Car Insurance Aggregators Market Research, 2031

The global car insurance aggregators market was valued at $3.7 billion in 2021, and is projected to reach $17.9 billion by 2031, growing at a CAGR of 17.5% from 2022 to 2031.

Car insurance aggregators are websites or online platforms that allow users to compare car insurance policies from different insurance providers in one place. Furthermore, these websites collect information from the user about their vehicle and their insurance requirements and then display a range of policy options from various insurance companies, with details such as coverage, price, and other features. This allows users to easily compare and choose the policy that best fits their needs and budget, without having to visit multiple insurance company websites or contact individual insurers. The market for car insurance aggregators has grown in recent years as consumers increasingly use online tools to research and purchase insurance products.

The car insurance aggregators offer cost savings to customers by allowing them to compare quotes from multiple insurance providers in one place. Thus, this helps customers to find the best deal for their individual needs and budget, as they can compare policies, coverage levels, and premiums side-by-side.

Moreover, aggregators and digital brokers offer customers a transparent way to compare and purchase car insurance policies by providing easy access to information on policy features, coverage, and pricing from multiple insurance providers in one place. Therefore, through these platforms, customers can compare policy details and prices side-by-side, enabling them to make informed decisions about which policy to purchase. In addition, best car insurance aggregators and digital brokers often provide detailed information on the terms and conditions of policies, making it easier for customers to understand what they are buying. Thus, this boosts the growth of the car insurance aggregators market.

However, limited geographic coverage can act as a restraint for the car insurance aggregators market. Many of the car insurance aggregators and digital brokers offer policies from multiple insurance providers, and their coverage may be limited to specific geographic regions or countries. This makes it difficult for customers in other regions or countries to access the policies offered through these platforms. On the contrary, aggregators and digital brokers can leverage this trend to expand their reach and offer convenient and efficient services to customers, as more customers turn to digital channels to research and purchase car insurance policies. Therefore, the overall trend toward increased digital influence presents a significant opportunity for the car insurance aggregators market, enabling aggregators and digital brokers to expand their reach and offer convenient and efficient services to customers.

The report focuses on growth prospects, restraints, and trends of the car insurance aggregators market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the car insurance aggregators market.

Segment Review

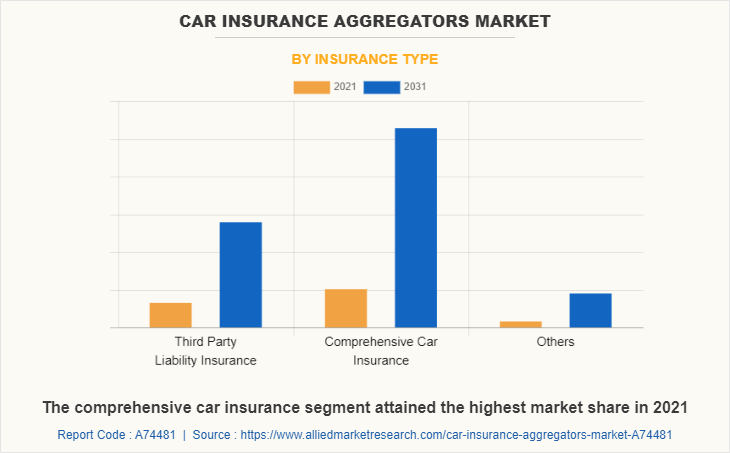

The car insurance aggregators market outlook is segmented on the basis of insurance type, enterprise size, application and region. Based on insurance type, it is segmented into third party liability insurance, comprehensive car insurance, and others. By enterprise size, it is segmented into large enterprises and small and medium-sized enterprises. By application, it is segmented into personal and commercial. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By insurance type, the comprehensive car insurance segment attained the highest growth in 2021. This is because there is a growing focus on customization and personalization, with many insurance providers offering flexible policy options that allow consumers to tailor their coverage to their specific needs and budget. In addition, in the car insurance aggregators market, comprehensive car insurance is often offered as a standalone policy or as part of a larger insurance package that includes other types of coverage. Thus, these trends are helping to make comprehensive car insurance accessible and consumer-friendly in the car insurance aggregator market. However, the other segment is considered to be the fastest growing segment during the forecast period. This is because car insurance aggregators often offer personal accident cover and roadside assistance as optional add-ons to a standard car insurance policy. Therefore, with these add-ons customers can choose to include these features in their policy for an additional premium, which can provide them with added peace of mind and protection while driving.

By region, North America attained highest growth in 2021. This is because the car insurance aggregators market in North America is driven by factors such as the increase in use of smartphones and the internet, rise in demand for online services, and increase in awareness about the benefits of using aggregators to purchase car insurance policies. However, the Asia-Pacific region is considered to be the fastest growing region during the forecast period. This is attributed to the fact that the car insurance aggregator market in Asia-Pacific has witnessed significant growth in recent years, driven by increase in internet penetration, developments in online sales channels, and surge in demand for transparent and convenient insurance products.

