Cell Sorter Market Research, 2032

The global cell sorter market size was valued at $0.5 billion in 2022, and is projected to reach $1.3 billion by 2032, growing at a CAGR of 8.6% from 2023 to 2032. Cell sorting is the process by which a particular type of cell is distinguished from others present in a sample based on its physical or biological characteristics, such as size, morphological parameters, viability, and the expression of both extracellular and intracellular proteins. Cell sorters are powerful instruments used to separate and isolate specific cells from a heterogeneous mixture. These devices combine with the flow cytometry principle, a method that analyzes and measures the character of cells, with the ability to physically separate and accumulate the preferred cells. Cell sorters are commonly utilized in diverse fields of study such as immunology, oncology, stem mobile studies, and microbiology.

Market Dynamics

Rise in adoption of cell sorters as they are widely used in immunology research and flow cytometry, a technique that measures multiple characteristics of cells which drives the market growth. In addition, the rise in prevalence of chronic diseases such as cancer drives the demand for cell sorting instruments to isolate and study cancer cell types. Cell sorting is also used by researchers to investigate how cancer develops, spreads, and metastasizes as well as to find possible treatment targets that will spur market expansion. For instance, as per the World Cancer Research Fund International anticipated that 18.1 million cancer cases diagnosed across the world in 2020. Of these, 9.3 million cases were in men and 8.8 million in women. Thus, the surge in burden of chronic diseases, such as cancer, drives the demand for cell sorter instruments and boosts the market growth.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure. The demand for cell sorter is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in adoption of advanced cell sorters and increase in awareness early diagnosis and treatment further provide the cell sorter market opportunity.

Moreover, the rise in demand for stem cell research to advance in various fields, including regenerative medicine, tissue engineering, and disease modeling further supports the market growth. Cell sorting enables the isolation of specific stem cell populations for further characterization and differentiation. For instance, researchers use cell sorters to purify hematopoietic stem cells for bone marrow transplantation or to isolate pluripotent stem cells for the development of organoids. Thus, usage of cell sorters in stem cell research propels the cell sorter market growth.

Cell sorting instruments are expensive, leading to less accessible to smaller research laboratories or institutions with limited budgets. The high initial cost, along with maintenance and operational expenses, is a significant factor that may restrain market growth. In addition, operating cell sorters requires specialized training and skills. The lack of skilled personnel in operating and maintaining these instruments may limit their adoption. Thus, a shortage of skilled staff in developing countries may limit the adoption of instruments and hinder the adoption of new cell sorting technologies.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global cell sorter market experienced a decline in 2020 due to global economic recession led by COVID-19. In addition, the pandemic caused disruptions in global supply chains, causing delays in the manufacturing and shipping of sorting devices, regulations on operations, and shortages of materials, impacting the supply and well-timed transport of cell sorters that negatively impacted the market growth. However, the market recovered after the pandemic and show stable growth for the cell sorter market. This is attributed to the rise in R&D activities in cell research, increase in demand for advanced cell sorters and growing prevalence of chronic diseases.

Segmental Overview

The cell sorter industry is segmented into product, application, end user, and region. By product, the market is categorized into instruments and consumables and reagents. On the basis of application, the market is segregated into research applications and clinical applications. By end user, the market is classified into hospitals and clinical testing laboratories, pharmaceutical and biotechnology companies, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

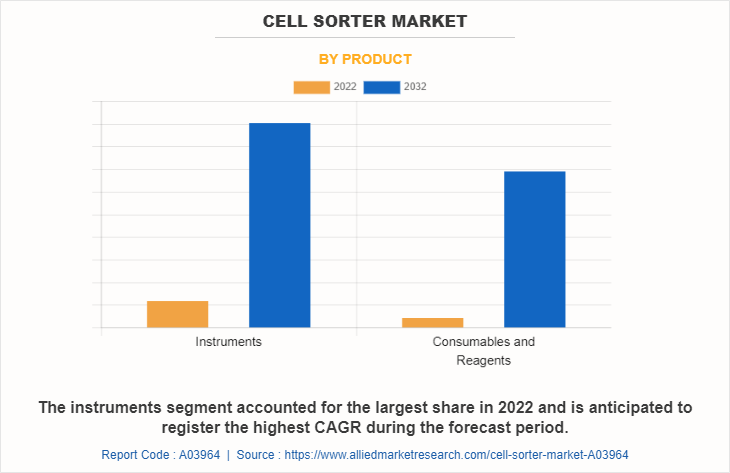

By Product

The instruments segment dominated the global cell sorter market share in 2022 and is expected to remain dominant throughout the forecast period, owing to as they offer high versatility and flexibility, high sorting efficiency, compatibility with fluorescent labels and widespread adoption of fluorescence-based droplet cell sorting. In addition, technological advancements in cell sorter instruments further support the segment growth.

