Calcium Aluminate Cement Market Research, 2032

The global calcium aluminate cement market was valued at $1.4 billion in 2022, and is projected to reach $2.2 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Report Key Highlighters:

- Quantitative information mentioned in the global calcium aluminate cement market includes the market numbers in terms of value ($Million) and volume (Kilotons) concerning different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on product type, end-use industry, and region. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Calucem, ALMATIS, CUMI, RWC, Zhengzhou Dengfeng Smelting Materials Co., Ltd, Cementos Molins, S.A., Denka Company Limited, hold a large proportion of the calcium aluminate cement market.

- This report makes it easier for existing market players and new entrants to the calcium aluminate cement industry to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Calcium aluminate cement (CAC) is a special type of cement consisting of hydraulic calcium aluminates. It is also known as aluminous cement or high-alumina cement. Unlike Portland cement, CAC does not release calcium hydroxide during hydration. The primary raw material for CAC is bauxite, which is a source of alumina, and its primary oxide is Al2O3.

CAC is primarily used for high heat refractory applications, moderate acid-resistant applications, high-early-strength, and quick-setting mixtures, and as part of the expansive component in some shrinkage-compensating cement. It is known for its high performance and heat-resistant properties, making it suitable for applications requiring early strength development and resistance to extreme temperatures, mild acids, and alkalis. CAC gains strength much faster than ordinary Portland cement, with strength developing in 24 hours compared to the 28 days required for Portland cement.

The escalating demand for calcium aluminate cement is intricately tied to the surge in construction and infrastructure development projects globally.

As nations strive for economic growth, urbanization, and enhanced living standards, the construction sector plays a pivotal role, necessitating advanced building materials with specific attributes. Calcium aluminate cement, distinguished by its rapid setting time, high early strength, and resistance to chemical corrosion, emerges as a favored choice in various construction applications. Its unique properties make it particularly suitable for projects requiring quick turnaround times and durability in aggressive environments.

Infrastructure development, ranging from highways and bridges to wastewater treatment plants and industrial facilities, relies on specialized materials to meet the stringent requirements of modern construction. Calcium aluminate cement finds applications in critical areas such as refractory linings in furnaces and kilns, water treatment infrastructure, and structural repairs. The versatile nature of this cement positions it as a valuable component in the construction industry's toolkit, catering to diverse needs across different project types.

Moreover, as sustainability becomes a key focus in the construction sector, calcium aluminate cement's potential role in environmentally friendly practices further accentuates its demand. With governments globally prioritizing infrastructure investment and urban development, the calcium aluminate cement market is to grow in tandem with the burgeoning construction and infrastructure landscape, meeting the evolving needs of a rapidly advancing global economy. According to the India Brand Equity Foundation, the Indian infrastructure sector is expected to grow at a CAGR of 8.5% between 2021-25.

The expanding water treatment sector stands as a pivotal driver propelling the demand for calcium aluminate cement market growth.

Renowned for its exceptional resistance to corrosion and high-temperature stability, calcium aluminate cement finds extensive application in the construction of water treatment infrastructure. Specifically, it is utilized in the development of sewage systems and wastewater treatment plants, where its unique properties contribute to the durability and longevity of critical structures. Cement’s ability to withstand harsh chemical environments and provide rapid settings further positions it as a preferred choice for projects necessitating robust and efficient water management solutions.

As concerns about water quality and environmental sustainability continue to escalate, investments in water treatment facilities are on the rise globally. Calcium aluminate cement, with its superior performance in corrosive conditions, aligns with the stringent requirements of the water treatment industry. Its use in constructing linings and structures within these facilities enhances resistance against corrosive agents present in wastewater and contributes to the longevity of infrastructure, thereby reducing the need for frequent repairs or replacements.

The calcium aluminate cement market size faces a significant challenge due to its comparatively higher cost in comparison to traditional Portland cement. This cost disparity poses a potential impediment to the widespread adoption of calcium aluminate cement in the construction industry. While calcium aluminate cement offers distinct advantages such as rapid setting, high-temperature resistance, and durability, its economic feasibility becomes a crucial factor influencing purchasing decisions.

