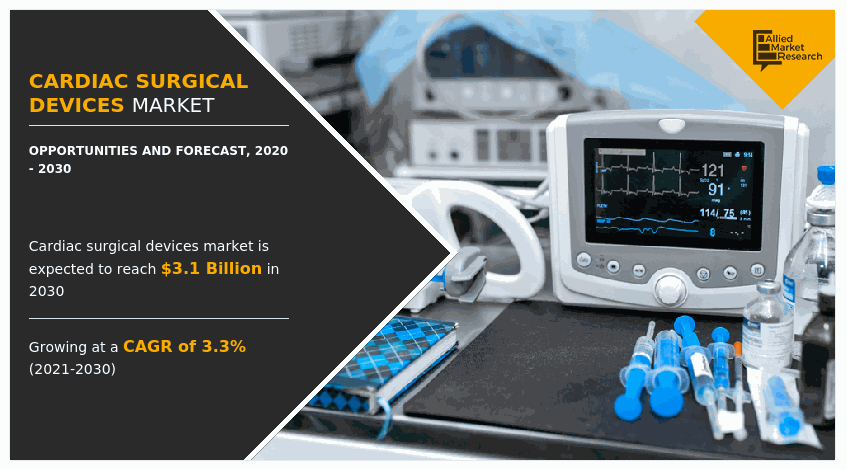

Cardiac Surgical Devices Market Research, 2030

The global cardiac surgical devices market was valued at $2.2 billion in 2020, and is projected to reach $3.1 billion by 2030, growing at a CAGR of 3.3% from 2021 to 2030. Cardiac surgery is the process performed to cure the heart tissue defects such as replacing the diseased heart valves (if blocked), grafting, or replacement of heart tissues in case of damage. There are two major types of heart surgeries performed—closed and open. Cardiac surgical device is used to treat heart complications, including valvar and congenital heart diseases. They are utilized in the diagnosis and treatment of heart illnesses and heart-related disorders all across the world. Cardiovascular disease or CVD is one of the most common cause of pain in medical applications across the globe. Furthermore, these devices aid in healing of structural problems in the circulatory system of heart, including damaged or clogged valves and arteries. Furthermore, with diseases, such as stroke and ischemic heart disease(IHD) contributing significantly to death and disability, cardiovascular surgical devices and their implications in heart-related therapy have surged in recent years.

Increase in prevalence of cardiac diseases, diabetes, and lifestyle disorders are some important factors which drives the cardiac surgical devices market growth. In addition, surge in the geriatric population with rising co-morbidities, increase in sedentary lifestyles, rise in excessive cigarette use, and increase in the number of people suffering from obesity further fuel growth of the market. However, high cost of procedures associated with cardiac surgeries and injuries caused in the latter stage hinders the growth of cardiac surgical devices market forecast. Conversely, increase in life expectancy and sudden treatment of cardiac injuries are expected to offer cardiac surgical devices market opportunity during the forecast period.

The outbreak of COVID-19 disrupted workflow in healthcare sector across the globe. The COVID-19 outbreak negatively impacted the growth of global cardiac surgical devices industry. The implementation of lockdown delayed the heart surgeries, for instance the data by NCBI declares 37% decrease in surgical cases during the pandemic which hinder the growth of cardiac surgical devices industry during pandemic.

The COVID-19 pandemic impacted the healthcare systems across the globe and increased the need for advanced hospitals. Many hospitals across the globe, including diagnostic centers were restructured to increase the hospital capacity for patients diagnosed with COVID-19. This cancelled many non-essential surgical procedures and quality of care declined toward patients other than COVID-19. This significantly hampered the growth of the global cardiac surgical market.

Cardiac Surgical Devices Market Segmentation

The global cardiac surgical devices market is segmented on the basis of product type, application, and age group. According to product, it is fragmented into beating heart surgery systems, cardiopulmonary bypass equipment, cardiac ablation devices, and perfusion disposable. Depending on application, it is categorized into congenital heart defects, cardiac arrhythmia, coronary heart disease, and congestive heart failure. As per the age group, it is categorised into new-born population (0-30 days), infant population (31 days-1 year), children population (1-18 years), and adult population (18+ years). Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

Based on product, it is bifurcated into beating heart surgery systems, cardiopulmonary bypass equipment, cardiac ablation devices, and perfusion disposable. The perfusion disposable segment dominated the cardiac surgical devices market share in 2020, and is anticipated to continue this trend in the forecast period, owing to increase in prevalence of coronary artery bypass grafting and heart valve replacement surgeries.

