Carbon Steel Market Research, 2032

The global carbon steel market size was valued at $0.9 trillion in 2022, and is projected to reach $1.3 trillion by 2032, growing at a CAGR of 3.6% from 2023 to 2032.

Report key highlighters

- Quantitative information mentioned in the global carbon steel market includes the market numbers in terms of value (USD Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on product, type, and end-user. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including AK Steel International B.V., ArcelorMittal S.A., Daido Steel Co., Ltd., Dongbei Special Steel Group International Trade Co., Ltd., HBIS Group Co., Ltd., Kobe Steel, Ltd., Marcegaglia, Nippon Steel Corporation, NLMK, and United States Steel Corporation, hold a large proportion of the carbon steel market.

- This report makes it easier for existing market players and new entrants to the carbon steel business to plan their strategies and understand the dynamics of the carbon steel market industry, which ultimately helps them make better decisions.

Steel and an alloy with a minimum of 2.1% carbon content are called carbon steel. High, medium, and low carbon steel make up the three main classifications for carbon steel. Carbon steels often have low compressive strength and are soft. However, they have high ductility, making them perfect for welding and machining and being naturally cheap. Low-carbon steels are used in food cans, pipes, food structures such as angle iron and I-beams, automobile body parts, and building and bridge parts. Railway rails, train wheels, and equipment requiring great strength, wear resistance, and toughness are frequently made of medium-carbon steel. High-carbon steels are used in cutting tools, springs, and high-strength wire due to their excellent wear resistance and hardness.

Alloying, quenching, and martempering may be used to improve the characteristics of carbon steel. It includes spheroidizing and other operations. Specific carbon steel may temper carbon steel in various end-user industries. Carbon steel has a reduced weldability factor with a high carbon content. However, adding carbon to steel makes it more robust and harder, making it a sought-after commodity for manufacturers in the construction and automotive industries.

Carbon steel infrastructures have seen an upsurge in investment. The constant need for building materials such as beams, angles, wire rods, and bars that are anticipated to be driven by development projects in India and ASEAN across the globe is anticipated to boost the expansion of the market. It is expected that the expenditure for repair and rehabilitation anticipated account for a significant share of the total figures. It is expected to result in a considerable scope of demand being generated for carbon steel products. In the years to come, several producers are projected to place a greater emphasis on recycling carbon steel to satisfy the rise in demand, and to cut down on emissions and ensure longer-term sustainability.

Expanding automobile industry and increase in demand for carbon steel in the automobile industry drives the growth of the market. The demand for carbon steel is driven by the consistent expansion of the automotive sector in countries worldwide. Moreover, this expansion is also a vital driver of the revenue growth that the market is seeing. The automobile sector uses carbon steel that has a high percentage of carbon and is quenched after heat treatment to achieve enhanced durability.

High Carbon Steel has a lower ductility and a greater tendency toward brittleness (AHSS) compared to advanced high strength steel. However, these materials are employed for various manufacturing applications, including the production of tools and metal fasteners as these steels are resistant to abrasion. In the automotive industry, these are utilized in producing a wide variety of components, including door panels, bushings, door frames, and chassis, amongst other things.

The complex manufacturing process and use is a significant element that is anticipated to limit market revenue growth. Carbon steel presents a challenging working environment due to its tremendous strength and brittleness. Its use is restricted in several applications due to the material difficulties in being twisted and molded into different shapes. Corrosion and rust are more expected to occur in carbon steel than in other types of steel. Manufacturers give steel a chromium coating to provide the appearance of "stainless steel," typically between 10% and 12%. The protective layer of chromium covering the substance protects the steel from moisture and subsequent corrosion. However, due to the absence of chromium in carbon steel, extended moisture exposure might result in rusting.