Construction projects often operate within stringent budget constraints, and the higher cost of calcium aluminate cement may deter builders and contractors from choosing it over the more economically viable Portland cement. Affordability is a paramount consideration in the construction sector, where profit margins are often tight. As a result, the market for calcium aluminate cement may be limited, particularly in regions or projects where cost considerations heavily influence material choices.

The cost factor also plays a role in influencing consumer behavior and the willingness of construction professionals to explore alternatives. Traditional cement, such as Portland cement, has dominated the market for decades due to its cost-effectiveness. The resistance to adopting a higher-priced alternative such as calcium aluminate cement is further exacerbated by the lack of widespread awareness about its benefits and applications.

Emerging economies offer a lucrative frontier for the calcium aluminate cement market share, driven by their rapid urbanization and industrialization. As these countries undergo robust economic development, there is a surging demand for advanced construction materials to support infrastructure projects. Calcium aluminate cement, known for its rapid setting and strength development, is well-suited for these applications. In emerging economies such as India, China, Brazil, and Southeast Asian countries, increased investments in residential, commercial, and industrial construction projects are creating a substantial market for calcium aluminate cement. The material's versatility in specialty concretes and refractory applications aligns with the evolving needs of these economies, where high-performance materials are essential for durable and resilient structures.

Moreover, the growing awareness of environmental sustainability in construction practices positions calcium aluminate cement favorably, offering a lower carbon footprint compared to conventional alternatives. As emerging economies prioritize sustainable development, this aspect can further drive the adoption of calcium aluminate cement in construction projects.

