Bus Infotainment System Market Research, 2034

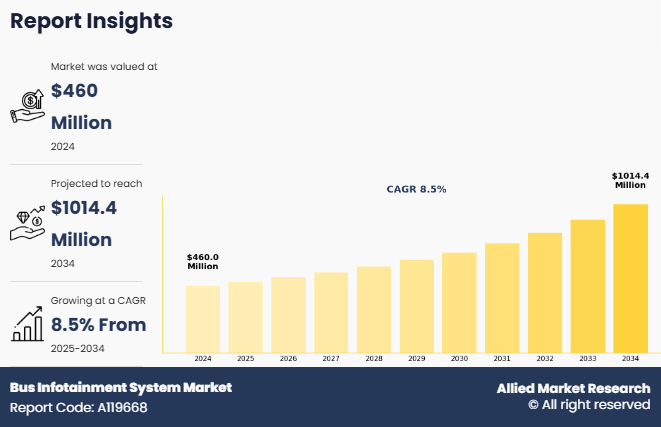

The global bus infotainment system market size was valued at $460 million in 2024, and is projected to reach $1014.4 million by 2034, growing at a CAGR of 8.5% from 2025 to 2034.

The bus infotainment system market refers to the industry focused on the development, production, and deployment of integrated multimedia and information systems designed specifically for buses and coaches. These systems include hardware components like display units, speakers, control panels, and software that delivers entertainment, navigation, real-time passenger information, safety announcements, and internet connectivity. The goal of bus infotainment systems is to enhance the travel experience for passengers while improving operational efficiency for transport providers.

Key Takeaways

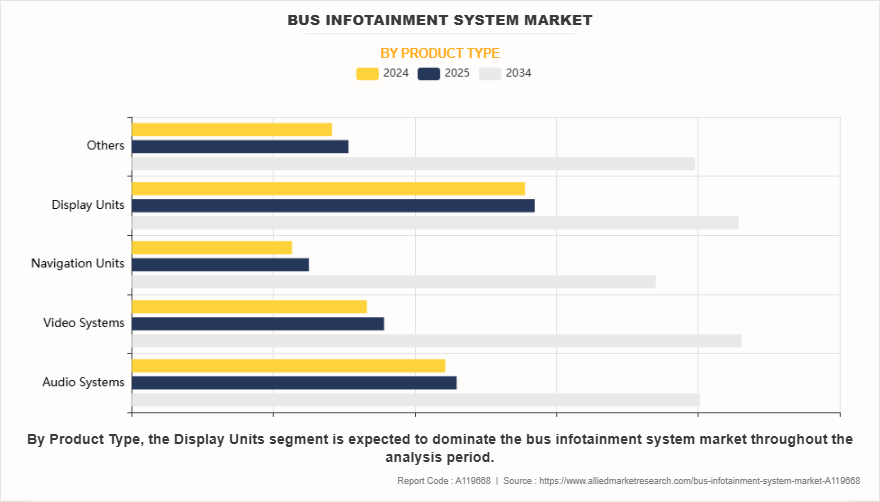

- On the basis of product type, the display units segment held the largest share in the bus infotainment system market in 2024.

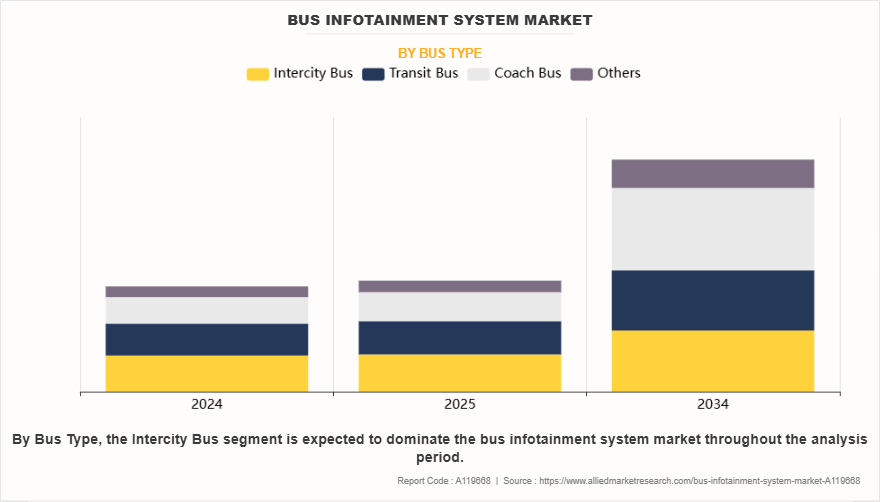

- By bus type, the intercity bus segment was the major shareholder in 2024.

- By connectivity, the Wi-Fi segment dominated the market, in terms of share, in 2024.

