Business Jet Maintenance Market Research, 2032

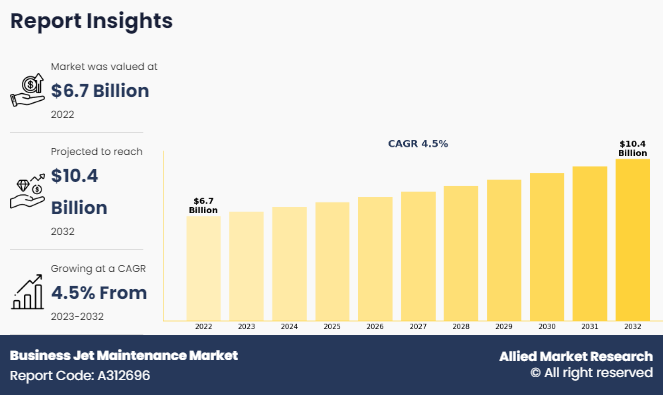

The global business jet maintenance market was valued at $6.7 billion in 2022, and is projected to reach $10.4 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032. Business jet maintenance refers to the comprehensive process of inspecting, repairing, and servicing private or corporate jets to ensure their safety, reliability, and compliance with regulatory standards. This specialized form of aircraft maintenance is crucial for ensuring that business jets remain airworthy and operate efficiently. It typically includes routine inspections, scheduled maintenance tasks, troubleshooting, repairs, and component replacements as necessary. Business jet maintenance involves highly skilled technicians and engineers who are trained in various aspects of aircraft systems, including avionics, engines, airframes, and electrical systems.

The increasing number of business jets in service globally drives the demand for maintenance services. With more businesses and individuals utilizing business jets for travel, the frequency of flights and overall aircraft utilization rises. This leads to more wear and tear on aircraft components, necessitating regular maintenance and repairs to ensure safety and efficiency. Modern business jets are equipped with increasingly sophisticated avionics, propulsion systems, and other complex components. Maintenance providers must adhere to these technological advancements to effectively service these aircraft, resulting in demand for expertise and equipment. Stringent safety regulations and maintenance requirements set forth by aviation authorities necessitate routine inspections and maintenance checks for business jets.

Maintenance providers play a crucial role in ensuring compliance with these regulations, thereby driving demand for their services. High-net-worth individuals often seek customization options for their business jets to reflect their personal preferences and branding. Maintenance providers offering refurbishment and customization services can capitalize on this increasing demand, further expanding the market. The globalization of businesses has led to an increase in international travel via business jets. This necessitates maintenance providers with a global presence or partnerships to support aircraft maintenance wherever they may operate, driving expansion of the market.

Business jets often require specialized parts that are not commonly used in other industries. These parts can be expensive to manufacture and source, driving up maintenance costs significantly. Maintenance of business jets requires highly skilled technicians and engineers with specialized training and certifications. These professionals have high salaries, adding to the overall cost of maintenance services. Business jets must adhere to stringent safety regulations set by aviation authorities. Compliance with these regulations often requires extensive documentation, testing, and inspections, all of which contribute to the overall cost of maintenance.

Business jets are equipped with advanced avionics, engines, and other systems that require specialized knowledge and training to maintain. Keeping up with rapid technological advancements in the industry requires ongoing training and investment, further driving up costs. Maintaining business jets requires specialized facilities, tools, and equipment, all of which represent significant capital investments. These costs are passed on to customers through maintenance fees.

The advancement of technology in aviation, such as improved avionics systems, more fuel-efficient engines, and composite materials, opens up opportunities for maintenance providers to offer specialized services. This includes services such as avionics upgrades, software updates, and troubleshooting for complex systems. Technological advancements have led to the development of more fuel-efficient and environmentally friendly jet engines. Maintenance providers can capitalize on this by offering specialized services for the maintenance, repair, and overhaul of these advanced engines. This includes predictive maintenance using data analytics and condition monitoring technologies to optimize engine performance and minimize downtime.

The increasing use of composite materials in aircraft construction offers opportunities for maintenance providers to develop expertise in composite repair and maintenance. Business jet operators require specialized services for inspecting, repairing, and maintaining composite components to ensure airworthiness and longevity of the aircraft. Business jet operators often seek to upgrade their aircraft with the latest technologies to enhance performance, comfort, and safety. Maintenance providers can offer a range of upgrade and modification services, such as cabin interior refurbishment, Wi-Fi connectivity installation, entertainment system upgrades, and aerodynamic enhancements, to meet the evolving needs of business jet owners.

