Cable Tray Market Research, 2032

The global cable tray market was valued at $5.0 billion in 2022, and is projected to reach $9.2 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

Key Report Highlighters:

- The report outlines the current cable tray market trends and future scenario of the market from 2023 to 2032 to understand the prevailing opportunities and potential investment pockets.

- The global cable tray market value ($ billion) has been analyzed in the report and is provided for 4 major regions and more than 15 countries.

- The cable tray market is fragmented in nature with a few players such as ABB Ltd., Atkore Inc. Basor Electric S.A, Chatsworth Products, Inc. Eaton, Hubbell Inc. Legrand, which hold a significant share of the market.

- The report provides strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the cable tray market.

A cable tray is a structural system designed to support and manage cables used for power distribution, communication, and control in buildings or industrial facilities. It is a component used in electrical wiring, usually made of metal or other materials such as aluminum, steel, or even fiberglass. These trays provide a safe and organized way to route and protect cables while allowing for easy installation, maintenance, and expansion of the electrical system. Cable trays are commonly installed in commercial buildings, data centers, manufacturing plants, and other industrial settings where multiple cables need to be managed efficiently and securely. The choice of a specific type of cable tray depends on factors such as the environment, the type of cables being used, load capacity requirements, and installation preferences.

As construction projects expand globally, there is a higher demand for effective cable management solutions such as cable trays. Urbanization and infrastructure development contribute significantly to this growth. In addition, compliance with safety standards and regulations drives the innovation and development of cable trays. There is a constant push for safer and more reliable cable management systems in buildings and industrial settings. All these factors are expected to drive the cable tray market growth during the forecast period.

However, the upfront cost of installing cable trays is higher compared to conventional wiring systems. This discourages their adoption, especially in budget-constrained projects. In addition, the complexity of the installation and the specific environment, laying out cable trays is more labor-intensive and requires specialized expertise, potentially increasing installation time and costs. All these factors hamper the cable tray market growth.

The demand for data centers continues to rise due to the exponential growth of digital data. Cable trays offer efficient cable management solutions within these centers, enabling organized layouts for networking cables, power distribution, and fiber optics. In addition, the rollout of 5G technology demands upgraded infrastructure and efficient cable management systems. Cable trays play a crucial role in managing the increased number of cables and ensuring proper organization and maintenance in telecom networks. All these factors are anticipated to offer cable tray market opportunities during the forecast period.

Market Dynamics

Growth In Construction Industry And Emphasis On Safety In Organizations

The construction industry has rapidly expanded lately, especially in emerging countries such as China, Brazil, India, and others. The rise in population growth, urbanization, and disposable income has fueled construction activities. These constitute the development of infrastructure such as roads, construction of new buildings, and bridges. With the growth of construction activities, there is a rise in electrical and communication wiring systems demand.

These trays are fundamental parts to support these wiring systems, making them a significant component of any construction project. Therefore, the cable tray market growth is due to the rising demand for trays in the construction industry. According to the International Trade Administration and the U.S. Department of Commerce, China’s 14th Five-Year Plan focused on new infrastructure developments in urbanization, energy, transportation, and water systems. China is expected to invest $1.49 trillion in new infrastructure during the 14th Five-Year Plan period (2021-2025). In contrast to traditional infrastructure such as water protection, roads & railways, the new infrastructure implies critical facilities based on information technologies such as industrial internet, the Internet of Things, AI, and 5G.

Rising Renewable Energy Demand To Drive The Market Growth

The growing demand for renewable energy sources, such as hydroelectric power, wind, and solar, has been one of the major demand drivers. Renewable energy sources need compound wiring systems to supply electricity from the source to the power grid. Cable trays offer a well-managed way of backing these wiring systems, ensuring efficient power transmission.

In recent years, there has been a noteworthy shift toward renewable energy sources as the world deals with the effects of climate change. Countries around the globe are adopting policies and rules that encourage using sustainable energy sources to diminish their carbon emission. Furthermore, renewable energy sources are often accommodated in remote and challenging terrain such as desert solar plants, offshore wind farms, and others. Utilizing these trays in such terrains guards the wiring systems against potential damage, decreasing the system shutdown and risks of power outages.

