Bulb Market Research, 2034

The global bulb market was valued at $66.9 billion in 2024, and is projected to reach $107.5 billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034. A bulb is a device that produces light by converting electrical energy into light. It consists of a base, a light emitting component such as a filament or LED chip, and a glass or plastic enclosure. Depending on the type, including incandescent, halogen, fluorescent or LED, the bulb generates light through heating, gas discharge or electroluminescence. Electric bulbs are manufactured by assembling components and sealing them in a controlled environment. Bulbs are used in homes, offices, streets, vehicles and industrial applications.

Market Dynamics

Increase in construction of residential and commercial infrastructure has significantly boosted demand in the global bulb industry. New buildings, offices, shopping centers, hotels, and public facilities require extensive lighting installations to ensure safety, functionality, and aesthetics. Developers and architects specify lighting systems to meet design and regulatory standards, thus driving demand for bulbs with varying shapes, sizes, and light outputs. This leads to a growing need for bulbs that offer durability, brightness, and versatility across different applications such as residential rooms, commercial offices, retail spaces, and outdoor areas.

Moreover, growth in infrastructure development also supports the adoption of advanced lighting systems with features such as automation and remote control in commercial spaces, driving bulb market share. Retail stores and hospitality venues require customizable lighting to enhance ambiance and customer experience. Residential construction has fueled demand for a wide range of lighting bulb products suitable for indoor and outdoor use. Renovations and expansions in both sectors further increase the need for replacement and supplementary lighting. Construction activities across urban and suburban areas have created steady demand for bulbs, contributing to sustained growth in the global bulb market size.

However, the decline in bulb market demand for incandescent and halogen bulbs has restrained growth in the global bulb market by significantly reducing the sales volume of these two widely used lighting categories. Regulatory actions in North America, Europe, and parts of Asia-Pacific have enforced bans or restrictions on incandescent and halogen bulbs owing to low energy efficiency and short operational life. Incandescent bulbs were commonly used for general household lighting, while halogen bulbs were preferred for directional lighting and compact fixtures. Reduced production and limited availability of incandescent and halogen bulbs have affected purchasing options, especially in markets dependent on affordable and easily replaceable lighting products.

In regions where infrastructure and consumer budgets limit immediate adoption of LED or CFL alternatives, the absence of incandescent and halogen bulbs has created a supply gap. Many residential users, small businesses, and rural communities continue to rely on traditional sockets and fixtures designed for incandescent or halogen formats. Higher upfront costs and compatibility issues related to LED technology have slowed replacement rates. The lack of low-cost and widely compatible lighting options following the decline of incandescent and halogen bulbs has contributed to uneven market performance and has restrained overall demand in the global bulb market growth.

Furthermore, customizable and color-tunable bulb technologies are creating new opportunities in the global bulb market forecast by addressing the rising demand for personalized and adaptive lighting. Color-tunable bulbs allow users to adjust color temperature and brightness levels to suit different moods, activities, and times of day, offering flexibility not available in standard lighting. Customizable bulbs with features such as scheduling, ambient presets, and voice or app control are gaining popularity in smart homes, hospitality environments, and commercial interiors. Manufacturers are developing integrated solutions that align with energy efficiency goals and wellness trends, such as circadian rhythm lighting and human-centric design.

In addition, the growing adoption of smart home ecosystems is expanding the customer base for color-tunable and customizable bulbs, particularly in North America, Europe, and urban areas of Asia-Pacific. Increased awareness, falling prices of smart bulbs, and compatibility with platforms such as Amazon Alexa, Google Home, and Apple HomeKit have made advanced lighting technologies more accessible. The demand for enhanced user experience, dynamic ambiance, and energy-saving benefits is driving product innovation and expansion into new segments. Customizable and color-tunable technologies are opening opportunities across residential, healthcare, retail, and office lighting, thus contributing to the expansion of the global market.

