Cell Counting Market Research, 2032

The global cell counting market size was valued at $7.7 billion in 2022, and is projected to reach $16.3 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032. The rise in incidences of cancer significantly contributes to the growth of the cell counting market owing to the critical role in cancer research, diagnosis, and treatment development. For instance, National Cancer Institute, Division of Cancer Control & Population Sciences (DCCPS), stated that, 623,405 people have lived with metastatic breast, prostate, lung, colorectal cancer or metastatic melanoma in the U.S. Cell counting methodologies are crucial in cancer studies for evaluating cell proliferation rates, assessing tumor progression, determining treatment responses, and analyzing cell characteristics, contributing substantially to understanding the complexities of cancer biology and facilitating the development of targeted and personalized treatment strategies to combat this widespread disease.

Moreover, continuous innovations and advancements in cell counting technologies, including automated systems, image-based analysis and flow cytometry, have significantly improved accuracy, speed and efficiency in cell counting processes. These advancements attract researchers, clinicians and industries seeking reliable and high-throughput cell analysis tools.

Key Takeaways

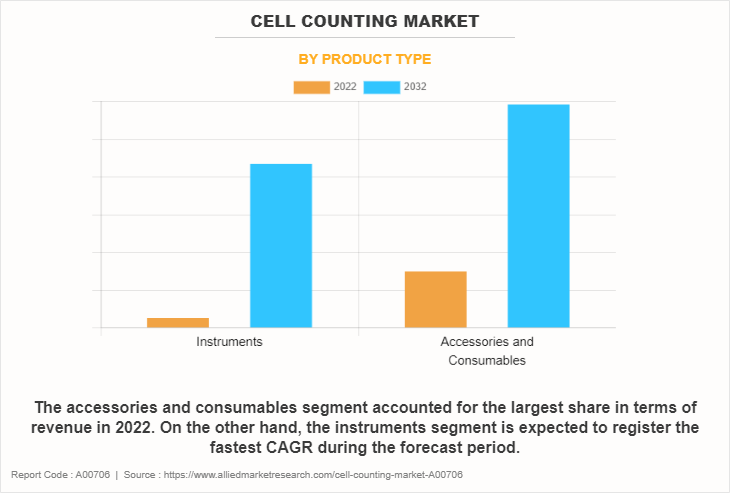

- On the basis of product type, the accessories and consumables segment dominated the market in terms of revenue in 2022. However, the instruments segment is anticipated to register the fastest CAGR during the forecast period.

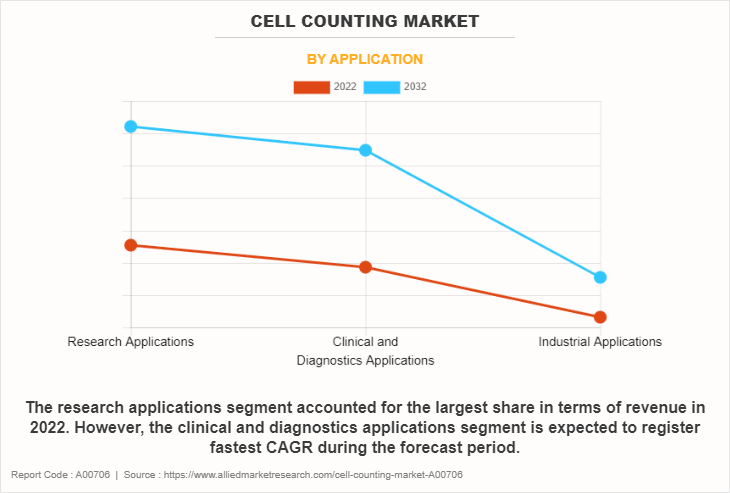

- On the basis of application, the research applications segment accounted for the largest share in terms of revenue in 2022. On the other hand, clinical and diagnostics applications segment is anticipated to register the fastest CAGR during the forecast period.

