C-Arm Market Research, 2031

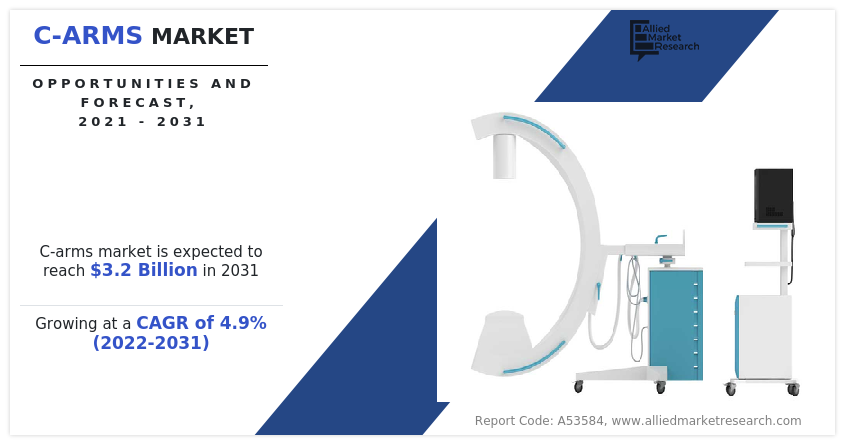

The global c-arms market size was valued at $2,003.12 million in 2021, and is projected to reach $3,233.76 million by 2031, growing at a CAGR of 4.9% from 2022 to 2031. C-Arm is a medical imaging device that is based on X-ray technology and can be used flexibly in various operation rooms within a clinic. The name is derived from the C-shaped arm used to connect the X-ray source and X-ray detector to one another. C-Arms comprises a generator called X-Ray source and an image intensifier for a flat panel detector. It is often used in surgery, orthopedics, traumatology, vascular surgery, and cardiology for intra-operative imaging. The device provides high-resolution X-ray images in real time, allowing the surgeon to monitor progress at any point during the surgery.

Market dynamics

The increase in the prevalence of chronic disease due to changing lifestyles such as heart diseases, diabetes, cardiovascular disease, chronic respiratory diseases, and others cause mortality and morbidity across the world, rising number of surgical procedures, and an increasing demand for technologically advanced medical devices are the major factors driving the growth of the C-arms market share. For instance, according to the report published by World Health Organization in September 2022, noncommunicable diseases (NCDs) kill 41 million people each year, equivalent to 74% of all deaths globally. Each year, 17 million people die from NCD before age 70; 86% of these premature deaths occur in low- and middle-income countries of all NCD deaths, 77% are in low- and middle-income countries. In addition, cardiovascular diseases account for most NCD deaths, or 17.9 million people annually, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million including kidney disease deaths caused by diabetes). Moreover, the rise in technological advancements in C-arms, such as improved imaging resolution and image intensifier tubes, are expected to fuel the C-arms market growth. These advancements have enabled C-arms to be used for a variety of purposes, including vascular surgeries, orthopedic surgeries, and tumor treatment. For instance, in June 2022, Siemens AG, launched its new, ceiling-mounted Artis icono ceiling angiography system. It provides three-dimensional (3D) data both at the patient’s head and from the patient’s side over a complete angular range of 200 degrees. The demand for C-arms devices is not only limited to developed countries, but is also being witnessed in developing countries, owing to the rapid increase in geriatric populations of countries such as China, Brazil, and India, which fuel the growth of the market.

However, the high cost of C-arms devices and lack of skilled professional hampers the C-arms market size. As it can limit the number of potential buyers and restrict the ability of hospitals and diagnostic clinics to acquire the latest technology. This can lead to a decrease in the adoption of technologically advanced diagnostic devices in clinics and hospitals, resulting in a decrease in the quality of X-ray images. Emerging economies such as India, China, Mexico, and Brazil, are anticipated to create new opportunities during the forecast period owing to the rise in geriatric population and increase in interest in minimally invasive surgeries as there are minimal stitches on the body and rapid increase in the number of chronic diseases.

Segmental Overview

The C-arms market is segmented on the basis of type, application, end-user, and region. By type, the market is segmented into mobile C-arms and fixed C-arms. The mobile C-arms is further segmented into a mini-C-arms and full-size C-arms. By application it is bifurcated into cardiology, gastroenterology, neurology, orthopedic & trauma, oncology, and others. By end user, it is segmented into hospitals, diagnostic centers, and specialty clinics. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type

The market is segmented into mobile C-arms and fixed C-arms. The mobile C-arms segment accounted for the largest share of the market. The dominance of this segment can be attributed to the ability of mobile C-arms to move around the patient, achieving the best angle for a high-quality image while keeping the patient comfortable, is one of its most significant advantages.

By Type

Mobile C-Arms segment exhibited the highest growth in 2021, and is anticipated to lead during the forecast period.

By application

The market is segmented into cardiology, gastroenterology, neurology, orthopedic & trauma, oncology, and others. The orthopedic & trauma segment accounted for the largest share of the market. The dominance of this segment can be attributed to the high incidence of musculoskeletal disease, increase in the number of road accidents and sports-related injuries, and a rise in the geriatric population.

By Application

Orthopedic & Trauma segment exhibited the highest growth in 2021, and is anticipated to lead during the forecast period.

By end user

The market is segmented into hospitals, diagnostic centers, and specialty clinics. The hospitals segment exhibited the highest growth in 2021, and is anticipated to lead during the forecast period, owing to the fact that hospitals are the primary end-users of C-arms devices, and are the main source of revenue for C-arms device vendors. The demand for C-arms devices in hospitals is driven by the need for mobile imaging, which is used for a variety of medical procedures, including orthopedic, vascular, and gastrointestinal surgeries.

