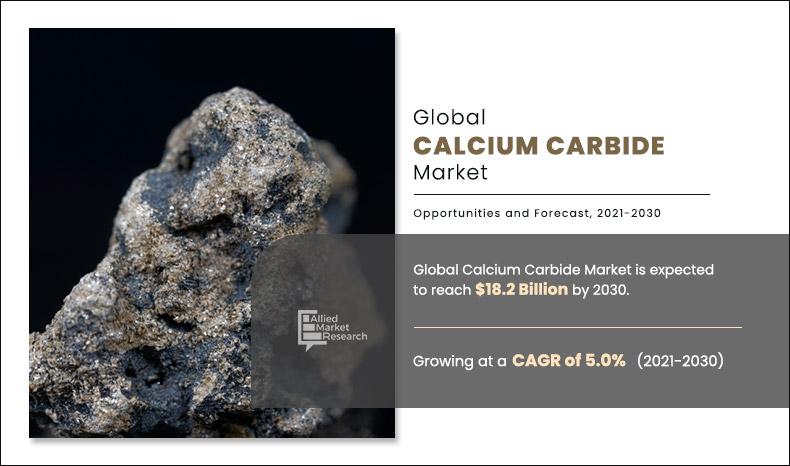

The global calcium carbide market was valued at $11.3 billion in 2020, and is projected to reach $18.2 billion by 2030, growing at a CAGR of 5.0% from 2021 to 2030.

Calcium Carbide Market Overview

Calcium carbide is a grayish-black lump or crystalline (sandlike) powder with a garlic-like odor. The other name of calcium carbide is calcium acetylide. Furthermore, its chemical formula is CaC2. It is a compound used in industries for production. It is used to produce acetylene gas, as a reducing agent, and in steel manufacturing and metal cutting. It is harmful for human consumption.

Calcium carbide is produced industrially by using calcium oxide and coke. It is used in the chemical industry for a variety of applications that include acetylene gas manufacturing and for the generation of acetylene in carbide lamps; chemicals manufacturing for fertilizer; and also in steelmaking. Steel is used in the construction industry because of its exceptional qualities like ductility and durability. It aids in the construction of earthquake-resistant structures. The increased use of high-speed trains in nations like China, Japan, and India has resulted in the development of special rails, which has increased carbon steel usage. As a result, demand for crude steel is predicted to boost the calcium carbide market growth during the forecast period.

The calcium carbide market size is segmented on the basis of application, end-use industry, and region. On the basis of application, the market is divided into acetylene gas, calcium cyanamide, reducing & dehydrating agent, desulfurizing & deoxidizing agent, and others. By end-use industry the market is classified into chemicals, metallurgy, pharmaceutical, food, and others. On the basis of region, the calcium carbide Industry is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest share of the calcium carbide market, followed by LAMEA and Europe.

Major players operating in the global calcium carbide industry include Denka Company Limited, AlzChem, American Elements, Thermo Fisher Scientific, Carbide Industries LLC, KC Group, Merck KGaA, MCB Industries Sdn. Bhd., Mil-Spec Industries Corporation, and Santa Cruz Biotechnology, Inc.

Calcium Carbide Market, By Application

The acetylene gas segment accounted for the largest calcium carbide market share in 2020, while the desulfurizing and deoxidizing agent segment is projected to grow at the highest CAGR of 7.5%. Acetylene is produced in acetylene production plants for a variety of industrial and commercial applications.

By Type

Acetylene Gas is projected as the most lucrative segment.

Calcium Carbide Market, By End-use Industry

The chemicals segment accounted for the largest share of the calcium carbide market in 2020 while the metallurgy segment is projected to grow at the highest CAGR of 5.7%. The bio-polishing segment is projected to hold the dominant share of the global market during the forecast period due to increase in demand for acetylene gas as acetylene can also be used as a raw material in the production of acetaldehyde, acetic anhydrite, and acetic acid.

By End-use Industr

Chemicals is projected as the most lucrative segment.

Calcium Carbide Market, By Region

The Asia-Pacific region accounted for the largest share of the calcium carbide market in 2020. China is the world's leading producer and consumer of calcium carbide.

