Car Carrier Market Insights, 2032

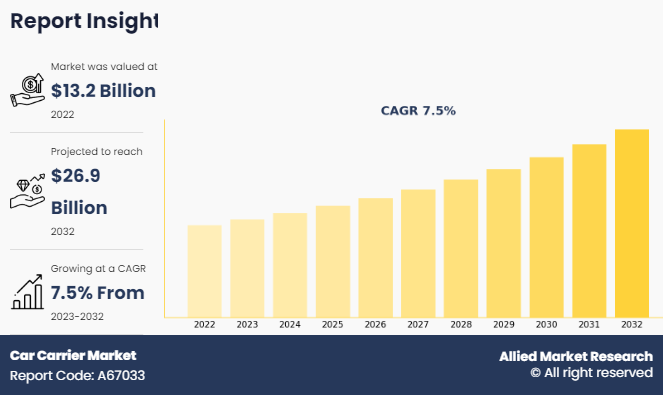

The global car carrier market share was valued at $13.2 billion in 2022, and is projected to reach $26.9 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032.

Key Takeaways

Based on type, the open-air car carrier segment held the largest share in the global car carrier market in 2022.

Based on end user, the automobile sales service shop 4S segment held the largest share in the global car carrier market in 2022.

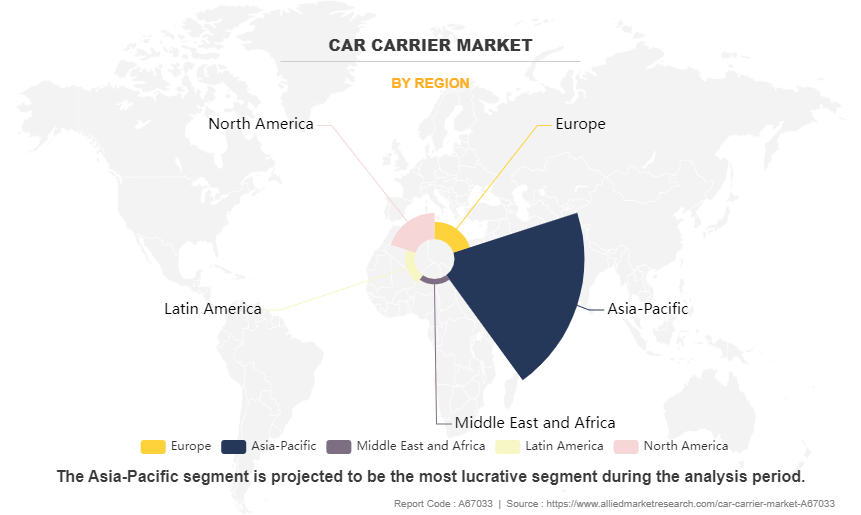

Based on region, the Asia-Pacific region held the largest share in the global car carrier market in 2022.

A car carrier is also known as auto transport trailer. Car carrier trailer helps to effectively transport passenger vehicles through truck. Car carriers are both open and closed. Different car carriers comprise of built-in ramps for loading and off-loading cars including hydraulics to raise and lower ramps for offering stand-alone accessibility. The commercial type of car carrier trailers is mostly utilized for shipping latest cars from manufacturers to the auto dealers. In U.S., shipping utilized vehicle is a big industry that is employed by car owners to relocate and select car shipping option instead of driving including consumers who purchase vehicle through the online second-hand market and require it to be delivered to the location.

Car carrier fits between 5 to 9 cars, depending on the car size and trailer model. The higher capacity vehicles are observed across the world in case of side-by-side loading that is the Chinese model. Open commercial car carrier trailers consist of a double decker design including both decks bifurcated into loading and storage ramps titled and lifted independently in case of hydraulics. The hydraulics present in the trailer helps the ramp to get aligned on a slope so that the cars can be driven and secured to the floor of the ramp with chains, tie-down ratchets and wheel straps after that the ramp can be entitled in any direction to optimize stacking.

The rear half of the deck is tilted and lowered hydraulically to load vehicles on the top deck of a double decker commercial trailer, to form a drive-up ramp to the upper deck. The top deck is first loaded and off loaded due to the presence of cars on the lower deck making it impossible to lower the top deck ramp. Trailer hydraulics are operated by utilizing a control box on the trailer to mount itself.

