Cash Advance Services Market Research, 2032

The global cash advance services market size was valued at $73.7 billion in 2022, and is projected to reach $138.5 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.

Cash advance services are a type of short-term borrowing that enables individuals and businesses to access funds quickly. These services provide immediate cash or funds that can be used to cover unexpected expenses or temporary financial shortfalls, emergencies, or other financial needs. Cash advances are typically available through various means, including payday loans, credit card cash advances, and merchant cash advances. Further, these services usually provide smaller loan amounts compared to traditional banks and financial institutions, and the repayment period is typically short-term, ranging from a few weeks to several months.

Rising awareness about short-term loans among the youth population and the increasing growth of digital payment infrastructure, especially in developing economies, are some of the important factors that boost the global cash advance services market across the globe. In addition, the rapid rise in government efforts to promote financial inclusion positively impacts the growth of the cash advance services market.

However, factors such as the high interest rate charged by cash advance lenders, along with the negative impact of payday loans on credit scores are expected to hamper the growth of cash advance services market. On the contrary, an increase in the adoption of advanced technologies in the lending landscape is expected to provide a lucrative opportunity to boost the growth of the cash advance services market around the world

The report focuses on growth prospects, restraints, and analysis of the global cash advance services market trend. The study provides Porters five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global cash advance services market.

Segment Review

The cash advance services market is segmented into Type, Deployment, Service Provider, and End User.

The cash advance services market is segmented on the basis of type, deployment, service providers, end users, and region. By type, the market is bifurcated into credit card cash advances, merchant cash advances, payday loans, and others. By deployment, the market is divided into online and offline. By service providers, the market is segregated into banks, credit card companies, and others. By end user, the market is divided into personal and commercial. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

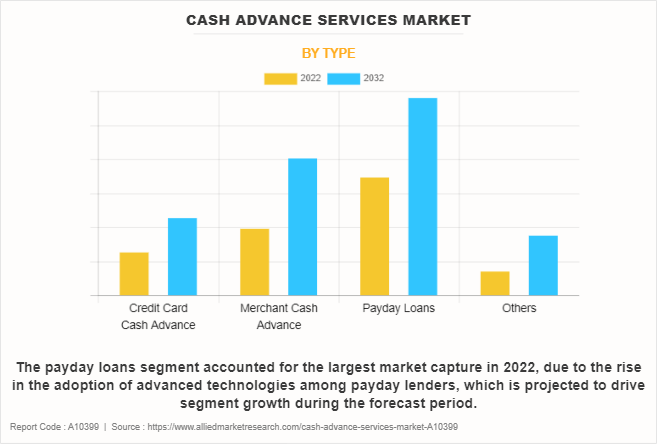

Depending on the type segment, the payday loans segment dominated the cash advance services market in 2022 and is expected to continue this trend during the forecast period, owing to the increased emergence of SMEs worldwide in need of capital funding and the growth of technological advancements in payment processing. However, the others (including tax refund advances and personal installment loans) segment is expected to witness the highest growth in the upcoming years, owing to increasing demand from consumers for quick access to funds to meet immediate financial needs, such as unexpected expenses or temporary cash flow shortages.

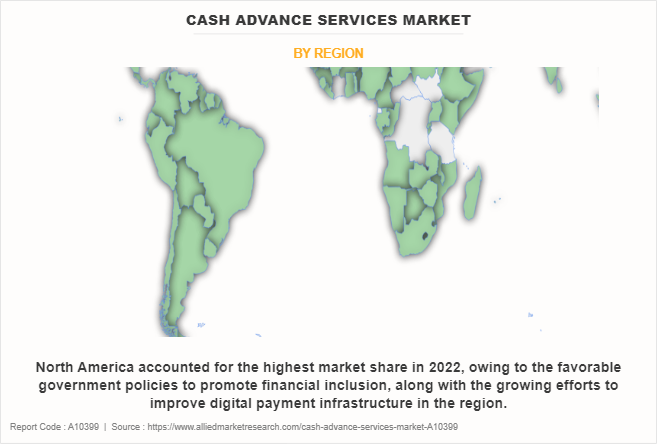

Region-wise, the cash advance services market was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the increase in consumer awareness about the benefits of cash advance services, along with the presence of relaxed credit card regulations, further contributing to the market growth within the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the growing focus on the expansion of fintech companies and increased customer-centric cash advance services solutions tailored to the diverse needs of the Asia-Pacific consumer market.

The global cash advance services market is dominated by key players such as American Express Company, CAN Capital Inc., Creditstar Group, Finova Capital, LLC, National Business Capital, PayPal, Social Finance Inc., Square Inc., and THL Direct, and TitleMax, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Competition Analysis

Recent product launches in the Cash Advance Services Market

- In June 2023, Square Inc. proclaimed the beta launch of new banking and spend management solutions for its U.S. sellers, including new credit tools and features that facilitate businesses to simplify their cash flow management and secure their finances.

- In November 2022, Amazon introduced a new merchant cash advance program provided by Parafin, doubling down on its support for small- and medium-sized businesses to secure financing options.

Recent Partnerships in the Cash Advance Services Market

- In December 2021, PayPal completed a partnership with EarlySalary to develop a cash advance facility for its employees. Under this arrangement, Paypal employees are likely to be able to instantly withdraw a percentage of their salary in advance.

Top Impacting Factors

Raising Awareness about Short-term Loans among the youth Population

Globally, there is a noticeable trend of increasing awareness about short-term loans among the youth population, and therefore, is expected to be a prime driving force for market growth. This trend is primarily driven by the rise of digital platforms, along with fintech companies providing accessible and convenient financial services to younger consumers. In addition, it is assessed that one-third of all adults aged between 25 and 34 years have a student loan, which is the primary source of debt for the population of Generation Z. This forces them to apply for short-term loans or cash advance services for fast and easy loans, which is driving the cash advance services market trends.

