Capital Expenditure Market Research, 2032

The global capital expenditure market size was valued at $653.9 trillion in 2022, and is projected to reach $2345.7 trillion by 2032, growing at a CAGR of 13.8% from 2023 to 2032.

Capital expenditure market refers to an investment made with either credit or cash for the acquisition of for a long time fixed or physical assets that are utilized in the operations of an organization. Capital expenditures are payments made for goods or services that are recorded or capitalized on a company's balance sheet instead of expensed on the income statement.

Increased investments into greenfield facilities, new factories, and production site modernization boost the growth of the global capital expenditure market. In addition, factors such as the shift to renewable power, clean fuels, and sustainable technologies necessitate significant capex, and capex allocation for emerging technologies such as AI, IoT, blockchain, and cloud platforms have positively impacted the growth of the capital expenditure market.

However, surges in geopolitical tensions trade conflicts, and supply chain disruptions impact project timelines to hamper the capital expenditure market growth. On the contrary, the surge in investment into large-scale infrastructure projects and 5G infrastructure rollouts by telecom providers are expected to offer remunerative opportunities for the expansion of the capital expenditure market during the forecast period. Each of these factors is projected to have a definite impact on the growth of the capital expenditure market.

The study investigates growth prospects, constraints, and trends within the global capital expenditure market. It utilizes Porter's Five Forces model to analyze the impacts of factors like supplier bargaining power, competitor rivalry, new entrant threats, substitute threats, and buyer bargaining power on the overall capital expenditure market.

The capital expenditure market is segmented into Asset Type and Industry Vertical

Segment Review

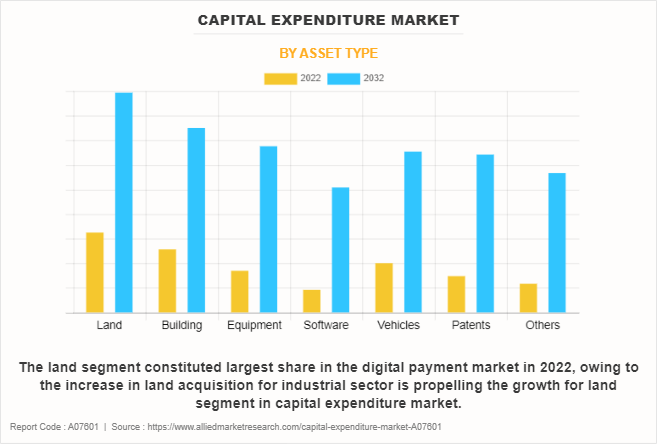

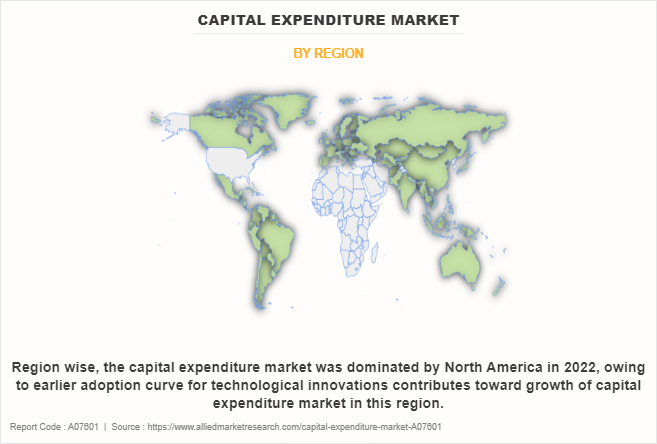

The capital expenditure market is segmented by asset type, industry vertical, and region. In terms of industry vertical, the capital expenditure market is fragmented into BFSI, oil & gas, mining, healthcare, manufacturing, IT & telecom, and real estate. Depending on asset type, capital expenditure market is divided into land, buildings, equipment, software, vehicles, patents, and others. Region-wise, capital expenditure market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By asset type, the land segment has acquired the highest capital expenditure market share in 2022. This is attributed to the fact that the rise in investments into industrial land acquisitions and factory buildings construction continues to rise driven by manufacturing expansions across developing regions.

Region wise, North America is expected to be one of the major regional capital expenditure markets for capital expenditure over the coming years. The manufacturing domain is seeing investments in intelligent factories and Industry 4.0-enabled facilities to refine production via sensors, automation, and real-time analytics. Energy leaders have raised budgets for renewable assets, battery solutions, and hydrogen plants to conform with decarbonization objectives across numerous states. Building infrastructure represents another key area, with a current focus on data center expansion by hyperscale cloud players, e-retailers, and electric vehicle charging deployment along highways and commercial areas to fulfill sustainability goals. Such development further propels the growth of the capital expenditure market in the region.

The key players profiled in the capital expenditure market analysis are U.S. Bancorp, Regions Financial Corporation, Truist Financial Corporation, JPMorgan Chase & Co., HSBC Holdings plc, Citibank, Bank of America Corporation, PNC Financial Services Group Inc., Wells Fargo, and First Citizens Bank. These players have adopted various strategies to increase their capital expenditure market penetration and strengthen their position in the industry.

