Cell Therapy Market Size & Trends

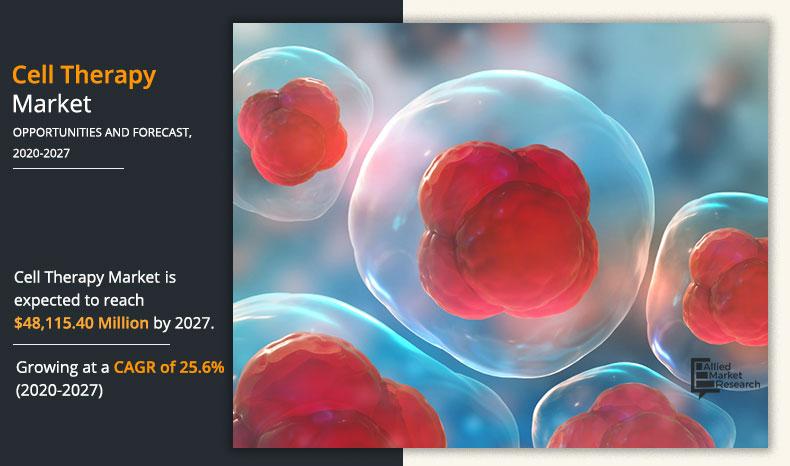

The global cell therapy market size accounted for $7,754.89 million in 2019, and is expected to reach $48,115.40 million by 2027, registering a CAGR of 25.6% from 2020 to 2027. Cell therapy is a technology that relies on replacing diseased or dysfunctional cells with healthy functioning ones. Cells mainly used for such advanced therapies are stem cells, owing to their ability to differentiate into specific cells required for repairing damaged or defective tissues or cells.

Market Introduction and Definition

Moreover, cell therapy finds its application in development of regenerative medicines, which is a multidisciplinary area aimed at maintenance, improvement, or restoration of cell, tissue, or organ function using methods mainly related to cell therapy. In addition, cells such as blood and bone marrow cells, mature, immature & solid tissue cells, adult stem cells, and embryonic stem cells are widely used in cell therapy procedures. Moreover, transplanted cells including induced pluripotent stem cells (iPSCs), embryonic stem cells (ESCs), neural stem cells (NSCs), and mesenchymal stem cells (MSCs) are divided broadly into two main groups including autologous cell therapy and non-autologous cell therapy.

Key Market Dynamics

The cell therapy market is negatively impacted by the pandemic as most countries adopted lockdown to combat the pandemic. In addition, most clinics across the globe have stopped undertaking new cases of stem cell therapy, organ transplant, and other treatments for next few months, till the conditions seem to be under control. In addition, biopharmaceutical companies, including major players such as Pfizer and Eli Lilly have also announced clinical trial delays. The impact on allogeneic cell therapies or cell therapies derived from a healthy donor are particularly acute.

Moreover, owing to social distancing restrictions, allogeneic donors are less likely and often unable to donate their cells. This causes delays in cell collection that ripple throughout an entire allogeneic cell therapy process. As continued evaluation of COVID-19 cases underscores that people with underlying conditions are disproportionately affected by the virus, many patients whose therapeutic need is not immediate are choosing to wait rather than risk exposure. Furthermore, patients are being prioritized according to risk and need at this time. Various country and region-specific conditions are being put in place to allow treatment and trials to continue, however, many existing trials and read outs have been delayed and new trials completely suspended.

Rise in adoption of human cells for cell therapeutics research, technological advancements in field of cell therapy, and increase in incidences of diseases such as cancer and cardiac abnormalities are the key factors that drive growth of the cell therapy market. Furthermore, implementation of stringent government regulations regarding the use of cell therapy is anticipated to restrict the growth of the market. On the contrary, surge in number of regulations to promote stem cell therapy and increase in funds for research in developing countries are expected to offer lucrative opportunities for the cell therapy market in the future.

