Carbon Fiber Composite Intermediates In Aerospace Market Research, 2033

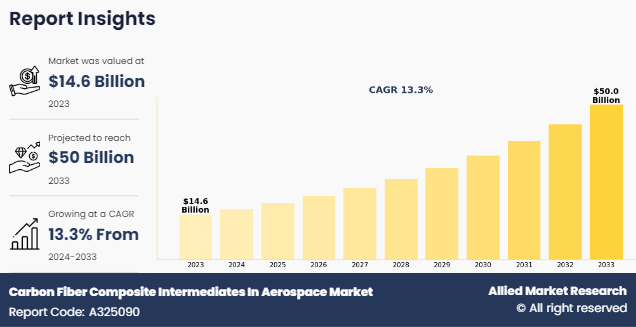

The global carbon fiber composite intermediates in aerospace market was valued at $14.6 billion in 2023, and is projected to reach $50 billion by 2033, growing at a CAGR of 13.3% from 2024 to 2033. Technological advancements like automated fiber placement and resin transfer molding have boosted carbon fiber composite intermediates in aerospace market by improving efficiency and reducing costs. While alternatives like aluminum-lithium alloys challenge their dominance, the rise of electric aircraft offers opportunities for growth, emphasizing the need for lightweight, high-performance materials in sustainable aviation materials.

Introduction

Carbon fiber composite intermediates in aerospace industry serve as foundational building materials for advanced composite structures used in aircraft and spacecraft. These intermediates typically include pre-impregnated fabrics (prepregs), towpregs, and woven or non-woven fabrics, all reinforced with carbon fibers and impregnated with resin systems such as epoxy. The high strength-to-weight ratio, stiffness, and resistance to fatigue and corrosion make these intermediates ideal for aerospace applications.

In the aerospace industry, these intermediates are critical for manufacturing lightweight and robust components, such as wings, fuselages, and control surfaces, which improve fuel efficiency and performance. The production process involves layering and curing these intermediates in molds under controlled temperature and pressure, forming rigid structures that withstand demanding flight environments. Furthermore, carbon fiber composite intermediates offer design flexibility, enabling complex shapes and structures that are challenging or impossible with traditional materials such as metals. The utilization of Carbon Fiber Composite Intermediates In Aerospace Industry continues to grow as technology advances, pushing the boundaries of what is possible in aircraft and spacecraft design, efficiency, and performance.

Market Dynamics

Technological advancements in production and application of carbon fiber composites have significantly contributed to their adoption in the aerospace industry. Innovations such as automated fiber placement (AFP), resin transfer molding (RTM), and 3D printing of composite materials have improved the efficiency and precision of manufacturing processes. The abovementioned advancements reduce production costs and enhance the performance characteristics of the composites, making them more attractive for aerospace applications. Furthermore, the high-temperature resins and toughened epoxy systems have expanded the range of applications for carbon fiber composites in more demanding environments, such as engine components and high-speed aircraft. As technology continues to evolve, the capabilities of carbon fiber composites are expected to further expand, thereby driving their use in increasingly complex and critical aerospace structures.

While carbon fiber composites offer exceptional properties, they are not the only advanced materials available for aerospace applications. Alternatives such as aluminum-lithium alloys, advanced ceramics, and even other composites, like glass fiber or aramid fiber composites sometimes offer comparable performance at a lower cost or with easier manufacturing processes. For instance, aluminum-lithium alloys provide a good balance of weight and strength, with the added benefit of being easier to work with using conventional metalworking techniques. In addition, some emerging materials such as nano-enhanced composites promise to deliver even greater performance improvements, potentially reducing the relative advantage of carbon fiber composites. The abovementioned alternatives challenge the growth of the carbon fiber composite intermediates market, as manufacturers opt for more cost-effective or simpler solutions.

The rise of electric and hybrid-electric aircraft represents a significant opportunity for the carbon fiber composite intermediates in aerospace market. These aircraft require materials that maximize energy efficiency, as reducing weight is crucial for extending the range and improving performance. Carbon fiber composites, with their high strength-to-weight ratio, are ideal materials for the aviation industry. As the aviation industry shifts towards more sustainable technologies, the demand for electric aircraft is expected to increase, driven by regulatory pressures, technological advancements, and increasing public awareness of environmental issues. Carbon fiber composites are expected to play a critical role in the development of these aircraft, from lightweight airframes to advanced battery housings. This growing market offers a substantial opportunity for companies to innovate and supply high-quality composite materials tailored to the specific needs of electric aviation.