- On the basis of component, the hardware segment held the largest share in the bus infotainment system market in 2024

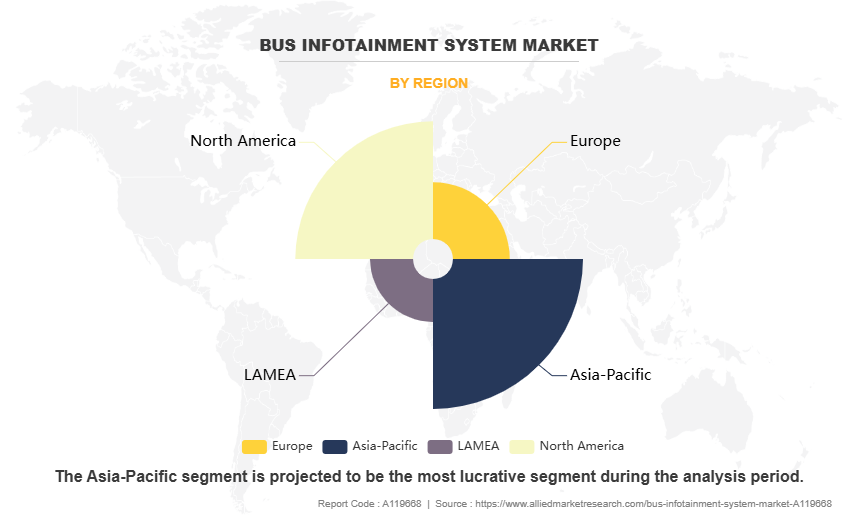

- Region wise, Asia-Pacific region held the largest market share in 2024.

In public transit, they provide real-time route updates and alerts, while in luxury and long-distance coaches, they offer entertainment and personalized content. The market encompasses OEM suppliers, software developers, telematics providers, and system integrators. Increasing demand for connected, comfortable, and informative travel experiences, coupled with advancements in 4G/5G, AI, and cloud technologies, is driving growth in this market. It plays a crucial role in modernizing bus fleets and supporting intelligent transportation and smart city initiatives globally.

For instance, in October 2022, ACTIA launched ACTiVi, an intelligent infotainment and on-board management system designed for modern passenger transport vehicles. This next-generation ECU connects to a display to centralize control of key functions such as infotainment, communication, diagnostics, and system management. Moreover, In April 2023, Continental and HERE have partnered with IVECO to boost safety and fuel efficiency in commercial vehicles through connected technologies. Continental provides high-precision vehicle positioning, data aggregation, and a scalable 4G/5G telematics control unit (TCU), enabling real-time communication with cloud services. This integration supports advanced driver assistance, predictive maintenance, and route optimization. By combining Continental’s telematics solutions with HERE’s location intelligence, the partnership aims to enhance fleet operations and reduce fuel consumption across IVECO’s commercial vehicle lineup.

The rise in demand for enhanced passenger experience in both public and private transport is driving the growth of the bus infotainment system market. Passengers increasingly seek real-time information, entertainment, and connectivity during travel, prompting operators to adopt advanced infotainment solutions. These systems improve comfort, engagement, and accessibility, making them essential for modern transit services and helping operators meet evolving expectations while improving overall travel satisfaction. Furthermore, integration of real-time data, navigation, and communication systems, and growing smart city initiatives and intelligent transportation systems have driven the demand for the bus infotainment system market. However, high initial installation and integration costs are hampering the bus infotainment system market growth. Many transport operators, especially in developing regions, face budget constraints that limit their ability to invest in advanced infotainment infrastructure. The need for customized hardware, software integration, and network setup further increases upfront expenses. These financial challenges discourage widespread adoption, particularly among small fleet operators, slowing down market expansion despite growing demand for passenger-centric technologies. Furthermore, Limited infrastructure in developing regions is hampering the growth of the bus infotainment system market. On the contrary, the expansion of 4G/5G connectivity presents a lucrative opportunity for the bus infotainment system market. High-speed networks enable real-time streaming, cloud-based updates, interactive applications, and seamless communication between systems. This connectivity enhances passenger experience and supports advanced features like live navigation and remote diagnostics, encouraging greater adoption of smart infotainment solutions in both urban and long-distance bus fleets.

Segment Review

The bus infotainment system market is segmented on the basis of product type, bus type, component, connectivity and Region. On the basis of product type, the market is divided into audio systems, video systems, navigation systems, display units, telematics, and others. By bus type, it is classified into intercity buses, transit buses, coach buses, and others. On the basis of connectivity, it is categorized into Wi-Fi, Bluetooth, satellite, and others. By component, it is categorized into hardware and software. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

On the basis of product type, the display units segment acquired the highest market share in 2024 in the bus infotainment system market. This is primarily due to their central role in delivering real-time passenger information, route updates, safety messages, and entertainment content. Display units serve as the visual interface for both passengers and drivers, enhancing communication, accessibility, and user engagement. Their widespread adoption in public transit, luxury coaches, and long-distance buses is driven by increasing demand for improved travel experiences and integration with navigation and telematics systems, advancements in touchscreen technology and high-resolution displays have further boosted their market dominance.