Segmental Overview

The bulb market is segmented by product type, technology, application, distribution channel, and region. By product type, the market is categorized into incandescent bulbs, LED bulbs, halogen bulbs, fluorescent bulbs, compact fluorescent lamps, and others. By technology, the market is divided into smart bulbs and non-smart bulbs. By application, the market includes residential, commercial, and industrial segments. The commercial segment comprises retail, hospitality, office and corporate spaces, educational institutions, and others, whereas the industrial segment includes manufacturing facilities, warehouses and logistics, roadway and infrastructure lighting, and utilities and energy. By distribution channel, the market is segmented into supermarkets/hypermarkets, specialty stores, departmental stores, online sales channels, and others. By region, the market is analyzed across North America (U.S., Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

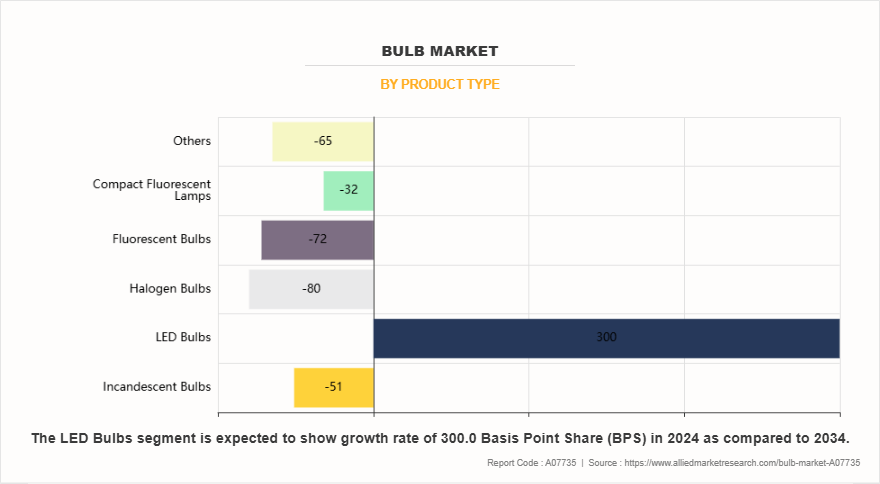

By Product Type

By product type, the LED bulbs segment dominated the global bulb market in 2024 and is anticipated to maintain its dominance during the forecast period. The dominance of LED bulbs is primarily driven by energy efficiency, long operational life, and reduced maintenance costs compared to incandescent, halogen, and fluorescent alternatives. LED bulbs consume significantly less electricity, which has made them a preferred option among consumers and commercial users aiming to lower energy bills. Government regulations in multiple countries promoting the phase-out of less efficient lighting technologies have further boosted the shift toward LED adoption. In addition, rapid advancements in LED technology have improved light quality, color temperature range, and design flexibility, expanding use across residential, retail, industrial, and outdoor applications. Manufacturers continue to invest in R&D to reduce costs and integrate smart features such as dimming, scheduling, and wireless control. Increased availability, improved affordability, and alignment with sustainability goals are expected to drive growth of this segment.

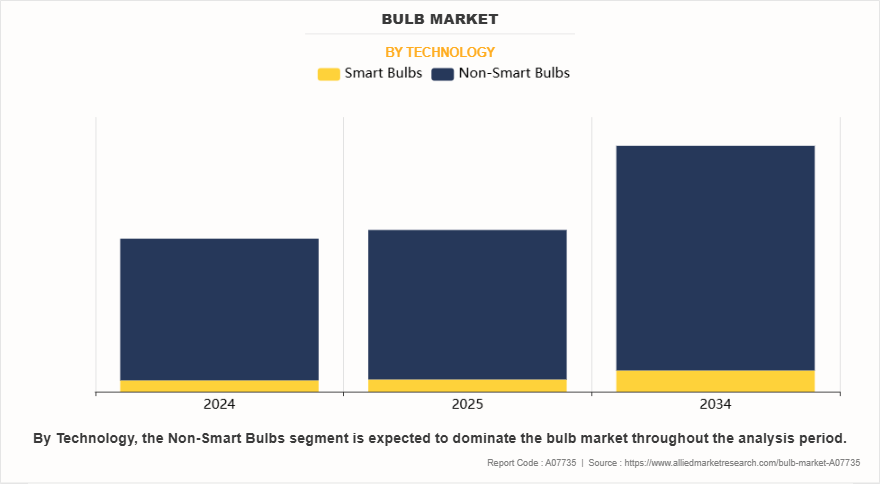

By Technology

By technology, the non-smart bulbs segment dominated the global bulb market in 2024 and is anticipated to maintain its dominance during the forecast period. Widespread use in households, commercial outlets, and public infrastructure has supported high demand for non-smart lighting solutions, especially in price-sensitive and infrastructure-limited regions. Non-smart bulbs offer ease of installation, broad compatibility with existing fixtures, and lower upfront costs compared to smart lighting systems. Many consumers continue to prefer basic functionality over advanced features such as remote control or connectivity. In rural and developing areas, limited access to stable internet connections and smart home systems also reinforces the demand for traditional lighting technologies. Moreover, non-smart bulbs are widely available across retail formats, which has made them accessible to a broader consumer base. Manufacturers continue to produce various types of non-smart bulbs including LED, compact fluorescent, halogen, and incandescent formats to serve markets where cost and simplicity remain top priorities, thus supporting continued segment dominance.