Segment overview

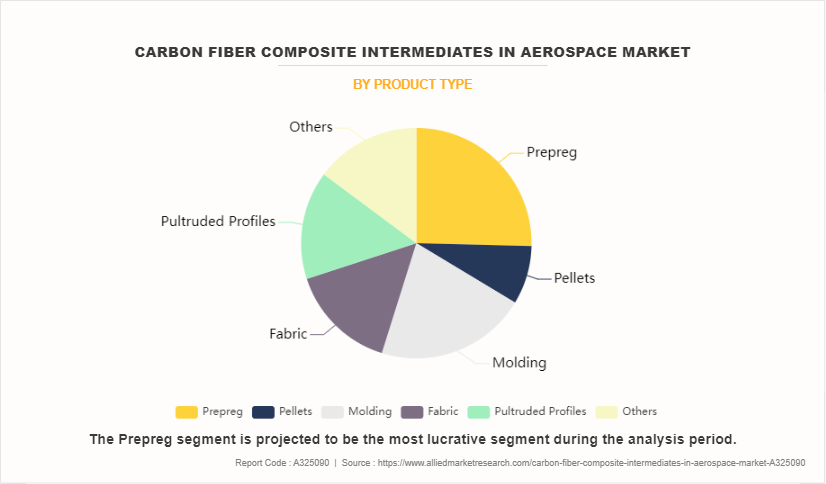

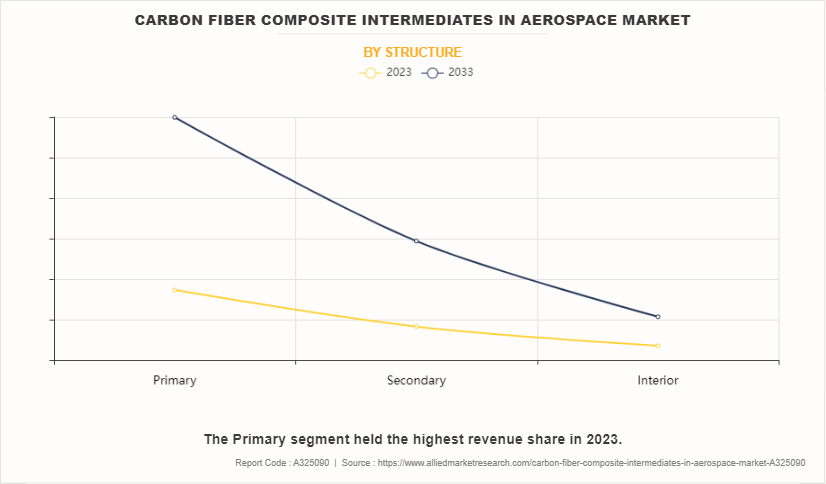

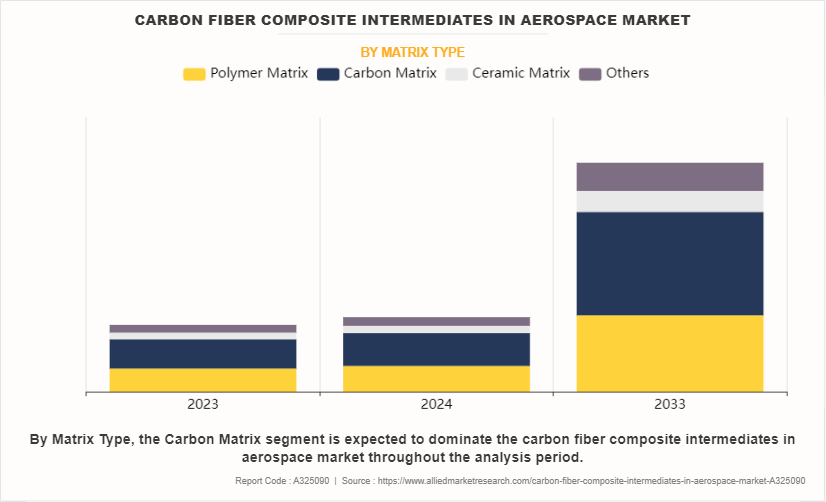

The carbon fiber composite intermediates in aerospace market is segmented into product type, matrix type, structure, application, end-use, and region. On the basis of product type, the market is divided into prepreg, pellets, molding, fabric, pultruded profile, and others. On the basis of matrix type, the market is segmented into polymer matrix, carbon matrix, ceramic matrix, and others. On the basis of structure, the market is segmented into primary, secondary, and interior. On the basis of application, the market is classified into commercial aircraft, military aircraft, spacecraft, unmanned aerial vehicles, helicopters, and general aviation. On the basis of end-use, the market is segmented into original equipment manufacturers, and maintenance, repair, and overhaul providers. On the basis of region, the carbon fiber composite intermediates in aerospace market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In 2023, the prepreg segment led the carbon fiber composite intermediates market, driven by its high strength-to-weight ratio critical for aerospace applications. Fuel efficiency, emission reduction, automated manufacturing technologies, and advancements in recyclable thermoplastic prepregs support its growth. Increased demand for lightweight materials in electric and hybrid aircraft and emerging aerospace markets boosts its dominance. Carbon fiber pellets saw a major CAGR of 15% in 2023. Their ease of handling and compatibility with injection molding make them popular for lightweight, durable aerospace interiors, supporting cost-effective production and sustainability goals.

