Butyl Rubber Market Research, 2033

The global butyl rubber market was valued at $4.0 billion in 2023, and is projected to reach $6.5 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

Market Introduction and Definition

Butyl rubber, a synthetic elastomer, is a copolymer primarily composed of isobutylene and a small amount of isoprene. Renowned for its exceptional impermeability to gases, water, and chemicals, butyl rubber possesses high resilience, flexibility, and weather resistance. Its unique molecular structure, featuring long polyisobutylene chains interspersed with short isoprene segments, grants it superior sealing properties, making it ideal for applications requiring airtight seals such as tire inner tubes, roofing membranes, and sealants for automotive and construction industries.

In addition, butyl rubber exhibits excellent resistance to heat, ozone, and aging, ensuring durability in various environmental conditions. Its low gas permeability makes it indispensable in manufacturing inner tubes for tires and pharmaceutical stoppers. Moreover, its resistance to acids and alkalis finds utility in gaskets and hoses for chemical processing equipment. Thus, butyl rubber stands as a versatile elastomer renowned for its sealing prowess and resilience across diverse industrial applications.

Key Takeaways

- The butyl rubber market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major butyl rubber industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in automotive production is driving growth in the butyl rubber market due to its wide range of applications in the automotive industry. Butyl rubber is extensively used in tire manufacturing, where its excellent air retention properties contribute to longer lasting and efficient tires. In addition, it is utilized in automotive sealants and gaskets, providing superior resistance to heat, weathering, and chemical exposure. The demand for butyl rubber in critical applications is expected to increase with surge in automotive production, fueling the market's growth trajectory. In 2023, there was a notable surge in car production, with a 30% increase reported by the China Automotive Association. In addition, the number of newly registered passenger vehicles witnessed a significant rise, reaching 23.14 million. China's FDI policy, which has been particularly supportive of the automotive sector, has attracted substantial investment from prominent global brands, contributing to the industry's success.

The increase in demand for butyl rubber in the construction sector is primarily driven by its exceptional properties that make it an ideal material for various applications. Butyl rubber's excellent weather resistance, durability, and flexibility make it well-suited for construction sealants, particularly in sealing joints and gaps in buildings, bridges, and other infrastructure projects. In addition, its resistance to water, chemicals, and UV radiation ensures long-term performance and prevents leakage, enhancing the durability of structures. The demand for butyl rubber in sealants is expected to increase with increase in construction activity, thus, driving the market growth.

However, the fluctuating prices of raw materials significantly impact the growth of the butyl rubber market. As butyl rubber is derived from petroleum-based feedstocks, its production costs are closely tied to the volatility of oil prices. Fluctuations in crude oil prices directly influence the cost of key raw materials like isobutylene and butadiene, which are essential for butyl rubber manufacturing. Consequently, when raw material prices surge, the production costs for butyl rubber increase, leading to higher prices for end-users. This price volatility poses challenges for market players in planning production, pricing strategies, and maintaining profitability, ultimately affecting market growth.

Technological innovations in butyl rubber compounding present a significant opportunity for the market, enabling manufacturers to enhance product performance and expand application possibilities. Companies can tailor butyl rubber formulations to meet specific industry requirements, such as improved tensile strength, elongation, and heat resistance by incorporating advanced additives, fillers, and processing techniques. These innovations not only widen the scope of applications in automotive, construction, and healthcare sectors but also offer opportunities for differentiation and competitive advantage in an evolving market landscape.

Market Segmentation

The butyl rubber market is segmented into type, application, end-use industry and region. By type, the market is bifurcated into regular butyl rubber and halogenated butyl rubber. By application, the market is segregated into tires and tubes, hoses and gaskets, adhesives and sealants, medical equipment, and others. As per end-use industry, the market is categorized into automotive, construction, pharmaceutical, consumer, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Patent Analysis of Global Butyl Rubber Market

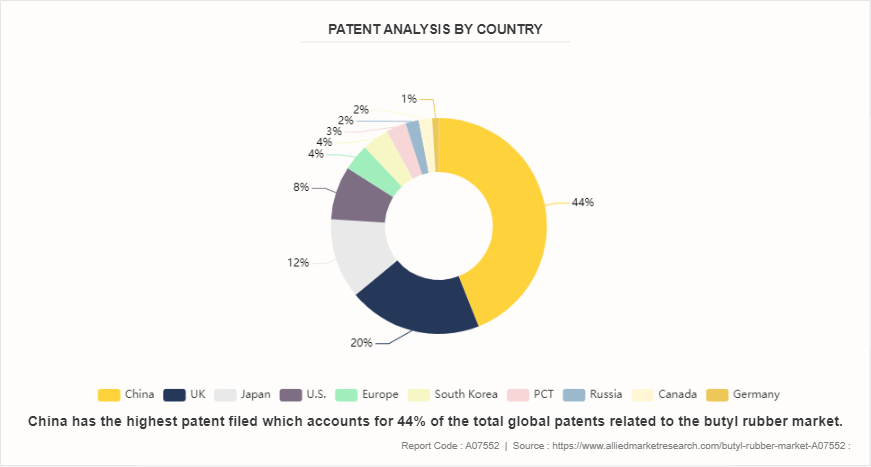

The patent analysis for the butyl rubber market reveals significant contributions from various countries. China and the UK collectively hold a significant portion of the total patents related to butyl rubber, indicating strong innovation and investment in this market within these countries. China leads with 44% of the patents, highlighting its dominant role in butyl rubber research and development. The UK follows with 20%, showcasing robust activity and competition. Japan and the U.S., holding 12% and 8% respectively, also contribute significantly to the global patent landscape. The European Patent Office and the Republic of Korea each have 4% of patents respectively, further emphasizing the global interest in butyl rubber innovations. In addition, the PCT accounts for 3%, while the Russian Federation, Canada, and Germany contribute smaller shares with 2%, 2% and 1% respectively. This analysis reflects the widespread focus on butyl rubber across various regions, with significant contributions from Asia and Europe in particular.