High Installation Costs

Cable tray systems need fitting tools, skilled labor, accurate measurement, specialized installation techniques, and others. The installation of such systems needs additional materials, such as elbow fittings, brackets, wall mounts, fasteners, and supports, which add to the system's total cost. In addition, nuclear plants, construction sites, and huge projects that need specific time, tools, and labor to install slow down the construction schedule and lead to supplementary system costs. Furthermore, the replacement and maintenance of such systems are cost-effective, as worn-out components or damage must be changed, and the entire system is tested frequently.

It becomes very problematic to inspect and detect the damaged cables, where cable trays are also involved and amplify the time needed for the installation again, thereby hampering the market growth. The imperative considerations for trays are their confrontation with fire, the possibility of ignition, and the spread of cable fire between adjacent trays. This is also associated with the cable materials, extra equipment, layout of the trays, area ventilation system, and fire protection system. The initial installation cost associated with cable trays is a significant restraint for some customers. This is especially true for large scale projects that require extensive cable tray networks. However, the long-term benefits and cost savings in terms of reduced maintenance and enhanced system reliability often outweigh the initial investments.

Integration Of Advanced Technologies

The incorporation of advanced technologies, such as smart monitoring system and IOT enabled devices present significant opportunities in the cable tray market. These technologies provide real time data on cable health, temperature, and performance, enabling proactive maintenance and minimizing downtime. Integration with smart systems enables remote monitoring and control of cable tray conditions. This feature is particularly valuable in large-scale installations or challenging environments, allowing quick responses to issues, and minimized troubleshooting. Implementing automation and robotics in cable tray installation and maintenance processes streamline operations and improve precision. Autonomous robots navigate complex environments to inspect, clean, or repair cable trays efficiently, reducing human intervention and enhancing safety.

The cable tray market size is analyzed on the basis of type, material, finishing, application, and region.

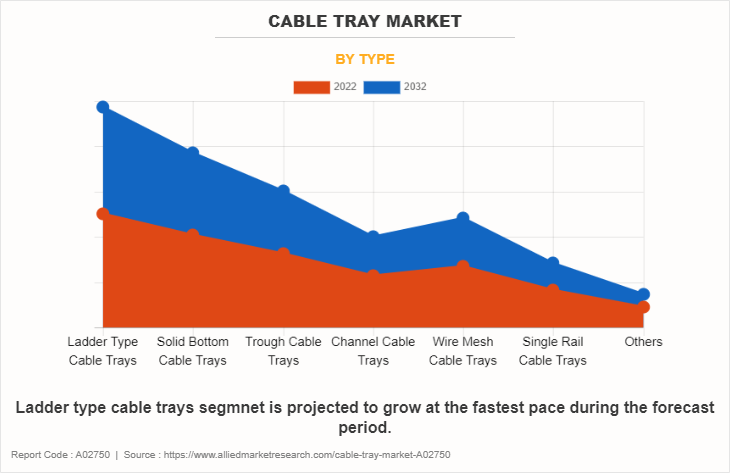

By type, the market is segmented into ladder type cable trays, solid bottom cable trays, trough cable trays, channel cable trays, wire mesh cable trays, single rail cable trays, and others. The ladder type cable trays segment accounted for one-fourth of the cable tray market share in 2022. The same is expected to maintain its dominance during the cable tray market forecast period. A growing trend has been witnessed in the market for cable tray systems that are recycled and originate from sustainable materials.

The increasing focus on safety standards has boosted the demand for cable trays that offer superior support and protection for cables, and ladder-type trays fit the bill perfectly with their open design allowing for easy inspection and maintenance. The cable tray market is experiencing a surge in demand due to the expanding infrastructure development globally. With rapid urbanization and the construction of commercial complexes, industrial facilities, & residential buildings, the need for efficient cable management systems such as ladder-type cable trays have escalated.