Furthermore, increase in financing and investments to support launch of new companies is expected to boost organic revenue growth of the market. For instance, in July 2019, Bayer invested $215 million for launch of Century Therapeutics, a U.S.-based biotechnology start-up that aimed at developing therapies for solid tumors and blood cancer. Funding was further increased to $250 billion by a $35 million contribution from Versant Ventures and Fujifilm Cellular Dynamics, which is anticipated to further boost the market growth.

Inception of effective guidelines for cell therapy manufacturing, development of advanced genomic analysis techniques, vast number of researches by cancer societies, and proven effectiveness of transplants are some of the primary growth factors of the cell therapy market. According to the transplantation statistics 2019, in the U.S., each year, approximately 18,000 people, aged 0 to 74 years, benefit from a potentially life-saving bone marrow or umbilical cord blood transplant. Furthermore, Asia-Pacific exhibits high potential for growth in the cell therapy market as it constituted around 4.60 billion of the global human population in 2019, which can serve as a potential patient base. Moreover, developing countries such as India and China are expected to experience growth, owing to surge in healthcare infrastructure, increase in affordability, and rise in awareness related to cell therapy.

Rise in prevalence of population suffering from cardiovascular, cancer, and other diseases is expected to positively affect growth of the cell therapy market. Moreover, increase in initiatives taken by authorities and governments to improve healthcare systems and spread awareness regarding benefits of cell therapy are also expected to increase growth of the global market.

Market Segmentation

The cell therapy market analysis is segmented on the basis of cell type, therapy type, therapeutic area, end-user, and region. On the basis cell type, the market is categorized into stem cell and non-stem cell.

By Cell Type

Stem cells segment is projected as one of the most lucrative segment.

Segment Review:

On the basis of cell type, the stem cell segment dominated the global cell therapy market in 2019, and is anticipated to continue this trend throughout the forecast period, as these are gaining popularity from initiatives taken by various governments. The number of stem cell banks are on the rise in developing nations, which further propels the cell therapy market growth. In addition, rise in awareness regarding storage of stem cells also have a positive effect on the cell therapy market size. In addition, by therapy type, the allogenic therapy segment dominated the market in 2019. This therapy is advantageous as it includes production of own immune stem cells, which could kill cancer cells that remain even after high-dose cytotoxic drugs treatment. Patients, who have a high risk of relapse after successful treatment of chemotherapy are recommended allogeneic transplants. Thus, rise in cases of cancer relapse fuels demand for allogeneic therapy in the global market.

By Therapy Type

Allogenic segment is projected as one of the most lucrative segment.

By therapy type, it is categorized into autologous and allogenic. By therapeutic area, the market is categorized into malignancies, musculoskeletal disorders, autoimmune disorders, dermatology, and others. By end-user, it is segmented into hospitals & clinics and academic & research institutes. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Spain, Italy, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Therapeutic Area

Malignancies segment is projected as one of the most lucrative segment.

By therapeutic area, the malignancies segment is anticipated to dominate the global market during the forecast period. Surge in cancer research, rise in geriatric population worldwide, and increase in adoption of cell therapy for treatment of malignancies are major factors that boost the cell therapy market growth.

By End User

Hospitals & clinics segment are forecasted to grow at the highest CAGR during the forecast period

By end user, the hospitals & clinics segment are forecasted to grow at the highest CAGR during the forecast period. The lucrative growth of the segment is attributed to increase in number of pipeline projects over the past few years. As per the Cancer Research Institute (CRI), number of cell therapy treatment projects increased from 753 in 2018 to 1,011 in 2019.

By Region

Asia-Pacific region would exhibit the highest CAGR of 31.6% during 2020-2027.

Regional/Country Market Outlook

Asia-Pacific presents lucrative opportunities for key players operating in the cell therapy market, owing to increase in population, coupled with high growing geriatric population and growth in awareness among healthcare entities and patients pertaining to potential of these therapies in chronic disease management. In addition, rise in healthcare expenditure and developing guidelines are expected to propel the market growth in the region.

