Carbon Fiber Market Size & Insights:

The global carbon fiber market size was valued at $5.5 billion in 2022, and is projected to reach $16.0 billion by 2032, growing at a CAGR of 11.4% from 2023 to 2032.

Introduction:

Carbon fiber is a high-strength, lightweight material composed of thin, crystalline filaments of carbon, typically woven together and embedded in a resin matrix to form a composite. Known for its exceptional strength-to-weight ratio, corrosion resistance, and high thermal and electrical conductivity, carbon fiber is widely used in aerospace, automotive, sports equipment, and industrial applications. Its rigidity and durability make it an ideal alternative to traditional materials such as steel and aluminum, particularly in industries where weight reduction and performance optimization are critical.

Key Takeaways:

- The report outlines the current carbon fiber market trends and future scenario of the market from 2022 to 2032 to understand the prevailing opportunities and potential investment pockets.

- The global carbon fiber market has been analyzed in terms of value ($ Billion) and volume (Kilotons). The analysis in the report is provided on the basis of raw material, type, form, end-use industry, 4 major regions, and more than 15 countries.

- The carbon fiber market is fragmented in nature with few players such as, DowAksa Advanced Composites Holding B.V, Formosa Europe, Solvay, TORAY INDUSTRIES, INC., Nippon Steel Corporation, Mitsubishi Chemical Group Corporation, SGL Carbon, Hyosung Co Public, Teijin Limited, and ZOLTEK which hold significant share of the market.

- The report proivdes strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the carbon fiber market.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global carbon fiber market.

Market Dynamics:

Growing demand in aerospace and automotive sectors is expected to drive the growth of the carbon fiber market. In the aerospace industry, carbon fiber composites are used in the construction of aircraft fuselages, wings, and interior components. These materials contribute to significant weight reduction, which in turn enhances fuel efficiency and reduces operating costs. Leading aircraft manufacturers like Boeing and Airbus have integrated carbon fiber into their newer models, such as the Boeing 787 Dreamliner and Airbus A350, both of which feature extensive use of carbon composites. In March 2024, Hexcel Corporation launched a new HexTow continuous carbon fiber, IM9 24K, providing the market with lightweight, strong, and durable carbon fiber with enhanced value for the world’s most advanced aerospace composite applications. The shift toward electric and hybrid vehicles has accelerated the demand for lightweight materials to offset the weight of battery systems and extend vehicle range. Carbon fiber is employed in body panels, structural reinforcements, and even interior components to help meet performance and efficiency goals. High-performance sports cars and luxury vehicles were early adopters of carbon fiber, but advancements in manufacturing processes are gradually making it more viable for mass-market vehicles. In June 2023, Dash-CAE unveiled the TR01 carbon fiber monocoque chassis, delivering superior performance in supercars and hypercars.

However, high production costs of carbon fiber are expected to hamper the growth of the carbon fiber market. One of the most significant restraints to the widespread adoption of carbon fiber is its high production cost, when compared to traditional materials such as steel and glass fiber. The manufacturing process of carbon fiber involves multiple intricate and energy-intensive steps. It begins with the production of the precursor material, typically polyacrylonitrile (PAN), which alone accounts for a substantial portion of the total cost. The precursor undergoes a complex series of processes, including stabilization, carbonization, surface treatment, and sizing. The manufacturing process of carbon fiber requires high temperatures and significant energy input, particularly during the carbonization stage. For a plant with a capacity of 3,000 tons per year, the production cost is estimated at $10.16 per kg, with energy costs being a major factor. Advanced machinery, skilled labor, and specialized software add to the overall production expense. Labor costs can contribute between 9.86% and 17.78% of the final product cost, depending on production scale and automation. The cost of industrial-grade carbon fiber was as high as $15 per pound, which is approximately $33 per kilogram. This high price was largely due to expensive raw materials, energy-intensive manufacturing processes, and the specialized technology required for production. However, advancements in production techniques and increased economies of scale have contributed to a notable reduction in costs over recent years. As a result, prices for industrial-grade carbon fiber have dropped to as low as $7 per pound, or about $15.40 per kilogram.

