The global bulletproof vests market size was valued at $1.8 billion in 2022, and is projected to reach $3.2 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

Key Highlighters:

- The report covers segments such as soft bulletproof vest, and hard bulletproof vest. The report is studied across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Bulletproof vests are specialized protective clothing designed to absorb or deflect physical attacks, minimizing the potential harm to the wearer. Initially developed for military use by soldiers in warfare, body armor has evolved to serve various professions and industries, offering enhanced safety and protection.

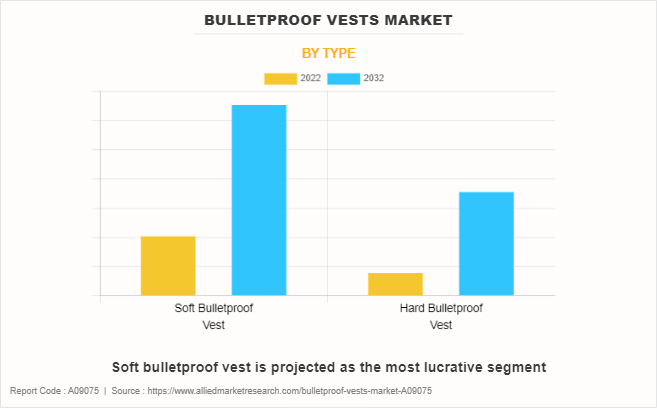

Soft bulletproof vest, also known as flexible or concealable vest, is a category of ballistic protection designed to offer a high level of comfort and flexibility to the wearer. This vest primarily utilizes soft, flexible materials, often composed of aramid fibers such as Kevlar or high-density polyethylene (HDPE). The development of soft vests involves layering these materials in a way that effectively disperses and absorbs the kinetic energy generated by a projectile, thus preventing penetration.

Soft bulletproof vests are witnessing growth due to a greater focus by manufacturers on developing lightweight, flexible fabrics that enhance comfort and reduce fatigue compared to traditional heavy Kevlar-only designs. Major companies are incorporating advanced ultra-high molecular weight polyethylene fibers like Dyneema and Spectra into vest layers, which provide protection at significantly lower weights. In addition, new materials like metallic nanofibers and graphene dispersions are being integrated into the fabric matrix to improve multi-hit capabilities against multiple gunshots in the same area. On the product side, manufacturers are catering to demands from private security services and civilians seeking discreet protection through concealed vests that can be covertly worn under regular clothing.

The wider adoption of soft vests among police forces globally is a major growth factor, as the improved comfort and ergonomics compared to plate carriers allows comfortable all-day use while on patrol duties. Demand from private security personnel, VIPs, and civilians in high-risk occupations needing concealed protection rather than bulky tactical armor is also propelling market revenues. The vest innovations enhancing the optimal balance of weight, flexibility, thinness and protective qualities are expected to boost adoption rates further.

Factors such as rise in insurgency activities and geopolitical conflicts, advancements in lightweight and durable ballistic materials, and increase in government budget on defense drive the growth of the bulletproof vests market. However, high cost of advanced body armor materials, and weight and thermal burden hinder the growth of the market. Furthermore, integration of smart textiles, sensors, and increase in demand for specialized bulletproof vests tailored to specific industry needs offer remarkable growth opportunities for the players operating in the bulletproof vest jacket market.