By Product Type

Perfusion Disposable segment held the major share of 3% throughout the forecast period.

By application, it is segmented into congenital heart defects, cardiac arrhythmia, coronary heart disease, and congestive heart failure The cardiac arrhythmia segment dominated the global cardiac surgical devices market size in 2020, and is anticipated to continue this trend during the forecast period, owing to increasing life expectancy and atrial fibrillation.

By Application

Cardiac Arrhythmia segment would witness the fastest growth, registering a CAGR of 3% during the forecast period.

As per the age group, it is divided into new-born population (0-30 days), infant population (31 days-1 year), children population (1-18 years), and adult population (18+ years). The adult segment dominated the global market in 2020, and is anticipated to continue this trend during the forecast period, owing to increase in prevalence of coronary artery diseases, initiatives taken by governments for development of medical infrastructure, rise in awareness regarding treatment & management of disease, and surge in sedentary life style.

By Age Group

Adult Population segment held the major share of 3% throughout the forecast period.

Region wise, North America dominated the cardiac surgical devices market size, in terms of revenue among other regions in 2020, owing to rise in cardiac surgeries and emergency ambulatory in North America.

On the other hand, Asia-Pacific was the third-largest contributor in the cardiac surgical devices market share in 2020, and is expected to register the fastest CAGR during the forecast period, owing to increase in diabetes, rise in healthcare facilities, and technological advancements.

The key players operating in the market include Edwards Life Science, Medtronic Inc., MAQUET GmbH & Co. KG, Quest Medical, Inc., Abbott Vascular, LivaNova PLC, Terumo Cardiovascular Systems Corporation, Boston Scientific Corporation, Cook Medical, and Angiodynamics, Inc

By Region

North America held largest share in the global market in 2020.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cardiac surgical devices market analysis from 2020 to 2030 to identify the prevailing cardiac surgical devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cardiac surgical devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cardiac surgical devices market trends, key players, market segments, application areas, and market growth strategies.

Cardiac Surgical Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 3.1 billion |

| Growth Rate | CAGR of 3.3% |

| Forecast period | 2020 - 2030 |

| Report Pages | 193 |

| By Product Type |

|

| By Application |

|

| By Age Group |

|

| By Region |

|

| Key Market Players | COOK GROUP, AngioDynamics, Inc., MEDTRONIC PLC, ATRION CORPORATION, EDWARD LIFESCIENCES CORPORATION, Terumo Corporation, LIVANOVA, PLC, Boston Scientific Corporation, GETINGE AB, Abbott Laboratories |

Analyst Review

Utilization of cardiac surgery devices is expected to increase, due to surge in government facilitations for better healthcare facilities and R&D innovations. Furthermore, surge in diabetes and increase in heart related diseases fuel the growth of cardiac surgical market. In addition, North America accounted for a majority of the global cardiac surgical device market share in 2020, and is anticipated to remain dominant during the forecast period. This is attributed to rise in prevalence of cardiac diseases, growth in availability of advanced technologies in the healthcare sector, and increase in number of clinical studies to evaluate safety and efficacy of devices. Asia-Pacific is anticipated to witness lucrative growth, owing to increase in diabetes, cardiac health, rise in population, growth in health care expenditures, and rise in sedentary lifestyle.

Moreover, increase in number of lifestyle-related and chronic diseases as well as technological improvements drive the growth of Asia-Pacific cardiac surgery devices market. However, high cost of healthcare and surgical procedures hinders the growth of the market. Moreover, minimally invasive surgeries, (MIS) which result in less post-operative pain and require lower doses of analgesics over traditional open procedures thus, influencing majority of cardiac surgical device. manufacturers and distributors focus on expanding their presence in the developing countries, such Asia-Pacific and LAMEA.

The major factor that fuels the growth of the cardiac surgical device market are government initiatives for increased R&D investments and awareness campaigns among people for cardiac health risk.

The cardiac surgical devices are used cardiovascular and thoracic operations.

North America is the largest regional market for Cardiac Surgical Devices.

Edwards Life Science Corporation, Medtronic Inc., Getinge Group, The Atrion Corporation, Abbott Laboratories, Sorin S.P.A., Terumo Medical Corporation, Boston Scientific Corporation, Cook Medical, and Angiodynamics, Inc. are some top companies which held the market share in cardiac surgical devices.

Cardiac Arrhythmia is the most influencing segment in cardiac surgical device market which is attributed to surge in lifestyle disorders, diabetes and constant risk of heart attack in the geriatric population.

Loading Table Of Content...

Loading Research Methodology...