Business Analytics In FinTech Market Research, 2031

The global business analytics in fintech market was valued at $3.1 billion in 2021, and is projected to reach $22.9 billion by 2031, growing at a CAGR of 22.4% from 2022 to 2031.

The fintech industry and consumers who utilize finance products generate an enormous amount of data daily. In addition, business analytics has changed the way this information is processed, making it possible to identify trends and patterns, which can then be used to inform business decisions at scale. This data can be used to understand or recognize multiple customer patterns and can help to promote sales and marketing strategies in business analytics in fintech sector.

Business analytics have been helping the fintech companies and financial institutions to know the customers and their buying patterns and behaviors, which is driving the growth of the market. In addition, significant increase in fraudulent activities such as accounting fraud, money laundering, and payment card fraud are the major factors that drive the global business analytics in fintech market growth. However, issues associated with implementation and integration of business analytics among fintech companies hamper the growth of the market. Conversely, integration of artificial intelligence in mobile banking apps and a rise in demand from developing economies are expected to provide major opportunities for the growth of the business analytics in fintech market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the business analytics in fintech market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the business analytics in fintech market outlook.

The business analytics in fintech market is segmented into Component, Deployment Mode, Type, Application and Organization Size.

Segment Review

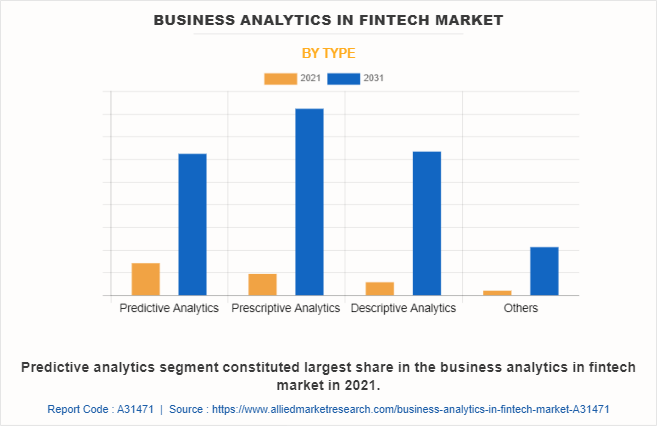

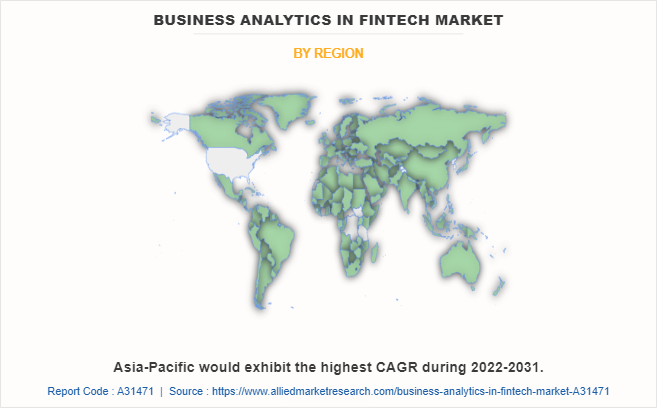

The business analytics in fintech market is segmented into component, deployment mode, type, application, organization size, and region. By component, the market is differentiated into solution and service. The service segment is further segregated into professional and managed services. The professional services is further bifurcated into system implementation & integration, support & maintenance, and training & consulting. Depending on deployment mode, it is fragmented into on-premise and cloud. By organization size, it is fragmented into large enterprise and small & medium sized enterprises. By type, the market is differentiated into predictive analytics, prescriptive analytics, descriptive analytics, and others. The applications covered in the study includes fraud detection & prevention, customer management, sales & marketing, workforce management, and others. By organization size, the market is segmented into large enterprises and small and medium sized enterprises. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By type, predictive analytics attained the highest share in business analytics in fintech market size 2021. This is attributed to the fact that it is increasingly aiding fintech companies in determining which specific items should be marketed to whom and in channeling their sales and marketing efforts. All of this leads to more successful cross-selling, resulting in increased profitability and a stronger customer connection.

By region, Asia-Pacific is expected to be the fastest growing region in business analytics in fintech market share. This is attributed to the fact the use of big data analytics across the Asia-Pacific region to solve a wide variety of business problems and other challenges has been growing. In addition, many financial institutions in Asia-Pacific are adopting predictive analytics for increasing the revenue of the fintech companies and improving decision making capabilities of the organization.

The key players that operate in the global business analytics in fintech market include as Alteryx, Inc., Amazon Web Services, Inc., Aspire systems, Dell Inc., Google, IBM, Knime AG, Microsoft, Mu Sigma, Oracle, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software, LLC (Salesforce), Zoho Corporation Pvt. Ltd, TIBCO Software Inc., and Finn AI. These players have adopted various strategies to increase their market penetration and strengthen their position in the business analytics in fintech industry.

COVID-19 Impact Analysis

COVID-19 pandemic has a significant impact on the business analytics in fintech industry, owing to increase in usage and adoption of business analytics in fintech sector to study and research the consumer data to implement effective strategies. Business analytics in fintech has experienced massive growth as there is increase in technological advancements in the market. Moreover, banks and fintech industries provide their customers with useful and appropriate insights to predict the future positions and situations. This, in turn, has become one of the major growth factors for the business analytics in fintech market during the global health crisis.

