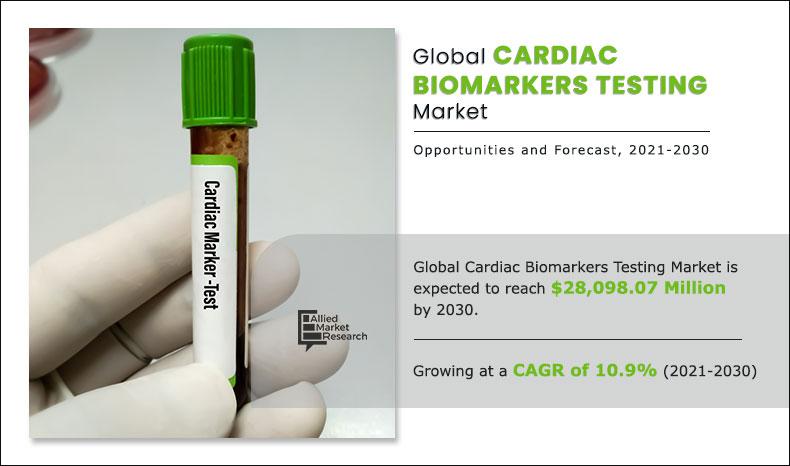

Cardiac Biomarkers Testing Market Research, 2030

The global cardiac biomarkers testing market size was valued at $9,766.93 million in 2020, and is projected to reach $28,098.07 million by 2030, registering a CAGR of 10.9% from 2021 to 2030. Cardiac biomarkers are protein molecules that are released into the blood after heart damage or heart-stress. These biomarkers act as a potential tool to detect various cardiovascular diseases (CVD) including cardiac ischemia, myocardial infarction, congestive heart failure, and acute coronary syndrome (ACS). Cardiac biomarker tests allow the doctor to determine the risk of a patient associated with such diseases.

These tests are performed after the patient suffers chest pain. The common cardiac biomarkers that are tested for CVD include troponin, creatine kinase-muscle/brain (CK-MB), B-type natriuretic peptide (BNP), high-sensitivity C-reactive protein (hs-CRP), and others. Cardiac biomarkers that are widely used as an integrated diagnostic approach for cardiovascular diseases (CVDs) include myocardial muscle creatine kinase (CK-MB), troponin I and T, myoglobin, brain natriuretic peptide (BNPs), ischemia modified albumin (IMA), and others.

The impact of COVID-19 pandemic is expected to remain positive for the cardiac biomarkers testing industry. Owing to increase in the number of COVID-19 patient with preexisting medical condition like cardiovascular diseases and among others. As these patients with existing medical conditions like cardiovascular disease suffering from COVID-19 are more heart attack. Furthermore, it was estimated that troponin levels were significantly higher in COVID-19 patients who died or were critically ill. This has led to increase in the demand of cardiac biomarker testing for the patients suffering from COVID-19. Thus, considering all these factors, the global cardiac biomarkers testing market exhibits positive growth during this pandemic and is expected to gain traction in the upcoming years.

Increase in geriatric population and rise in number of patients suffering from heart attacks & chest pain due to changes in lifestyles are expected to drive the market in the coming years. Furthermore, rise in funding from public and private organizations for research on cardiac biomarkers is expected to boost the market growth in the upcoming years. However, factors such as limited specificity in some cases and side effects associated with cardiac biomarkers such as skeletal muscle injury are likely to hinder the cardiac biomarkers testing market growth in the upcoming years.

Global Cardiac Biomarkers Testing Market Segmentation

The cardiac biomarkers testing market is segmented on the basis of biomarker type, application, and location of testing. By cardiac biomarker type, the market is divided into creatine kinase (CK-MB), troponins, myoglobin, natriuretic peptides (BNP and NT-proBNP), ischemia modified albumins, and other biomarkers type. By application, the market is classified into myocardial infarction, congestive heart failure, acute coronary syndrome, atherosclerosis, and others. By location of testing, the market is bifurcated into point of care testing and laboratory testing. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Cardiac Biomarker Type

By cardiac biomarker type segment, the troponin segment held the largest share in 2020 and is anticipated to maintain its dominance during the forecast period. This large share is due to increase in the prevalence of acute coronary syndrome and myocardium infarction, rise in the number of congestive heart failure cases across the globe are the key factors to drive the market growth. The creatine kinase is estimated to grow at the highest CAGR 13.0% during the forecast period.

By Biomarker Types

Troponin segment dominated the market in 2020 and will continue to maintain the lead over the forecast period.

