Cardiovascular Digital Solutions Market Research, 2032

The global cardiovascular digital solutions market size was valued at $84.4 billion in 2022, and is projected to reach $154.1 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032. The cardiovascular digital solutions market refers to the sector of the healthcare industry that focuses on digital technologies and solutions designed to improve the diagnosis, treatment, and management of cardiovascular diseases. It encompasses a wide range of digital tools, software applications, and devices that assist healthcare providers in delivering more efficient and effective cardiovascular care.

Market dynamics

The cardiovascular digital solutions market in expected to grow significantly, owing to surge in prevalence of cardiac disorders, high adoption of digital technology by patients and healthcare professionals, and technological advancement in remote patient monitoring devices.

The prevalence of cardiac diseases has been on the rise, and this alarming trend has become a major driving force behind the growth of the cardiovascular digital solutions market. Heart-related conditions, including coronary artery disease, heart failure, arrhythmias, and stroke, continue to be leading causes of morbidity and mortality worldwide. According to World Heart Federation, in 2021, it was estimated that 20.05 million people died from cardiovascular diseases, globally. The global death rate due to cardiovascular diseases increased by 69.4% in last three decades (1990 to 2021). Furthermore, 2023 report from World Heart Federation highlighted that high blood pressure, air pollution, tobacco use, and elevated low-density lipoproteins (LDL) cholesterol were among the leading contributors to deaths by cardiovascular disease (CVD).

In addition, the key factor contributing to the growth of the market is the increasing prevalence of cardiac diseases in the aging population. As people live longer, the risk of developing cardiovascular conditions significantly rises. Moreover, sedentary lifestyles, unhealthy dietary habits, and the growing incidence of obesity and diabetes further compound the problem. These risk factors not only increase the likelihood of developing heart-related ailments but also contribute to the severity and complexity of the diseases. According to 2023 report by the American Heart Association, it was estimated that the incidence rates (95% Cardiac Index) for cardiovascular disease (CVD) events, including myocardial infarction (MI), angina pectoris (AP), stroke, and heart failure (HF) were the lowest in the 20 to 49 years age group followed by those in the 50 to 59 years age group and was highest in 60 to 75 years age group. Remote cardiac monitoring devices play an important role in managing heart health in elderly patients as it is more convenient than frequently going to hospitals. Thus, the rise in prevalence of cardiovascular diseases is expected to drive the growth of the market.

Furthermore, high adoption of digital technology by patients and healthcare professionals is expected to drive the growth of the market. Patients now have easy access to a range of mobile health applications and wearable devices that allow them to monitor their heart health in real-time. Devices such as cardiac monitoring patches and smartwatches and fitness trackers can track vital signs, such as heart rate, blood pressure, and even perform electrocardiograms (ECGs) at home. The convenience and accessibility of these digital tools have empowered patients to take an active role in managing their cardiovascular health, leading to better outcomes and reduced healthcare costs. In addition, healthcare professionals have embraced digital solutions as a means to enhance their diagnostic capabilities and streamline patient care. Advanced analytics and artificial intelligence (AI) algorithms can now analyze large volumes of patient data, providing clinicians with valuable insights and aiding in early detection of cardiac abnormalities. This assists in making accurate diagnoses and developing personalized treatment plans for patients.

Moreover, technological advancement in the remote monitoring devices, and presence of cardiovascular digital solutions industry is anticipated to contribute to the cardiovascular digital solutions market growth. The healthcare industry is constantly seeking new advancements to enhance the quality of life for patients. In recent times, technology has made its way into the hands of doctors, with wearable remote patient monitoring devices becoming increasingly prevalent. The wearable cardiac monitoring devices use miniaturization and wireless communication technology, that can promptly deliver vital information to users and their physicians. They encompass various tools such as glucose monitors, blood pressure cuffs, pulse oximeters, heart monitors, pedometers, and more. Even widely available fitness trackers and smartphones now provide valuable insights for managing health. Wearable remote patient monitoring technologies present healthcare professionals with detailed information about patients' conditions, which can be utilized to aid in health management between regular office visits. Some of the remote monitoring devices are apple watch (Apple Inc), MCOT (Philips) and KardiaMobile 6L (AlivCor, Inc.)

However, high implementation costs are expected to act as a significant restraint for the cardiovascular digital solutions market. Moreover, integration of artificial intelligence in cardiac devices is expected to present significant growth opportunity.

Segmental Overview on Cardiovascular Digital Solutions Market

The cardiovascular digital solutions market share is segmented into service, component, end user, and region. By service, the market is categorized into unobtrusive monitoring, CVD health informatics, and cardiac rehabilitation programs. By component, the market is categorized into devices and software. On the basis of end user, the market is categorized into healthcare provider, healthcare consumer, and others. The others include rehab centers, payers. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA)..

