Cash Logistics Market Insights, 2030

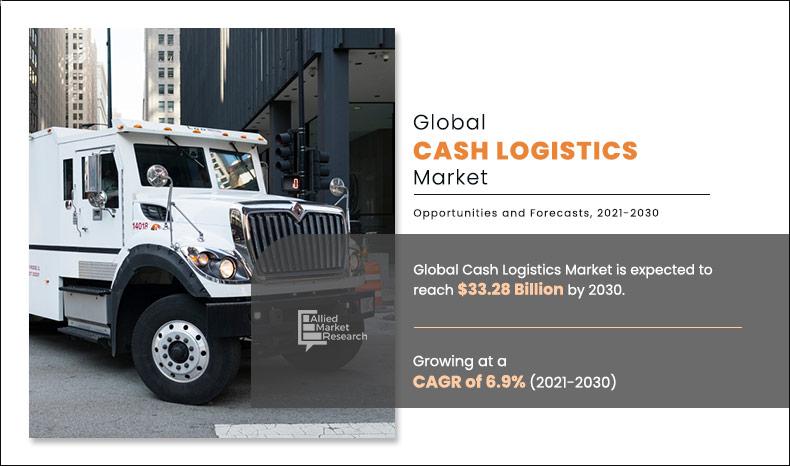

The global cash logistics market was valued at $16.83 billion in 2020, and is projected to reach $33.28 billion by 2030, registering a CAGR of 6.9% from 2021 to 2030.

Cash logistics service refers to a physical movement as well as handling of cash from one location to another. It primarily manages, transports, and protects the funds by eliminating risks & public exposure. The cash logistics mainly consists of cash-in-transit, cash management, and ATM replenishment services. The locations include cash centers & bank branches, ATM points, large retailers, and other premises. The organizations specialized in the transportation& processing of cash from one location to another are included in cash-in-transit services.

Moreover, cash management service is the process that involves collecting & managing cash flows along with wrapping, sorting, checking quality bills, and others to maintain the financial stability of the organizations. At present, many cash logistics companies have strengthened themselves in terms of valuable transport by acquiring technology-based companies to protect the valuables from threats & ensure the safe availability of cash during any crisis. Hence, the adoption of cash logistics services by various businesses & government agencies reduces the added risk in today’s economic environment using operational controls to provide efficient project management, dependable infrastructure, and others.

Factors such as growth in the circulation of cash, rise in the demand for safe & vault for cash management, and increase in the deployment of ATMs supplement the market's growth across the globe. However, factors such as surge in cash-in-transit vehicle robberies and rise in the adoption of digital money hamper the market's growth around the world. Moreover, factors such as production of fully automated cash-in-transit vehicle and rise in cash demand from emerging economies create ample opportunities for the market's growth during the forecast period.

The cash logistics market report is segmented into service type,end-user, mode of transit, and region. Depending on service type, the global market has been segmented into cash management, cash-in-transit, and ATM services. By end-user, the global market has been segmented into financial institutions, retailers, government agencies, hospitality, and others.Based on mode of transit, the market has been segmented into roadways, railways, and airways. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service Type

Cash Management is projected as the most lucrative segments

The key players operating in the global cash logistics market are Cash Logistics Security AG, CMS, GardaWorld, GSL, GSLS, G4S, Lemuir Group, Loomis AB, Prosegur, and The Brink’s Company.

Growth in the circulation of cash

The growth in currency circulation in the economy has led to increase in the need for cash logistics solutions such as cash management, cash-in-transit, ATM services, and others. In 2021, according to the State Bank of India (SBI), the circulation of currency in the country had risen from 7.7% from the year 2020, owing to economic growth & interest rate. The adoption of cash logistics services makes cash management efficient and has advantages such as time consumption, less chance of mistakes, and efficient cash flow. In addition, new statistics published by the Bank for International Settlements (BIS), a financial institution owned by central banks, claims that an increase in the use of large-denomination notes caused the growth of total cash in circulation. Therefore, growth in cash circulation boosts the growth of the global cash logistics market.

By End User

Hospitality is projected as the most lucrative segments

Rise in demand for safe & vault for cash management

There has always been a colossal requirement for safety vaults and locks from the banking sector for cash storage and other valuable items. The vaults are bugged with alarm arrays and anti-theft equipment to protect these vaults from unwanted external infiltration. The digital electronic vaults have successfully replaced the manually operated vaults and have become increasingly popular as the inefficiencies of the manual vaults have been considerably eliminated in the digital vaults. Motorized shooting bolts for extra protection, low battery indicator, password protection, and non-volatile memory are a part of the digital vaults. These vault doors, panels, and locks have emergency ventilators, embedded integrated light switches with electrical boxes, and low-cost maintenance. The increased demand for cash management services among banking institutions, commercial entities, government offices, and other organizations from countries such as UAE, Saudi Arabia, North America, and Europe holds the largest share in the global vault services across commercial as well as residential applications. In addition, the number of ATMs worldwide boosts the growth of the banking sector, with an estimated global ATM market to cross the revenue of about $20 billion by 2020.

