Carbon Credits Market Research, 2032

The global carbon credits market was valued at $2 billion in 2022, and is projected to reach $143.5 billion by 2032, growing at a CAGR of 55.5% from 2023 to 2032. Carbon credits are kind of permit in which one carbon credit represents one ton of carbon dioxide that is removed from the environment. These carbon credits are largely purchased by individuals or companies to compensate for their carbon emissions that is produced as a result of industrial activities. The carbon credits are largely governed by several registries namely American Carbon Registry (ACR), Climate Action Reserve (CAR), UN Clean Development Mechanism (UN CDM), and others. Also, the revenue generated from the sale of carbon credits provides financial support to emission reduction projects. This funding helps to incentivize and finance additional projects, thereby contributing to global efforts to mitigate climate change and transition to a low-carbon economy.

The carbon market allows for the purchase and sale of carbon credits. To offset their own emissions and achieve their sustainability objectives, buyers, such as businesses, governments, or individuals, buy carbon credits. Through specialized platforms or exchanges, the carbon credits are transferred from the seller to the buyer. When carbon credits are bought, they are usually retired or cancelled, making sure they cannot be used or traded again. Governments or regulatory bodies typically establish registries or tracking systems to record the issuance, ownership, and retirement of carbon credits. These systems provide a transparent and auditable record of the transactions and ensure the accurate accounting of emission reductions. Registries also help prevent double-counting or double-selling of carbon credits.

The market for carbon credits that are bought voluntarily (as compared with for compliance purposes) is growing significantly. Using voluntary carbon credits, private funding is directed to climate change projects that would not otherwise be able to start. Additional advantages of carbon credits include the preservation of biodiversity and reduction of pollution. Carbon credits also encourage spending on the innovation needed to bring down the price of new climate technologies that helps in achieving sustainability by reducing carbon footprints. These factors are anticipated to boost the carbon credits market growth during the forecast period.

The market is expected to experience difficulties owing to the rising price of carbon credits. One of the limitations of carbon credit is that with the help of carbon credits, companies do not invest in efforts to reduce carbon as they can buy unlimited carbon credits. These factors are anticipated to restrain the carbon credits market opportunities in the upcoming years.

Carbon credits can help to reduce the impact that carbon emissions have on the environment. Thus, with the help of carbon credits, companies can effectively invest in other initiatives that lower greenhouse gas emissions by buying carbon credits. The adoption and implementation of renewable energy projects such as solar energy, wind power, and others is increasing across the world. Such renewable energy projects helps in generating the carbon credits. For instance, India greatly contributes to the emission of harmful greenhouse gases. Hence, the country is actively engaging in sustainable development goals to reduce the carbon footprint which is anticipated to generate excellent opportunities in the global carbon credits market in the upcoming years.

The key players profiled in this report include South Pole, 3Degrees, EKI Energy Services Ltd, TerraPass, NATUREOFFICE, Moss.Earth, Climate Impact Partners, Carbon Credit Capital, LLC, CarbonBetter, and NativeEnergy. Investment and agreement are common strategies followed by major market players. For instance, on February 17, 2022, The GyapaTM Cookstoves project released an additional 1 million tons of independently verified Gold Standard carbon credits, according to a statement from ClimateCare and Relief International. With this, the project has now successfully reduced emissions by more than 5 million over the course of 12 years.