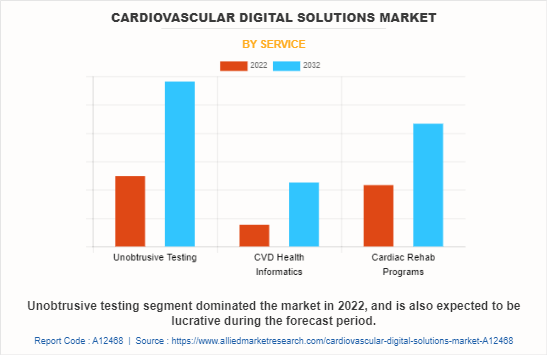

By Service:

The cardiovascular digital solutions market size is categorized into unobtrusive monitoring, CVD health informatics, and cardiac rehabilitation programs. The unobtrusive monitoring segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to the high adoption of unobtrusive monitoring devices such as wearable devices.

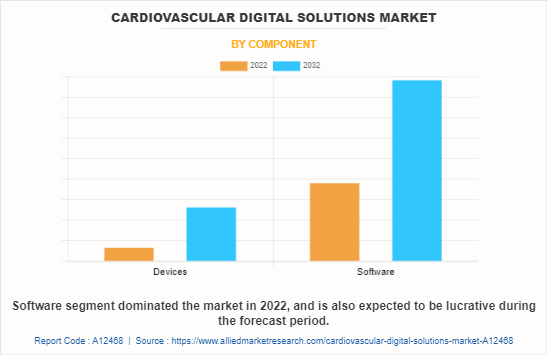

By Component:

By component, the market is categorized into devices and software. The software segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period due to the high use of software to diagnose cardiac abnormality in hospitals.

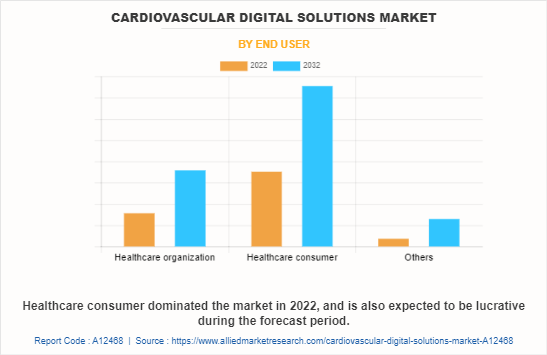

By End users:

On the basis of end user, the market is categorized into healthcare provider, healthcare consumer, and others. The other includes rehabilitation centers and payers. The healthcare providers segment dominated the market in 2022 and is expected to remain dominant throughout the cardiovascular digital solutions market forecast period, owing to high usage of cardiac devices by healthcare providers to manage and treat large patient base.

By region:

On the basis of region, the cardiovascular digital solutions market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, North America had the highest market share in 2022, owing to presence of major cardiovascular digital solutions industry, surge in prevalence of cardiac diseases, strong presence of key players. However, Asia-Pacific is expected to exhibit fastest growth during the forecast period, owing to favorable government initiatives such as funding to develop healthcare facilities.

Competition Analysis

Competitive analysis and profiles of the major players in the cardiovascular digital solutions market, such as AlivCor, Inc, Apple Inc., General Electric, Verily Life Sciences LLC, Koninklijke Philips N.V., HeartFlow, Inc, iRhythm Technologies, Inc., Baxter International Inc, Cardiac Insight Inc., and Cardiac Insight Inc. Major players have adopted partnership, strategic alliance, product launch, acquisition, and collaboration as key developmental strategies to improve the product portfolio and gain strong foothold in the cardiovascular digital solutions market .

Recent Partnership in the cardiovascular digital solutions market

In January 2023, Koninklijke Philips N.V, a global medical technology company and Masimo, a medical devices company announced an expansion of their partnership to augment patient monitoring capabilities in home telehealth applications with the Masimo W1 advanced health tracking watch. The W1 will integrate with Philips’s enterprise patient monitoring ecosystem to advance the forefront of telemonitoring and telehealth.

Recent Strategic alliance in the cardiovascular digital solutions market

In April 2022, AliveCor, Inc a leader in personal ECG products and Omron Healthcare, Co., Ltd., a global leader in personal heart health and wellness technology announced a global, strategic alliance that combines AliveCor's ECG technology with industry-leading blood pressure devices from Omron to better serve customers and expand access to remote patient care. This partnership aligns with global trends to deploy non-invasive remote monitoring devices to facilitate patient monitoring while reducing patient and healthcare provider contact during the pandemic.