Furthermore, the youth demographic, particularly millennials and Generation Z, tended to be more open to non-traditional financial services, including short-term loans, due to their familiarity and awareness with digital technology and online transactions. The ease of access and simplified application processes offered by numerous online lending platforms played a critical role in the increased awareness and adoption of short-term loans among the youth. For instance, nearly 84% of millennials prefer a line of credit over instant personal loans (14%) or buy now pay later (2%), while roughly 49% of them, prefer small-ticket loans of less than US$120, as per the report by CASHe in 2022. Hence, these factors are anticipated to boost the growth prospect of the cash advance services market, especially among the youth population.

In addition, the lack of financial education among young people is contributing to the rising awareness about short-term loans. For instance, a 2020 study found that merely 30% of high school seniors had taken a personal finance course. As a result, the rising awareness of short-term loans, especially among the young population, is a positive trend that provides quick access to funds during unforeseen emergencies, paving the cash advance services market growth worldwide.

High Interest Rate Charged by Cash Advance Lenders

Cash advance lenders typically charge higher interest rates for cash advance loan compared to traditional lenders due to the short-term nature of the loans and the higher risk associated with lending to individuals or businesses with less-than-perfect credit scores. Several researchers found that the average interest rate on a cash advance usually accounts for almost 25-30%. However, few cash advance lenders charge interest rates as high as 400%. This indicates that a US$500 cash advance may cost the borrower more than US$2,000 in interest if they are unable to repay the loan quickly. Therefore, these are major factors that hamper the growth of the cash advance services market.

Further, the higher interest rates are also characterized by the fact that cash advances are generally considered to be a high-risk loan product. Borrowers who take out cash advances are more expected to default on their loans, thereby lenders are required to charge higher interest rates to compensate for this risk. Thus, the involvement of such risk led borrowers to look for alternative financing options rather than cash advance services, which could potentially obstruct market growth. In addition, the combination of high-interest rates and fees can make cash advances costlier. These fees can include an origination fee, a transaction fee, and a late payment fee. Hence, the additional fees charged along with the high-interest rate make cash advance services more expensive, thereby limiting the cash advance services industry around the world.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cash advance services market analysis from 2022 to 2032 to identify the prevailing cash advance services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cash advance services market forecast assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cash advance services market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global cash advance services market share, key players, market segments, application areas, and market growth strategies.

Cash Advance Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 138.5 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 276 |

| By Type |

|

| By Deployment |

|

| By Service Provider |

|

| By End User |

|

| By Region |

|

| Key Market Players | Square Inc., National Business Capital, Creditstar Group, PayPal, Social Finance, Inc., Finova Capital, LLC, THL Direct, CAN Capital, Inc., American Express Company, TitleMax, Inc. |

Analyst Review

In accordance with several interviews conducted with top-level CXO executives, the adoption of cash advance services has increased in the last few years, due to the changing financial needs of consumers, particularly those seeking quick and accessible financing options. The perspective of CXOs is crucial for shaping the overall strategic direction, customer-centric approach, and operational excellence of companies in the cash advance services industry. In addition, the growing entrepreneurial ecosystem has driven the adoption of cash advance services among small and medium-sized enterprises (SMEs) and startups, which is expected to drive the growth of the market.

In addition to this, the supply side of the cash advance services market is driven by a range of factors, including the expansion of e-commerce, competitive pricing models, and the implementation of robust risk management strategies. The ease of online price comparison has compressed retail margins, creating a need for merchants to augment revenue and boost profitability by selling cash advance services. Furthermore, CXOs can promote the adoption of cash advance services and strengthen their organizations' position within the competitive financial services landscape by prioritizing customer-centric approaches, technological innovation, and responsive financial solutions.

Moreover, key players in the cash advance services market such as Square Inc. and PayPal, account for a significant share of the market, followed by some other top vendors in the local and regional markets. With larger requirements for lending services, companies introduced various strategies to strengthen their market position capabilities. For instance, in June 2023, Square Inc. proclaimed the beta launch of new banking and spend management solutions for its U.S. sellers, including new credit tools and features that facilitate businesses to simplify their cash flow management and secure their finances. Such strategic initiatives by the market players are expected to contribute to significant growth of the cash advance services market across the globe.

Moreover, market players have expanded their business operations and geographical footprint by making strategic collaborations and partnerships. For instance, in December 2021, PayPal completed a partnership with EarlySalary to develop a cash advance facility for its employees. Under this arrangement, Paypal’s employees are likely to be able to instantly withdraw a percentage of their salary in advance. These aforementioned strategic advancements propel the growth of the cash advance services market.

Rising awareness about short-term loans among the youth population and the increasing growth of digital payment infrastructure, especially in developing economies, are some of the important factors that boost the global cash advance services market across the globe.

Based on end user, the personal segment accounted for the largest share in 2022, contributing to around two-thirds of the global cash advance services market revenue.

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global cash advance services market revenue

The global cash advance services industry generated $73.70 billion in 2022, and is anticipated to generate $138.52 billion by 2032, witnessing a CAGR of 6.6% from 2023 to 2032.

The global cash advance services market is dominated by key players such as American Express Company, CAN Capital Inc., Creditstar Group, Finova Capital, LLC, National Business Capital, Paypal, Social Finance Inc., Square Inc., and THL Direct, and TitleMax, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...

Loading Research Methodology...