Top Impacting Factors

Increase in Adoption of Advanced Technologies for Fraud Detection

In recent years, the fintech industry have seen a significant increase in fraudulent operations. Customers have started using banking services via a variety of channels, which has led to surge in bank frauds such as money laundering, payment card fraud, and fraudulent loans. In addition, advanced technologies such as artificial intelligence and machine learning algorithm-based fraud detection solutions can help to decrease such fraudulent actions. Furthermore, machine learning-based fraud detection aids fintech companies in detecting online fraud and swiftly advises decision makers on what steps to take. Several prominent banks have started using fraud detection technologies based on predictive analytics to detect fraudulent activity across several payment channels.

Furthermore, business analytics software is being used in mobile apps for remote ordering, banking, and payment of products and services by these organizations. For instance, Danske Bank, has used Teradata's fraud detection solution, which combines machine learning and artificial intelligence technologies. Danske Bank was able to detect real-time fraud 50% faster with the aid of the system. As a result, the expansion of business analytics in the fintech industry has been fueled by growth in number of such implementations of business analytics for fraud detection among fintech companies.

Better Risk Management and Internal Controls through Business Analytics

Fintech companies can lower credit risk and make better judgments based on numerous of risk characteristics with the incorporation of innovative technologies. The platform for business data and analytics enables fintech companies to regulate credit risk and avoid default scenarios. Detecting fraud in real-time with the aid of business analytics tools helps avoid credit and liquidity risk by allowing close monitoring of borrowers with ability to predict loan failure. Applying credit risk indicators based on behavioral patterns in payment transactions has proven to detect credit events significantly earlier than traditional indicators based on overdrawn accounts and late payments. Decisions based only on risk assessment and transparency can be made with the assistance of analytics tools. The Bank of America is an excellent illustration of how high-risk account can be identified utilizing business analytics. The corporate investment group is liable for determining the probability of default on 9.5 million mortgages, which assisted Bank of America in predicting losses owing to loan defaults. The bank was able to boost its efficiency by reducing the time required to calculate loan defaults from 96 to 4 hours. Thus, better risk management and internal controls through fintech and business analytics is propelling the growth of the market.

Rise in use of business analytics in fintech for better customer services

Customer support services is another area where business analytics can contribute. Continuous data collection delivers knowledge and insight regarding customer issues. If data indicates that a certain service department routinely receives similar questions, a knowledge base can be developed to facilitate self-service. Using information gained from previous interactions, the user experience could be enhanced by quickly resolving their difficulties. Customers generate the great majority of business data in fintech, either through interacting with sales teams as well as service representatives or via transactions. The transactional data provide fintech companies with a clear sight of their customer's spending habits and the behavioral patterns which helps fintech companies to develop tailored services for customers. Thus, rise in use of business analytics in fintech for better customer services is driving the growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the business analytics in Fintech market forecast from 2021 to 2031 to identify the prevailing business analytics in Fintech market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the business analytics in Fintech market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global business analytics in Fintech market trends, key players, market segments, application areas, and market growth strategies.

Business Analytics in FinTech Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 22.9 billion |

| Growth Rate | CAGR of 22.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 413 |

| By Component |

|

| By Deployment Mode |

|

| By Type |

|

| By Application |

|

| By Organization Size |

|

| By Region |

|

| Key Market Players | Amazon Web Services, Inc., Microsoft, Finn AI, Tableau Software, LLC (Salesforce), Knime AG, TIBCO Software Inc., Dell Inc., Zoho Corporation Pvt. Ltd., SAP SE, Aspire Systems, Mu Sigma, Sisense Inc., SAS Institute Inc., Alteryx, Inc., IBM, Google, Oracle |

Analyst Review

Fintech companies are anticipated to play an increasingly important part in company operations in the future owing to the sheer enormous economic value provided by business analytics models. Fintech companies can use business analytics to take preventative action across a number of roles. Some of the profitable potential prospects attainable with business analytics models are fraud prevention in fintech companies, catastrophe protection for governments, and magnificent marketing efforts. Surge in internet access and increased smart device usage in Europe and Asia-Pacific fuel demand for business analytics in these regions. Moreover, the business analytics industry is likely to benefit from increased cloud use and rise in investment in business analytics in upcoming years.

The COVID-19 outbreak has a significant impact on the business analytics in fintech market. Furthermore, the breakout of the COVID-19 pandemic in 2020 has prompted the development of business analytics solutions to battle the issue and assist the fintech industry in working successfully and continuing all financial activities in the event of a crisis. This, as a result promoted the demand for business analytics, thereby accelerating the revenue growth.

The business analytics in fintech market is fragmented with the presence of regional vendors such as Alteryx, Inc., Amazon Web Services, Inc., Aspire systems, Dell Inc., Google, IBM, Knime AG, Microsoft, Mu Sigma, Oracle, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software, LLC (Salesforce), Zoho Corporation Pvt. Ltd, TIBCO Software Inc., and Finn AI. Major players that operate in this market have witnessed significant adoption of strategies, which include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for business analytics in fintech across the globe, major players have collaborated their product portfolio to provide differentiated and innovative products.

The business analytics in fintech market is estimated to grow at a CAGR of 22.4% from 2022 to 2031.

The business analytics in fintech market is projected to reach $22.89 billion by 2031.

Increase in adoption of advanced technologies for fraud detection, better risk management and internal controls through business analytics, and rise in use of business analytics in fintech for better customer services majorly contribute toward the growth of the market.

The key players profiled in the report include Alteryx, Inc., Amazon Web Services, Inc., Aspire systems, Dell Inc., Google, IBM, Knime AG, Microsoft, Mu Sigma, Oracle, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software, LLC (Salesforce), Zoho Corporation Pvt. Ltd, TIBCO Software Inc., and Finn AI.

The key growth strategies of business analytics in fintech market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...