The Brink’s Company offers a comprehensive closed-loop cash management solution with its intelligent safety vault, CompuSafe that eliminates deposit discrepancies and reduces theft risks for every commercial business segment. Thus, the rise in demand for safe and vault for cash management boosts the growth of the cash logistics market.

By Mode Of Transit

Roadways is projected as the most lucrative segments

Increase in cash-in-transit vehicle robberies

The rate of cash-in-transit vehicles heist has increased exponentially in recent days. For instance, the surge in cash robbery is one of the significant factors in South Africa, which discourages cash logistics agencies from opting for cash payment. In the past financial years, the cash-in-transit heist increased by around 56%, which led to the reduction of cash movement by cash logistics companies, leading to the loss of customers' confidence. Thus, an increase in cash-in-transit vehicle robberies hinders the growth of the cash logistics market.

Production of fully automated cash-in-transit vehicle

In recent days, the rate of cash-in-transit vehicle robberies has increased exponentially, leading to injured staff and sometimes death. For instance, in January 2019, workers at a garage were shot in Chiawelo, South Africa, while a cash-in-transit vehicle was collecting cash. The productions of fully automated &robust vehicles, which are impenetrable and can only be operated by authorized vehicles, reduce such casualties, and hence no lives are at risk. For instance, the Mercedes Benz Sprinter is the perfect example of an automated cash-in-transit vehicle that offers CCTV cameras, armored sliding doors, interlocked system, fingerprint scanner, LED push buttons for door controls, and coded infrared sensors. Thus, fully automated cash-in-transit vehicle production possesses a remarkable growth opportunity for the key players operating in the cash logistics market.

By Region

LAMEA region would exhibit the highest CAGR of 8.1% during 2021-2030.

Covid-19 Impact Analysis

- The COVID-19 crisis has created uncertainty in the market by slowing down the logistics services, hampering business growth, and increasing panic among the customer segments.

- Governments across different regions announced total lockdown and temporarily shutdown of industries, which led to border closures that restricted the movement of transportation & logistics services.

- The global business outlook has changed dramatically post COVID-19 health crisis.

- Moreover, the overall service activities of market players have declined, owing to drastic fall of demand in the cash usage to avoid the risk of contamination.

- As per current scenario, overall world is getting back on track slowly. With new policies, a significant recovery in product sales across the retail sector may assert a positive influence on the cash logistics market to support the economic activities across all industries.

Key Benefits For Stakeholders

- This study presents the analytical depiction of the global cash logistics market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities ofthe market with a detailed impact analysis.

- The current market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Cash Logistics Market Report Highlights

| Aspects | Details |

| By Service |

|

| By End User |

|

| By Mode of Transit |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The current business scenario of cash logistics market has witnessed an upsurge in the adoption of novel technology in developed as well as developing regions. In accordance with the insights of the CXOs of leading companies, the cash logistics market is highly competitive & concentrated and indicates positive growth in the near future. The factors such as growth in the circulation of cash due to heightened uncertainty caused by pandemic and high demand for cash management services from cash-intensive environments such as the retail industry are expected to dominate the market during the forecast period. Furthermore, an increase in the application areas among end-users, rise in crime rates, and heavy venture capital investments in R&D activities to develop solutions with enhanced capabilities are expected to create numerous opportunities for the key players operating in the cash logistics market.

According to insights gathered from primary sources, the significant adoption of cash logistics services is observed in various industries such as government, transportation, retail, and others. For instance, NatWest & G4S are working to offer an innovative cash system based on on-site automated technology to enable businesses to benefit from automated account crediting of cash transactions daily without depositing in their local branches. Although cashless payments have become increasingly common, the demand for cash is still on rise in many advanced & emerging economies. In 2019-20, according to the annual report of RBI (Reserve Bank of India), the preference for cash had seen growth in currency accelerating from 11.3% to 21.3%, which resulted in the increase of GDP ratio.

Factors such as growth in the circulation of cash, rise in the demand for safe & vault for cash management, and increase in the deployment of ATMs supplement the market's growth across the globe. However, factors such as increase in cash-in-transit vehicle robberies and rise in the adoption of digital money hamper the market's growth around the world. Moreover, factors such as production of fully automated cash-in-transit vehicle and rise in cash demand from emerging economies create ample opportunities for the market's growth during the forecast period.

Among the analyzed regions, Europe is the highest revenue contributor, followed by North America, LAMEA and Asia-Pacific. On the basis of forecast analysis, LAMEA is expected to maintain its lead during the forecast period, owing to increased demand for cash based transaction across LAMEA.

The global Cash Logistics market was valued at $16,826.08 million in 2020, and is projected to reach $33,283.6 million by 2030, registering a CAGR of 6.86%

Cash logistics service providers serve cash from onbe place to another through armoured vehicles.

The sample/company profiles for global cash logistics market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report

Increased cash based transaction at low internet penetration countries drives the market towards positive growth

The company profiles of the top market players of automotive lighting market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the automotive lighting market

Increased cash based transaction at low internet penetration countries drives the market towards positive growth

Introduction of safer cash transportation & cash management system are the recent developments in cash logistics

Companies such as Brinks are the leaders in cash logistics industry

Loading Table Of Content...