Insurance Business Process Outsourcing (BPO) entails delegating functions such as policy administration, claims management, underwriting, customer support, and finance and accounting to external parties which are experts in these fields. The essential objective of Protection BPO is to upgrade activities, improve effectiveness, and drive cost investment funds for insurance agencies. In addition, insurance BPO allows companies to streamline their operations and focus on core competencies by outsourcing non-core functions to specialized service providers. By doing so, Canadian insurance companies can reduce costs, increase efficiency, and enhance their overall competitiveness in the market.

Business process outsourcing companies help insurance companies to take benefits by reducing costs, accurate data, and enhancing operational efficiency. Thus, insurance companies have been outsourcing various activities in order to stay abreast with the latest trends. Additionally, insurance BPO enables Canadian customers to tap into a global talent pool and access specialized expertise that may not be available in-house. Outsourcing tasks such as claims processing, policy administration, underwriting, and customer support to experienced BPO providers helps to improve service quality and faster turnaround times, leading to enhanced customer satisfaction. These factors are majorly driving the growth of the market.

The insurance business process outsourcing (BPO) service allows insurance companies to outsource various back-office tasks like policy checking, COI processing, claims management, and policy administration to third-party service providers like insurance BPO companies. In Canada, technological advancements and digital transformation within the insurance industry are leveraging the adoption of insurance BPO. BPO providers often have access to advanced technologies, such as artificial intelligence (AI), robotic process automation (RPA), and data analytics, which can significantly improve process efficiency and decision-making capabilities.

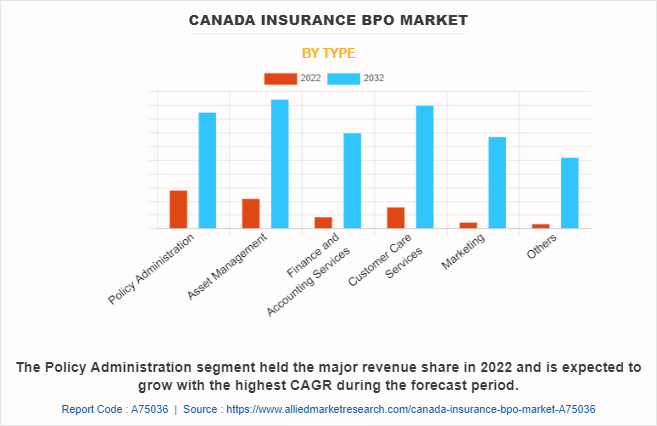

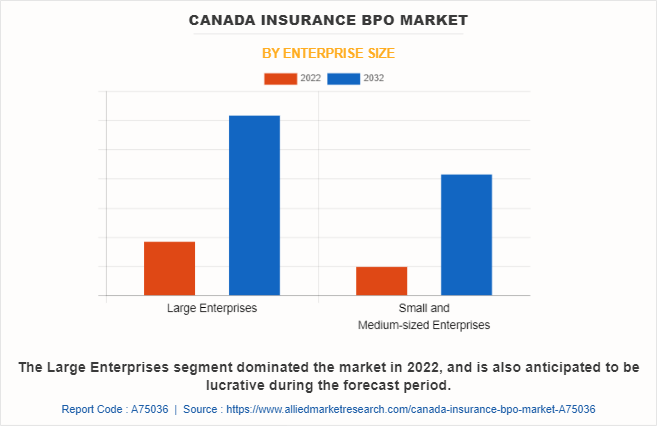

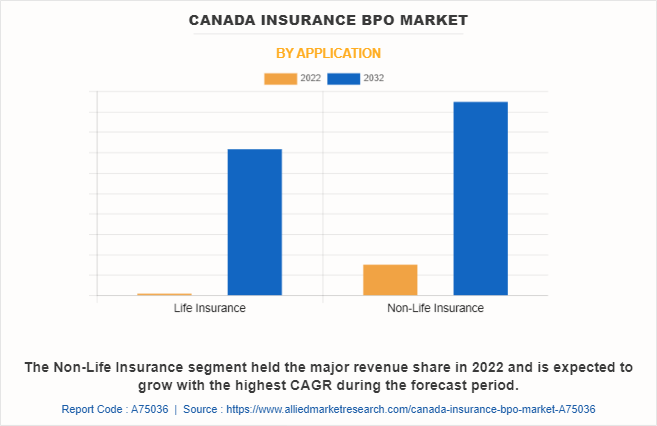

The insurance BPO market is segmented based on type, enterprise size and application. The type segment includes policy administration, asset management, finance and accounting services, customer care services, marketing and others. By enterprise size the market is bifurcated into large enterprise size and small and medium-sized enterprises. On the basis of application, the insurance BPO market is categorized into life insurance and non-life insurance market.

Major key players covered in this research study are Accenture, Cognizant, Infosys, Wipro, Genpact, Xerox, DXC Technology, CGI Group, HCL Technologies, and Capgemini.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Canada Insurance BPO Market analysis from 2022 to 2032 to identify the prevailing Canada Insurance BPO industry opportunities.

- The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

- In-depth analysis of the Canada Insurance BPO Market growth assists to determine the prevailing market opportunities.

- The report includes an analysis of the regional as well as Canada Insurance BPO Market share, key players, market segments, application areas, and market growth strategies.

- Major countries are mapped according to their revenue contribution to the Canada Insurance BPO Market size.

- Identify key players and their strategic moves in the Canada Insurance BPO Market forecast.

- Assess and rank the top factors that are expected to affect the growth of the Canada Insurance BPO Market outlook.

Canada Insurance BPO Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 90 |

| By Type |

|

| By Enterprise Size |

|

| By Application |

|

| Key Market Players | IntelliSource Solutions, Fusion BPO Services, Sun Life Financial, Desjardins General Insurance Group, Manulife Financial, Canada Life, Aviva Canada, Economical Insurance, Intact Insurance, BGI Solutions |

The Canada Insurance BPO Market is projected to grow at a CAGR of 14.1% from 2022 to 2032

Company 1, Company 10, Company 2, Company 3, Company 4, Company 5, Company 6, Company 7, Company 8, Company 9 are the leading players in Canada Insurance BPO Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in canada insurance bpo market.

3. Assess and rank the top factors that are expected to affect the growth of canada insurance bpo market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the canada insurance bpo market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Canada Insurance BPO Market is classified as by type, by enterprise size, by application

Loading Table Of Content...

Loading Research Methodology...