The report analyzes the profiles of key players operating in the car insurance aggregators market such as Comparepolicy.com, Gabi, Girnar Insurance Brokers Pvt. Ltd. (InsuranceDekho), Insurance Zebra, Insuranks.com, Insurify, Inc., Kweeder, NerdWallet, Inc., Policybazaar.com, and Turtlemint. These players have adopted various strategies to increase their market penetration and strengthen their position in the car insurance aggregators market growth.

Market Landscape and Trends

The car insurance aggregator market has become increasingly competitive in recent years, with a growing number of players entering the space. Furthermore, this market allows consumers to compare and purchase car insurance policies from multiple providers, often resulting in lower premiums and better coverage options. Additionally, advancements in technology such as the increased use of artificial intelligence and machine learning algorithms to improve the accuracy and relevance of insurance quotes are expected to further enhance the user experience of these platforms. Overall, the car insurance aggregator market is set to continue its upward trajectory as it provides a valuable service to consumers seeking affordable and comprehensive car insurance coverage. Therefore, these are the major market trends of car insurance aggregators industry.

Top Impacting Factors

Offers Cost Savings to the Customers

The car insurance aggregators offer cost savings to customers by allowing them to compare quotes from multiple insurance providers in one place. Furthermore, instead of having to visit multiple insurance websites or call different insurance companies individually, customers can enter their information into an aggregator website and receive quotes from various providers. Thus, this helps customers to find the best deal for their individual needs and budget, as they can compare policies, coverage levels, and premiums side-by-side. In addition, some insurance aggregators may offer exclusive discounts or promotions that customers may not have been aware of otherwise. Thus, all these factors lead to the growth of the car insurance aggregators market size.

Provides Transparency in the Process

Aggregators and digital brokers offer customers a transparent way to compare and purchase car insurance policies by providing easy access to information on policy features, coverage, and pricing from multiple insurance providers in one place. Moreover, through these platforms, customers can compare policy details and prices side-by-side, enabling them to make informed decisions about which policy to purchase. In addition, aggregators and digital brokers often provide detailed information on the terms and conditions of policies, making it easier for customers to understand what they are buying.

Furthermore, the transparency offered by aggregators and digital brokers is particularly valuable in a market where there is a wide variety of car insurance policies available, and where the terms and conditions can be complex and difficult to understand. Thus, aggregators and digital brokers help to create a more competitive and efficient marketplace, by making it easier for customers to compare policies and understand the coverage and pricing. Overall, the trend toward greater transparency in the car insurance market is expected to continue driving the growth of the car insurance aggregators market, as customers seek out convenient and trustworthy ways to compare and purchase policies.

Rise in Number of Aggregators and Digital Brokers

The digitalization of the insurance industry has made it easier for customers to access information about insurance policies and pricing. Customers are increasingly turning to aggregators and brokers to simplify their insurance purchasing process with the rise of digital channels, including online marketplaces and mobile apps. Furthermore, aggregators and brokers offer a range of benefits to customers, such as a wider range of policy options, more competitive pricing, and faster and more efficient service.

Moreover, the increase in competition in the car insurance market has led to a rise in the number of insurance companies partnering with aggregators and brokers to expand their reach and attract more customers. Thus, these partnerships allow insurance companies to increase their visibility and customer base, while also providing customers with a more diverse range of options to choose from. Overall, the trend of rising aggregators and digital brokers is expected to drive the growth of the car insurance aggregators market, providing customers with greater choice and convenience in their insurance purchasing decisions.

Dependence on Insurance Providers

The dependence on insurance providers can act as a restraint for the car insurance aggregators market. As these aggregators and digital brokers rely on partnerships with insurance providers to offer policies to customers, and their success is closely tied to the availability and competitiveness of the policies offered by these providers. In some cases, insurance providers may be reluctant to partner with aggregators and digital brokers, either due to concerns about the potential impact on their brand or because they prefer to sell policies through their own channels. Thus, this can limit the range of policies available through aggregators and digital brokers, making it more difficult for them to attract and retain customers. In addition, the terms of partnerships between aggregators and insurance providers may limit the ability of aggregators to offer the best deals to customers. For instance, an insurance provider may require that its policies be offered at a certain price point, or that certain features or benefits be included in the policies offered through an aggregator. This can limit the ability of aggregators to negotiate lower prices or better terms for customers.

Furthermore, aggregators and digital brokers may face challenges in maintaining the quality of the policies offered through their platforms, as they may not have direct control over the underwriting and claims processes. Therefore, it leads to issues with customer satisfaction and trust, which can undermine the success of the aggregator or digital broker. Overall, dependence on insurance providers can act as a constraint for the car insurance aggregators market, limiting the range of policies available and the ability of aggregators to negotiate favorable terms for customers.