Competitive Landscape

The report provides a comprehensive analysis of the leading companies operating in the global cell therapy market are Kolon Tissue Gene, Inc., Osiris Therapeutics, Inc., JCR Pharmaceuticals Co. Ltd., NuVasive, Inc., Stemedica Cell Technologies, Inc., Cells for cells, Holostem Terapie Avanzate S.r.l., Mesoblast Ltd., and Medipost Co., Ltd.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2020 to 2027 to identify the prevailing cell therapy market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cell therapy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cell therapy market trends, key players, market segments, application areas, and cell therapy market growth strategies.

Cell Therapy Market Report Highlights

| Aspects | Details |

| By Cell Type |

|

| By Therapy Type |

|

| By Therapeutic Area |

|

| By End User |

|

| By Region |

|

| Key Market Players | CELLS FOR CELLS, JCR PHARMACEUTICALS CO., LTD., OSIRIS THERAPEUTICS, INC., MEDIPOST CO., LTD., STEMEDICA CELL TECHNOLOGIES, INC, HOLOSTEM TERAPIE AVANZATE SRL, MESOBLAST LTD, KOLON TISSUEGENE, INC., NUVASIVE, INC., ALLOSOURCE |

Analyst Review

Cell therapy is an integral part of immunotherapy that has shown excellent therapeutic ability in several clinical indications. In recent years, studies regarding the use of cells for their therapeutic ability have gained immense popularity in scientific and healthcare research communities. In addition, several techniques such as CAR-T cell therapy, stem cell therapy, and cord blood cell therapy have gained extreme popularity, owing to their wide applications in several clinical indications such as cancer and cardiovascular disease.

Rise in demand for oncology-oriented cell-based therapy clinical trials is the major factor expected to drive growth of the global cell therapy market during the forecast period. In addition, rise in demand for advanced cell therapy, owing to its affordability and sustainability is another factor anticipated to fuel growth of the global market. Moreover, increase in government investments in cell-based research therapy for lifestyle diseases such as diabetes is also estimated to drive growth of the cell therapy market during the forecast period.

However, certain pharmacological and manufacturing issues and regulatory hurdles hamper demand for cell therapy and restrain growth of the target market. On the contrary, increase in adoption of cell therapy technologies in developing countries is expected to create a lucrative opportunity for growth of the global cell therapy market.

The total market value of cell therapy market is $7,754.89 million in 2019.

The forcast period for cell therapy market is 2020 to 2027

The market value of cell therapy market in 2027 is $ 48,115.40 million.

The base year is 2019 in cell therapy market

Top companies such as JCR Pharmaceuticals CO., LTD., AlloSource, Kolon Tissuegene, INC., Nuvasive, INC., and Medipost CO., LTD. held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in different regions.

In cell type segment stem cell is the most influencing segment, as these are gaining popularity from initiatives taken by various governments. The number of stem cell banks are increasing in developing nations, which further propels the market growth. In addition, rise in awareness regarding storage of stem cells also have a positive effect on the market.

The major factor that fuels the growth of the global cell therapy market includes rise in technological advancements in the field of cell therapy, coupled with rise in number of cell therapy clinical studies is the major factor that boosts the market growth. However, competitive pricing offered by local manufacturers is expected growth of the market. On the contrary, developing economies and untapped markets are expected to provide lucrative opportunities for the market growth in the future.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the emerging countries. This is due to improvement in health awareness, development in healthcare infrastructure, and rise in number of hospitals & research centers equipped with advanced medical facilities.

Cell therapy is the transplantation of human cells to replace or repair damaged tissue and/or cells. With new technologies, innovative products, and limitless imagination, many different types of cells may be used as part of a therapy or treatment for a variety of diseases and conditions

cell therapies include treating cancers, autoimmune disease, urinary problems, and infectious disease, rebuilding damaged cartilage in joints, repairing spinal cord injuries, improving a weakened immune system, and helping patients with neurological disorders

Loading Table Of Content...