The key players profiled in this report include Airbus, Boeing, Bombardier, Cirrus Aircraft, Dassault Aviation, Embraer, Gulfstream, HondaJet, Pilatus, and Textron Aviation. Product innovation and development are common strategies followed by major market players. For instance, in March 2022, Embraer signed a service agreement to support Avantto's executive jet fleet through the Embraer Executive Care Program. The Embraer Executive Care Program is a comprehensive airframe maintenance program carefully designed and managed by Embraer to provide a simple and predictable way of budgeting aircraft maintenance cost.

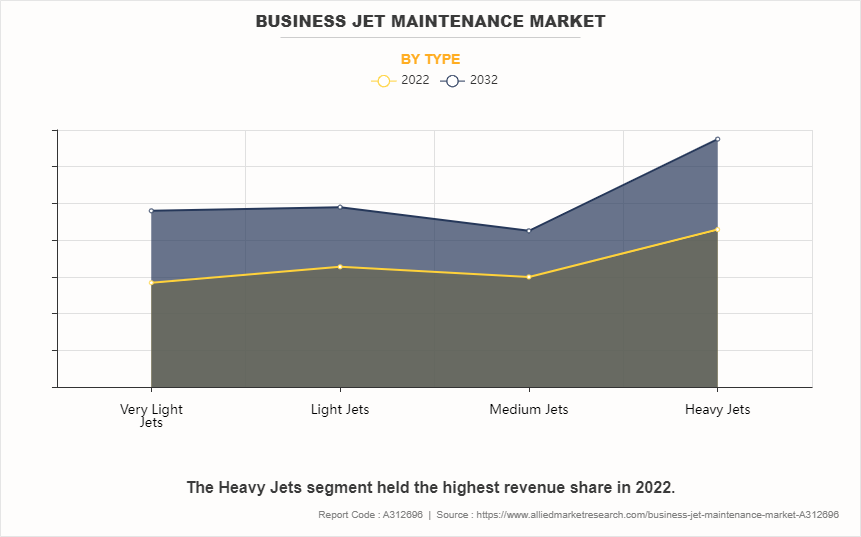

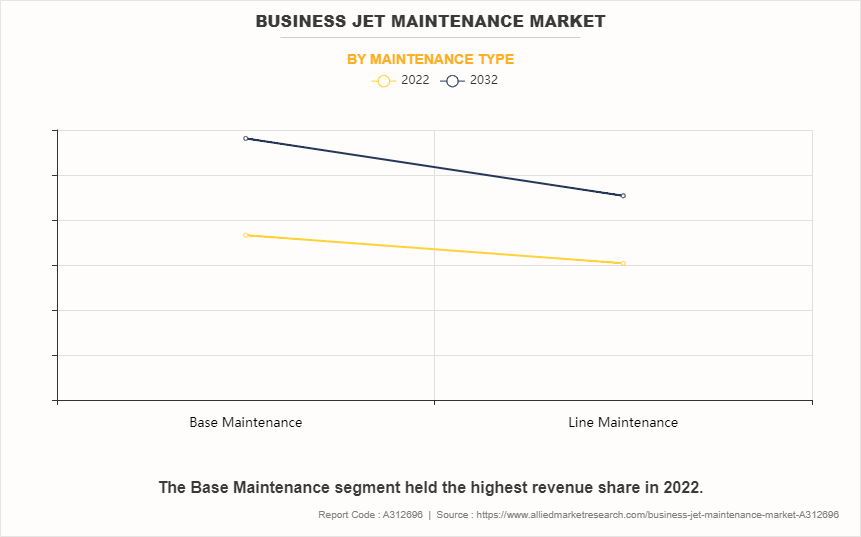

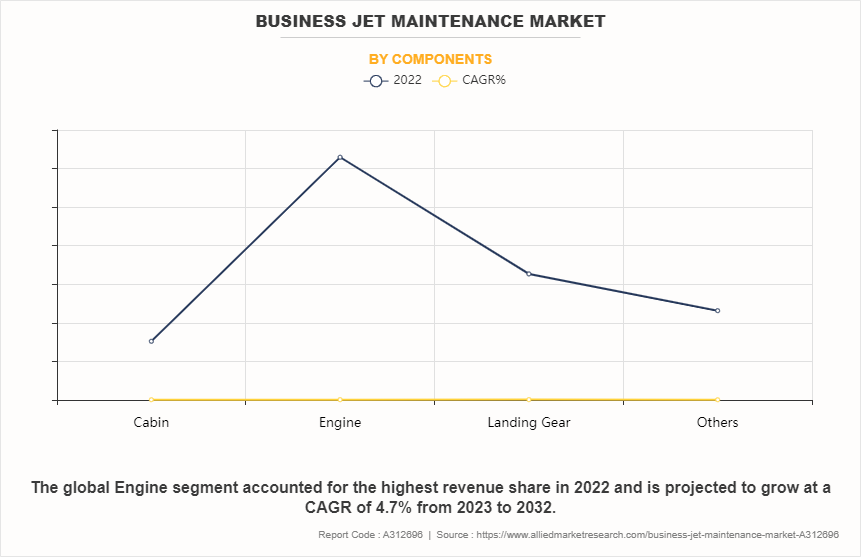

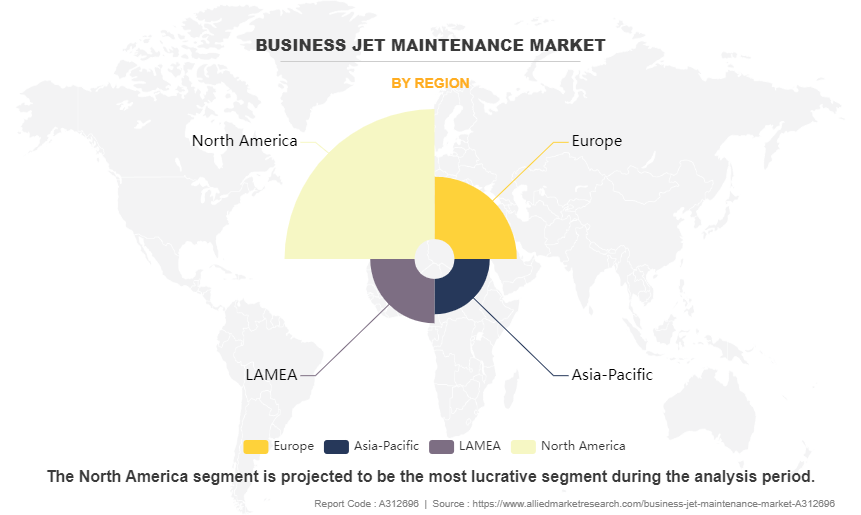

The business jet maintenance market is segmented based on type, maintenance type, component, and region. By type, the market is classified into very light jets, light jets, medium jets, and heavy jets. By maintenance type, the market is classified into base maintenance and line maintenance. By component, the market is classified into cabin, engine, landing gear, and others. By region, the business jet maintenance market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The business jet maintenance market is segmented into Type, Maintenance Type and Components.