There are various benefits associated with the car carrier market. The car carrier helps to avoid the stress of driving. In addition, it saves time and effort. Car carriers also help with safe and secure transportation. Furthermore, it provides convenience and flexibility as it offers door-to-door car pick-up service and enclosed and open transport shipping options. In addition, the car carrier services are more cost effective as the driver must pay for only the shipping costs. Moreover, the car carrier also helps with professional handling as they offer the service to skilled professionals. In addition, car carriers offer specialized options and insurance coverage benefits. Specialized options offer special equipment and handling for transportation of high-end luxury vehicles. Insurance coverage offers the benefit of insuring the person’s vehicle in case of damage to the vehicle while carrying.

Segment Review

The Car Carrier Market Size is segmented into product type, application, and region. By type the market is bifurcated into open air car carrier and enclosed car carrier. Based on application, the market is divided into automobile sales service shop 4S, terminals and others.

Type

By product type, the open-air car carrier dominated the car carrier market size in 2022. This is because the open-air car carrier offers more affordable and common applications to ship vehicles over long distances. However, the enclosed car carrier segment is growing at an increasing pace as it is offering more protection for luxury, classic, and latest vehicles despite being more expensive.

End User

Based on end user, automobile sales service shop 4S is dominating the car carrier market. This is due to the large sales of automobiles in the global market.

Region

Based on region, the Asia Pacific region dominates the car carrier industry This is due to the high production of heavy-duty trucks in the region. However, the Middle East and Africa region will be growing in the future due to heavy investment by the region in infrastructure such as transportation networks, logistics facilities, ports and roads.

Key Players

The key players in the car carrier market are Miller Industries, Boydstun, Cottrell, Landoll, Kentucky Trailers, Delavan, Wally-Mo Trailer, Infinity Trailer, Tec Equipment Inc., and Dongfeng Trucks. Major strategies such as product launch and acquisition were applied by players to increase their share in the car carrier industry.

Market Dynamics

Increasing population and demand for automotive vehicles

Global population is increasing in urban and rural areas resulting in an increasing demand for personal transportation including cars, trucks and other vehicles. Urbanization is increasing demand for automobiles. Furthermore, as people are moving to cities and urban areas, the requirement for personal vehicles is also growing due to factors such as work commute, accessing services and recreational activities. Urbanization is increasing the demand for cars and vehicles, thus consequently increasing the demand for car carrier market. Moreover, the expansion of the middle class is resulting in greater purchasing power and high automobile demands. Furthermore, people are increasingly aspiring to purchase their own vehicles. In addition, the increasing demand for vehicles is translating into better production and sales, thus increasing the demand for the car carrier market. Therefore, all these factors are expected to drive the growth of the car carrier market during the forecast period.

Rapid technological advancements in the automotive industry

Rising innovations in the field of global positioning system (GPS) and telematics system is helping car carriers to track vehicles in real-time, optimize navigation routes and offer accurate estimates of delivery. These innovations are also enhancing operational efficiency, reducing transit times, and improving customer services. Car carriers utilize vehicle monitoring systems to remotely monitor vehicle conditions during transportation for checking factors such as temperature, humidity and security. This helps in ensuring that vehicles can be transported safely and in better conditions. Hence this technology is increasing the value of the car carrier market. Moreover, automation technologies such automatic loading and unloading systems are streamlining the process of loading vehicles to the carriers and also helping the carriers to unload themselves at their destinations. This technology is helping in reducing the requirement for manual labor, minimizing the loading and unloading times and improving the overall efficiency. Therefore, all these factors are expected to drive the market growth during the forecast period.

Changing Government Regulations

Governments are imposing strict emission standards to eliminate pollution and climate related problems. To meet these standards, the car carrier companies will have to incur costs to meet the new standards and displace the old fleet methods. Furthermore, carriers have to invest importantly in gathering specialized equipment, such as vehicle restraint systems and loading ramps, to prevent damage to vehicles and ensure secure transportation, in case of new regulations implemented by vehicle regarding the safety of vehicles during transportation. Moreover, sometimes the government may impose regulations in relation to the maximum weight and vehicle dimensions that are allowed on the roads. Carriers have to follow these restrictions in case of transporting vehicles to avoid fines and comply with transportation laws. In addition, heavy vehicles require special permissions and routing in case of increasing operational complexity and carrier costs. Therefore, all these factors are expected to hamper the growth of the market during the forecast period.

