Cabin Curtain Market Research, 2034

Market Introduction and Definition

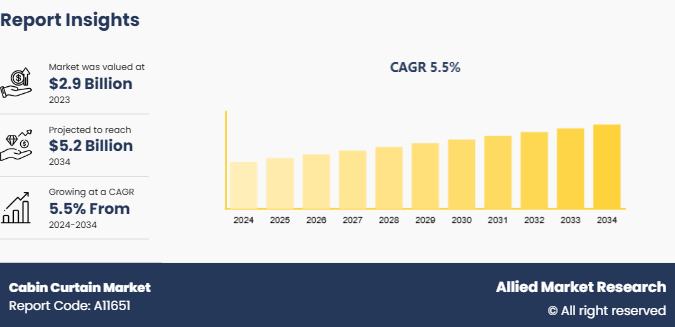

The global cabin curtain market size was valued at $2.9 billion in 2023, and is projected to reach $5.2 billion by 2034, growing at a CAGR of 5.5% from 2024 to 2034. Cabin curtains are window coverings used in enclosed spaces such as airplanes, ships, trains, and recreational vehicles (RVs) to provide privacy, control light, and add to the interior aesthetics. These curtains are made from durable, flame-retardant materials to meet strict safety and regulatory standards. In aircraft and ships, cabin curtains are used to separate sections, such as first class from economy or passenger areas from crew quarters. Designs of cabin curtains range from basic, utilitarian fabrics to luxurious materials, depending on the desired ambiance. Curtains include special hardware for easy sliding and secure attachment during movement or turbulence. Functional purposes of cabin curtains include reducing glare, blocking drafts, and giving passengers a personal space during travel. Moreover, cabin curtains help create a comfortable and private atmosphere within confined spaces.

Key Takeaways

The cabin curtains market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major cabin curtains industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The expansion of premium air travel services has significantly driven cabin curtain market demand as airlines focus on improving passenger experience through upgraded cabin interiors. Premium cabins require high-quality materials that provide superior aesthetics, increased privacy, and comfort to passengers. Cabin curtains are used to separate first-class, business-class, and private spaces from other sections, creating a luxurious and exclusive atmosphere for travelers. Design and functional features such as sound insulation and light blocking in premium cabin curtains contribute to higher passenger satisfaction, thus driving the growth of cabin curtain market. Moreover, many airlines have integrated custom branding and high-performance fabrics that align with luxury service offerings. This trend has led manufacturers to innovate with advanced materials that meet strict safety and performance standards while supporting the goal of delivering unique passenger experiences. Thus, the growth of premium and long-haul air travel routes has boosted the demand for cabin curtains as competition among airlines increases in the coming years.

However, high costs associated with specialized flame-retardant curtain materials have restrained market growth of cabin curtains. These materials must comply with strict aviation safety standards, which require advanced technology and rigorous testing processes. The use of high-quality, flame-retardant fabrics increases production expenses, which makes it challenging for airlines to balance budget constraints while maintaining compliance. Smaller or budget airlines, in particular, face difficulties with these higher costs, which can limit their investments in new or replacement cabin curtains. In addition, fluctuations in the prices of raw materials further worsen financial pressures on manufacturers and suppliers. These cost challenges lead to longer purchasing cycles and reduced market growth, as airlines seek cost-effective alternatives or delay cabin upgrades, impacting overall cabin curtain market growth on the global market.

Furthermore, the expansion of cruise ships and trains has created significant opportunities in the cabin curtain market. As the cruise industry grows with new ships offering luxurious amenities, there is an increase in demand for high-quality cabin curtains to improve passenger comfort and privacy. Similar trends are seen in the rail industry, where long-distance trains require upgraded interiors to meet the expectations of modern travelers. The need for specialized curtains that provide privacy, sound insulation, and light-blocking capabilities is rising in both sectors, thus driving global cabin curtains market expansion. Manufacturers are innovating to offer customized solutions that match the specific requirements of cruise lines and train operators, such as fabrics that resist moisture and withstand heavy use. The growth in the cruise and rail sectors broadens the cabin curtain market share, driving demand for diverse, high-performance products across these expanding transportation industries.