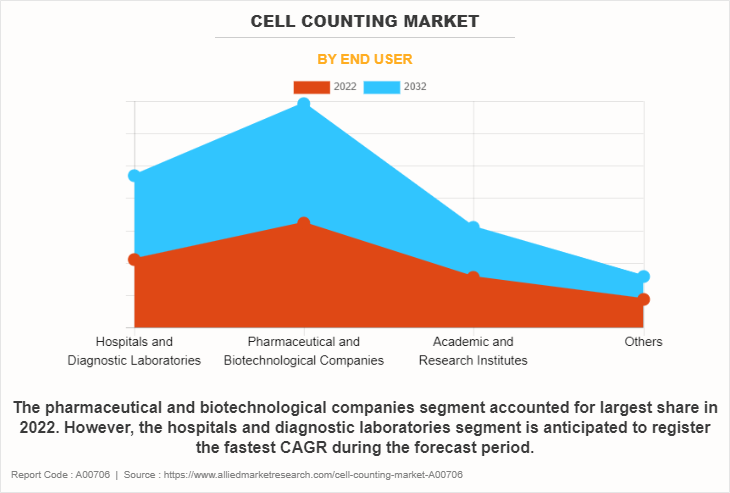

- On the basis of end user, the pharmaceutical and biotechnological companies segment dominated the market in terms of revenue in 2022. However, hospitals and diagnostic laboratories segment is anticipated to register fastest CAGR during the forecast period.

- On the basis of region, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

Cell counting refers to the quantitative assessment and enumeration of cells within a biological sample, employing various methodologies and instruments to determine the concentration, viability, proliferation, or specific characteristics of cells present. This essential technique provides crucial insights into cellular behavior, aiding researchers, clinicians, and scientists across multiple disciplines such as biology, medicine, biotechnology, and pharmaceuticals. Cell counting techniques facilitate the understanding of disease mechanisms, drug development, stem cell research, immunology, and various other areas, playing a fundamental role in research, diagnostics, and therapeutic advancements by accurately counting cells.

Market Dynamics

The major factors driving the growth of the cell counting market include technological advancements, expanding applications across various research sectors, and growth in demand for personalized medicine and regenerative therapies. Technological innovations, especially in automated cell counting techniques and equipment, have revolutionized the accuracy, speed and efficiency of cell counting processes. This evolution includes the development of high-throughput systems, such as flow cytometry and image-based cell counting, which offer enhanced precision and reduced manual errors, catering to the rise in demand for reliable cell analysis across research, diagnostics and drug development domains.

Furthermore, escalating investment of the healthcare industry in research anbd development activities to explore cell-based therapies and their potential applications has been a major driver for the cell counting market growth. For instance, stem cell research has gained substantial momentum owing to its promise in regenerative medicine and the treatment of various chronic diseases. The need for accurate cell counting methodologies becomes crucial in such contexts to determine cell viability, concentration and proliferation rates, thereby fueling the demand for advanced cell counters.

Furthermore, the expanding adoption of cell counting methodologies across pharmaceutical and biotechnology companies for drug development and toxicity testing purposes has significantly contributed to the market growth. Cell-based assays are increasingly being utilized in preclinical studies to assess drug efficacy, safety and pharmacokinetics, necessitating precise cell counting methodologies for reliable experimental outcomes. In addition, the rise in prevalence of chronic diseases and cancer globally has heightened the demand for cell counting techniques in disease diagnosis and monitoring, as accurate cell enumeration plays a pivotal role in understanding disease progression and treatment responses.

Moreover, the cell counting market has expanded significantly in emerging markets owing to the development of healthcare infrastructure and increased research and development activities. Rapid urbanization and economic growth in countries such as China and India have created substantial opportunities for cell counter manufacturers to cater to the needs of these growing markets.

However, challenges such as high costs associated with advanced cell counting equipment, limited accessibility in certain regions, and complexities related to standardization and validation of methodologies pose hindrances to widespread adoption of cell counters, thereby restraining the cell counting market growth.

Segmental Overview

The cell counting industry is segmented into product type, application, end user and region. On the basis of product type, the market is bifurcated into instruments, accessories and consumables. The instruments segment is further divided into flow cytometers, hematology analyzers, cell counters and others. The hematology analyzers segment is further divided into fully automatic hematology analyzers and semi-automatic hematology analyzers. The cell counters segment is further segmented into automated cell counters and manual cell counters. On the basis of application, the market is classified into research applications, clinical and diagnostics applications and industrial applications. The research applications segment is further segmented into oncology research, immunology research, neurology research, stem cell research and other research.