By Region

Asia-Pacific is projected as the most lucrative market.

Key benefits for stakeholders

- The global calcium carbide market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis help analyze potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides in-depth analysis of the global calcium carbide market forecast for the period 2021–2030.

- The report outlines the current global calcium carbide market trends and future scenario of the global market from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- Key drivers, restraints, & opportunities and their detailed impact analysis are explained in the global calcium carbide market study.

Impact Of Covid-19 On The Global Calcium Carbide Market

- COVID-19 has spread to almost 213 countries around the globe with the World Health Organization declaring it a public health emergency on March 11, 2020.

- Some of the major economies suffering from the COVID-19 crises include Germany, France, Italy, Spain, the UK, and Norway.

- Calcium carbide is primarily used in chemicals, industrial, and food. Online grocery sales are expected to account for 12.4% of all e-commerce sales in the U.S. by 2021.

- Calcium carbide is primarily utilized in the production of acetylene and other chemical compounds in industry. Calcium carbide is primarily used in the chemical and metallurgical industries. The outbreak of COVID-19 has affected many manufacturing industries and general economic activities.

- The chemical industry has been impacted by the adoption of lockdowns in many nations and supply shortages. At the same time, the decline in economic activity has hampered infrastructure development, the introduction of new industries, and expansions, all of which have a negative influence on metal product demand, impacting the metallurgical industry.

- In many countries, the economy has dropped due to the halt of several industries, especially transport and supply chain. Demand for the product has been hindered as there is no development due to the lockdown.

- The COVID-19 epidemic has impacted negatively on the manufacturing and industrial industries due to a scarcity of resources in various parts of the world. The industry's top players are concerned about the market's prospects and are rethinking their strategies to meet the challenge.

Calcium Carbide Market Report Highlights

| Aspects | Details |

| By APPLICATION |

|

| By END-USE INDUSTRY |

|

| By Region |

|

| Key Market Players | Praxair S.T. Technology, Inc., MIL-SPEC INDUSTRIES CORPORATION, DENKA COMPANY LIMITED, Merck KGaA, MCB INDUSTRIES SDN. BHD., Santa Cruz Biotechnology, Inc., ALZCHEM, AMERICAN ELEMENTS, KC GROUP, CARBIDE INDUSTRIES, Thermo Fisher Scientific Inc. |

Analyst Review

According to the analyst, the calcium carbide market is driven by an increase in usage of fabric desizing and bio-polishing due to the changing lifestyles. Moreover, the calcium carbide market may benefit from an increase in global textile manufacturing. The denim clothing sector's significant potential, as well as innovations in textile production, gives new growth prospects for participants in the calcium carbides market. However, due to regulations on the production process of enzymes may hamper the calcium carbide market.

The growth drivers, restraints, and opportunities are explained in the report to better understand the market dynamics. This report further highlights the key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and role of each stakeholder. The report features the strategies adopted by key market players to maintain their foothold in the market. Furthermore, it highlights the competitive landscape of the key players to increase their market share and sustain intense competition in the industry.

Increasing production of steel and growing demand for acetylene in various applications are the key factors driving the global calcium carbide market

The market value of global calcium carbide market in 2021 is expected to be $11.3 billion and projected to rise to $18.2 billion in 2030.

The leading players in the market Denka Company Limited, AlzChem, American Elements, Thermo Fisher Scientific, Carbide Industries LLC, KC Group, Merck KGaA, MCB Industries Sdn. Bhd., Mil-Spec Industries Corporation, and Santa Cruz Biotechnology, Inc.

The chemical industry is projected to increase the demand for calcium carbide market

The global calcium carbide market is segmented on the basis of application, end-use industry and region.

Increase in in demand of acetylene gas is some of the driver of calcium carbide market.

The acetylene gas application in the global calcium carbide market is projected to increase the demand of calcium carbide during the forecast period.

Due to COVID-19 pandemic, transport limitations were implemented, resulting in reduced industrial production and disrupted supply chains, which affected global economic growth by a substantial proportion, severely impacting market growth.

Loading Table Of Content...