By type, the heavy jets sub-segment dominated the global business jet maintenance market share in 2022. As the global economy grows and businesses expand, there is a rising demand for long-range, large-cabin jets to accommodate executives and high-net-worth individuals. This leads to an increase in the number of heavy jets in operation, thereby driving the demand for maintenance services. Many heavy jets in service are aging, requiring more frequent maintenance and overhauls to ensure continued airworthiness and compliance with safety regulations.

This necessitates regular maintenance checks and upgrades, contributing to the growth of the maintenance market. Heavy jets are subject to stringent regulatory requirements, particularly in terms of safety, security, and environmental standards. Compliance with these regulations necessitates regular inspections, maintenance, and upgrades, driving demand for maintenance services. Advancements in aircraft technology, such as more sophisticated avionics systems, composite materials, and fuel-efficient engines, require specialized maintenance procedures and equipment. Heavy jet operators need maintenance providers with expertise in handling these advanced technologies, driving demand for specialized maintenance services.

By maintenance type, the base maintenance sub-segment dominated the global business jet maintenance market share in 2022. Adherence to aviation regulatory requirements is paramount in the maintenance of business jets. Base maintenance facilities must comply with regulations set by aviation authorities such as the Federal Aviation Administration (FAA) in the U.S. or the European Union Aviation Safety Agency (EASA) in Europe. Changes or updates in regulations can drive demand for base maintenance services as operators strive to remain compliant.