On the basis of end user the market is divided into hospitals and diagnostic laboratories, pharmaceutical and biotechnological companies, academic and research institutes, and others. On the basis of region, market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (India, China, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product Type

The accessories and consumables segment accounted for largest cell counting market share in terms of revenue in 2022, owing to continuous usage and necessity of the consumables such as reagents, counting chambers, calibration standards and sensor cassettes, in routine laboratory operations and diagnostics, thereby driving the growth of segment. Furthermore, the rise in focus on maintaining quality control measures and standardizing laboratory procedures contributes significantly to the heightened demand for consumables and accessories.

On the other hand, the instruments segment is expected to register the fastest CAGR during the forecast period. This is attributed to various technological advancements leading to the development of more sophisticated and automated cell counting instruments, enhancing accuracy, speed and throughput. In addition, increased adoption of automated cell counting systems in clinical diagnostics and research facilities, driven by the need for high-throughput and precise analyses, fuels the segment growth.

By Application

The research applications segment accounted for largest cell counting market share in terms of revenue in 2022, owing to increase in fundings for research and development activities leading to adoption of cell counting systems. In addition, extensive utilization of cell counting technologies in various academic and industrial research to study biological sciences, drug development and various diseases is anticipated to fuel the segment growth.

However, the clinical and diagnostics applications segment is expected to register fastest CAGR during the cell counting market forecast period, owing to increase in incidences of chronic diseases which necessitates accurate diagnostic tools, escalating the adoption of cell counting systems for disease assessment and management.

By End User

The pharmaceutical and biotechnological companies segment dominated the cell counting market size in 2022. This is attributed to the significant investment in research, driving the demand for precise cell counting technologies, increasing adoption of cell counting for quality control, ensuring the efficacy and safety of pharmaceutical products and biotechnological advancements. In addition, continuous innovation in pharmaceuticals and biotechnology drives the demand for precise cell counting technologies, crucial for drug development and research.

However, the hospitals & diagnostic laboratories segment is anticipated to register fastest CAGR during the forecast period, owing to rise in prevalence of chronic diseases which necessitates accurate diagnostics, elevating the adoption of cell counting systems for disease assessment and management. In addition, advancements in healthcare infrastructure and the expansion of diagnostic capabilities in hospitals and laboratories augment the adoption of sophisticated cell counting instruments for improved patient care, thereby driving the segment growth.

By Region

The cell counting market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the global cell counting market size in terms of revenue in 2022, driven by its advanced healthcare infrastructure, substantial investments in R&D, and the presence of major industry players offering innovative cell counters. The growth in emphasis of North America on precision medicine, alongside increased healthcare spending, has heightened the demand for precise diagnostics and personalized treatments, thereby amplifying the use of cell counting technologies. Moreover, ongoing technological advancements, such as the incorporation of automation and digital health solutions into cell counting systems, have contributed to market growth in the region.

On the other hand, Asia-Pacific is expected to register the fastest CAGR during the forecast period. This is attributed to rise in population, escalating healthcare expenditures, and rapid technological advancements that significantly contribute to market expansion. The rise in incidence of chronic diseases and infectious conditions in countries such as China, India, and Southeast Asian nations has spurred the demand for accurate diagnostics and advanced medical technologies, including cell counting methodologies.

Furthermore, the expansion biopharmaceutical sector in the Asia-Pacific region, coupled with a focus on innovative therapies and drug development, has accelerated the adoption of cell counting technologies. Initiatives aimed at enhancing healthcare accessibility and affordability, alongside the integration of digital health solutions into cell counting devices, have further propelled market growth across the region.

Moreover, the substantial population within the Asia-Pacific region presents an extensive pool of individuals for clinical trials and research investigations, thereby amplifying the demand for cell counting solutions in both preclinical and clinical settings. Governmental support for scientific research initiatives, combined with collaborations between local and global players, is propelling innovation in cell counting technologies, positioning Asia-Pacific as an exceptionally dynamic and promising market during forecast period.

