Cardiac Monitoring & Cardiac Rhythm Management Market Overview:

Global Cardiac Monitoring & Cardiac Rhythm Management Market size was valued at $19,397 million in 2015 and is expected to reach $32,216 million by 2022, growing at a CAGR of 7.6%. The volume market is poised to grow at a CAGR of 13.6% from 2016 to 2022. Cardiac monitoring (CM) devices help in continuous examination of a patient’s cardiac activity. Cardiac rhythm management (CRM) devices maintain normal cardiac rhythm in patients suffering from rate and rhythm disorders of the heart. These devices play a crucial role in the treatment of serious cardiac disorders, including heart failure, atrial fibrillation, atrial flutter, indications of recent heart attack, coronary ischemia, lack of oxygen supply to cardiac muscles, effects of drugs, and certain genetic errors among others.

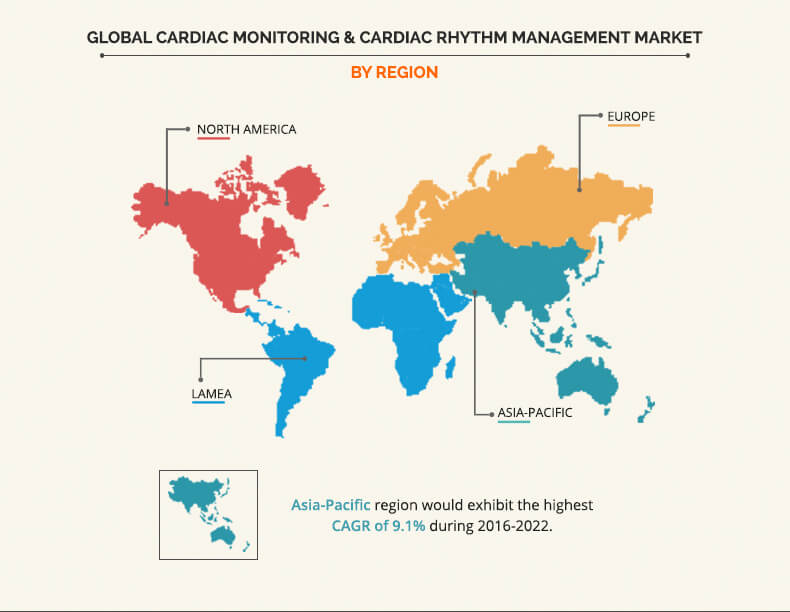

The market is driven by factors such as growing incidence of cardiac disorders, technological advancements, patient awareness, and increasing number of unmet medical needs in developing and underdeveloped countries. Conversely, the market is hampered by limited insurance coverage options; high cost of these devices, especially in developing nations; and preference for drugs over treatment devices. However, the development of new MRI-labeled devices and growth opportunities in the emerging economies of Asia-Pacific and LAMEA regions are expected to provide opportunities for growth of cardiac monitoring & cardiac rhythm management industry during the forecast period.

Cardiac monitoring & cardiac rhythm management industry includes a large number of small and large manufacturers at regional as well as global level. The market is consolidated with two large players namely General Electric Company (GE) and Koninklijke Philips N.V., These two players dominate the overall cardiac monitoring devices market.

Segment Review:

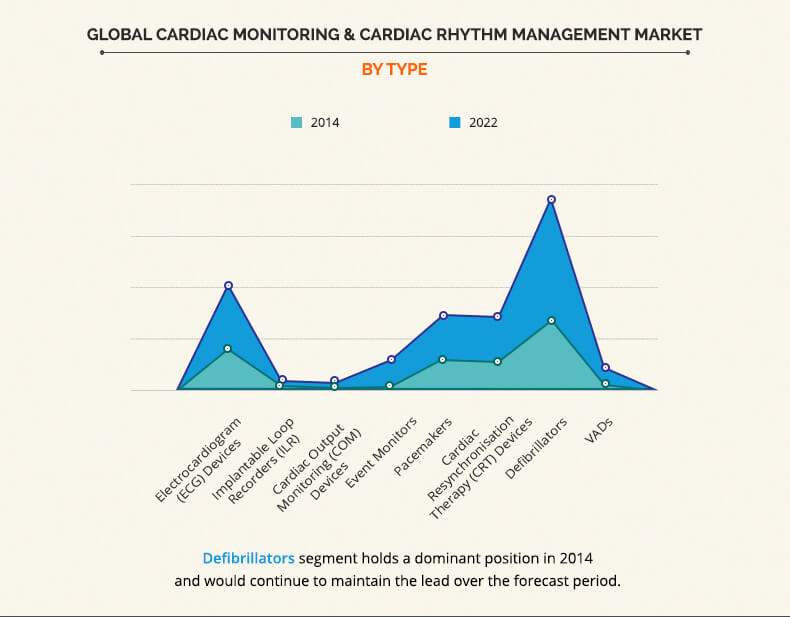

The defibrillators segment accounted for the largest market share in 2015. Increasing adoption of technologically advanced defibrillators, growing demand for quality medical care, and high incidence of sudden cardiac arrest (SCA) and cardiovascular diseases (CVDs) are the drivers of the defibrillators market. In addition, increasing focus of public & private organizations and key market players on public access defibrillators, and increasing number of training & awareness programs across the globe fuel the market growth. Moreover, promoting innovation in next generation external defibrillators to improve safety and effectiveness, enhancing the ability of industry, identifying and addressing problems associated with devices by the FDA, and focusing on the SCA are anticipated to create lucrative opportunities for the global defibrillators market.

Brazilian Cardiac Monitoring & Cardiac Rhythm Management Market, Snapshot

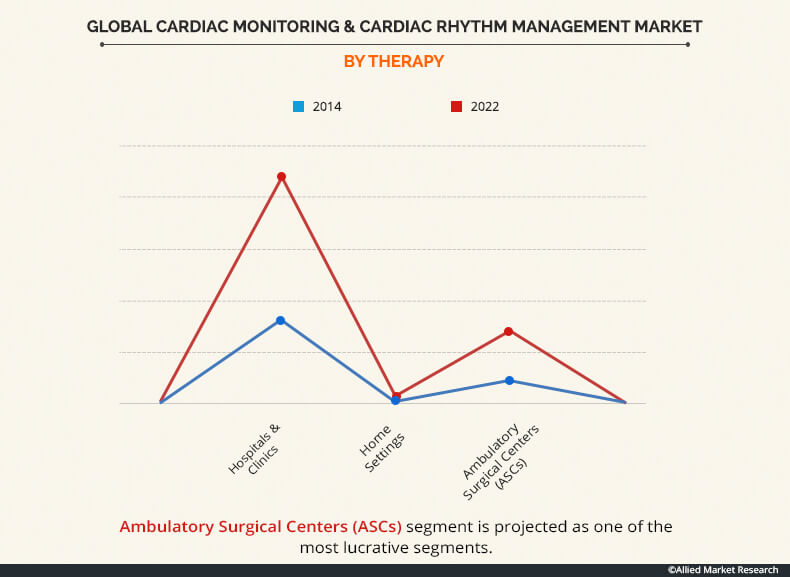

Increasing focus of market vendors on the emerging markets, namely Asia-Pacific and LAMEA regions, is expected to boost the market growth. For instance, key players, namely GE Healthcare and Philips Healthcare have heavily invested in the development of their infrastructure, such as R&D centers and production facilities in the emerging countries in the last few years to provide low-cost treatment devices in this region. This has boosted cardiac monitoring market in the region. The market in Brazil is primarily driven by the rising incidence of cardiac disorders coupled with rapidly growing geriatric patient population. This is evident from an article published in the Journal of the American College of Cardiology 2013, which stated that the estimated prevalence rate of heart failure in Latin America ranges from 64 to 69%. Growth in cardiac rhythm management devices market would also lead to growth in cardiac monitoring devices market as a patient with rhythm disorder would require monitoring as well. The diagnosis of cardiac abnormalities, monitoring, and treatment is expected to be a lucrative area of investment for market players in future, owing to the increasing number of technological advancements in cardiac monitoring & cardiac rhythm management devices. This is expected to provide stellar opportunities to the market growth in the future.

Top Impacting Factors

Growing Incidence of Cardiac Disorders

Geriatric population face various cardiac problems, which leads to heart failures, thereby increasing the demand for pacemakers, ventricular assisted devices (VADs), electrocardiogram (ECG), and implantable cardioverter defibrillators (ICDs). The use of these devices to treat cardiac diseases has increased due to the rise in fatalities due to heart failure and other cardiac abnormalities across the globe. Therefore, this factor has a prominent impact on the growth of CM and CRM devices market.

Technological Advancements

The impact of this factor has a significant effect on increasing the adoption of novel devices, as the market is highly driven by the technological innovation implemented in this sector. Moreover, increase in cardiac diseases is projected to boost the demand for effective treatment solutions. Thus, this factor is expected to continue to have a significant impact on the growth of CM and CRM devices market during the forecast period.

Increasing Patient Awareness

The impact of this factor has affected the market growth in emerging economies, as the adoption of advanced treatment devices is low these regions. There are several innovative and implantable-assisted products available in the market; however, the surgeons and patients in the underdeveloped economies are not well-aware about the devices, thereby hindering the market growth. The impact of this factor is likely to reduce in the future, as manufacturers have collaborated with government hospitals to spread awareness about novel cardiac monitoring & cardiac rhythm management devices.