Segments Overview:

The carbon fiber market is segmented on the basis of raw material, type, form, end-use industry, and region. On the basis of raw material, the market is bifurcated into PAN-based carbon fiber, and pitch-based & rayon-based carbon fiber. On the basis of type, it is categorized into continuous, long, and short carbon fibers. On the basis of form the market is bifurcated into composite and non-composite carbon fibers. On the basis of end-use industry, the market is fragmented into aerospace & defense, sports/leisure, wind turbines, molding & compounds, automotive, pressure vessels, civil engineering, marine, pultrusion misc., misc. consumer, sailing/yacht building, and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

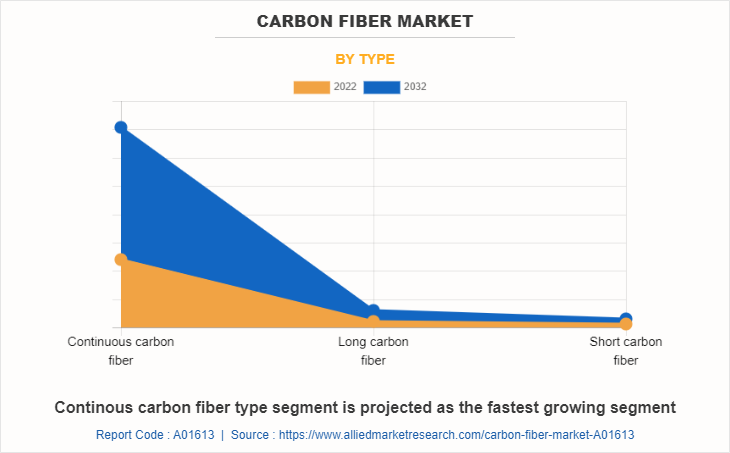

Carbon Fiber Market By Type

On the basis of type, the continuous carbon fiber segment dominated the global market in 2022 and is anticipated to grow at a CAGR of 11.4% during forecast period. The adoption of continuous carbon fiber has expanded due to advancements in automated manufacturing processes, such as automated fiber placement (AFP) and 3D printing with continuous fiber reinforcement. These technologies have made it easier to fabricate complex geometries with tailored strength characteristics. Furthermore, continuous carbon fiber is increasingly being used in the development of lightweight electric vehicles and next-generation aircraft, where fuel efficiency and performance are key drivers. In February 2025, space infrastructure company Sidus Space (Cape Cavaveral, Fla., U.S.) announced the successful launch and deployment of its LizzieSat satellite. It uses a flame-retardant 3D printing material from Markforged (Waltham, Mass., U.S.) known as Onyx FRA along with continuous carbon fiber to reinforce the satellite structure. The accuracy of the 3D printed parts is such that they can snap together, eliminating the need for metal screws.

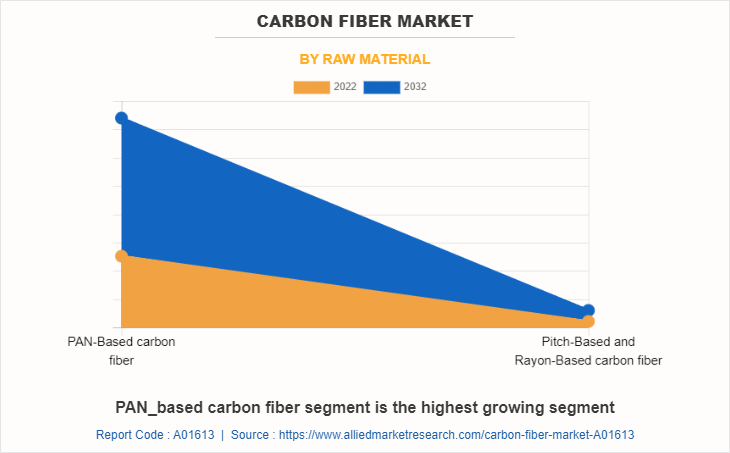

Carbon Fiber Market By Raw Material

On the basis of raw material, the PAN-based carbon fiber segment dominated the global market in 2022 and is anticipated to grow at a CAGR of 11.4% during forecast period. Polyacrylonitrile (PAN)-based carbon fiber is the most widely used type of carbon fiber globally due to its excellent balance of strength, stiffness, and durability. PAN serves as the primary precursor material in the production of high-performance carbon fibers. The carbonization process transforms the PAN polymer into a fiber composed primarily of carbon atoms aligned in a crystalline structure, which gives the material its exceptional mechanical properties. Projects like OSCAR are pioneering the development of 100% biobased PAN precursors derived from renewable resources such as glycerol (a biodiesel byproduct) and lignin (from the paper industry), aiming to reduce reliance on petroleum sources and enhance the sustainability of carbon fiber production.

