Cash Handling Device Market Research, 2032

The global cash handling device market size was valued at $11.3 billion in 2023, and is projected to reach $18.4 billion by 2032, growing at a CAGR of 5.5% from 2024 to 2032. A cash handling device is an electronic or mechanical tool used for managing, counting, sorting, and processing cash transactions. These devices enhance efficiency, reduce human error, and secure cash handling in financial institutions, retail, and other cash-intensive environments.

Market Introduction and Definition

Cash handling devices refer to a range of equipment and technology used in various industries, particularly in retail and banking, to manage cash transactions efficiently and securely. These devices include cash counters, cash recyclers, cash drawers, point of sale systems, and teller cash recyclers (TCRs).

Cash handling devices automate processes such as accepting, counting, storing, and dispensing cash, enhancing operational efficiency and accuracy in financial transactions. They play a crucial role in improving cash management practices, reducing errors, enhancing security, and optimizing the overall cash handling process in businesses and institutions.

Key Takeaways

The cash handling device market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major cash handling device industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The cash handling device market growth is driven by the increase in adoption of technology and innovation in cash handling automated systems, such as cash recyclers and smart safes. These advancements lead to improved efficiency, security, and speed of transactions, enhancing the accessibility and reliability of cash management processes, therby propels the growth of cash handling device market. Furthermore, the rise in demand for secure and efficient cash management solutions, driven by the need for better reconciliation, authentication, and sorting of cash, especially in sectors such as banking and retail is driving the gowth of cash handling device market. However, regulatory oversight and high entry barriers, particularly in developed markets such as the UK, can limit the entry of new companies and force existing service providers to rethink their strategies. Moreover, challenges related to technological complexities and the need for substantial initial investments are projected to hinder the growth of cash handling device market.

On the contrary, the integration of cash management technology solutions in large retail markets, the operation of mobile bank branches for enhanced customer convenience, and the outsourcing of bank teller staffing to cash management companies, which propels the growth of cash handling device market. These opportunities offer avenues for market players to expand their service offerings, improve operational efficiency, and cater to evolving customer needs in the cash management sector, which further drives the growth during the cash handling device market forecast period.

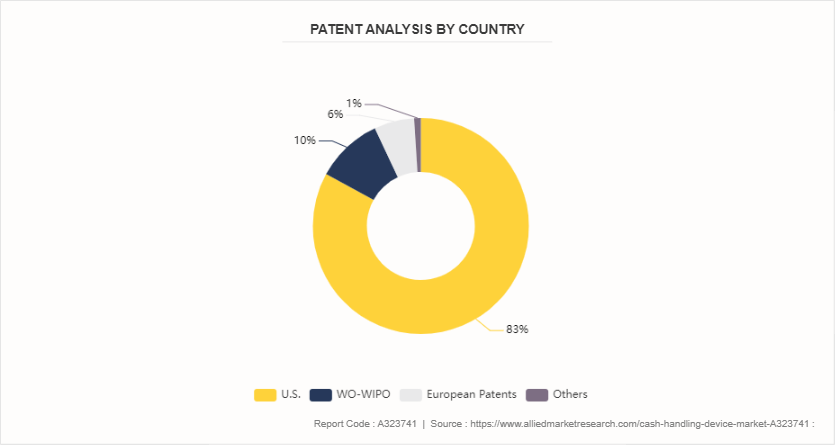

Patent Analysis of the Global Cash Handling Device Market

According to world intellectual property organization (WIPO) the patent analysis for cash handling device market reveals a predominant focus on patents from the U.S. jurisdiction related to detecting item interaction and movement in cash handling processes. The analysis showcases a concentration of patents in the U.S., WO-WIPO, European Patents, China, Japan, Canada, Australia, Korea, Bulgaria, Russia, UK, Taiwan, Mexico, Malaysia, and Sweden market, highlighting advancements and technological developments in cash handling equipment within this jurisdiction. This comprehensive analysis based on jurisdictional insights and document count (percentage data) offers valuable perspectives for stakeholders in the cash handling device market to navigate intellectual property landscapes, drive innovation, and make informed decisions regarding product development and cash handling device market strategies.

Market Segmentation

The cash handling device market outlook is segmented into type, application, and region. On the basis of type, the market is divided into banknote sorter, coin sorter, and automatic teller machine (ATM) . On the basis of application, the market is categorized into banks, retail, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/Country Market Outlook

Electric vehicles (EVs) are gradually penetrating various sectors of the economy. The cash-handling industry is the latest to adopt this trend, to lower carbon emissions. Loomis, a prominent player in cash delivery services, has announced the expansion of its collaboration with Xos. As part of this initiative, Loomis placed an additional order for 150 armored electric vehicles to be utilized in their operations across the U.S.