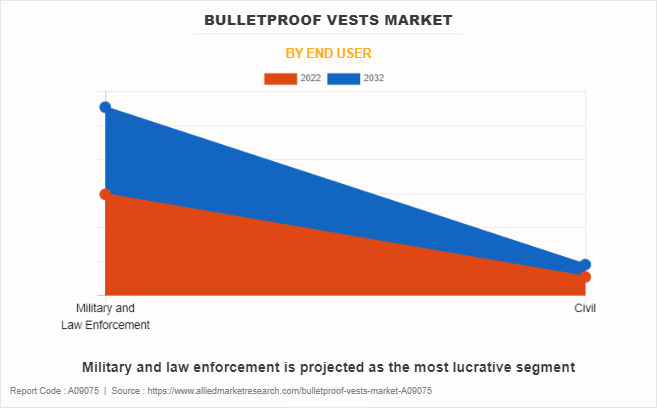

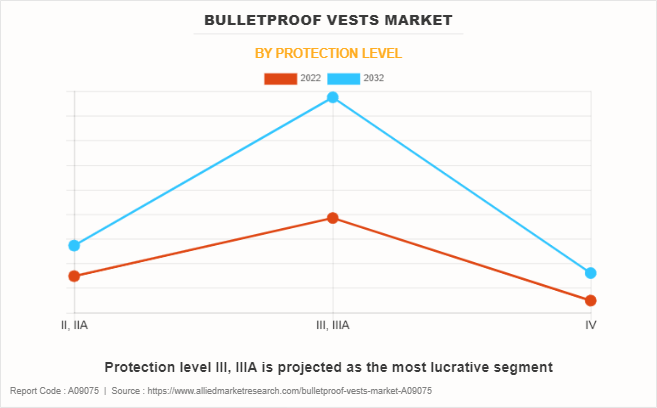

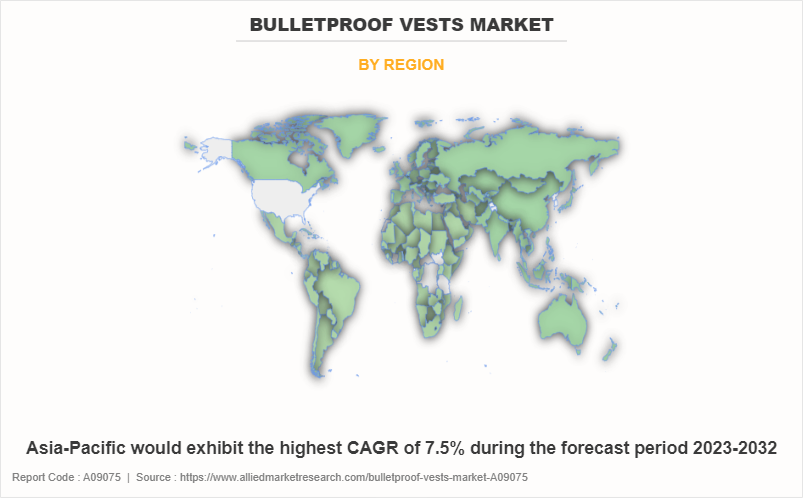

The bulletproof vests market is segmented on the basis of type, end user, protection level, and region. On the basis of type, the market is divided into soft bulletproof vest and hard bulletproof vest. On the basis of end user, the market is classified into military and law enforcement, and civil. On the basis of protection level, the market is categorized into II, IIA, III, IIIA, and IV. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America includes countries such as the U.S, Canada, and Mexico. The bulletproof vests market of this region exhibits a dynamic landscape shaped by diverse factors such as security concerns, law enforcement requirements, and advancements in protective technologies.

There is increase in demand for advanced protective solutions driven by rise in security threats in North America. Law enforcement agencies in the U.S. are actively seeking innovative vests that provide not only ballistic resistance but also incorporate features like modularity and compatibility with tactical gear. The trend towards multifunctional vests aligns with the evolving needs of security personnel facing complex and unpredictable threats.

The continuous investment in research and development by manufacturers and government agencies is a major growth factor in the region. The U.S. has a robust defense and security sector that fosters innovation in protective technologies. For instance, in May 2023, Chicago police officers received 500 new bulletproof vests by the Chicago Police Memorial Foundation. This development fuels the development of vests with enhanced ballistic resistance, improved ergonomics, and integration with advanced materials.

Furthermore, the geopolitical landscape, including concerns related to border security and counter-terrorism efforts, plays a crucial role in shaping the market growth. As security threats evolve, the need for cutting-edge protective solutions propels the demand for advanced bulletproof vests in North America.

The leading companies profiled in the report include Point Blank Enterprises, Inc., MARS Armor Ltd., U.S. Armor Corporation, VestGuard UK Ltd., Armor Express, MKU Limited, Slate Solutions, Safariland, LLC., EnGarde Body Armor, and ARGUN s.r.o. These companies are adopting various strategies to increase their bulletproof vests market share.

Rise in insurgency activities and geopolitical conflicts

The rise in insurgency activities and geopolitical conflicts across several regions globally has emerged as a key driver for the bulletproof vests market. Ongoing instability and terrorist threats have led to increased deployment of military personnel for operations where combat protective apparel like bulletproof vests is critically required for safety.

Regions like the Middle East, parts of Africa, and Eastern Europe have seen protracted insurgencies by rebel militia groups and high risks of ambush attacks on peacekeeping forces. For example, United Nations peacekeeping troops involved in the Mali conflict face regular asymmetric warfare threats from insurgent factions, necessitating personal protective equipment like bullet-resistant vests.

Similarly, the threat from improvised explosive devices and small arms ambushes on NATO coalition forces previously deployed in Afghanistan demonstrated the need for tactical body armor.

The 2022 Russian invasion of Ukraine has also spotlighted demand for bulletproof vests. For instance, in February 2022, Finland supplied military protective equipment to Ukraine, encompassing 2,000 bulletproof vests, 2,000 composite helmets, 100 stretchers, and equipment for two emergency medical care stations. The threat of cross-border violence and insurgency in disputed geopolitical hotspots is thus a major demand factor as military buyers prioritize protective gear for deployed troops.

Therefore, the unstable security environment driven by insurgent groups and geopolitical conflicts has made bullet-resistant vests indispensable for combat missions, driving procurement by defense forces engaged in these regions and acts as a key macro driver for the bulletproof vests market currently.