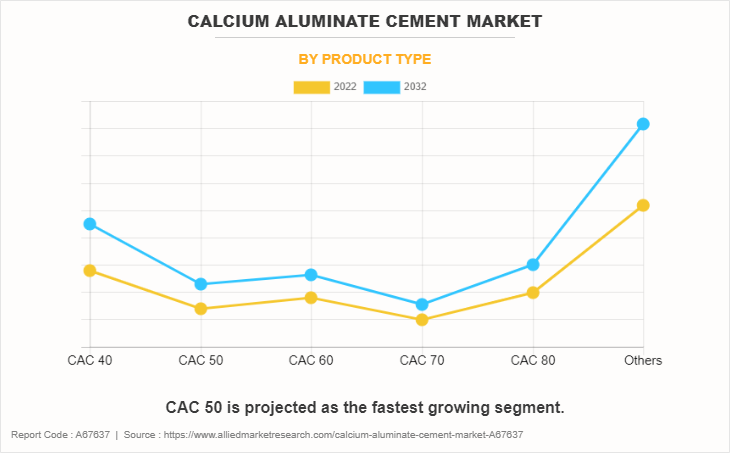

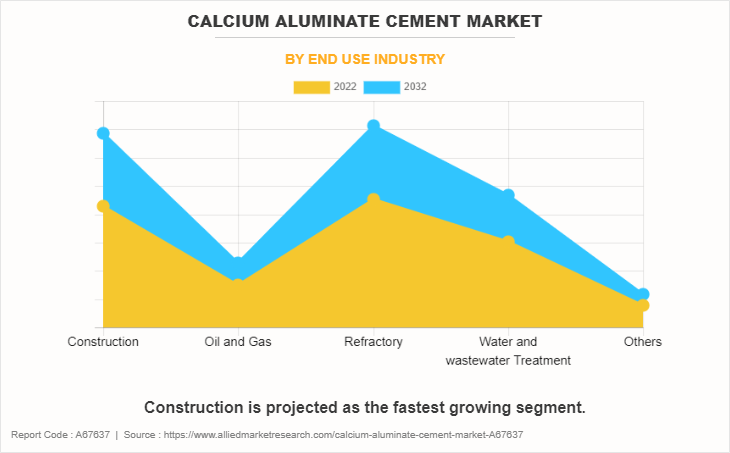

The calcium aluminate cement market is segmented based on product type, end-use industry, and region. By product type, the market is divided into CAC 40, CAC 50, CAC 60, CAC 70, CAC 80, and others. By end-use industry, it is categorized into construction, oil and gas, refractory, water and wastewater treatment and others. region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The others segment which include CAC 90, Low-Cement CAC, Insulating CAC accounted for the largest share in 2022. The growing demand for CAC 90 in the calcium aluminate cement market is propelled by its superior performance in refractory applications, increased infrastructure development, and rising demand for high-temperature resistant materials in industries such as construction, steel, and petrochemical.

CAC 50 is expected to register the highest CAGR of 5.2%. The demand for CAC 50 in the calcium aluminate cement market is increasing due to its high early strength, rapid setting properties, and resistance to harsh environmental conditions. Its versatility and suitability for various applications contribute to its growing popularity among construction professionals.

The refractory segment accounted for the largest share in 2022. The growing demand for calcium aluminate cement in the refractory industry is propelled by its high-temperature resistance, rapid setting, and improved strength. Industries such as steel, cement, and petrochemicals increasingly rely on these qualities for efficient and durable refractory applications.

Construction is expected to register the highest CAGR of 4.9%. The growing demand for calcium aluminate cement in the construction industry can be attributed to its rapid strength development, resistance to harsh environments, and suitability for specialized applications such as refractory construction, thereby enhancing overall construction efficiency and durability.

Asia-Pacific garnered the largest share in 2022. The increase in demand for calcium aluminate cement in Asia-Pacific can be attributed to a surge in construction activities, particularly in infrastructure and industrial projects. The cement's rapid setting, high-temperature resistance, and durability make it a preferred choice for various applications, fostering its growing popularity in the region.

Competitive landscape

The players operating in the global calcium aluminate cement market are Calucem, ALMATIS, CUMI, RWC, Zhengzhou Dengfeng Smelting Materials Co., Ltd, Cementos Molins, S.A., Denka Company Limited, Henan Suntek International Co., Ltd., ABC Supply Co., Inc., Union Cement Company. The unique technologies and innovative approaches of the abovementioned companies contribute to the advancement of the calcium aluminate cement market.

Calucem: A global leader in specialty cements, Calucem specializes in calcium aluminate cements. Known for high-performance products, they cater to diverse industries, ensuring durability and strength in applications such as refractories and construction.

ALMATIS: ALMATIS is a leading alumina and specialty materials provider. With a focus on high-quality alumina products, they contribute to the calcium aluminate cement market by supplying key raw materials for various applications, including refractories.

CUMI (Carborundum Universal Limited): CUMI is a renowned manufacturer of industrial ceramics, refractories, and abrasives. In the calcium aluminate cement sector, they offer innovative solutions, ensuring superior performance and reliability in diverse industrial settings.

RWC: RWC is a significant player in the calcium aluminate cement market. They specialize in sourcing and supplying raw materials for refractories and offer comprehensive solutions for various industries, emphasizing quality and consistency.

Zhengzhou Dengfeng Smelting Materials Co., Ltd: As a key producer of smelting materials, Zhengzhou Dengfeng is actively involved in the calcium aluminate cement market. Their focus on quality and technological advancements positions them as a reliable supplier for refractories and construction applications.

Cementos Molins, S.A.: Cementos Molins is a global cement and building materials company. In the calcium aluminate cement sector, they contribute by manufacturing high-quality products suitable for specialized applications, ensuring durability and performance in construction projects.

Denka Company Limited: Denka is a diversified chemical company with a presence in the calcium aluminate cement market. Their innovative products cater to a range of industries, providing solutions that enhance performance, durability, and sustainability.

Henan Suntek International Co., Ltd.: Henan Suntek is a prominent supplier in the calcium aluminate cement market, offering a wide range of products for applications in refractories and construction. Their commitment to quality and customer satisfaction strengthens their position in the industry.