Value Chain of Global Cabin curtains Market

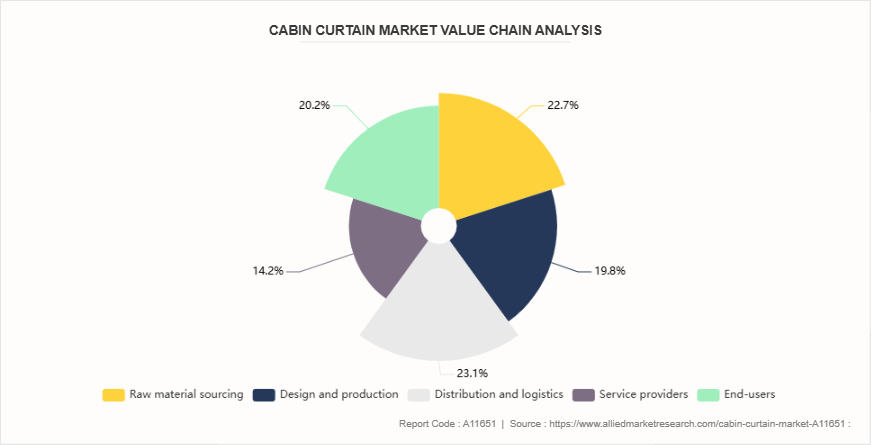

The value chain of the cabin curtain market starts with raw material suppliers, providing fabrics such as polyester, recycled textiles, and fire-resistant materials. Manufacturers design and produce cabin curtains by integrating these materials with features such as thermal insulation and antimicrobial coatings. Distributors and logistics providers handle the transportation of finished curtains to original equipment manufacturers (OEMs) or aftermarket suppliers who install them in aircraft and railway cabins. Service providers, including maintenance and repair companies, ensure that the cabin curtains meet safety and hygiene standards during use. Regulatory bodies oversee compliance with safety and environmental standards. Finally, end-users such as airplanes, ships, trains, and recreational vehicles operators install and use the curtains, improving passenger comfort and meeting sustainability goals.

Market Segmentation

The global cabin curtains market is segmented based on material type, end-user, distribution channel, and region. Based on material type, the market is classified into cotton, nylon, microfiber, PVC coated fabrics, and others. Based on end-user, the market is divided into airlines, rail operators, cruise operators, hospitality industry, public transport providers, and others. Based on distribution channel, it is categorized into B2B and B2C. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The well-established aviation and rail sectors of North America require regular updates and maintenance of cabin interiors to meet passenger expectations and ensure safety. Strict safety and hygiene regulations, particularly fire resistance and antimicrobial standards, play a crucial role in driving demand for specialized cabin curtains. Moreover, as sustainability becomes a priority for both consumers and companies, airlines and rail operators increasingly opt for eco-friendly materials in their cabin furnishings. This shift toward sustainable products boosts the demand for environmentally responsible cabin curtain solutions, driving market growth. Furthermore, high passenger expectations for comfort, aesthetics, and innovative designs in transportation contribute to the continuous need for premium cabin curtain options.

The growth in cruise industry in the Asia-Pacific region requires premium interior solutions to meet passenger comfort and safety standards, driving the need for high-quality cabin curtains. Luxury buses in urban areas require customizable and eco-friendly curtains to meet the increasing demand for comfort. In addition, the hospitality sector, including hotels and resorts, seeks to upgrade their interior designs, further boosting the market for cabin curtains. As urbanization and economic growth continue in the region, the need for cabin curtains across various modes of transport and hospitality expands, creating diverse market opportunities.

Industry Trends:

The cabin curtain market has seen a significant shift toward sustainable and eco-friendly materials. Airlines and rail companies prioritize sustainability to meet global environmental goals and growing consumer expectations. Cabin curtains made from recycled fabrics, biodegradable fibers, or textiles with a lower carbon footprint have become a major objective for transportation companies. Eco-friendly cabin curtains help reduce waste and contribute to energy efficiency within cabin environments through improved thermal insulation properties. Manufacturers have developed innovative coatings for cabin curtains that improve fire resistance and antimicrobial properties without relying on harsh chemicals. Sustainable practices along with advanced functionality in cabin curtains highlight the commitment of cabin curtain industry to environmentally conscious, high-performance products that attract eco-aware passengers and comply with regulatory standards for safer, greener transportation solutions. Thus, such innovations and eco-friendly steps by manufacturers are anticipated to boost market growth during the cabin curtain market forecast period.

Competitive Landscape

The major players operating in the cabin curtains market include Collinson, Safran Cabin, Aircraft Cabin Modification Inc., FACC AG, Zodiac Aerospace, Tapis Corporation, K&S Aircraft Interiors, AIM Altitude, JAMCO Corporation, and Diehl Aerospace.

Recent Key Strategies and Developments

In July 2022, ABC International expanded its aircraft interior solutions by introducing a movable class divider, a type of cabin curtain, for Airbus A320 aircraft and plans for Boeing 737 and ATR turboprops.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cabin curtain market analysis from 2024 to 2034 to identify the prevailing cabin curtain market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cabin curtain market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cabin curtain market trends, key players, market segments, application areas, and market growth strategies.

Cabin Curtain Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 5.2 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 381 |

| By Material Type |

|

| By End-User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Zodiac Aerospace, Collinson, K&S Aircraft Interiors, Tapis Corporation, Inc., FACC AG, Aircraft Cabin Modification Inc., Diehl Aerospace, Safran Cabin, Jamco Corporation, AIM Altitude |

The global cabin curtains market was valued at $2.9 billion in 2023.

The PVC coated fabric segment has the leading application of Cabin Curtain Market.

Upcoming trends in the cabin curtain market include demand for sustainable materials, improved functionality, and integration with smart technologies for comfort.

Based on region, North America held the highest market share in terms of revenue in 2023.

The major players operating in the cabin curtains market include Collinson, Safran Cabin, Aircraft Cabin Modification Inc., FACC AG, Zodiac Aerospace, Tapis Corporation, K&S Aircraft Interiors, AIM Altitude, JAMCO Corporation, and Diehl Aerospace.

Loading Table Of Content...