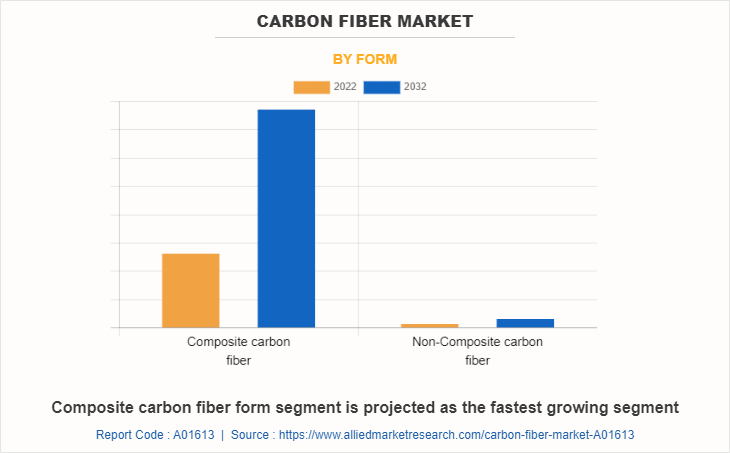

Carbon Fiber Market By Form

On the basis of form, the composite carbon fiber segment was the largest revenue generator in 2022, and is anticipated to grow at a CAGR of 11.4% during the forecast period. Composite carbon fiber is a high-performance material widely used across various industries due to its exceptional strength-to-weight ratio, durability, and versatility. It is composed of thin, strong crystalline filaments of carbon tightly woven together and embedded in a polymer matrix, typically epoxy resin, which acts as a binder to hold the fibers in place and distribute loads evenly. This combination results in a lightweight yet incredibly strong composite that outperforms traditional materials like steel and aluminum in many applications. In March 2023, Toray announced a $600 million investment to expand its composite carbon fiber production in South Korea and Japan, aiming to meet the growing demand from aerospace and automotive sectors. This move highlights the increasing reliance on carbon fiber composites in various industries. Moreover, the Defense Research and Development Organization (DRDO) developed the SWiFT, a stealth unmanned combat aerial vehicle (UCAV) constructed using lightweight carbon prepreg composites. The drone features integrated fiber-optic sensors for structural health monitoring and demonstrated autonomous landing capabilities, showcasing India's growing expertise in composite materials for defense applications.

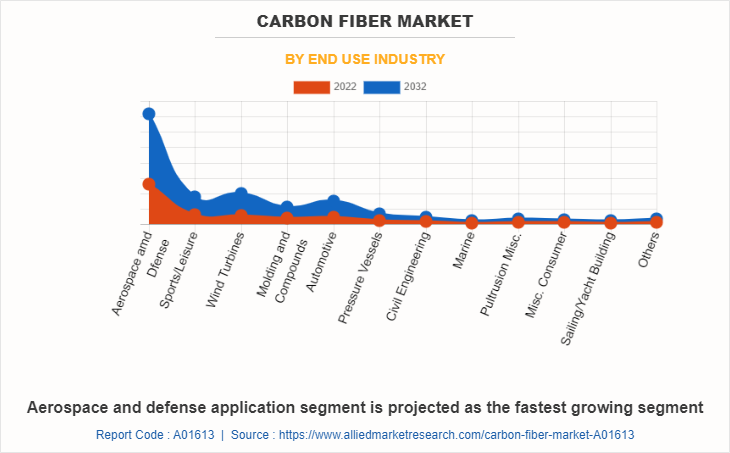

Carbon Fiber Market By End Use Industry

On the basis of end use industry, the aerospace and defense segment was the largest revenue generator in 2022, and is anticipated to grow at a CAGR of 10.6% during the forecast period. Carbon fiber has become an indispensable material in the aerospace and defense industries due to its exceptional strength-to-weight ratio, durability, and resistance to corrosion. In aerospace, reducing the weight of aircraft components is crucial for improving fuel efficiency, increasing payload capacity, and enhancing overall performance. Carbon fiber composites, which combine carbon fibers with resin matrices, provide these benefits by being significantly lighter than traditional metals like aluminum and steel while maintaining or even exceeding their strength. In March 2024, GE Aerospace announced over $650 million in investments to expand production capacities for LEAP and GE9X engines, supporting both commercial and defense sectors.