Market Landscape and Trend

The capital expenditure market is driven by investments made by public and private enterprises to construct infrastructure, facilities, systems to support core operations and future growth plans. The manufacturing, utilities, and oil & gas sectors have traditionally accounted capital expenditure for the bulk of capex to fund facilities, construction, and equipment purchases. This has expanded over the years to encompass other capital-intensive domains such as information technology infrastructure, healthcare, transportation, and sustainable energy projects.

In terms of capital expenditure market dynamics, some key ongoing trends are reshaping capex allocation decisions and the supplier landscape. Global enterprises are modernizing operations via automated and connected tech such as smart sensors, big data platforms, and IoT across assembly lines. Several players are migrating enterprise systems to cloud-based solutions, catalyzing related infrastructure investments. The manufacturing sector also adopting Industry 4.0 innovations spanning robotics, AR, and AI applications to transform assembly line configurations.

In addition, the sustainability revolution is anticipated to compel companies to revamp supply chains via circular economy, renewable energy adoption, and carbon footprint reduction initiatives. This is expected to necessitate sizeable capex for renewable energy farms, waste recycling plants, carbon capture projects, and related cleantech avenues right from mining and chemicals to real estate sectors. Governments have a pivotal role via stimulatory policies and public infrastructure programs targeting emission reductions and local community development. For instance, urban metros expansion, healthcare access improvement, and digital services enhancement remain high on the priority list for upcoming capex cycles.

The positive outlook provides a lucrative opportunity for capital expenditure market players, project financing agencies, engineering consultants, and allied stakeholders during the forecasted period.

Top Impacting Factors

Increased Investments into Greenfield Facilities, New Factories, Production site Modernization

Companies across manufacturing, energy, utilities, and other industrial sectors are investing heavily in setting up new greenfield production facilities along with modernizing their existing sites. For instance, in January 2024, IndiGrid issued Letters of Intent by REC Power Development and Consultancy for the construction of two greenfield inter-state transmission projects. These projects were secured through the tariff-based competitive bidding (TBCB) mechanism and will be developed on a build, own, operate, and transfer (BOOT) basis for a 35-year duration. The combined estimated capital expenditure for both projects exceeds approximately $120 million (Rs 1,000 crores), and the construction timeline for each project is approximately 24 months.

Various enterprises today are directing substantial capital into constructing novel manufacturing plants, assembly lines, and logistics hubs to satisfy growing market needs, optimize operations, widen production scope, and incorporate cutting-edge advancements. As an illustration, prominent tech corporations such as Intel and Samsung have undertaken billion-dollar initiatives to build new semiconductor foundries to mitigate current microchip deficiencies. Similarly, major consumer product brands such as PepsiCo, Coca Cola, Unilever are establishing additional manufacturing units and storage facilities to make their supply networks more resilient.

Moreover, aside from these greenfield undertakings, businesses across many sectors are earmarking considerable shares of their capital expenditure to refurbish and upgrade existing production facilities through integration of automated platforms, state-of-the-art equipment, and technological tools to heighten throughput and yields. Therefore, such development coupled with significant investment propels the growth of the capital expenditure market.

Shift to Renewable Power, Clean Fuels, and Sustainable Technologies Necessitates Significant Capex

The global energy transition toward renewable sources and decarbonization is also catalyzing large Capex spending by utility firms, oil & gas majors, automakers, and chemical manufacturers. Investments into solar, wind, and hydropower generation assets have increased exponentially to curb emissions from fossil fuel plants. Governments too are upping budgets for large-scale renewable energy farms, grid infrastructure and battery storage systems.

In addition, auto manufacturers are reallocating vehicle production Capex from diesel/ petrol to financing new electric vehicle assembly facilities and local battery manufacturing plants. The emergence of hydrogen economy for clean fuel is mandate large scaled-up investments into electrolysis and distribution infrastructure buildouts. A significant amount is required in Capex over the next few decades for renewable energy farms, EV charging networks, hydrogen production plants, power grid upgrades to enable sustainability goals. Thus, investment from automtive sector supports the growth of the capital expenditure market.

Petrochemical giants are financing bio-refineries, carbon capture systems, hydrogen production hubs through new Capex to transition existing brownfield sites into sustainable models, thereby enabling their net-zero strategies aligned to ESG focus. For instance, in October 2023, Vertex Energy, Inc. officially appointed BofA Securities, Inc. (BofA) as its strategic financial advisor. BofA will assist Vertex in executing the company's growth strategy for renewable fuels and sustainable products. Such developments further support capital expenditure market growth.