Accounting for nearly 60% of the Carbon Fiber Composite Intermediates In Aerospace Market Share in 2023, the primary segment remains dominant, driven by demand for lightweight composites in large aircraft. Advanced manufacturing technologies and cost reduction are expanding opportunities for hybrid and stronger materials.

The carbon matrix segment led with nearly 40% of the Carbon Fiber Composite Intermediates In Aerospace Market Size in 2023, vital for high-temperature aerospace applications like hypersonic vehicles and reusable space systems. Innovations in production methods and sustainability enhance its role in defense and space exploration.

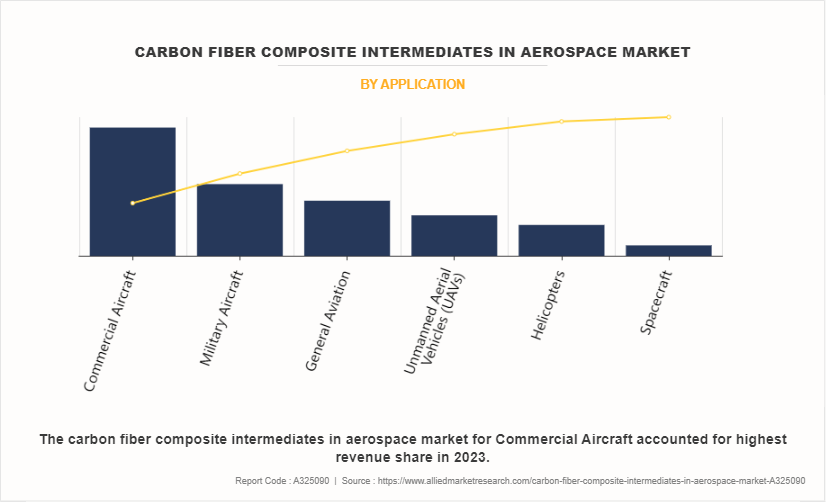

With over one-third of the market in 2023, the commercial aircraft segment leads due to the rising demand for fuel-efficient and eco-friendly planes. Innovations in composite manufacturing and the push for sustainable aviation bolster its growth.

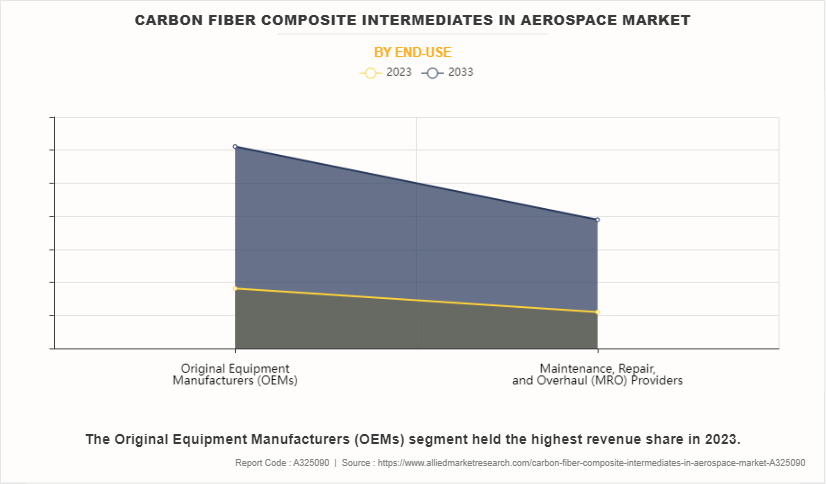

The aerospace OEM market, comprising over 60% of the share in 2023, is driven by the use of composites in fuel-efficient aircraft like the Boeing 787 and Airbus A350. Emission regulations and electric aircraft trends further expand opportunities.