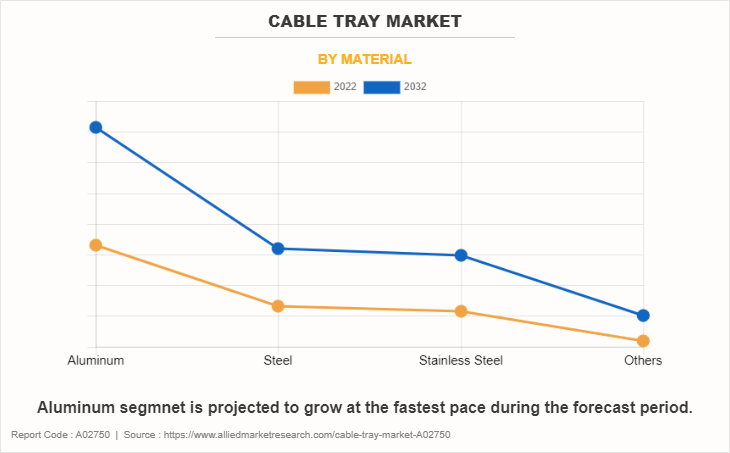

By material, the market is classified into aluminum, steel, stainless steel, and others. The aluminum segment accounted for more than 40% of the cable tray market share in 2022 and is expected to maintain its dominance during the forecast period. Aluminum’s corrosion resistance and malleability make it valuable in construction. Demand for aluminum in infrastructure projects, particularly in developing countries, is growing. Because it has so many positive qualities, aluminum is a lightweight, strong metal that is commonly used to make cable trays. Aluminum is utilized to build cable management systems in the context of cable trays.

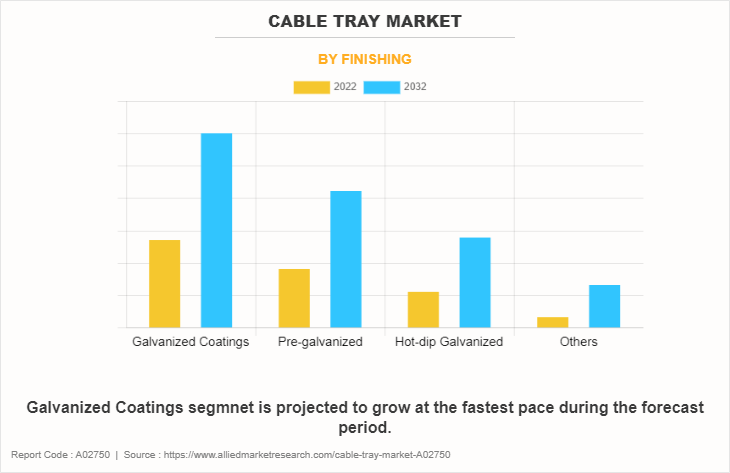

By finishing, the market is segmented into galvanized coatings, pre-galvanized, hot-dip galvanized, and others. The galvanized coatings segment accounted for highest cable tray market share in 2022 and is expected to maintain its dominance during the forecast period. Advancements in galvanization techniques and technologies enhance the performance and durability of the coatings. Innovations focus on achieving better adhesion, uniformity, and thickness of the zinc layer to improve corrosion resistance and extend product lifespan.

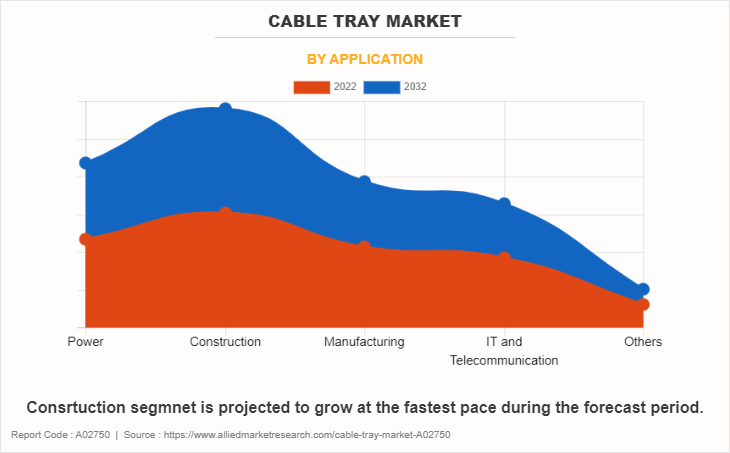

By application, the market is divided into power, construction, manufacturing, IT & telecommunication, and others. The construction segment accounted for around one-third of the cable tray market share in 2022 and is expected to maintain its dominance during the forecast period. Integration of IOT devices and smart building technologies for improved energy management, security, maintenance, and occupant comfort is on the rise, driven by the demand for connected and sustainable spaces.