Fluctuating Fuel Prices

Fluctuating fuel prices are leading to volatility of cost for car carrier companies. The expenses related to fuel comprise a substantial portion of operating costs for transportation companies. As the fuel prices are rising, carriers can suffer to achieve profits, if they are not able to sell their services to the businesses and consumers at a high price to cover their high shipping costs. Furthermore, car carriers can operate in thin profit margins and but changes in fuel prices can disrupt profitability. In addition, rapid changes in the fuel costs can also shake the profit margins resulting in financial issues for carriers, particularly in the case of smaller companies with limited financial resources. Moreover, car carriers that are operating in highly competitive markets are witnessing struggles in the adjustment of shipping rates to reduce increased fuel expenditure. In addition, in case of competitive markets, carriers hesitate to increase their rates due to the fear of losing business to competitors, which can further enhance their financial pressure.

Rising Globalization In Automotive Supply Chains

Globalization is helping automotive manufacturers to collect components and assemble vehicles in various regions in order to take advantage of cost efficiencies and to access new markets. Furthermore, high volume of vehicles is being produced and distributed across borders, driving the demand for car carrier services to transport the vehicles from manufacturing plants to the end users. In addition, globalization has enabled automotive manufacturers to enter new markets and reach customers in regions where earlier there was a limited presence of automotive industry. Car carriers are playing an important role to facilitate this expansion by offering end-to-end transportation. The global supply chains in the automotive industry are complex in nature and they involve multiple suppliers, manufacturing facilities and distribution centers that are spread across various countries and continents. Car carrier can offer comprehensive logistics solutions to manage the above-mentioned complex supply chains including multi-modal transportation options and efficient route planning that are placed in the right position to capitalize on the growing demand for automotive transportation services. Therefore, all the above factors are expected to drive the growth of car carrier market opportunity during the forecast period.

Growing E-Commerce Platforms

E-commerce platforms are enabling automotive manufacturers to sell vehicles directly to consumers online, bypassing traditional dealership networks. This trend is increasing the requirement for car carriers to transport vehicles from manufacturing facilities and distribution centers directly to the customer’s location. Furthermore, car carriers can capitalize over e-commerce platforms by offering services to consumers in remote and underserved areas that are not accessible to nearby dealerships. Therefore, all these factors are expected to provide an opportunity for car carrier market growth during the car carrier market forecast.

Recent Developments in the Car Carrier Market

Using the technology's cutting-edge combinatorial optimization capabilities, Fujitsu Limited and Nippon Yusen Kabushiki Kaisha, a significant international shipping company, collaborated and introduced Fujitsu's quantum inspired Digital Annealer technology in September 2021 to greatly simplify complex stowage planning for car carriers. For NYK's dedicated car carriers, the Digital Annealer will help automate parts of the storage planning process. This is a very complicated task that involves a huge number of potential storage patterns depending on the number of vehicles loaded, the models of vehicles, and the number of ports called along the shipping route.

In February 2024, Toyota launched flatbed truck delivery system to ensure safer transportation of new cars before customer delivery. With Toyota's new "Amazing New Car Delivery Solution" program, consumers will receive their new vehicles with the fewest number of miles feasible. As part of this program, flatbed trucks will deliver new cars to Toyota's retail locations. The safer transportation of the cars is another promise made by this delivery program. These cars will also be covered for any potential damage that may arise while they are being transported. Toyota claims that the consumer will not be charged any extra finance for this new delivery procedure.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the car carrier market analysis from 2022 to 2032 to identify the prevailing car carrier market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the car carrier market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global car carrier market trends, key players, market segments, application areas, and market growth strategies.

Car Carrier Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 27 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Infinity Trailers, Miller Industries, Wally-Mo Inc, Tec Equipment Inc., Landoll Corporation, Kentucky Trailers, Delavan, Dongfeng Motor Company, Cottrell Trailers, Boydstun Equipment Manufacturing |

The growing trend of online vehicle sales is reshaping the car carrier market. The increasing demand for last mile delivery service to transport vehicles to user’s doorstep is driving the car carrier market.

Open-air car carrier is the leading application of Car Carrier Market

Asia-Pacific is the largest regional market for Car Carrier

$13.2 Billion is the estimated industry size of Car Carrier

Miller Industries, Boydstun, Cottrell, Landoll, Kentucky Trailers, Delavan, Wally-Mo Trailer, Infinity Trailer, Tec Equipment Inc., and Dongfeng Trucks.

Loading Table Of Content...

Loading Research Methodology...