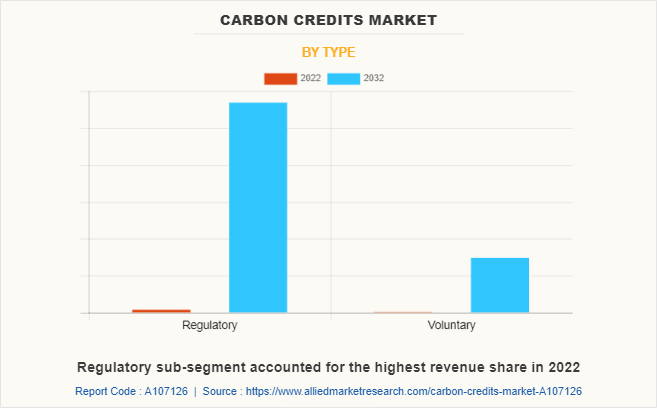

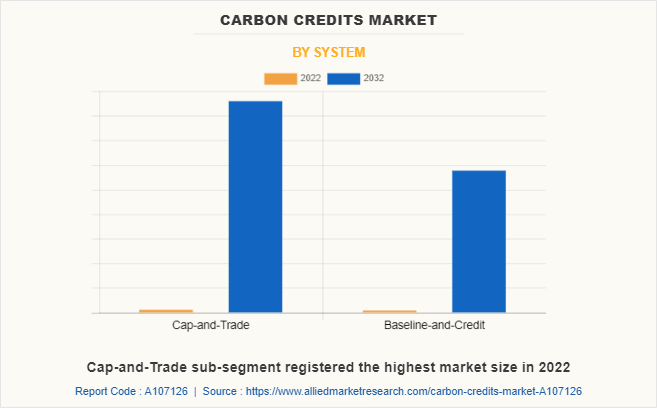

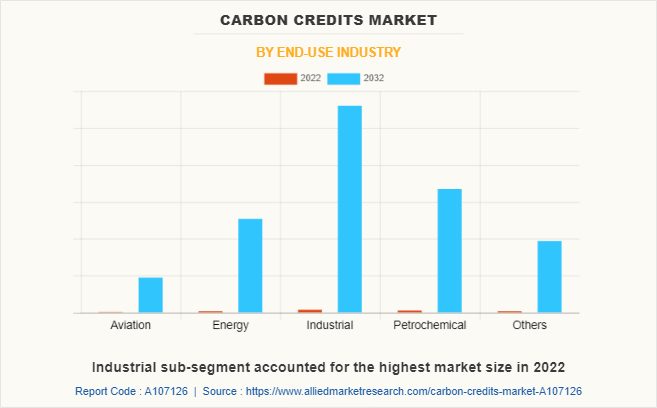

The carbon credits market is segmented on the basis of type, system, end-use industry, and region. By type, the market is sub-segmented into regulatory and voluntary. By system, the market is classified into cap-and-trade and baseline-and-credit. By end-use industry, the market is classified into aviation, energy, industrial, petrochemical, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The carbon credits market is segmented into Type, System and End-use Industry.

By type, the regulatory sub-segment dominated the market in 2022. In the regulatory carbon credits market, companies are legally mandated to offset their carbon emissions. In this sub-segment, the carbon-emitting industries are regulated by emission standards that were established in the Framework of the United Nations Convention on Climate Change (UNFCCC). The benefit of regulatory carbon credits is that the emission reduction norms are validated by designated operational entities which ensures that measurable and real carbon emission reduction is achieved. With regulatory carbon credits, companies or individuals that buy carbon credits must be verified by Verified Emission Reduction (VER). These are predicted to be the major factors affecting the carbon credits market size during the forecast period.

By system, the cap-and-trade sub-segment dominated the global carbon credits market in 2022. Systems that use cap-and-trade frequently allow for the use of offsets. Offsets are credits produced from projects to reduce emissions that are not subject to the cap but still help to reduce overall emissions. The cap-and-trade program helps in lowering the greenhouse gas emissions. In this system, certain limits are mentioned for aggregate emissions from a group of emitters which is known as ‘cap.’ Cap-and-trade programs frequently offer adaptable mechanisms to account for fluctuating emission reduction costs and advance cost-efficiency. In this system, the government can generate revenue by auctioning the carbon credits or selling them directly to the entities. The cap-and-trade system requires regular monitoring, verification, reporting, and assessment of carbon credits to ensure transparency in the process.