By Bus Type

On the basis of bus type, the intercity bus segment acquired the highest market share in 2024 in the bus infotainment system market. This dominance is attributed to the longer travel durations associated with intercity routes, which drive the need for advanced infotainment solutions to enhance passenger comfort and engagement. Operators prioritize entertainment, real-time navigation, and connectivity features to improve customer satisfaction and differentiate services in a competitive market. Moreover, intercity buses often have larger budgets and space to accommodate sophisticated infotainment systems compared to urban transit buses. Growing tourism and interstate travel further bolster demand, reinforcing intercity buses as the leading segment in this market.

By Region

Region-wise, Asia-Pacific attained the highest market share in 2024 and emerged as the leading region in the bus infotainment system market, driven by rapid urbanization, expansion of smart city projects, and increasing investments in public transportation infrastructure. Countries like China, India, and Japan are witnessing rising demand for connected and comfortable commuting solutions, prompting bus manufacturers and transit authorities to integrate advanced infotainment systems. The region's growing middle-class population, increasing intercity travel, and adoption of digital technologies have further accelerated market growth. Government initiatives supporting smart mobility and 5G connectivity also contribute to the region’s dominant position in the market.

Meanwhile, North America is projected to grow at the fastest rate in the bus infotainment system market during the forecast period, driven by rising demand for advanced passenger engagement solutions and increasing adoption of connected vehicle technologies. The region's focus on improving public and private transportation comfort, coupled with growing investments in smart infrastructure and 5G networks, is fueling market expansion. The presence of leading tech companies and OEMs, along with a high penetration of luxury coach services and school buses equipped with infotainment features, supports growth. Regulatory initiatives promoting safer, more connected transit systems further strengthen the regional outlook.

The report focuses on growth prospects, restraints, and trends of the bus infotainment system market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Bus infotainment system market.

Competitive Analysis

The report analyses the profiles of key players operating in the Bus infotainment system market such as Robert Bosch, Continental AG, Panasonic Corporation, Denso Corporation, Harman International, Valeo SA, VOXX International Corporation, ZF Friedrichshafen AG, Luminator Technology Group, and Actia Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the bus infotainment system market outlook.

Rise in Demand for Enhanced Passenger Experience in Public and Private Transport.

The rise in demand for enhanced passenger experience in both public and private transportation is significantly boosting the growth of the bus infotainment system market size. As passengers increasingly seek more comfortable, engaging, and connected travel experiences, transport operators are adopting advanced infotainment systems to meet these expectations. These systems offer features such as entertainment content, real-time travel updates, internet connectivity, and navigation support, transforming traditional bus travel into a more enjoyable and productive journey. In public transport, these solutions help reduce perceived travel time and improve customer satisfaction, while in private and luxury coach services, they serve as value-added features that attract premium passengers. In adddition, operators benefit from increased customer loyalty and competitive differentiation. This shift is especially pronounced in urban areas and intercity services, where the demand for infotainment, comfort, and connectivity is accelerating. Overall, the growing emphasis on user experience is a key driver propelling the bus infotainment system market forward.

Integration of Real-time Data, Navigation, and Communication Systems.

The integration of real-time data, navigation, and communication systems is significantly increasing the demand for the bus infotainment system industry. These advanced features enhance the overall travel experience by providing passengers with up-to-date route information, estimated arrival times, and seamless connectivity during the journey. Real-time data improves operational efficiency by enabling dynamic route adjustments and quick responses to traffic conditions. Navigation systems help in optimizing travel paths, reducing delays, and improving service reliability. In addition, communication systems keep passengers informed and engaged, contributing to increased satisfaction and loyalty. This integration makes buses more efficient, interactive, and appealing to modern travelers.

Growing Smart City Initiatives and Intelligent Transportation Systems.

The growing adoption of smart city initiatives and intelligent transportation systems is significantly increasing the demand for the bus infotainment system market. As cities become smarter, there is a rising emphasis on enhancing urban mobility through connected, data-driven, and passenger-friendly solutions. Bus infotainment systems play a key role in this transformation by offering features such as real-time passenger information, location-based services, entertainment, and seamless connectivity. These systems contribute to safer, more efficient, and more enjoyable public transport experiences, which align with the core objectives of smart city projects. Governments and transit authorities are increasingly investing in intelligent transportation infrastructure to reduce congestion, lower emissions, and improve the quality of life for commuters. As a result, infotainment systems are being integrated into public buses to support these goals, offering better engagement, timely updates, and overall convenience for passengers. This trend is expected to fuel the widespread adoption of infotainment technologies in the coming years.