Focus on sustainable construction practices, including the use of eco-friendly materials, energy efficient designs, renewable energy integration, and green certifications such as Leadership in Energy and Environmental Design and Building Research Establishment Environmental Assessment Method. The adoption of advanced construction technologies, such as building information modeling, drones, robotics, 3D printing, and internet of things, enhances productivity, efficiency, and safety in construction processes.

As per region, the cable tray market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, Asia-Pacific accounted for 44.0% waste to energy market share in 2022 and is expected to maintain its dominance during the forecast period. The adoption of advanced technologies in cable tray manufacturing and installation processes is a notable trend. Manufacturers in the Asia-Pacific region have integrated technological innovations to enhance the quality, durability, and efficiency of cable trays. This includes the use of cutting-edge materials, automated manufacturing processes, and improved design techniques to meet the evolving demands of infrastructure projects in the region. This trend has led to a growing preference for cable tray systems made from recyclable materials, such as steel or aluminum, and manufacturing processes that minimize environmental impact.

Key players operating in the cable tray industry include ABB Ltd., Atkore Inc. Basor Electric S.A, Chatsworth Products, Inc. Eaton, Hubbell Inc. Legrand, Niedax Group, OBO Bettermann Holding GmbH & Co. KG, and Superfab Inc. The drivers, restraints, and opportunities are explained in the report to better understand the market dynamics. This report further highlights the key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and the role of each stakeholder. The report features strategies adopted by key market players to maintain their foothold in the market. Furthermore, it highlights the competitive landscape of key players to increase their market share and sustain the intense competition in the industry.

Policies Across Globe

Safety Standards

Regulations emphasize safety measures for cable tray installations to prevent hazards such as electrical shock, fire risks, and cable damage. Standards specify proper spacing, load-bearing capacities, and materials to mitigate potential risks.

Quality Assurance And Certification

Manufacturers often need to obtain certifications or adhere to quality assurance programs to demonstrate compliance with regulations. Complying with these regulation factors is vital for manufacturers, installers, and users of cable tray systems to ensure safety, reliability, and legal compliance. Adherence to standards helps in preventing accidents, ensuring proper functionality of electrical systems, and maintaining uniformity in installations across various industries and regions.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cable tray market analysis from 2022 to 2032 to identify the prevailing cable tray market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cable tray market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cable tray market trends, key players, market segments, application areas, and market growth strategies.

Cable Tray Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.2 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Material |

|

| By Finishing |

|

| By Application |

|

| By Region |

|

| Key Market Players | Legrand, Hubbell Inc., ABB Ltd., Niedax Group, Superfab Inc., Chatsworth Products, Inc., Eaton, Atkore Inc., OBO Bettermann Holding GmbH & Co. KG, Basor Electric S.A |

| Other Key Market Players | Hoffman, RS Pro, CE, igus, EDP, Vantrunk, Marco Cable Management, Metsec (part of Voestalpine), Unitrunk, Ellis, Niedax, Chatsworth Products, Panduit, Enduro Composites |

Analyst Review

According to the opinions of various CXOs of leading companies, the cable tray market is expected to witness significant traction during the forecast period. Surge in the construction industry emphasis on safety in organizations and rising renewable energy demand are projected to propel the cable tray market during the forecast period.

Cable trays, essential for organizing and protecting electrical cables and wires, are witnessing heightened demand due to the expanding construction industry worldwide. The surge in urbanization, infrastructure development, and the need for reliable cable management solutions in both commercial and industrial settings drive this growth trajectory.

Moreover, the evolution of technology demands adaptable and versatile cable management systems. Cable trays, available in various types and materials, offer the flexibility required to accommodate different wiring systems used in telecommunications, data centers, renewable energy projects, and various emerging sectors.

Growth in construction industry and emphasis on safety in organizations and rising renewable energy demand are the upcoming trends of Cable Tray Market in the world.

Construction is the leading application of Cable Tray Market.

ABB Ltd. Atkore Inc. Basor Electric S.A, Chatsworth Products, Inc. Eaton, Hubbell Inc. Legrand are the top companies to hold the market share in Cable Tray.

Asia-Pacific is the largest regional market for Cable Tray.

$9.2 billion is the estimated industry size of Cable Tray.

Loading Table Of Content...

Loading Research Methodology...