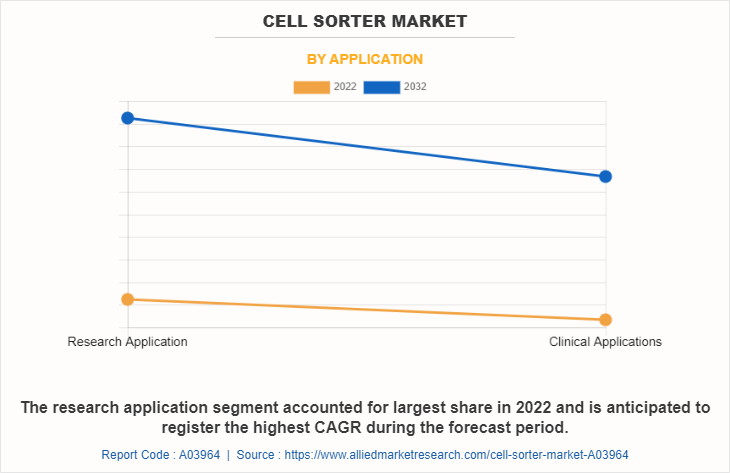

By Application

The research application segment dominated the cell sorter market size in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to increase in research and development activities, advancements in cell sorting technologies, rise in disease research, availability of funding, and collaborative efforts in the research community.

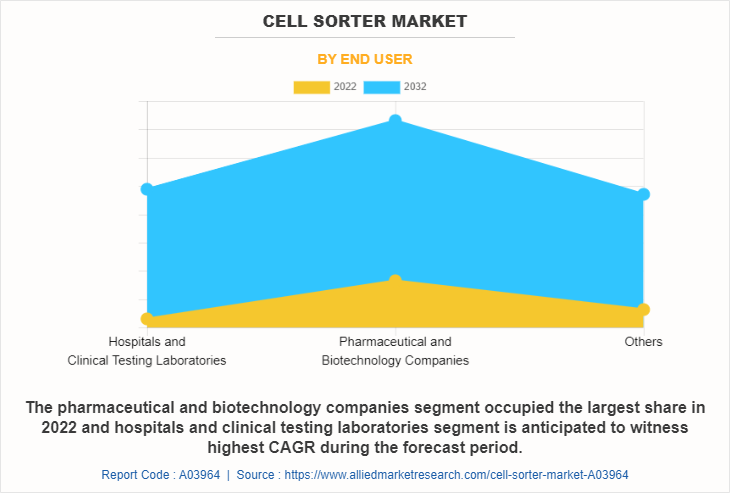

By End User

The pharmaceutical and biotechnology companies segment held the largest cell sorter market share in 2022 and is expected to remain dominant throughout the forecast period, owing to high adoption rate of cell sorters in pharmaceutical and biotechnology companies, heavily invest in research and development activities to discover and develop new drugs and therapies, and rise in technological advancements in cell sorter. However, the hospitals and clinical testing laboratories segment is expected to register the highest CAGR during the forecast period. This is attributed to the increase in adoption of advanced diagnostic and research tools in healthcare facilities and growing prevalence of chronic diseases necessitates accurate and efficient cell analysis.

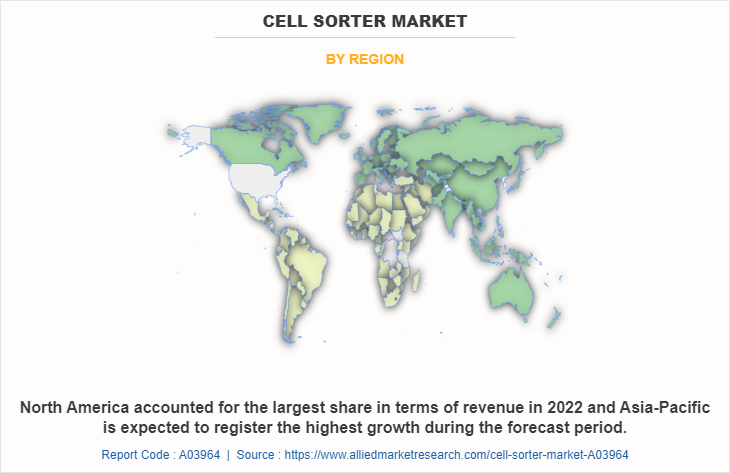

By Region

The cell sorter industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the cell sorter market in 2022 and is expected to maintain its dominance during the forecast period. Presence of several major players, such as Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., and Danaher Corporation and advancement in manufacturing technology of cell sorters in the region drive the growth of the market. In addition, surge in concern among people for maintaining a healthy lifestyle and consistent growth in geriatric population has increased the demand for cell sorters to treat the various diseases which contributes towards the market growth.

Furthermore, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of advanced cell sorters are expected to drive the market growth. In addition, product launch, acquisition, and partnership adopted by the key players in this region boost the growth of the market.

Moreover, the development in research methodologies and the adoption of innovative technologies drive the demand for cell sorters and fuel the market growth. For instance, the Hydris cell sorting system developed by Cytonome/St, LLC company has a high throughput cell purification system and uses parallel power of technology. In addition, it has advanced automation to improve the efficiency of routine and repetitive cell sorting tasks. Such advanced features offer by cell sorters fuel the market growth in this region.