Carbon Fiber Market By Region

The Europe carbon fiber market size is projected to grow at the highest CAGR of 11.7% during the forecast period and accounted for 36% of carbon fiber market share in 2022. Europe is one of the leading regions in the adoption and application of carbon fiber across various industries due to its strong focus on innovation, sustainability, and advanced manufacturing. Germany stands out as a major hub for carbon fiber manufacturing and utilization. The country’s automotive industry, which includes global giants like BMW, Audi, and Mercedes-Benz, increasingly incorporates carbon fiber to reduce vehicle weight and improve fuel efficiency. In 2024, the EU introduced the Ecodesign for Sustainable Products Regulation (ESPR), mandating that by 2027, all new composite products must contain at least 30% recycled content. Non-compliance could result in fines up to 4.2% of annual revenue. This regulation has accelerated the adoption of recycled carbon fiber (rCF) in industries such as automotive and aerospace. Moreover, in August 2024, Teijin Carbon Europe celebrated the 40th anniversary of the laying of the foundation stone for production line 1 in Heinsberg-Oberbruch. This pioneering project paved the way for what is still the only industrial carbon fiber production facility in Germany.

Competitive Analysis:

The global carbon fiber market profiles leading players that include DowAksa Advanced Composites Holding B.V, Formosa Europe, Solvay, TORAY INDUSTRIES, INC., Nippon Steel Corporation, Mitsubishi Chemical Group Corporation, SGL Carbon, Hyosung Co Public, Teijin Limited, and ZOLTEK. The global carbon fiber market report provides in-depth competitive analysis as well as profiles of these major players.

- In October 2023, Toray Industries introduced TORAYCA™ T1200, the world's highest-strength carbon fiber at 1,160 kilopounds per square inch (Ksi). This development aims to reduce environmental footprints by lightening carbon-fiber-reinforced plastic materials, with applications ranging from aerospace to consumer products.

- In February 2024, Mitsubishi Chemical Group announced the development of a high heat-resistant ceramic matrix composite utilizing pitch-based carbon fibers. With heat resistance up to 1,500°C, this advanced material is expected to play a key role in space industry applications.

- In March 2025, Mercedes-AMG Petronas F1 Team showcased plans to use sustainable carbon fiber composites in their 2025 Formula 1 car, the W16. This initiative is part of their goal to achieve a net-zero carbon footprint by 2040.

Recent Key Developments in Carbon Fiber Market:

- In September 2024, China announced a five-year policy to strengthen its domestic carbon fiber industry, targeting an annual production capacity of 50,000 tons by 2028. This move highlights China's commitment to becoming a global leader in carbon fiber production.

- In February 2025, Apply Carbon announced a significant investment to strengthen the circular supply chain for carbon and aramid fibers. The company established a 16,500-square-meter recycling facility, producing over 2,500 metric tons annually, with plans to expand capacity to over 4,000 metric tons.

- In July 2024, startups like Arris Composites, 9T Labs, and Orbital Composites pioneered automated manufacturing processes for carbon fiber components. These innovations aim to reduce production costs and time, making carbon fiber more accessible for industries such as aerospace, automotive, and consumer electronics. For instance, Arris Composites collaborated with Airbus to replace metal brackets inside aircraft with carbon fiber components, thus enhancing performance and reducing weight.

Trump’s Tariff Impact on Carbon Fiber Market

President Donald Trump's reinstatement and escalation of tariffs in 2025 have significantly impacted the carbon fiber industry, particularly in the U.S. These measures, including a 10% universal tariff and reciprocal tariffs as high as 245% on imports from China, have disrupted global supply chains and increased costs for manufacturers reliant on imported materials.

In response to these tariffs, the U.S. manufacturers are increasingly focusing on domestic production of carbon fiber and related composites. Institutions like the University of Maine's Advanced Structures and Composites Center are leading research and development efforts to enhance sustainable composite materials. However, challenges such as limited infrastructure and raw material availability hinder the scalability of these domestic initiatives

Which Carbon Fiber Products Are Affected by Tariffs?