By end-use industry, the industrial sub-segment dominated the global carbon credits market share in 2022. The industrial sector is one of the major carbon-emitting sector. This is because industrial sectors such as oil & gas, manufacturing, steel processing, and others have high energy demand and the combustion of fuels in these industrial sectors leads to the emission of greenhouse gases. The ongoing R&D in the industrial sector aims at reducing the carbon emission and improving energy efficiency. Thus, carbon credits can play a major role in reducing harmful carbon emissions. This is because carbon credits offers flexibility to the companies to meet their carbon reduction targets. The trading of carbon credits or allowances allows industrial entities to benefit economically from their emission reduction efforts. This encourages the adoption of cleaner technologies and practices, facilitates the transfer of emission reduction projects, and promotes sustainable industrial development.

By region, Asia-Pacific dominated the global market in 2022 and is projected to be the fastest-growing region during the forecast period. The popularity of carbon credits market across countries namely China, Japan, India, and others can be attributed to several sustainability initiatives taken by the companies in this region. For instance, in May 2022, Japan decided to launch a first exchange for carbon emissions trading. This trading platform is named as Japan Exchange Group (JPX) which is established together with the Ministry of Economy, Trade, and Industry (METI) that focuses on reduction of carbon dioxide. In line with this initiative, JPX already started the carbon credit trading trial in September 2022. Also, China is one of the leading carbon credits market, and the country has decided to relaunch its domestic voluntary carbon mechanism called the China Certified Emission Reduction program in May 2023. In first quarter of 2023, China which is the leading supplier of carbon credits, accounted for 20.8% of total voluntary carbon credit issuances. These factors are anticipated to boost the regional carbon credits market expansion in the upcoming years.

Impact of COVID-19 on the Global Carbon Credits Industry

- The onset of the COVID-19 pandemic negatively impacted the carbon credits market. This is majorly owing to reduced industrial & manufacturing activities that have led to a decline in the demand for carbon credits

- The investments in carbon emission reduction projects such as renewable energy projects, reforestation initiatives, and carbon credits have been reduced significantly. This is majorly owing to disruptions in supply chain, delay or cancellation in the issue of carbon credits owing to reduced manufacturing activities

- Many companies faced financial uncertainties owing to closure of manufacturing plants, shortage of labor, reduced demand for the products which have led to shift in focus towards revenue saving to deal with financial crisis. Thus the demand for carbon credits and market opportunities was reduced significantly owing to severe economic losses faced by many countries and uncertainty about the future

Key Benefits For Stakeholders

The report provides an exclusive and comprehensive analysis of the global carbon credits market trends along with the carbon credits market forecast

The report elucidates the carbon credits market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts

Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building

The report entailing the carbon credits market analysis maps the qualitative sway of various industry factors on market segments as well as geographies

The data in this report aims on market dynamics, trends, and developments affecting the market growth

Carbon Credits Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 143.5 billion |

| Growth Rate | CAGR of 55.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By System |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | CarbonBetter , South Pole , Moss.Earth, 3Degrees , Climate Impact Partners, TerraPass , EKI Energy Services Ltd., NATUREOFFICE, NativeEnergy, Carbon Credit Capital, LLC. |

Rising awareness regarding environmental sustainability and increase in government initiatives to reduce harmful carbon emissions are the key drivers anticipated to generate excellent opportunities in the carbon credits market in the upcoming years.

The major growth strategies adopted by carbon credits market players are investment and agreement.

South Pole, 3Degrees, EKI Energy Services Ltd, TerraPass, NATUREOFFICE, Moss.Earth, Climate Impact Partners, Carbon Credit Capital, LLC, CarbonBetter, and NativeEnergy are the major players in the carbon credits market.

Asia-Pacific will provide more business opportunities for the global carbon credits market in the future.

The industrial sub-segment of the end-use industry acquired the maximum share of the carbon credits market in 2022.

Industrial sectors including oil & gas, manufacturing, construction, energy, power, and others are the major customers in the global carbon credits market.

The carbon credits market has a wide range of applications across aviation, petrochemical, energy, industrial, and other sectors which is estimated to boost the market adoption.

The trends such as rising importance of carbon credits that enable organizations to compensate or neutralize emissions is anticipated to boost the market growth in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...