Busbar Protection Market Research, 2033

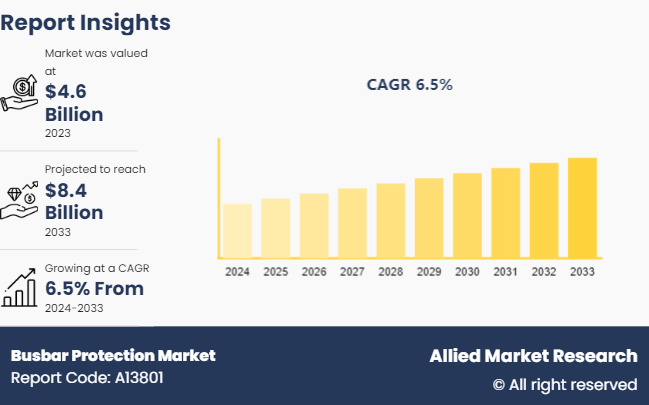

The global busbar protection market size was valued at $4.6 billion in 2023, and is projected to reach $8.4 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Market Definition and Overview

Busbar protection refers to a set of measures and systems designed to safeguard busbars, which are conductive bars used to distribute electrical power in substations and industrial facilities. These protection systems detect faults such as short circuits or overloads within the busbar network and automatically isolate affected sections to prevent damage to equipment and ensure system reliability. Busbar protection typically involves various technologies, including current transformers, protective relays, and circuit breakers, to monitor and control the electrical flow. Advanced protection schemes, such as differential protection, compare the current entering and leaving the busbar to detect imbalances and trigger alarms or disconnects. Effective busbar protection ensures the safe operation of electrical networks and minimizes the risk of widespread outages or equipment damage.

Key Takeaways

- The busbar protection market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major busbar protection industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Market Dynamics

The rising demand for reliable power supply is a key driving factor in the busbar protection market. As industrial, commercial, and residential sectors increasingly depend on uninterrupted and stable power, the need for advanced busbar protection systems is expected to rise. These systems are essential for safeguarding electrical networks from faults, minimizing downtime, and ensuring the continuous operation of critical infrastructure. In industries where power reliability directly impacts productivity and safety, advanced busbar protection technologies are becoming indispensable. The increasing emphasis on energy efficiency and grid stability further boosts the adoption of these systems, making them crucial in modern power distribution networks. All these factors are predicted to drive the market growth during the forecast period.

High installation and maintenance costs pose a significant challenge to the busbar protection market growth. Advanced busbar protection systems, essential for safeguarding complex electrical networks, require substantial investment in both initial setup and ongoing upkeep. This financial burden can be particularly challenging for smaller organizations or projects with constrained budgets. The high cost of sophisticated protection solutions can deter adoption and limit their implementation to larger enterprises or critical infrastructure, affecting market growth and accessibility.

Technological advancements in busbar protection, particularly the development of digital and smart protection systems, present significant opportunities in the market. These innovations enable more precise monitoring and control of busbar systems, improving fault detection and response times. Digital systems offer real-time data analytics and remote diagnostics, enhancing operational efficiency and reliability. Smart protection solutions integrate with broader network management systems, providing advanced features such as predictive maintenance and automated responses to electrical faults. These capabilities drive demand for modern, intelligent busbar protection systems, opening new market opportunities as industries seek to optimize their electrical infrastructure and enhance safety.

Parent Market Overview

The busbar protection market operates within the broader electrical protection and control equipment sector. This parent market includes devices and systems designed to safeguard electrical networks and ensure their reliable operation. Busbar protection specifically focuses on protecting busbars, which are crucial components in electrical substations and distribution systems that carry multiple circuits of electricity. These protection systems detect faults or anomalies within the busbar, isolating the affected section to prevent damage and ensure continuous power distribution. The broader market encompasses circuit breakers, relays, and monitoring systems that work together to maintain the stability and safety of electrical grids. As power infrastructure evolves with renewable energy integration and smart grid technologies, the demand for sophisticated busbar protection solutions is projected to increase to address emerging challenges and ensure efficient power management.