By End User

Hospitals segment exhibited the highest growth in 2021, and is anticipated to lead during the forecast period.

By region

The C-arms market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the C-arms market in 2021 and is expected to maintain its dominance during the forecast period. The presence of several major key players and the rising advancement in technology in this region drive the growth of the market. Moreover, increase in the prevalence of chronic disease, the rapid increase in the geriatric population, rising demand for minimally invasive surgical procedures, increasing adoption of technologically advanced C-arms devices and improved healthcare infrastructure, are the major factor driving the growth of the C-arms market in this region.

Asia-Pacific is expected to grow at the highest rate during the C-arms market forecast. The market growth in the Asia-Pacific region is supplemented by highly populated countries along with increasing collaboration between key organizations and hospitals to improve quality of healthcare and research infrastructure, availability of government funding for research activities, and growing application of C-arms devices for the diagnosis of disease and provide better image quality.

By Region

North America accounted for a majority of the C-arm market share in 2021 and is anticipated to remain dominant during the forecast period.

COMPETITION ANALYSIS

The report provides competitive analysis and profiles of the major players in the C-arms market, such as Canon Inc, Fujifilm Holding Corporation, General Electric Company, Hologic Inc, Koninklijke Philips N.V., Nanjing Perlove Medical Equipment Co. Ltd., Shimadzu Corporation, Siemens AG, Trivitron Healthcare and Ziehm Imaging GmbH.

Some examples of product launches are

In June 2022, Siemens AG, launched its new, ceiling-mounted Artis icono ceiling angiography system. It provides three-dimensional (3D) data acquisitions both at the patient’s head and from the patient’s side over a complete angular range of 200 degrees. Thus, launch of the new C-arms device Artis icono will help the company to gain a strong foothold in the C-arms industry.

In February 2022, Siemens AG, launched Artis icono biplane to expand its cardiology portfolio. It offers new features for diagnosing and treating cardiac arrhythmia, coronary heart disease, and structural heart disease that simplify clinical workflows and provides excellent image quality at a low radiation dose.

In January 2022, Philips announced the launch of advanced new 3D image guidance capabilities device through its image-guided therapy mobile C-arms System – Zenition. It delivers enhanced clinical accuracy, efficiency, and aims to improve the outcomes for patients undergoing endovascular treatment.

In November 2021, FUJIFILM Healthcare launched the Persona CS mobile fluoroscopy system, its new, compact mobile C-arms imaging solution designed for rapid and seamless positioning in operating room (OR) environments.

In March 2021 GE Healthcare, announced 510(k) clearance from the U.S. FDA for OEC 3D, a new surgical imaging system capable of 3D and 2D imaging. This product will set a standard for interoperative 3D imaging with precise volumetric images for spine and orthopedic procedures. This new system combines the benefits and familiarity of 2D imaging with greater efficiency to increase access and usability to 3D.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the c-arms market analysis from 2021 to 2031 to identify the prevailing c-arms market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the c-arms market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global c-arms market trends, key players, market segments, application areas, and market growth strategies.

C-Arms Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.2 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 434 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Trivitron Healthcare, Shimadzu Corporation, General Electric Company, Siemens AG, Canon Inc., Ziehm Imaging GmbH, Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Nanjing Perlove Medical Equipment Co., Ltd., Hologic, Inc. |

Analyst Review

According to the insights of CXOs, an increase in the demand for diagnostic imaging, rise in the prevalence of chronic disease, a surge in the technological advancement in the field of medical devices, and a rise in the number of geriatric populations.

The C-arms market is expected to witness steady growth in the future. The rise in the prevalence of chronic disease and increase in the number of surgical procedures increases the demand for diagnostic imaging medical devices that fuel the market growth. In addition, the growth in healthcare expenditure, increase in focus on patient safety has led to the development of advanced C-arms systems with improved safety features and the increase in adoption of minimally invasive surgical procedures, as C-arms imaging technology is used in various minimally invasive surgeries such as cardiac, orthopedic, vascular, and neurosurgery are the key factors driving the growth of the market. However, the high cost of the C-arms medical devices, and lack of skilled professionals to operate C-arms devices hampers the growth of the market up to some extent over the forecast period.

North America is expected to dominate the global C-arms market during the forecast period, followed by Europe. In addition, emerging economies such as India, China, Mexico, and Brazil are expected to offer lucrative opportunities owing to rapidly improving healthcare facilities, the rising number of geriatric population and increase in the prevalence of chronic disease are the key factors attributing to the growth of the market.

C-arms is an advanced imaging technology based on the principles of X-ray technology. It is increasingly being used in well-equipped hospitals, diagnostic centers and clinics. In addition, this technique is increasingly being used in minimally invasive surgical procedures. These are also known to intensify the image which in turn results in diagnostic and treatment purposes.

The increase in the prevalence of chronic disease, increase in the number of surgical procedures and rise in the technological advancement.

The factors that restrain the growth of the market are high cost of C-arms devices and lack of skilled professionals.

Top companies such as Canon Inc, Fujifilm Holding Corporation, General Electric Company, Hologic Inc, Kononklijke Philips N.V. Siemens AG and Shimadzu Corporation held a high market position in 2021.

The total market value of the C-Arms market is $2,003.12 million in 2021.

The forecast period for C-Arms market is 2022 to 2031.

Yes, the competitive landscape is included in the C-Arms market report

The base year is 2021 in C-Arms market.

Loading Table Of Content...

Loading Research Methodology...