As business jets age, they require more frequent and extensive maintenance to ensure continued airworthiness and safety. Base maintenance activities, including inspections, repairs, and overhauls, become increasingly essential for older aircraft. The growing number of aging business jets in service contributes to sustained demand for base maintenance services. Technological innovations in business jet design and avionics systems require specialized knowledge and equipment for maintenance. Base maintenance facilities invest in training and infrastructure to keep pace with advancements in aircraft technology, driving demand for their services.

By component, the engine sub-segment dominated the global business jet maintenance market share in 2022. Advancements in engine technologies drive the need for specialized maintenance services to ensure optimal performance, fuel efficiency, and compliance with regulatory standards. This includes improvements in engine materials, design, and performance monitoring systems.

Strict regulatory requirements mandate regular inspections, maintenance, and repairs of aircraft engines to ensure safety and airworthiness. Compliance with regulations such as FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) standards is crucial, driving demand for maintenance services. Many corporate jets maintenance, private jets maintenance have aging engines that require frequent maintenance and upgrades to remain operational and compliant with safety regulations. As these aircraft age, the demand for engine maintenance, repair, and overhaul (MRO) services increases. The growth in the number of business jets in operation globally expands the market for engine maintenance services.

By region, North America dominated the global business jet maintenance market in 2022. North America has one of the largest fleets of business jets in the world. The U.S., in particular, has a large number of corporate aircraft, including jets owned by businesses, individuals, and charter companies. The sheer size of the fleet necessitates robust maintenance services. The Federal Aviation Administration (FAA) in the U.S. sets rigorous standards for aircraft maintenance, ensuring safety and airworthiness.

Compliance with these regulations drives demand for maintenance services to ensure that business jets meet regulatory requirements. Business jets incorporate advanced technologies to enhance performance, efficiency, and safety. These sophisticated systems require specialized maintenance and skilled technicians, driving demand for maintenance services in the region. Business jets, corporate jets maintenance, private jets maintenance in North America are often utilized extensively for corporate travel, charter operations, and personal transportation. High utilization rates lead to increased wear and tear, necessitating frequent maintenance and inspections to ensure optimal performance and safety.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the business jet maintenance market analysis from 2022 to 2032 to identify the prevailing business jet maintenance market size opportunities.

- The business jet maintenance market trends research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the business jet maintenance market growth segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global business jet maintenance industry forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global business jet maintenance market forecast trends, key players, market segments, application areas, and market growth strategies.

Business Jet Maintenance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.4 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Type |

|

| By Maintenance Type |

|

| By Components |

|

| By Region |

|

| Key Market Players | Dassault Aviation., Cirrus Aircraft, Embraer, Textron Aviation, Bombardier, gulfstream aerospace, hondajet, Pilatus, Airbus, Boeing |

The growing overall size of the business jet fleet directly impacts the demand for maintenance services. As the number of business jets in operation increases, so does the need for maintenance, repair, and overhaul (MRO) services. These factors are anticipated to drive the market growth.

The major growth strategies adopted by business jet maintenance market players are investment and agreement.

North America will provide more business opportunities for the global business jet maintenance market in the future.

Airbus, Boeing, Bombardier, Cirrus Aircraft, Dassault Aviation, Embraer, Gulfstream, HondaJet, Pilatus, and Textron Aviation are the major players in the business jet maintenance market.

The base maintenance sub-segment of the maintenance type segment acquired the maximum share of the global business jet maintenance market in 2022.

Aircraft companies are the major customers in the global business jet maintenance market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global business jet maintenance market from 2022 to 2032 to determine the prevailing opportunities.

Growing advances in aircraft technology, such as avionics systems, engines, and materials, require specialized maintenance capabilities and equipment. Operators often seek MRO providers with expertise in servicing the latest technologies to ensure optimal performance and safety. These are the major factors expected to drive the adoption of business jet maintenance.

Growing emphasis on sustainability and environmental regulations may drive demand for eco-friendly aircraft modifications and upgrades. MRO providers offering services to enhance fuel efficiency, reduce emissions, and comply with environmental standards are expected to witness an increase in demand. This ongoing trend is predicted to drive the global business jet maintenance market in the upcoming years

Loading Table Of Content...

Loading Research Methodology...