Competitive Landscape

The key market players operating in the butyl rubber market include Exxon Mobil Corporation., Reliance Industries Limited., Ramsay Rubber Limited, Lanxess AG, Timco Rubber., Goodyear Rubber Company, JSR Corporation, China Petrochemical Corporation., SIBUR Holding PJSC and Zhejiang Cenway Materials Co., Ltd.

Regional Industry Outlook

In the Asia-Pacific and North America regions, the automotive, construction, and pharmaceutical industries are key drivers of the butyl rubber market growth. In Asia-Pacific, rapid industrialization and urbanization fuel demand for automobiles, infrastructure development, and healthcare products, all of which rely heavily on butyl rubber. Similarly, in North America, robust automotive production, construction activity, and pharmaceutical manufacturing contribute to the increase in use of butyl rubber. The material's versatility, coupled with its resistance to heat, chemicals, and weathering, makes it indispensable in these sectors, driving continuous growth in both regions.

- In 2022, the combined demand for passenger cars and commercial vehicles in Japan reached 5.19 million units, marking a 2.2% increase from the previous year. Passenger cars and commercial vehicles, excluding mini vehicles, totaled 3.34 million units, experiencing a slight decrease of 0.7% compared to fiscal 2022. Meanwhile, mini vehicles saw a notable increase, reaching 1.86 million units, up by 7.9%. South Korea's commercial vehicle market constitutes 10% of its overall automotive sector. In 2022, South Korea produced 4.2 million automobiles, with 360, 000 of them categorized as commercial vehicles. The Asia-Pacific region witnessed a surge in sales of heavy-duty trucks and commercial vehicles, driven by factors such as economic expansion and substantial ongoing investments in infrastructure.

- In May 2022, The Statistics & Planning Department, Rubber Board, Kottaya, announced that natural rubber (NR) production in the India improved to 775, 000 tons during 2021-22 compared to 715, 000 tons during 2020-21, recording a growth of 8.4 % compared to a growth of 0.4 % registered during the previous year.

- According to the Invest India, India's automotive industry is worth around $222 billion in 2022, while the EV market in India is estimated to be valued at $2 billion by 2023 and $7.09 billion by 2025. Further, the automotive industry accounts for 8% of all national exports. This sector accounts for 40% of the total $31 billion of global research and development spending. Thus, butyl rubber’s ability to maintain flexibility and elasticity across a broad temperature range makes it an ideal material for seals, gaskets, and hoses in engines and other automotive systems.

- According to the Bureau of Economic Analysis, the total value generated by the construction industry in the first three quarters of 2022 in the U.S. was around $2, 980 billion, or roughly 5% more than the previous year for the same time. Thus, the expanding landscape of construction projects globally drives the growth of the butyl rubber market.

Industry Trends

- As environmental awareness rises, industries are seeking sustainable materials. Butyl rubber's recyclability and reusability make it an attractive choice, aligning with the growing demand for eco-friendly solutions. Its potential for multiple applications in various sectors presents opportunities for reducing waste and minimizing environmental impact.

- According to the International Rubber Study Group (IRSG) , rubber production across the world during 2021 was 13.770 million tons compared to 13.065 million tons produced in 2020, registering a positive growth of 5.4%. During 2021, production in main producing countries viz; Thailand, Indonesia, Vietnam, Cote d’Ivoire, China and India increased whereas production in Malaysia decreased when compared to 2020.

- Butyl rubber's chemical inertness and biocompatibility have led to its increased utilization in healthcare. The market for butyl rubber in medical devices, pharmaceutical packaging, and healthcare products is on the rise. This growth is fueled by the material's ability to meet stringent regulatory requirements and ensure product safety.

Key Sources Referred

- Statistics & Planning Department, Rubber Board

- Invest India

- International Rubber Study Group (IRSG)

- Rubber Board, Ministry of Commerce, and Industry

- India Brand Equity Foundation

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the butyl rubber market analysis from 2024 to 2033 to identify the prevailing butyl rubber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the butyl rubber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global butyl rubber market trends, key players, market segments, application areas, and market growth strategies.

Butyl Rubber Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.5 Billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Type |

|

| By Application |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Reliance Industries Limited, Lanxess AG, China Petrochemical Corporation, JSR Corporation, Goodyear Rubber Company, Exxon Mobil Corporation, SIBUR Holding PJSC, Timco Rubber, Ramsay Rubber Limited, Zhejiang Cenway Materials Co., Ltd. |

The global butyl rubber market was valued at $4.0 billion in 2023 and is estimated to reach $6.5 billion by 2033, exhibiting a CAGR of 5.1% from 2024 to 2033.

Technological innovations in rubber compounding is the upcoming trends of butyl rubber market in the globe.

Tires and tubes is the leading application of butyl rubber market.

Asia-Pacific is the largest regional market for butyl rubber.

The key market players operating in the butyl rubber market include Exxon Mobil Corporation., Reliance Industries Limited., Ramsay Rubber Limited, Lanxess AG, Timco Rubber., Goodyear Rubber Company, JSR Corporation, China Petrochemical Corporation., SIBUR Holding PJSC and Zhejiang Cenway Materials Co., Ltd.

Loading Table Of Content...