Limited Geographic Coverage

Limited geographic coverage can act as a restraint for the car insurance aggregators market as many of the car insurance aggregators and digital brokers offer policies from multiple insurance providers, and their coverage may be limited to specific geographic regions or countries. This, makes it difficult for customers in other regions or countries to access the policies offered through these platforms.

Furthermore, the regulatory and legal environments for car insurance can vary widely from country to country, and even from region to region within a country. In addition, some customers may prefer purchasing policies from local insurance providers that they are more familiar with or that have a better reputation in their region. Thus, this can limit the appeal of policies offered through aggregators and digital brokers, particularly in regions where local insurance providers are well-established and have a strong presence. Therefore, limited geographic coverage can act as a constraint for the car insurance aggregators market, limiting the availability of policies and potentially reducing the appeal of these platforms to customers in certain regions.

Increase in Digital Influence

Aggregators and digital brokers can leverage this trend to expand their reach and offer more convenient and efficient services to customers as more customers turn to digital channels to research and purchase car insurance policies. Furthermore, digital channels offer a range of benefits to customers, including the ability to research policies and pricing from multiple providers at any time, from anywhere. In addition, aggregators and digital brokers can take advantage of this trend by offering easy-to-use online platforms that enable customers to compare policies and pricing from multiple insurance providers in one place.

Moreover, the increase in use of digital channels can enable aggregators and digital brokers to leverage new technologies, such as artificial intelligence and machine learning, to offer personalized recommendations and streamlined purchasing experiences to customers. Thus, these technologies can help to improve the customer experience, reduce friction in the purchasing process, and increase customer satisfaction. In addition, developments in digital channels have led to the emergence of new customer segments, such as millennials and Gen Z, who are more likely to use digital channels to research and purchase car insurance policies. Therefore, the overall trend toward increased digital influence presents a significant opportunity for the car insurance aggregators market, enabling aggregators and digital brokers to expand their reach and offer more convenient and efficient services to customers.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the car insurance aggregators market forecast from 2022 to 2031 to identify the prevailing car insurance aggregators market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the car insurance aggregators market share assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global car insurance aggregators market trends, key players, market segments, application areas, and market growth strategies.

Car Insurance Aggregators Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 17.9 billion |

| Growth Rate | CAGR of 17.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 356 |

| By Insurance Type |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Gabi, Insuranks.com, Kweeder, Turtlemint, NerdWallet, Inc., Policybazaar, Comparepolicy.com, The Zebra, Girnar Insurance Brokers Pvt. Ltd. (InsuranceDekho), Insurify, Inc. |

Analyst Review

The car insurance aggregators market refers to the industry or market segment that provides online platforms or tools that allow consumers to compare and purchase car insurance policies from various insurance providers. These aggregators typically collect and display information on the available insurance policies and prices from multiple providers, allowing consumers to easily compare and select the most suitable option for their needs.

Furthermore, market players are adopting strategies like acquisition for enhancing their services in the market and improving customer satisfaction. For instance, in 2023, Insurify, Inc., America’s top-rated virtual insurance agent to compare, buy and manage insurance has entered into an agreement to acquire Inspop USA, LLC and its subsidiary, Compare.com Insurance Agency, LLC. This strategic acquisition brings two leading online insurance shopping platforms under one larger scale entity that combines Insurify's cutting edge AI-powered technology, expert advice, and organic marketing expertise with Compare.com's robust consumer choice and long-established insurance experience. Therefore, such strategies are projected to boost the growth of the market in the upcoming years.

Moreover, some of the key players profiled in the report include Comparepolicy.com, Gabi, Girnar Insurance Brokers Pvt. Ltd. (InsuranceDekho), Insurance Zebra, Insuranks.com, Insurify, Inc., Kweeder, NerdWallet, Inc., Policybazaar.com, and Turtlemint. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The car insurance aggregators offer cost savings to customers by allowing them to compare quotes from multiple insurance providers in one place. Thus, this helps customers to find the best deal for their individual needs and budget, as they can compare policies, coverage levels, and premiums side-by-side.

North America is the largest regional market for Car Insurance Aggregators

The global car insurance aggregators market was valued at $3,672.64 million in 2021, and is projected to reach $17,930.77 million by 2031, growing at a CAGR of 17.5% from 2022 to 2031.

Comparepolicy.com, Gabi, Girnar Insurance Brokers Pvt. Ltd. (InsuranceDekho), Insurance Zebra, Insuranks.com, Insurify, Inc., Kweeder, NerdWallet, Inc., Policybazaar.com, and Turtlemint

Loading Table Of Content...

Loading Research Methodology...