Asia-Pacific is expected to register the highest CAGR during the cell sorter market forecast period. The attributed to the presence of pharmaceutical and biotechnology companies in the region as well as growth in the purchasing power of populated countries, such as China and India. In addition, the Asia-Pacific region has witnessed a significant growth owing to rise in research and development activities in various fields such as biotechnology, pharmaceuticals, and life sciences. This growth fuels the demand for advanced cell sorter instruments to support research efforts, thereby propels the market growth in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the cell sorter, such as Becton, Dickinson and Company, Bio-Rad Laboratories, Inc. Cytonome/St, LLC Danaher Corporation Harvard Bioscience, Inc. Miltenyi Biotec GmbH On-Chip Biotechnologies Co., Ltd. Sony Corporation, Sysmex Corporation, and Thermo Fisher Scientific Inc. are provided in this report. Major players have adopted product launch, partnership, and acquisition as key developmental strategies to improve the product portfolio of the cell sorter market.

Recent Product Launches in the Cell Sorter Market

- In May 2023, Becton, Dickinson and Company, a leading global medical technology company, announced the worldwide commercial launch of BD FACSDiscover S8 Cell Sorter to combine spectral flow cytometry with real-time imaging technology that enable researchers to uncover more detailed information about cells that was previously invisible in traditional flow cytometry experiments.

- In January 2020, Miltenyi Biotec launched the world’s first GMP-compliant operator-free cell sorting system. The MACS GMP Tyto Cartridge is used in the induced Pluripotent Stem (iPS) trial of Parkinson’s Disease currently ongoing at the Center for iPS Cell Research and Application (CiRA), Kyoto.

Recent Acquisitions in the Cell Sorter Market

- In August 2021, Thermo Fisher Scientific Inc., the world leader in serving science, announced that it has acquired cell sorting technology assets from Propel Labs, a wholly-owned subsidiary of SIDIS Corp. This acquisition helped to expand their product portfolio.

- In April 2020, Bio-Rad Laboratories, Inc. a global leader of life science research and clinical diagnostic products, announced that it has acquired Celsee, Inc., a company that offers instruments and consumables for the isolation, detection, and analysis of single cells. The acquisition helps Bio-Rad Laboratories to enhance its product portfolio in the field of single-cell analysis.

Recent Partnership in the Cell Sorter Market

- In October 2020, On-chip Biotechnologies Co., Ltd. new partnership with PHC Corporation of North America (PHCNA). PHCNA will be distributing and marketing our products in North America.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cell sorter market analysis from 2022 to 2032 to identify the prevailing cell sorter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cell sorter market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cell sorter market trends, key players, market segments, application areas, and market growth strategies.

Cell Sorter Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.3 billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 273 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Cytonome/St, LLC, Harvard Bioscience, Inc., Thermo Fisher Scientific Inc., On-Chip Biotechnologies Co., Ltd., Miltenyi Biotec GmbH, Sysmex Corporation, Becton, Dickinson and Company, Danaher Corporation, Sony Corporation, Bio-Rad Laboratories, Inc. |

Analyst Review

This section provides various opinions in the global cell sorter market. The increase in demand for advanced cell sorters, surge in research and development activities in healthcare and pharmaceutical industries, advancements in diagnostic procedures, and increase in prevalence of chronic diseases such as diabetes and cancer are expected to offer profitable opportunities for the expansion of the market. However, the high cost of cell sorters and lack of skilled staff in developing countries hinder market growth.?

In addition, advancements in biotechnology field and increase in adoption of cell sorters for R&D activities are expected to propel the market growth. This has led to an increase in demand for cell sorter instruments to analyze the cells across the globe, which is expected to fuel market growth during the forecast period.

Furthermore, North America is expected to witness the largest growth, in terms of revenue, owing to the surge in prevalence of chronic diseases along with rise in R&D activities in cell research and presence of major key players in the region. However, Asia-Pacific is anticipated to register the highest growth owing to rise in prevalence of HIV & cancer, surge in number of biotechnology & pharmaceutical companies, and growth in healthcare infrastructure.

The total market value of cell sorter market is $579.3 million in 2022.

The market value of cell sorter market in 2032 is $1,296.1 million.

The forecast period for cell sorter market is 2023 to 2032.

The base year is 2022 in cell sorter market.

Top companies such as Becton, Dickinson and Company, Danaher Corporation, Bio-Rad Laboratories, Inc., Sony Corporation, and Thermo Fisher Scientific Inc. held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The instruments segment is the most influencing segment in cell sorter market owing to rise in number of key players offering cell sorter instruments, and growing awareness about advanced cell sorter instruments.

Cell sorters are laboratory instruments used to isolate and separate specific cells from a heterogeneous mixture based on their unique characteristics. They operate on flow cytometry principles, analyzing cells one at a time as they pass through laser beams and using fluorescent markers to identify and sort target cells.

Cell sorters are widely used in various research fields such as immunology, cancer research, stem cell research, microbiology, and biotechnology. They are crucial for studying cell populations, isolating rare cell types, and performing single-cell analysis.

Loading Table Of Content...

Loading Research Methodology...