High Initial Installation and Integration Costs.

High initial installation and integration costs are significantly hampering the demand for the bus infotainment system market. Implementing advanced infotainment solutions requires substantial upfront investments in hardware such as display units, audio-video systems, navigation modules, and connectivity devices, as well as the software needed to run these systems effectively. In addition, integrating these technologies into existing bus infrastructures often necessitates customization, skilled labor, and system upgrades, further escalating costs. For many fleet operators, especially in cost-sensitive or developing markets, these expenses can be prohibitive, delaying or deterring adoption. Maintenance and periodic system upgrades also add to the total cost of ownership, making it challenging for small and medium-sized transport service providers to justify the expenditure. This financial barrier can limit market penetration, particularly in regions with limited government funding or where return on investment is not immediately apparent. Consequently, high installation and integration costs continue to restrain the widespread adoption of the bus infotainment system industry.

Limited Infrastructure in Developing Regions.

Limited infrastructure in developing regions is a significant factor hampering the demand for the bus infotainment system market. Many countries in Asia, Africa, and Latin America face challenges such as underdeveloped road networks, unreliable power supply, and insufficient digital connectivity, which are crucial for the effective functioning of infotainment systems. Without stable internet access, GPS coverage, and communication networks, the core features of these systems—such as real-time navigation, streaming services, and passenger connectivity—cannot operate reliably. Moreover, a lack of skilled technical workforce and inadequate maintenance services in these regions further restricts the installation and long-term sustainability of such technologies. Bus operators in developing regions are often focused on cost-efficiency and operational necessities, with limited budgets available for premium features like infotainment. In addition, government support and funding for smart transportation infrastructure are still in early stages in many areas. These infrastructural limitations collectively pose a major barrier to the widespread adoption of bus infotainment systems.

Development of AI-based personalized content and services.

The development of AI-based personalized content and services offers a lucrative opportunity for the bus infotainment system market, revolutionizing the way passengers engage with on-board entertainment. By leveraging artificial intelligence, infotainment systems can analyze user preferences, travel history, and behavioral patterns to deliver customized content such as music, movies, route-specific advertisements, and real-time travel information. This personalization significantly enhances passenger satisfaction, especially during long commutes or intercity travel. Additionally, AI-driven voice assistants and language translation features can further improve accessibility and user interaction. Fleet operators can utilize AI analytics to gain insights into passenger demographics and preferences, enabling targeted advertising and service optimization, ultimately increasing revenue potential. As AI technology becomes more affordable and scalable, its integration into infotainment platforms is expected to become more widespread. This shift not only transforms the in-vehicle experience but also aligns with the broader trend toward intelligent, connected, and user-centric transportation solutions, fueling long-term market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bus infotainment system market share from 2024 to 2034 to identify the prevailing Bus infotainment system market forecast.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Bus infotainment system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Bus infotainment system market trends, key players, market segments, application areas, and market growth strategies.

Bus Infotainment System Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 1 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 342 |

| By Product Type |

|

| By Bus Type |

|

| By Connectivity |

|

| By Component |

|

| By Region |

|

| Key Market Players | Voxx International Corporation, Continental AG, HARMAN International, Actia Group, VALEO SA, ZF Friedrichshafen AG, DENSO Corporation, Luminator Technology Group, Panasonic Corporation, Robert Bosch GmbH |

The global bus infotainment system market is witnessing upcoming trends such as the integration of 5G connectivity for faster streaming, adoption of AI-driven personalized content, increased use of cloud-based services, enhanced passenger interactivity through touchscreens and voice control, and a growing shift toward eco-friendly, energy-efficient systems. Additionally, partnerships between OEMs and tech companies are fueling the development of advanced infotainment ecosystems that deliver immersive, connected travel experiences.

The leading application of the bus infotainment system market is in transit buses, where these systems enhance passenger experience by offering real-time travel updates, entertainment, and connectivity, improving comfort and engagement during daily commutes.

Asia-Pacific is the largest regional market for Bus Infotainment System

$1014.4 million is the estimated industry size of Bus Infotainment System

KOITO MANUFACTURING CO., LTD., Valeo S.A., HELLA GmbH & Co. KGaA, Stanley Electric Co., Ltd., ams-OSRAM AG., Marelli Holdings Co., Ltd., Lumax Industries, Robert Bosch GmbH, Koninklijke Philips N.V., and Grupo Antolin.

Loading Table Of Content...

Loading Research Methodology...