the application and products the market used across the globe.

- Key market players and their strategies have been analyzed to understand the competitive outlook of the bronchoscopy market.

Key Market Segments

By Product

- Endoscope

- Visualization & Documentation Systems

- Accessories

- Other Products

By Usability

- Disposable Equipment

- Reusable Equipment

- By Application

- Bronchial Diagnosis

- Bronchial Treatment

By End User

- Hospitals

- Disposable Equipment

- Reusable Equipment

- Ambulatory Surgical Centers & Clinics

- Disposable Equipment

- Reusable Equipment

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Bronchoscopy Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By USABILITY |

|

| By APPLICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | JOHNSON & JOHNSON, BOSTON SCIENTIFIC CORPORATION, COOK GROUP INCORPORATED, OLYMPUS CORPORATION, FUJIFILM HOLDINGS CORPORATION, AMBU A/S, RICHARD WOLF GMBH, .HOYA CORPORATION, KARL STORZ SE AND CO. KG, MEDTRONIC PLC. (COVIDIEN) |

Analyst Review

The bronchoscopy market has witnessed significant growth due to increase in hospital investments in bronchoscopy facilities, rise in demand for bronchoscopy due to the increase in prevalence of respiratory diseases, surge in demand for minimally invasive surgery, and technological advancements in bronchoscopy. However, risk of contamination of devices may hinder the growth of the bronchoscope market and is among the major restraints to this market.

North America is expected to hold a major market share in the global bronchoscope market due to increase in number of bronchoscopy procedures and higher prevalence rates of respiratory diseases such as lung cancer. According to the American Cancer Society, approximately 228,820 new cases of lung cancer were recorded in 2020; thereby, driving the demand for bronchoscope devices. According to the National Centre of Biotechnology Information, around 500,000 procedures of bronchoscopy are performed in the U.S. every year. Hence, it is expected to boost the bronchoscope market growth.

The total market value of Bronchoscopy market is 2558.21 million in 2020.

The forcast period for Bronchoscopy market is 2021 to 2030

The market value of Bronchoscopy market in 2021 is $2816.59 million.

The base year is 2020 in Bronchoscopy market

Top companies such as Olympus Corporation, KARL STORZ, Fujifilm Holdings Corporation, Ambu A/S, Boston Scientific, Medtronic, Johson & Johnso, Hoyo Corporation, Richard Wolf GmbH and Cook Medical held a high market position in 2020.

Based on product, endoscopes segment accounted for the largest share of the bronchoscopy market in 2020. The large share of this segment can be attributed to the high cost of bronchoscopes compared to the imaging systems and accessories, increasing prevalence of lung cancer, and technological advancements.

Growing hospital investments in bronchoscopy facilities, rising demand for bronchoscopy owing to the rising prevalence of respiratory diseases, the growing demand for minimally invasive surgery, and technological advancements in bronchoscopy will further propel the market growth. However, the dearth of trained physicians and pulmonologists may hinder the growth of bronchoscope market.

Bronchoscopes are primarily used for the assessment and management of multiple respiratory and airway diseases. Conditions such as blockages, chronic obstructive pulmonary diseases (COPD), bronchopulmonary hemorrhage, tumors, airway stenosis, and inflammatory conditions can be detected and diagnosed through these devices.

Loading Table Of Content...