By Application

By application, the residential segment dominated the global bulb market in 2024 and is anticipated to maintain its dominance during the forecast period. Continuous demand for lighting in homes for general, task, and decorative purposes has driven growth in this segment. Increase in urbanization and rise in disposable incomes encourage consumers to upgrade lighting systems to more energy efficient options such as LED and smart bulbs. Government policies promoting energy conservation and subsidies for efficient lighting in households also contribute to increased adoption. Furthermore, evolving consumer preferences for enhanced comfort, ambiance, and smart home integration boost demand for advanced lighting solutions. The broad variety of residential lighting needs, ranging from basic illumination to customizable mood lighting, ensures sustained growth in the residential segment. Furthermore, expansion in housing developments and renovation projects globally has boosted the residential segment market share in recent years.

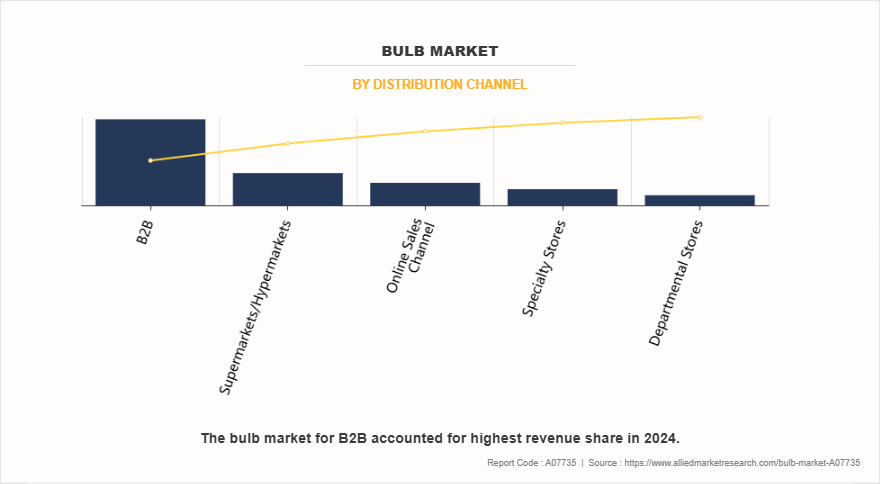

By Distribution Channel

By distribution channel, the B2B segment dominated the global bulb market in 2024 and is anticipated to maintain its dominance during the forecast period. The B2B segment benefits from high-volume purchases by commercial enterprises, industrial facilities, and public institutions that require large-scale lighting installations. Organizations often replace or upgrade lighting systems in offices, factories, warehouses, retail stores, and public spaces to improve efficiency and meet regulatory standards. Long-term contracts and bulk buying agreements with manufacturers and distributors provide cost advantages and supply security, which has in turn driven the preference for B2B channels. In addition, infrastructure projects and commercial real estate development generate steady demand for lighting products. Service providers and facility managers rely on B2B suppliers to meet ongoing maintenance and replacement needs. The complexity and scale of lighting requirements in commercial and industrial applications ensure that the B2B distribution channel remains critical in the market demand for bulbs throughout the forecast period.