Recent Product Launch in the cardiovascular digital solutions market

In May 2022, AlivCor, Inc., a leader in personal ECG products announced the launch of KardiaComplete, a comprehensive heart health enterprise solution designed to drive improved health outcomes and reduce the cost of cardiac care.

In February 2022, AlivCor, Inc a leader in personal ECG products announced the launch of KardiaMobile Card, the slimmest, most convenient personal ECG device ever created. At the size of a standard credit card, KardiaMobile Card fits easily into any wallet and delivers a medical-grade, single-lead ECG in 30 seconds.

In October 2021, AlivCor, Inc., a leader in personal ECG products announced the launch of AliveCor Labs, further establishing the company’s footprint in enterprise class clinical workflows. AliveCor Labs is an independent diagnostic testing facility (IDTF) which offers the U.S. healthcare providers enhanced, reimbursed cardiac monitoring services including access to real-time data to facilitate informed clinical decision-making.

Recent Acquisition in the cardiovascular digital solutions market

In February 2021, Koninklijke Philips N.V a global medical technology company announced that it has completed the acquisition of BioTelemetry, Inc, a leading U.S.-based provider of remote cardiac diagnostics and monitoring. The acquisition of BioTelemetry is a strong fit with Philips’ cardiac care portfolio, and its strategy to transform the delivery of care along the health continuum with integrated solutions.

In December 2021, Baxter International Inc., a global medtech leader, announced that it has completed its acquisition of Hillrom. The acquisition unites two leading medtech organizations in a shared vision for transforming healthcare and advancing patient care worldwide.

Recent Collaboration in the cardiovascular digital solutions market

In July 2021, AliveCor, Inc., a leader in personal ECG products and Acutus Medical, an arrhythmia management company announced the collaboration to assess the integration of data collection tools across the cardiology continuum of care that can potentially advance the field of arrhythmia treatment and disease management.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cardiovascular digital solutions market analysis from 2022 to 2032 to identify the prevailing cardiovascular digital solutions market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cardiovascular digital solutions market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cardiovascular digital solutions market trends, key players, market segments, application areas, and market growth strategies.

Cardiovascular Digital Solutions Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 154.1 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 255 |

| By Service |

|

| By Component |

|

| By End User |

|

| By Region |

|

| Key Market Players | HeartFlow, Inc, iRhythm Technologies, Inc., General Electric, Baxter International Inc., Apple Inc., Koninklijke Philips N.V., Murata Manufacturing Co., Ltd., Cardiac Insight Inc., Verily Life Sciences LLC, AlivCor, Inc. |

Analyst Review

The cardiovascular digital solutions market refers to the sector within the healthcare industry that focuses on using digital technologies and software solutions to manage and improve cardiovascular health. It encompasses a wide range of digital tools, platforms, and devices designed to prevent, diagnose, monitor, and treat cardiovascular diseases.

In January 2023, Koninklijke Philips N.V, a global leader in health technology and Masimo, a global medical technology company announced an expansion of their partnership to augment patient monitoring capabilities in home telehealth applications with the Masimo W1 advanced health tracking watch. The W1 will integrate with Philips’s enterprise patient monitoring ecosystem to advance the forefront of telemonitoring and telehealth.

In April 2023, HeartFlow, Inc, a medical technology company, announced the launch of the RoadMap analysis, a new AI-enabled product that assists CT readers to accurately, efficiently, and consistently identify stenoses in the coronary arteries. With its expanded product portfolio, HeartFlow is now the only company to offer anatomical and physiological visualization of the coronary arteries to help improve heart disease diagnosis and enable physicians to guide treatment decisions.

The top companies that hold the market share in cardiovascular digital solutions market are AlivCor, Inc, Apple Inc., General Electric, Verily Life Sciences LLC, Koninklijke Philips N.V., HeartFlow, Inc, iRhythm Technologies, Inc., Baxter International Inc, Cardiac Insight Inc., and Cardiac Insight Inc.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to the rise in geriatric population and government initiative towards healthcare facilities.

The key trends in the cardiovascular digital solutions market are surge in prevalence of cardiac disorders, high adoption of digital technology by patients and healthcare professionals, and technological advancement in remote patient monitoring devices.

The base year for the report is 2022.

North America is the largest regional market for cardiovascular digital solutions market

The total market value of cardiovascular digital solutions market market is $84.4 billion in 2022 .

The forecast period in the report is from 2023 to 2032

Major restraints in the cardiovascular digital solutions market are high implementation costs of cardiac devices

Loading Table Of Content...

Loading Research Methodology...