The tariff hikes primarily target industrial-grade carbon fiber used in aerospace, automotive, and construction sectors. Products such as prepregs (pre-impregnated composite fibers) and raw carbon fiber materials are subject to increased import duties. These changes disproportionately affect countries with high export volumes to the U.S., like Japan and Germany. According to 2024 trade data, Japan accounts for 31% of U.S. carbon fiber imports by value ($412 million annually), followed by Germany (24%, $318 million), China (17%, $226 million), and South Korea (9%, $119 million). Japanese suppliers like Toray Industries and Teijin, who specialize in aerospace-grade carbon fiber, face significant market disruption despite their long-standing quality reputation and established supply chains with the U.S. manufacturers.

Impact on Cost and Supply Chain

The higher import duties have led to:

Increased Costs: Carbon fiber prices have surged due to added tariffs, forcing manufacturers to reevaluate procurement budgets.

Supply Chain Disruptions: Importers face delays as they navigate new compliance requirements and adjust sourcing strategies.

Competitive Pressure: Domestic suppliers may benefit in the short term, but limited capacity could lead to bottlenecks.

For example, aerospace companies relying on imported carbon fiber for lightweight aircraft components are grappling with higher costs and potential delays in production schedules.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon fiber market analysis from 2022 to 2032 to identify the prevailing carbon fiber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon fiber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon fiber market trends, key players, market segments, application areas, and market growth strategies.

Carbon Fiber Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16 billion |

| Growth Rate | CAGR of 11.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 446 |

| By Type |

|

| By Raw Material |

|

| By Form |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Formosa Europe, TORAY INDUSTRIES, INC., ZOLTEK, Solvay, Nippon Steel Corporation, SGL Carbon, TEIJIN LIMITED., Mitsubishi Chemical Group Corporation, DowAksa |

Analyst Review

According to to CXOs of leading companies, the global carbon fiber market is expected to exhibit high growth potential due to rise in demand for lightweight, high-strength materials across various end-use industries such as aerospace & defense, automotive, and building & construction. Moreover, the surge in demand for lightweight, fuel-efficient cars encourages automotive manufacturers to adopt carbon fiber.

Carbon fibers enable the manufacturers to considerably reduce the weight of the vehicle without compromising on strength. The product is being utilized to produce a variety of automotive components, including interior body panels, floors, chassis components, diffusers, and spoilers.

The CXOs further added that aerospace-grade carbon fiber has progressively replaced traditional materials, on account of their lightweight and high-strength attributes. The product is being increasingly adopted in the production of a variety of aerospace components such as helicopter blades, fuselage components, aircraft flooring, and antennas. Thus, the rapid expansion of the automotive and aerospace industries across the developing economies, such as China, India, and Brazil, is expected to significantly contribute toward the growth of the carbon fiber market during the forecast period.

Carbon fiber is a strong and lightweight material composed of thin, strong crystalline filaments of carbon atoms. It is known for its exceptional strength-to-weight ratio, making it ideal for applications where high strength and low weight are essential.

Europe has accounted for thr largest regional market for carbon fiber market.

Governments and private enterprises are investing heavily in research and development to further improve carbon fiber properties and explore new applications. These investments have accelerated the development of advanced carbon fiber composites.

DowAksa, Formosa Europe, Mitsubishi Chemical Group Corporation, Nippon Steel Corporation, SGL Carbon, Solvay, TEIJIN LIMITED., TORAY INDUSTRIES, INC., ZOLTEK.

The carbon fiber market is segmented on the basis of raw material, type, form, end-use industry, and region. On the basis of raw material, the market is bifurcated into PAN-based carbon fiber, and pitch-based & rayon-based carbon fiber. On the basis of type, it is categorized into continuous, long, and short carbon fibers. On the basis of form the market is bifurcated into composite and non-composite carbon fibers.

The global carbon fiber industry generated $5.5 billion in 2022, and is estimated to reach $16 billion by 2032, witnessing a CAGR of 11.4% from 2023 to 2032.

Aerospace and defense sector is the leading application of carbon fiber market.

Loading Table Of Content...

Loading Research Methodology...