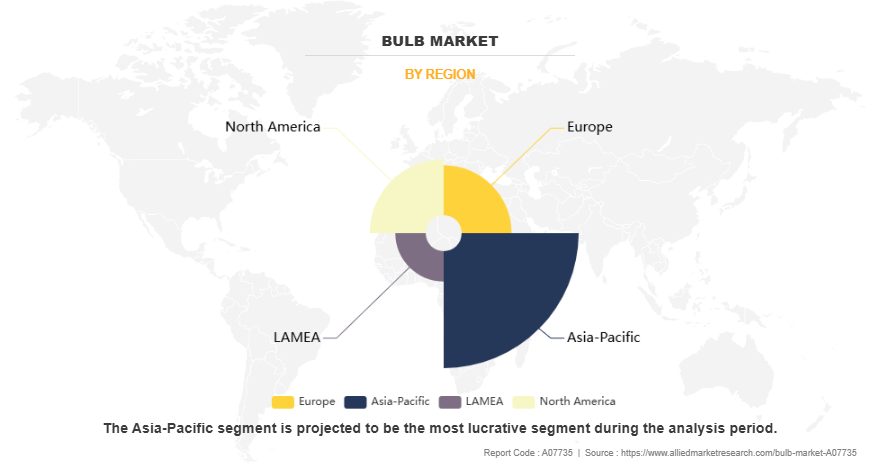

By Region

By region, Asia-Pacific is anticipated to dominate the global bulb market with the largest share during the forecast period. Rapid urbanization and industrialization across countries such as China, India, Japan, and Southeast Asian nations drive strong demand for lighting solutions in residential, commercial, and infrastructure sectors. Rising population and expanding middle-class income levels lead to increased adoption of energy-efficient and affordable lighting products. Government initiatives promoting energy conservation, along with regulations phasing out inefficient lighting technologies, are expected to support market growth in the coming years. Consequently, large-scale construction projects and modernization of existing facilities in the region create continuous demand for bulbs. The presence of numerous manufacturers and suppliers in Asia-Pacific also contributes to competitive pricing and the availability of a wide range of products. All such factors are expected to collectively position Asia-Pacific as the leading region in the bulb market throughout the forecast period.

The key players operating in the global bulb industry include Acuity Brands Inc., ams-OSRAM AG., Cree LED, Inc., Current (HLI Solutions, Inc.), Eaton, Everlight Electronics Co., Ltd., GE Lighting (Savant Technologies LLC), Nichia Corporation, Philips Lighting, Seoul Semiconductor Co., Ltd., and Zumtobel Group. Several well-known and upcoming brands are vying for dominance in the expanding bulb market. Smaller, niche firms are more well known for catering to consumer demands and preferences in the global market. However, large conglomerates control most of the market and often buy innovative start-ups to broaden their reach globally.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bulb market analysis from 2024 to 2034 to identify the prevailing bulb market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bulb market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bulb market trends, key players, market segments, application areas, and market growth strategies.

Bulb Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 107.5 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 462 |

| By Product Type |

|

| By Technology |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Eaton, Philips Lighting (Signify Holding), Everlight Electronics Co., Ltd., Seoul Semiconductor Co., Ltd, Nichia Corporation, GE Lighting, Zumtobel Group, ams-OSRAM AG., Cree LED, Inc., Acuity Brands Inc., Current (HLI Solutions, Inc.) |

Analyst Review

This section consists of the opinion of the top leaders in the bulb market. Many executives stated that technological innovation is a key factor driving growth in the global bulb market. The rise of smart and connected lighting solutions offers users greater control, energy savings, and customization options. Integrating digital technology and the Internet of Things expands product offerings and creates new business opportunities through services such as remote monitoring and adaptive lighting. An increase in consumer demand for sustainable products has encouraged companies to invest in eco-friendly materials and energy-efficient designs. The shift toward renewable energy sources and stricter regulations encourages faster adoption of advanced lighting technologies over traditional bulbs.

Leaders also emphasized the importance of strategic partnerships and optimizing global supply chains to remain competitive. Emerging markets in Asia-Pacific and Africa show strong potential because rapid urbanization and large-scale infrastructure projects increase demand for lighting solutions. At the same time, fluctuating raw material prices create cost pressures, and frequent changes in government regulations require companies to adapt quickly to stay compliant and competitive. Meeting customer needs by offering better after-sales support and providing customized lighting solutions for different applications is becoming increasingly important to build loyalty and differentiate products in these growing markets. Overall, the market is anticipated to expand rapidly owing to innovation, expanding global reach, and evolving consumer preferences shaping the future of the global bulb market.

The global bulb market was valued at $66,880.0 million in 2024.

The LED bulbs segment has leading application is bulb market.

Upcoming trends in the global bulb market include smart lighting, energy-efficient LEDs, hybrid technologies, and integration with IoT systems.

By region, Asia-Pacific is anticipated to dominate the global bulb market with the largest share during the forecast period.

The key players operating in the global bulb industry include Acuity Brands Inc., ams-OSRAM AG., Cree LED, Inc., Current (HLI Solutions, Inc.), Eaton, Everlight Electronics Co., Ltd., GE Lighting (Savant Technologies LLC), Nichia Corporation, Philips Lighting, Seoul Semiconductor Co., Ltd., and Zumtobel Group.

Loading Table Of Content...

Loading Research Methodology...