By Application

By application, the market is segmented into myocardial infarction, congestive heart failure, acute coronary syndrome, atherosclerosis, and others. The myocardial infarction accounted for the larger share in 2020, whereas, congestive Heart Failure segment is the faster growing segment with a CAGR of 12.2% owing to increase in cardiovascular disease and increased demand for biomarker tests for early detection of heart failure are key factors anticipated to boost the growth of the global cardiac biomarkers testing market in future.

By Application

Myocardial infarction segment held the dominant position in 2020 and would continue to maintain the lead over the forecast period.

By Location of Testing

On the basis of location of testing, the laboratory testing segment held the largest share in 2020 and is anticipated to maintain its dominance during the forecast period, owing to the reform in healthcare infrastructure, increase in healthcare spending, rise in disposable incomes, and government initiatives for preventing heart attack are expected to drive the cardiac biomarkers testing market in the Asia-Pacific region. Thus, the increase in cardiovascular diseases (CVDs) around the globe, has augmented the demand for cardiac biomarkers testing for lowering the burden of heart attack and other CVDs.

By Location Of Testing

Laboratory testing segement held a dominant position in 2020 and continue to maintain lead in the forecast year

By Region

By region, North America accounted for the largest share in 2020, and is anticipated to maintain its dominance from 2020 to 2030, due to high expenditure on R&D, presence of major players & their product availability, and well-established healthcare infrastructure in the region. However, Asia-Pacific is expected to register the highest CAGR of 12.5% during the forecast period, as Governments of Asian countries are investing in the development of healthcare infrastructure.

By Region

Asia-Pacific region would exhibit the highest CAGR of 12.50% during 2020-2028.

Competitive Analysis

Some of the key players operating in the global cardiac biomarkers testing market include Abbott Laboratories, Becton, Dickinson and Company, bioMerieux, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., PerkinElmer Inc., Siemens AG, Thermo Fisher Scientific, Inc., and Tosoh Corporation.

Key Benefits For Stakeholders

- This report entails a detailed quantitative analysis along with the current global cardiac biomarkers testing market trends from 2020 to 2030 to identify the prevailing opportunities along with the strategic assessment.

- The cardiac biomarkers testing market forecast is studied from 2020 to 2030.

- The market size and estimations are based on a comprehensive analysis of key developments in the cardiac biomarkers testing industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the cardiac biomarkers testing market.

Cardiac Biomarkers Testing Market Report Highlights

| Aspects | Details |

| By BIOMARKERS TYPE |

|

| By Application |

|

| By Location Of Testing |

|

| By Region |

|

| Key Market Players | F. HOFFMANN-LA ROCHE LTD., THERMO FISHER SCIENTIFIC, INC., ABBOTT LABORATORIES, DANAHER CORPORATION, BECTON, DICKINSON AND COMPANY, PERKINELMER INC., TOSOH CORPORATION, BIOMERIEUX, INC., SIEMENS AG, BIO-RAD LABORATORIES, INC. |

Analyst Review

In accordance to several interviews conducted, the cardiac biomarkers testing market is expected to witness a steady growth in the future. Owing to development of novel and advanced cardiac biomarkers such as, troponin and myoglobin that would help in early detection of cardiac disorders is a major factor that boosts the market growth for cardiac biomarkers. This has increased the adoption of cardiac biomarkers across the world. Decrease in the cost of medical devices and increase in awareness for early diagnosis & prognosis of cardiac diseases have offered lucrative opportunities for the growth of the cardiac biomarkers market. Moreover, cardiac biomarkers find their application in list of chronic to mid cardiovascular conditions, which fuel their adoption across the globe, thereby propelling the market growth. The adoption of cardiac biomarkers has increased considerably, owing to their easy operational features and increase in awareness for early disease diagnosis is expected to boost the market growth in the near future.

The total market value of Cardiac Biomarkers Testing Market was $9,766.93 million in 2020

The forecast period in the report is from 2021 to 2030

The CAGR of Cardiac Biomarkers Testing Market during the forecast period is 10.9%.

The base year for the report is 2020

Yes, Cardiac Biomarkers Testing Market companies are profiled in the report

The top companies that hold the market share in Cardiac Biomarkers Testing Market are are Abbott Laboratories, Becton, Dickinson and Company, BioMerieux, Inc., Bio-Rad Laboratories, Inc., and Danaher Corporation.

yes, there is value chain analysis provided in the Cardiac Biomarkers Testing Market report

The key trends in the Cardiac Biomarkers Testing Market are due to rise of prevalence of cardiac diseases that widely remain undiagnosed and rise in geriatric population.

Loading Table Of Content...