ABC Supply Co., Inc.: ABC Supply is a leading distributor of construction materials. While not a manufacturer, they play a crucial role in the calcium aluminate cement market by supplying a variety of construction products, including those utilizing calcium aluminate technology.

Union Cement Company: Union Cement Company is a major player in the cement industry. In the calcium aluminate cement market, they contribute by manufacturing and supplying high-quality products that meet the stringent requirements of various applications, ensuring reliability and durability.

Other players include Taiheiyo Cement Corporation, Eagle Materials, Vicat Group, Siam Cement Group, Titan Cement, JK Cement, Ambuja Cements, Shree Cement, Votorantim Cimentos, Taiwan Cement Corporation.

Strategic Developments By Key Players:

- In April 2022, Calucem, a subsidiary of Cementos Molins, had planned to increase its position in the U.S. market by investing $35 million in a manufacturing site in New Orleans.

- In October 2022, Imerys facilitated a calcium aluminate binder factory with a capacity of 30,000 tons per year at Atchatapuram, Andhra Pradesh. According to the Hindu newspaper, the plant will offer refractory materials for use in buildings. Imerys intends to increase the plant's capacity to 50,000 tons per year by 2030, to meet rising demand from India's expanding cement sector. It will be Imery's largest facility in the country.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the calcium aluminate cement market analysis from 2022 to 2032 to identify the prevailing calcium aluminate cement market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the calcium aluminate cement market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global calcium aluminate cement market trends, key players, market segments, application areas, and market growth strategies.

Calcium Aluminate Cement Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.2 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Product Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | CUMI Inc., Union Cement Company, Cementos Molins, S.A., ABC Supply Co., Inc, Henan Suntek International Co, Ltd, RWC, Almatis GmbH, Zhengzhou Dengfeng Smelting Materials Co., Ltd, Denka Company Limited., Calucem GmbH |

Analyst Review

According to the insights of the CXOs of leading companies, the increasing demand from the construction industry is driving the demand for the market. Calcium aluminate cement is renowned for its high-performance characteristics, including rapid hardening and setting times, making it a preferred choice in applications where quick construction is essential. The burgeoning construction activities, particularly in emerging economies, contribute significantly to the market's expansion.

However, the Calcium Aluminate Cement market is not without its restraints. One notable constraint is the higher cost associated with this specialty cement compared to traditional Portland cement. This cost factor can act as a deterrent, especially in price-sensitive markets, impacting the widespread adoption of calcium aluminate cement. In addition, limited awareness among end-users about the benefits and applications of Calcium Aluminate Cement poses a challenge to market growth. Overcoming these cost-related concerns and enhancing awareness through effective marketing strategies will be crucial to mitigating these restraints.

The CXOs further added that the growing focus on sustainable and durable construction materials is opening avenues for Calcium Aluminate Cement, given its eco-friendly properties and resistance to harsh environmental conditions. Moreover, ongoing research and development efforts to improve the formulation and cost-effectiveness of calcium aluminate cement offer promising opportunities for market players to stay competitive and broaden their market reach.

The global calcium aluminate cement market was valued at $1.4 billion in 2022, and is projected to reach $2.2 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

North America, Europe, Asia-Pacific and LAMEA are covered in Calcium Aluminate Cement Market.

Asia-Pacific is the largest regional market for Calcium Aluminate Cement.

Emerging economies is the upcoming trend of Calcium Aluminate Cement Market in the world.

The escalating demand for calcium aluminate cement is intricately tied to the surge in construction and infrastructure development projects globally is the driver of the of Calcium Aluminate Cement Market.

Refractory is the leading end-use industry of Calcium Aluminate Cement Market.

Calucem, ALMATIS, CUMI, RWC, Zhengzhou Dengfeng Smelting Materials Co., Ltd, Cementos Molins, S.A., Denka Company Limited, Henan Suntek International Co., Ltd., ABC Supply Co., Inc., Union Cement Company are the top companies to hold the market share in Calcium Aluminate Cement.

Loading Table Of Content...

Loading Research Methodology...