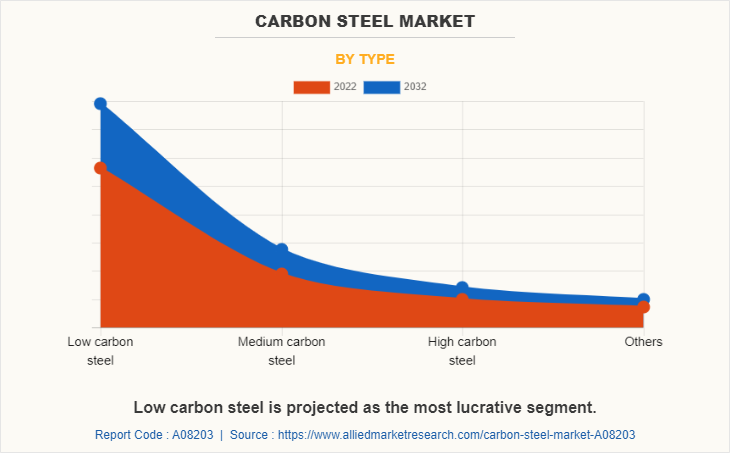

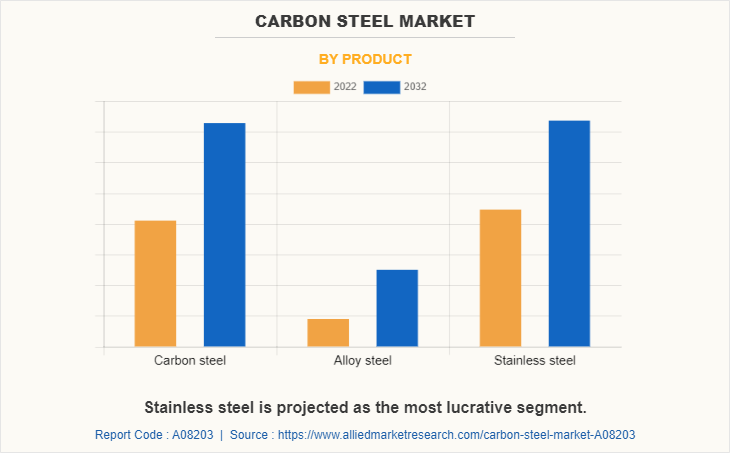

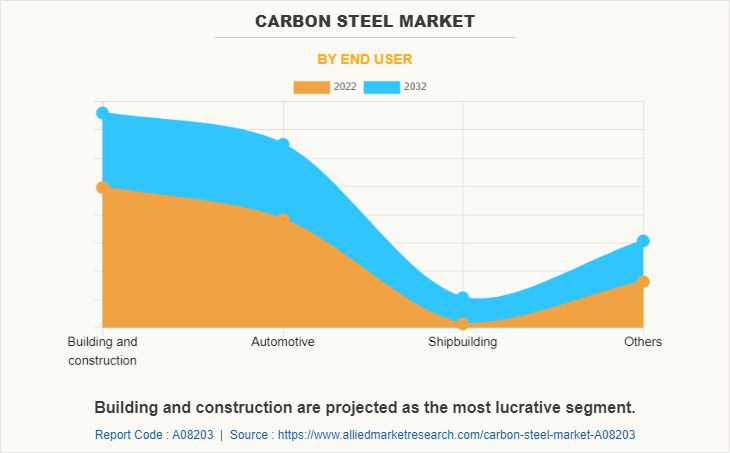

The carbon steel market is divided on the basis of type, product, end-user, and region. On the basis of type, the market is classified into low carbon steel, medium carbon steel, high carbon steel, and others. On the basis of product, the market is classified into carbon steel, alloy steel, and stainless steel. On the basis of the end-user, the market is segregated into building and construction, automotive, shipbuilding, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global carbon steel market are AK Steel International B.V., ArcelorMittal S.A., Daido Steel Co., Ltd., Dongbei Special Steel Group International Trade Co., Ltd., HBIS Group Co., Ltd., Kobe Steel, Ltd., Marcegaglia, Nippon Steel Corporation, NLMK, and United States Steel Corporation. These players have adopted various key strategies including agreement, collaboration, expansion, and partnership to increase their carbon steel market shares.

The low carbon steel segment is leading by type. The use of low carbon steel, or mild steel, is driven by several compelling factors that contribute to its widespread adoption and popularity in various industries. One of the primary driving factors is its excellent weldability. Low carbon steel has a lower carbon content, which reduces the likelihood of cracking and distortion during welding.

The stainless steel segment is leading by product. The use of stainless steel in the carbon steel market is driven by several compelling factors that contribute to its growth in prominence and demand. One of the primary driving factors is stainless steel superior corrosion resistance.