Market Segmentation

The market is segmented into voltage, impedance end user, and region. On the basis of voltage, the market is divided into medium voltage, high voltage, and extra-high voltage. As per impedance, the market is classified into high impedance and low impedance. On the basis of end user, the market is divided into utilities, industries, and transportation. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

In Asia-Pacific, the busbar protection market share growth is driven by rapid urbanization and infrastructure development, which lead to an increase in demand for reliable electrical distribution systems. Rising industrialization and investments in power generation and transmission infrastructure further boost the need for advanced busbar protection solutions. In addition, government initiatives focusing on upgrading electrical grids and enhancing safety standards accelerate the adoption of sophisticated protection technologies, ensuring the stability and efficiency of expanding electrical networks.

- In November 2022, Siemens Limited launched advanced manufacturing in Aurangabad to address increasing global demand in India and worldwide, including over 200 bogies for export. These bogies, built on Siemens' proven ‘SF30 Combino Plus’ design, highlight the company's focus on innovation and reliability. Integrating busbar protection in such critical infrastructure ensures safe, uninterrupted power distribution, supporting Siemens' commitment toward excellence in manufacturing and system stability.

Competitive Landscape

The major players operating in the busbar protection market include ABB, Andritz AG, Basler Electric, Eaton Corporation, Inc., ERL Phase Power Technologies Ltd., General Electric Company, Mitsubishi Electric Corporation, NR Electric Co., Ltd., Schneider Electric SE, Siemens, and others.

Recent Key Strategies and Developments

- In September 2021, Vertiv Holdings Company acquired E&I Engineering Ireland and its UAE affiliate, Powerbar Gulf, for $1.8 billion, with potential additional cash considerations. As the largest busbar system manufacturer in the GCC, this acquisition enhances Vertiv's portfolio in critical digital infrastructure. The integration of advanced busbar systems supports improved busbar protection and overall electrical safety solutions.

Industry Trends

- In March 2023, Eaton showcased its power terminals and connectors for off-highway vehicles and electrified construction at CONEXPO-CON/AGG 2023 in Las Vegas. Developed by Royal Power Solutions, acquired by Eaton in 2022, these connectors enhance electrical system reliability. Their integration with busbar protection systems ensures secure, efficient power distribution in demanding construction environments, minimizing fault risks and equipment damage.

- In April 2018, the Nepal Electricity Authority (NEA) selected Siemens AG to upgrade its 15-year-old SCADA/Energy Management System at the Kathmandu Load Dispatch Center. This modernization enhances real-time monitoring and control, crucial for reliable power distribution. Improved SCADA/EMS integration also strengthens busbar protection, ensuring efficient fault detection and isolation, and strengthening the stability of Nepal's electrical grid.

Key Sources Referred

- Annual Reports

- Investor Presentations

- Press Releases

- Research Papers

- D&B Hoovers

- Government Publications

- Industry Publications and News Outlets

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the busbar protection market analysis from 2023 to 2033 to identify the prevailing busbar protection market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the busbar protection market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global busbar protection market forecast market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global busbar protection market trends, key players, market segments, application areas, and market growth strategies.

Busbar Protection Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.4 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Voltage |

|

| By Impedance |

|

| By End User |

|

| By Region |

|

| Key Market Players | NR Electric Co., Ltd., General Electric Company, Eaton Corporation, Inc., Andritz AG, ERL Phase Power Technologies Ltd., Schneider Electric SE, ABB Ltd, Mitsubishi Electric Corporation, Siemens, Basler Electric |

Upcoming trends in the global busbar protection market include increased adoption of digital technologies, integration with smart grid systems, and enhanced focus on energy efficiency and reliability in industrial and commercial applications.

The leading application of busbar protection is in electrical substations, where it ensures the reliable operation of power distribution systems by detecting and isolating faults to prevent system failures.

Asia-Pacific is the largest regional market for busbar protection.

The busbar protection market is estimated to reach $8.4 billion by 2033, exhibiting a CAGR of 6.5% from 2024 to 2033.

The major players operating in the busbar protection market include ABB, Andritz AG, Basler Electric, Eaton Corporation, Inc., ERL Phase Power Technologies Ltd., General Electric Company, Mitsubishi Electric Corporation, NR Electric Co., Ltd., Schneider Electric SE, and Siemens.

Loading Table Of Content...