Asia-Pacific offers profitable cell counting market opportunity for key players operating in the cell counting market, thereby registering the fastest growth rate during the forecast period, owing to the developments in healthcare infrastructure, rise in R&D activities, as well as well-established presence of domestic companies in the region. In addition, the rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the cell counting industry, such as Danaher Corporation, Agilent Technologies, Inc., Merck KGaA, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. PerkinElmer, Inc., Aligned Genetics, ChemoMetec, NanoEntek and DeNovix Inc., are provided in the report. Major players have adopted product launch, and collaboration as key developmental strategies to improve the product portfolio of the cell counting market.

Recent Product Launch in Cell Counting Market

In May 2020, Logos Biosystems, a leading provider of innovative life science research tools, launched the LUNA-FX7, the newest and most advanced member of the Select Science award-winning LUNA Cell Counter Family.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cell counting market analysis from 2022 to 2032 to identify the prevailing cell counting market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cell counting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cell counting market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the cell counting market players.

- The report includes the analysis of the regional as well as global cell counting market trends, key players, market segments, application areas, and market growth strategies.

Cell Counting Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.3 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | ChemoMetec, Thermo Fisher Scientific Inc. , PerkinElmer, Inc., NanoEntek, Bio-Rad Laboratories, Inc. , DeNovix Inc., Aligned Genetics, Merck KGaA, Agilent Technologies, Inc., Danaher Corporation |

Analyst Review

This section provides various factors driving the global cell counting market. Rise in adoption of cell counting in research and diagnostics, use of cell counting in early disease detection and rise in technological advancements in cell counters are the factor anticipated to propel market expansion. In research and diagnostics, cell counting serves as a foundational tool aiding in understanding cellular behavior, disease mechanisms, and therapeutic interventions.

In clinical settings, the increase in emphasis on precision medicine and early disease detection fuels the adoption of cell counting instruments for accurate diagnostics and treatment monitoring. Moreover, the global rise in chronic diseases necessitates precise cell-counting technologies for disease management. Furthermore, technological advancements have revolutionized cell counting methodologies, offering high-throughput, automated, and accurate systems catering to the demands of biotechnology, pharmaceuticals, and academic research.

On the basis of region, North America dominated the global cell counting market in terms of revenue in 2022, owing to advanced healthcare infrastructure, substantial investments in R&D, presence of major key players offering advanced cell counters, and the presence of leading biotechnology and pharmaceutical companies. In addition, increase in emphasis of the region on precision medicine, coupled with rise in healthcare expenditure, fuels the need for accurate diagnostics and personalized treatments, further propelling the utilization of cell counting technologies. Furthermore, continuous technological advancements, including the integration of automation and digital health solutions into cell counting systems contribute to the growth of the market.

On the other hand, Asia-Pacific is expected to register the fastest CAGR during the forecast period. This is attributed to rise in population, increase in healthcare spending and rapid technological advancements contribute significantly to the market growth. Rise in prevalence of chronic diseases and infectious conditions in countries such as China, India, and Southeast Asian countries fuels the demand for precise diagnostics and advanced medical technologies. Expansion of biopharmaceutical sector in Asia-Pacific, coupled with a focus on innovative therapies and drug development, propels the adoption of cell counting technologies. Furthermore, initiatives aimed at improving healthcare accessibility and affordability, along with the integration of digital health solutions into cell counting devices, further accelerate market expansion in the region.

The total market value of cell counting market is $7,722.93 million in 2022.

The market value of cell counting market in 2032 is $16,254.83 million.

The forecast period for cell counting market is 2023 to 2032.

The base year is 2022 in cell counting market.

Top companies such as Danaher Corporation, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., ChemoMetec, and NanoEntek held a high market position in 2020. These key players held a high market position owing to the strong geographical foothold in different regions.

Accessories and consumables segment is the most influencing segment in cell counting market owing to continuous usage and necessity of the consumables such as reagents, counting chambers, calibration standards, and sensor cassettes, in routine laboratory operations and diagnostics, thereby driving the growth of segment.

The major factor that fuels the growth of the cell counting market are rise in research activities, advancements in cell counting instruments and rise in adoption of cell counting in biopharmaceutical industry.

Cell counting stands as an essential method applied in biological and medical disciplines to measure the number of cells within a given sample.

Loading Table Of Content...

Loading Research Methodology...