The building and construction segment dominated the global market. The use of carbon steel in building and construction is influenced by several emerging trends and opportunities that present potential for its continued growth in the industry. One prominent trend is the focus on sustainable construction practices and materials. Carbon steel, being highly recyclable, aligns with the principles of sustainability.

Region-wise, Asia-Pacific dominated the market. One of the primary driving factors is the rapid industrialization and urbanization in countries across Asia-Pacific. As economies in the region continue to develop, there is a significant demand for carbon steel in various industries such as construction, automotive, and manufacturing.

Key Developmental Strategies Undertaken by Key Players

- In 2021, Nippon Steel & Sumitomo Metal Corporation announced a new business strategy called “NSSMC Beyond 2022” aimed at expanding its business globally and strengthening its competitiveness in the market. This expansion will boost the carbon steel market growth.

- In 2020, ArcelorMittal S.A. announced its plans to invest around $500 Million in a new steel plant in Mexico. The investment was aimed at expanding ArcelorMittal S.A. presences in the North American market and strengthening its product portfolio.

- In 2020, U.S. Steel Corporation announced a $1.2 Billion investment to construct a new sustainable endless casting and rolling facility in Pennsylvania. The investment was aimed at improving operational efficiency of the companies and reducing their environmental footprint.

- In 2020, Tata Steel announced its plans to acquire the remaining 25.1% stake in Tata Steel BSL Limited, a subsidiary of Tata Steel, for $321 Million. The acquisition was aimed at strengthening Tata Steel position in the Indian market and expanding its product portfolio.

- In 2020, China Baowu Steel Group Corp., Ltd. announced its plans to merge with Magang (Group) Holding Co., Ltd. The merger was valued at around $2.8 Billion and aimed to expand China Baowu product offerings and strengthen its competitiveness in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon steel market analysis from 2022 to 2032 to identify the prevailing carbon steel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon steel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon steel market trends, key players, market segments, application areas, and market growth strategies.

Carbon Steel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1306.6 billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 354 |

| By Type |

|

| By End user |

|

| By Product |

|

| By Region |

|

| Key Market Players | Marcegaglia, Kobe Steel, Ltd., NLMK, United States Steel Corporation, ArcelorMittal, Nippon Steel Corporation, Dongbei Special Steel Group International Trade Co., Ltd., HBIS Group Co., Ltd., AK Steel International B.V., Daido Steel Co., Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies. Iron and carbon make up the majority of the alloy that is carbon steel, with trace amounts of manganese, silicon, and copper. For many different applications, including those in the construction, automotive, and aerospace industries, carbon steel is widely employed in the manufacturing industry. The demand for lightweight and strong materials in the automotive and aerospace industries, as well as rise in construction activity, are the main drivers of the expansion of the global carbon steel market.

One of the main final customers of carbon steel is the construction sector. The construction sector is expected to expand due to increased government spending on infrastructure development, particularly in developing nations such as India and China. The need for carbon steel in construction applications such as beams, columns, and reinforcement bars are expected to increase as the global construction sector.

In addition, a significant end-user of carbon steel is the automotive industry. Lightweight materials are being used increasingly in the automotive industry to increase fuel efficiency and cut carbon emissions. Carbon steel is a desirable material due to its high strength and inexpensive price compared to other lightweight materials such as aluminum and magnesium. The demand for carbon steel in the automotive industry is expected to increase in response to the growing popularity of electric cars (EVs).

The steel industry continues to innovate and develop advanced manufacturing processes and steel grades. This includes the production of high-strength, corrosion-resistant, and formable carbon steel grades. Technological advancements help meet the evolving needs of various industries and expand the applications of carbon steel.

Building and construction are the potential customers of carbon steel market industry.

Asia-Pacific region will provide more business opportunities for the carbon steel market in the coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

AK Steel International B.V., ArcelorMittal S.A., Daido Steel Co., Ltd., Dongbei Special Steel Group International Trade Co., Ltd., HBIS Group Co., Ltd., Kobe Steel, Ltd., Marcegaglia, Nippon Steel Corporation, NLMK, and United States Steel Corporation are the top players in carbon steel market.

Loading Table Of Content...

Loading Research Methodology...