Presence of High-Unmet Medical Needs

The key players of the market have launched technologically advanced devices in the developing and underdeveloped economies. For instance, Boston Scientific Corporation have tried to obtain a regulatory approval for its S-ICD system to market it across Asia, Middle East, and Africa. The key manufacturers have collaborated with government bodies to provide effective and innovative cardiac solutions. In addition, the government and private sector authorities have strived to provide favorable reimbursement schemes for treatment of cardiac disorders in developing and underdeveloped economies. Moreover, the increase in awareness, disposable incomes, and approvals for technologically advanced devices are expected to further continue to have huge impact on the market during the forecast period.

Limited Insurance Coverage and High Cost of Devices

Technologically advanced cardiac monitoring & cardiac rhythm management devices, such as wireless pacemakers, leadless pacemakers, MRI compatible devices, biocompatible materials, miniaturized devices, and durable batteries, are readily available in the market, especially in developed regions, for the treatment of heart ailments. However, high cost of these devices has a negative impact on the market growth, due to their lower adoption and less number of procedures involving the usage of these devices. The adoption of these devices is low in developing and underdeveloped economies, owing to the high cost of these. However, the impact of this factor is expected to decrease in the near future, as the companies plan to develop affordable cardiac monitoring & cardiac rhythm management devices.

Preference for Drugs

The impact of this factor is currently affecting the market growth, as the adoption of these devices depends on consumer preferences and behavior. However, the impact of this factor is expected to reduce in the near future, as the manufacturers have collaborated with government hospitals to spread awareness about the current treatment patterns with improved devices. In addition, the impact of this factor is projected to be low on the market growth, as drugs cannot be used for heart monitoring.

Key Benefits:

- The study provides an in-depth analysis of cardiac monitoring & cardiac rhythm management market along with current trends and future estimations to elucidate the imminent investment pockets.

- The report provides a quantitative analysis for the period of 20142022 to enable stakeholders to capitalize on the prevailing opportunities in CM and CRM devices market.

- Extensive analysis of the market based on product helps in understanding the type of devices used for treating blockages associated with chronic diseases.

- Competitive intelligence highlights the business practices followed by leading players across various regions.

- Comprehensive analysis of all geographical regions helps in determining the prevailing opportunities in these regions.

- Key market players and their strategies are analyzed to understand the competitive outlook of the global market.

- Extensive analysis of the market is conducted by following key product positioning and monitoring the top contenders within the market framework.

Cardiac Monitoring & Cardiac Rhythm Management Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By END USER |

|

| By GEOGRAPHY |

|

| Key Market Players | MEDTRONIC PLC, NIHON KOHDEN CORPORATION, ST. JUDE MEDICAL, INC., CARDIAC SCIENCE CORPORATION, SCHILLER AG, KONINKLIJKE PHILIPS N.V., RELIANTHEART, INC., HILL-ROM HOLDINGS, INC., BOSTON SCIENTIFIC CORPORATION, JARVIK HEART, INC., ABIOMED, INC., BIOTRONIK SE & CO. KG, LIVANOVA PLC, GENERAL ELECTRIC COMPANY, BERLIN HEART GMBH |

Analyst Review

Globally cardiac disorders constitute a high proportion of health and economic burden; hence monitoring of activities of the heart and management of normal heart rhythm is vital to ensure that the patient has a well-functioning heart. Therefore, the cardiac monitoring and cardiac rhythm management market will observe a significant rise in the upcoming years. These devices are used to cure and monitor several serious cardiac disorders, including heart failure, atrial fibrillation, atrial flutter, indications of recent heart attack, coronary ischemia, lack of oxygen supply to cardiac muscles, effects of drugs, and certain genetic errors among others.

The rise in incidence of sudden cardiac arrest (SCA) has led to an increase in the use of defibrillators, thereby increasing the market share for defibrillators in the total market. In addition, increase in adoption of technologically advanced defibrillators, growth in demand for quality medical care, increase in focus of public organizations, private organizations, and key market players on public access defibrillators; and increase in number of training and awareness programs across the globe also lead to the growth of defibrillators market.

Cardiac monitoring is an essential part of treatment of any cardiac patient and ECG is one of first tests conducted during the examination of a patients heart. Therefore, ECG devices also occupy a significant share in the total market. In addition, ECG provides a cost-effective, minimally invasive method for the diagnosis of a variety of cardiac abnormalities; therefore, it is generally preferred by physicians and patients.

Geographically, the Asia-Pacific market offers lucrative growth opportunity due to increase in demand for advanced health care services in the emerging economies (such as India and China) and increase in prevalence of cardiac disorders coupled with rise in elderly population in these nations. Thus, the emerging markets have a huge potential for the market growth in the cardiac monitoring & cardiac rhythm management area.

Loading Table Of Content...