Restraints

Surge in Geopolitical Tensions and Trade Conflicts

Rise in geopolitical tensions and international trade conflicts engender an unfavorable climate for companies to undertake major capital expenditure projects across borders. Specifically, rise in tensions between major economies along with an increase in protectionist trade policies have contributed to uncertainty in the global economy. Tariffs, economic sanctions, and import-export restrictions imposed between nations directly increase input costs and reduce addressable market access for firms planning overseas investments. This pose planning challenges for proposed greenfield facilities, production sites when budgeting for requisite construction materials, technical equipment, and human capital. Investments into emerging high-growth regions also witness downside risks from an ownership, data security and technological self-reliance standpoint.

Supply Chain Disruptions Impacting Project Timelines

Recent supply chain disruptions arising from factors such as pandemic induced logistics bottlenecks, conflict zones, climate events are also delaying procurement and commissioning schedules for major Capex programs. Critical equipment non-availability such as electronics chips, vital components going into automotive, aerospace, telecom and industrial hardware fabrication has slowed down the factory upgrade plans. The risk of missing project milestones due to external dependencies linked to overseas modular equipment deliveries or inventory stockpiles acquisition is compelling companies to approach Capex planning more conservatively. To avoid taking on too much execution risk, some companies are postponing or downsizing capital investments until supply conditions improve and become more reliable. Maintaining contingency buffers, securing local alternate vendors earlier on has become imperative to mitigate timeline uncertainties.

Opportunities

Surge in Investment into Large-scale Infrastructure Projects

Public and private infrastructure development presents a significant opportunity area for capital expenditure (Capex) requirements globally. Expanding urbanization trends especially across emerging economies in Asia and Africa has catalyzed government funding into upgrading transportation networks, establishing new commercial zones and strengthening digital backbone to serve rising metropolitan populations.

Construction of mass rapid transit systems including metro rails, light rails, bus networks to enhance mobility in congested cities like Bangkok, Manila, Nairobi. Similar largescale allocations are planned for new airports capacity enhancement considering air traffic growth estimates. For instance, in November 2023, JP Morgan, Aditya Birla Finance, Tata Cleantech Capital, India Infrastructure Finance Company Ltd (IIFCL) and ICICI Bank jointly extended a debt facility of approximately $300 million (Rs 2,475 crore) to GMR Goa International Airport Ltd (GGIAL). GGIAL is a special purpose vehicle of GMR Airports Ltd established to construct and manage the new airport in Goa.

Emerging markets are also encouraging investments into warehousing parks, IT specific special economic zones, smart commercial integrated properties to attract companies establishing global inhouse centers, production hubs, data storage sites. Such instances provide lucrative opportunities during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the capital expenditure market segments, current trends, estimations, and dynamics of the capital expenditure market forecast from 2022 to 2032 to identify the prevailing capital expenditure market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces Capital Expenditure Market Outlook highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the capital expenditure market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global capital expenditure industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global capital expenditure market trends, key players, market segments, application areas, and market growth strategies.

Capital Expenditure Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2345.7 trillion |

| Growth Rate | CAGR of 13.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 349 |

| By Asset Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Truist Financial Corporation, JPMorgan Chase & Co., First Citizens Bank, BANK OF AMERICA CORPORATION, PNC Financial Services Group Inc., HSBC Holdings plc, U.S. Bancorp, WELLS FARGO, Regions Financial Corporation, Citigroup Inc. |

Analyst Review

The capital expenditures landscape has demonstrated robust resilience despite recent economic challenges and geopolitical frictions. Players across manufacturing, energy, utilities, infrastructure, and technology industry continue pushing ahead with capacity elevations, modernization efforts and digital transitions needing crucial capital allotments over the projected timeline.

Key providers in the capital expenditure market are U.S. Bancorp, Regions Financial Corporation, Truist Financial Corporation, JPMorgan Chase & Co., HSBC Holdings plc, Citibank, Bank of America Corporation, PNC Financial Services Group Inc., Wells Fargo, and First Citizens Bank. Many businesses have developed partnership strategies in response to the increasing market demand for capital expenditure solutions to expand their portfolio of offerings.

In addition, several businesses have increased their footprint to keep up with the market's rising demand due to the surge in demand for industrial goods. For instance, in February 2023, capital equipment manufacturer ABB unveiled plans for India footprint expansion to address swelling industrial product demand fueled by ascending public and private capital outlays. ABB India presently derives 87% revenue from domestic sales and 13% via exports. The capacity boost decision factors in positive export market momentum.

U.S. Bancorp, Regions Financial Corporation, Truist Financial Corporation, JPMorgan Chase & Co., HSBC Holdings plc, Citibank, Bank of America Corporation, PNC Financial Services Group Inc., Wells Fargo, and First Citizens Bank

The global capital expenditure market was valued at $653.9 trillion in 2022, and is projected to reach $2345.7 trillion by 2032, growing at a CAGR of 13.8% from 2023 to 2032.

Largest regional market for Capital Expenditure is North America

Upcoming trends of Capital Expenditure Market is the surge in investment into large-scale infrastructure projects and 5G infrastructure rollouts by telecom providers.

Leading application of Capital Expenditure Market is land capital expenditure application.

Loading Table Of Content...

Loading Research Methodology...