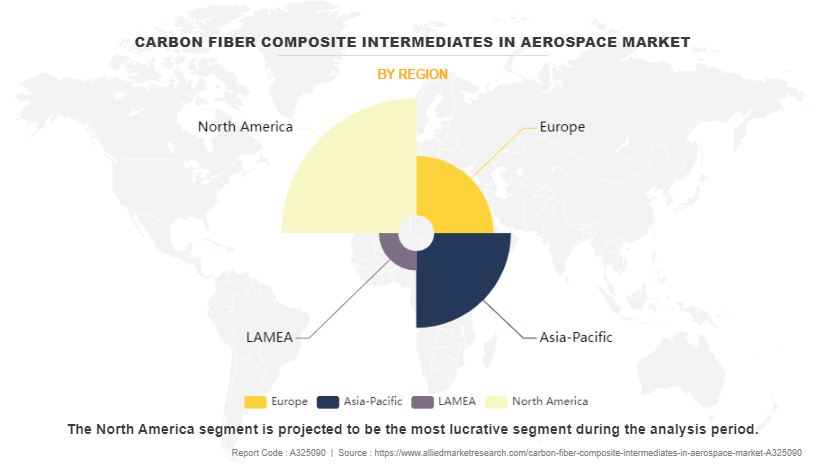

North America, with over 40% of the 2023 market, dominates due to strong aerospace advancements, especially in the U.S. Innovations by companies like Boeing and Lockheed Martin and defense spending enhance regional growth, particularly in sustainable composites.

The major players operating in the carbon fiber composite intermediates in aerospace market include Toray Industries, inc., Mitsubishi Chemical Corporation, Hexcel Corporation, SGL Carbon, Teijin Limited., Solvay, Isovolta group, Saertex GmbH and CO. KG, Rock West Composites, Inc., and Huntsman corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon fiber composite intermediates in aerospace market analysis from 2023 to 2033 to identify the prevailing carbon fiber composite intermediates in aerospace market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon fiber composite intermediates in aerospace market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon fiber composite intermediates in aerospace market trends, key players, market segments, application areas, and market growth strategies.

Carbon Fiber Composite Intermediates In Aerospace Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 50 billion |

| Growth Rate | CAGR of 13.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 568 |

| By Product Type |

|

| By Structure |

|

| By Matrix Type |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Rock West Composites, Inc., TEIJIN LIMITED., Huntsman Corporation, Mitsubishi Chemical Group Corporation., SAERTEX GmbH & Co.KG, TORAY INDUSTRIES, INC., Hexcel Corporation, Solvay, SGL Carbon, ISOVOLTA AG |

Analyst Review

From CXO's perspective, carbon fiber composite intermediates are a pivotal advancement in the aerospace market, offering unparalleled opportunities to meet the demands of the industry. As the aerospace sector prioritizes fuel efficiency, environmental sustainability, and performance, the role of advanced composites becomes critical. These materials provide the strength and durability required for modern aircraft and contribute significantly to weight reduction, which is essential for improving fuel efficiency and reducing carbon emissions.

The growing application of carbon fiber composites in aerospace drives innovation across the supply chain. At the CXO level, it’s imperative to recognize that the demand for lightweight, fuel-efficient aircraft is expected to only accelerate, necessitating the development of more advanced and cost-effective carbon materials. Investing in research and development to enhance the performance of these composites, while simultaneously reducing production costs, is crucial for the development of firms. By reducing the high costs associated with carbon fiber production and processing, the aerospace industry is expected to unlock greater market potential and make these materials more accessible to a broader range of applications within aerospace and beyond.

The market dynamics also highlight the importance of strategic collaborations and partnerships. The influx of new market entrants and the trend of established companies engaging in mergers, acquisitions, and joint ventures indicate a highly competitive landscape. As a CXO, fostering strong partnerships and securing long-term contract agreements with reliable suppliers and customers is essential for sustaining business operations and expanding our global footprint. By aligning with trusted partners, the executives expect to enhance the firm's supply chain resilience, increase production capacities, and tap into emerging markets with high growth potential.

Moreover, as the aerospace industry moves towards greater sustainability, there is a growing need to focus on the recyclability of carbon fiber composites. Hence, developing and adopting recyclable composites aligns with global environmental goals and presents a new avenue for innovation and differentiation in the market. By leading efforts in sustainable materials development, executives expect to position the firm as a leader in the aerospace industry committed to technological excellence and environmental responsibility.

$14.6 billion is the industry size of Carbon Fiber Composite Intermediates In Aerospace in 2023.

Expansion in emerging markets are the upcoming trends of Carbon Fiber Composite Intermediates In Aerospace Market in the globe.

Commercial aircraft is the leading application of Carbon Fiber Composite Intermediates In Aerospace Market in 2023.

North America is the largest regional market for Carbon Fiber Composite Intermediates In Aerospace in 2023.

Toray Industries, inc., Mitsubishi Chemical Corporation, Hexcel Corporation, SGL Carbon, Teijin Limited., Solvay, Isovolta group, Saertex GmbH and CO. KG, Rock West Composites, Inc., and Huntsman corporation are the top companies to hold the market share in Carbon Fiber Composite Intermediates In Aerospace.

Loading Table Of Content...

Loading Research Methodology...