In October 2023, new data released from financial industry champions UK Finance revealed that cash payments across the UK rose for the first time in a decade during 2022, with approximately one million people using it for the majority of their transactions. The number of cash transactions increased by 7% from 2021 to 2022, meaning 6.4 billion payments were made in physical cash. This equals 14% of total payments, making cash the second most popular payment option behind debit cards. Therefore, these factors propelling the demand for cash handling devices in the UK.

In September 2023, an Australian Asian grocery retailer that is progressively installing automated cash-handling devices across its store network says the technology has cut customer checkout waiting times, reduced manual labor for its staff, and boosted its bottom line. Tong Li – Sydney’s largest Asian grocery chain with 19 stores has installed Glory Global Solutions (Glory) ’s CashInfinity closed-loop cash handling system in 13 stores over the past three years, with the other nine scheduled to convert in the upcoming years, which is thus driving the growth of the cash handling device market.

Industry Trends

Retailers are increasingly adopting cash handling automation to streamline their operations. A recent study by British analyst group RBR in January 2023, reveals a significant surge in the installation of cash handling systems in retail stores, with a growth rate of over 20% between 2019 and 2022, resulting in more than 900, 000 devices worldwide.

The RBR study, titled Retail Cash Automation 2023, highlights Glory as the leading technology provider at checkouts, largely due to its extensive installations in Japan. However, European retailers are also increasingly adopting these devices, such as Lidl, which has been using Glory's cash recyclers for self-checkout systems in Germany since spring 2022. The study also identifies Strongpoint and Volumatic as key providers of cash handling solutions at the point of sale.

The RBR Data Services' Global Branch Transformation research 2024, conducted by Datos Insights, reveals that banks globally are restructuring their branch layouts to optimize efficiency and profitability amid a reduction in the number of physical outlets. This strategic shift includes transitioning towards a universal banker model, where tellers assume additional responsibilities beyond basic transactions, such as sales and advisory services.

The study by RBR Data Services highlights a global increase in TCR installations, surpassing 140, 000 devices by the end of 2023 across surveyed key markets, marking a 7% growth from 2018. Notably, the U.S. accounts for 40% of these installations, with major banks in the country deploying TCRs extensively to enhance branch operations, contributing significantly to the overall expansion with over 18, 000 new units since 2018.

Competitive Landscape

The major players operating in the cash handling device market include Diebold Nixdorf, Incorporated; NCR Corporation; Triton Systems of Delaware, LLC; GRG Banking; Hitachi Channel Solutions, Corp.; HESS Cash Systems; TetraLink; Fujitsu Frontech Limited; Edge One; and Volumatic. Other players in the cash handling device market include CashTech Currency Products, SOUTH Automation Int., CIMA Cash Handling America Inc., and others.

Recent Key Strategies and Developments in Cash Handling Device Industry

In May 2024, leading cash management experts Volumatic and the foremost UK provider of Cash Security G4S Cash Solutions (UK) have joined forces to offer a cash solution, that has been designed to meet the evolving needs of retail businesses across the UK.

In September 2023, NCR Corporation, a leading enterprise technology provider, announced a strategic investment in Clip Money Inc. and has established a long-term, firmware exclusive, commercial collaboration that combines Clip's pioneering business cash deposit solution with NCR’s cardless cash deposit API and cash in network.

In January 2021, PayComplete, the new brand and identity of the cash handling division of SUZOHAPP announced its launch. The introduction of PayComplete follows a strategic review of SUZOHAPP’s gaming & amusement and cash handling strategies, operations, technology, and end-customers.

Key Sources Referred

European Central Bank

Reserve Bank of India (RBI)

Financial Conduct Authority

Financial Services Commission

Bank for International Settlements

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cash handling device market analysis from 2024 to 2032 to identify the prevailing cash handling device market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cash handling device market segmentation assists to determine the prevailing cash handling devicemarket opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cash handling device market trends, key players, market segments, application areas, and market growth strategies.

Cash Handling Device Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.4 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 354 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | CIMA Cash Handling America Inc., HESS Cash Systems, Fujitsu Frontech Limited, Diebold Nixdorf, Incorporated, CashTech Currency Products, Volumatic, NCR Corporation, TetraLink, Edge One, GRG Banking, Hitachi Channel Solutions, Corp., Triton Systems of Delaware, LLC, SOUTH Automation Int. |

The total market value of cash handling device market is $11.3 billion in 2023.

The market value of cash handling device market in 2032 is $18.4 billion.

The latest technological trend includes automation, integration with digital payment systems, remote monitoring, AI-based fraud detection, and cash recycling technologies.

The base year is 2023 in the cash-handling device market.

The forecast period for cash handling device market is 2024 to 2033.

Loading Table Of Content...