Advancements in lightweight and durable ballistic materials

Leading manufacturers are investing significantly in R&D in new materials technology to engineer lighter and thinner ballistic panels without compromising on bullet-stopping performance.

Traditionally, vests used standalone woven sheets of the ultra-high molecular weight polyethylene fiber Kevlar as the interception layer. But new engineered materials are now blending Kevlar with fibers like Dyneema, Spectra, and Gold Flex, as well as utilizing tightly woven Para-aramid textiles to enhance multi-hit capabilities.

For instance, in January 2020, Honeywell introduced the latest addition to its Spectra Shield 6000 series, called Spectra Shield 6166. This innovation is part of Honeywell's range of high-performing ballistic materials, meeting stringent requirements for protective equipment and addressing the increasing global demand for lightweight protection. Spectra Shield 6166 enhances Honeywell's suite of high-performing hard armor products designed for military and law enforcement applications. The complete Spectra Shield series has gained extensive adoption and validation for highly advanced armor applications on a global scale. These applications include bullet-resistant vests, breastplates, helmets, combat vehicles, and military aircraft.

In addition, DSM’s Dyneema Force Multiplier Technology enables reduction in weight by altering polymer chemistry to deliver greater ballistic strength. There are several developments underway. These include incorporating nanomaterials like graphene and carbon nanotubes into the fiber matrix through dispersion coating methods. Graphene has shown potential for lighter panels with superior energy absorption from ballistic impacts. This is projected to enable lighter yet stronger Type III and Type IV rifle-resistant vests.

Therefore, pioneering development of hybrid composite textiles and nano-engineered fibers has enabled lighter and thinner performing soft armor materials. This, in turn, helps address wearability and weight challenges associated with thick, multi-layer Kevlar vests, which act as a key evolutionary driver influencing vest design and capabilities.

Increase in government budget on defense

The increase in defense budgets and modernization spending by governments globally has emerged as a major driver for the bulletproof vests market over the last decade. Allocation for procurement of new tactical bulletproof vests has increased substantially with military forces prioritizing upgrades to frontline soldier equipment and gear.

The U.S. allocated $766 billion for national defense during the fiscal year (FY) 2022, representing 12 percent of the federal budget, as reported by the Office of Management and Budget. These budget allocations further support the procurement of bulletproof jackets for army, which in turn support the growth of the market.

Moreover, tactical personal armor is a key developmental area of focus given infantry combat requirements. Several nations are investing to outfit special forces and rapid response teams with the latest body armor designs featuring integrated communications and optics.

Higher military spending cycles especially in the U.S., India, and across Europe are facilitating large orders of vests by defense agencies looking to replace legacy vest inventories with modern variants. Therefore, increased prioritization on soldier modernization programs by militaries is driving substantial R&D and procurement activity around tactical bulletproof vests.

Recent Developments:

In January 2022, Point Blank Enterprises, Inc introduced hard armor speed plates level IIIA, 40260SA - special rifle threats and tactical body armor, concealable and ballistic systems and related accessory products at the sands expo convention center in Las Vegas, Nevada.

In September 2022, Armor Express was awarded a contract from US Army to deliver the Modular Scalable Vest (MSV) System Gen II.

In March 2021, MKU Limited delivered high performance body armor ballistic vests to Military Police Sao Paulo, Brazil.

The bulletproof vests market is segmented into Type, Protection Level and End User.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bulletproof vests market analysis from 2022 to 2032 to identify the prevailing bulletproof vests market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bulletproof vests market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bulletproof vests market trends, key players, market segments, application areas, and market growth strategies.

Bulletproof Vests Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.2 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 330 |

| By Type |

|

| By Protection Level |

|

| By End User |

|

| By Region |

|

| Key Market Players | VestGuard UK Ltd., Armor Express, MKU LIMITED, MARS Armor Ltd., Slate Solutions, ARGUN s.r.o., EnGarde Body Armor, Safariland, LLC., U.S. Armor Corporation, Point Blank Enterprises, Inc. |

The global Bulletproof Vests industry generated $1.8 billion in 2022, and is anticipated to generate $3.2 billion by 2032, witnessing a CAGR of 6.4% from 2023 to 2032.

The leading companies in the market include Point Blank Enterprises, Inc., MARS Armor Ltd., U.S. Armor Corporation, VestGuard UK Ltd., Armor Express, MKU Limited, Slate Solutions, Safariland, LLC., EnGarde Body Armor, and ARGUN s.r.o.

The largest regional market for bulletproof vests market is North America.

The leading application of bulletproof vests market is military and law enforcement.

The upcoming trends in the market include Integration of smart textiles, sensors, and communication devices into bulletproof vests.

Loading Table Of Content...

Loading Research Methodology...