Cephalosporin Market Research, 2027

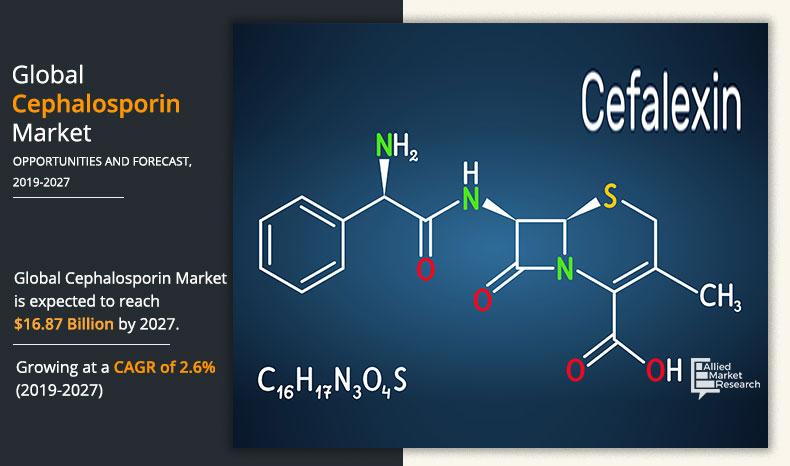

The global cephalosporin market size was valued at $13.69 billion in 2019, and is estimated to reach $16.87 Billion by 2027, growing at a CAGR of 2.6% from 2019 to 2027.

Cephalosporin is a bactericidal, broad-spectrum, and β-lactam antibiotic originally derived from fungus Acremonium, which is used to treat bacterial infections such as pneumonia, skin infections, strep throat, staph infections, tonsillitis, bronchitis, otitis media, gonorrhea, and others. They inhibit enzymes in cell wall of susceptible bacteria, disrupting cell synthesis. Cephalosporins are mainly designated for prophylaxis as well as treatment of infections caused by bacteria. First-generation cephalosporins are active mainly against gram-positive bacteria, such as Streptococcus and Staphylococcus. Hence, they are used primarily for soft tissue and skin infections as well as to prevent from hospital-acquired surgical infections. Successive generations i.e. from second-generation to fifth generation of cephalosporins have increased activity against gram-negative bacteria and gram-positive organisms. Cephalosporin may be used for patients who are allergic to penicillin due to different β-lactam antibiotic structure.

Severe Acute Respiratory Syndrome Coronavirus 2 (SARS-CoV-2) is the causative agent of coronavirus disease 19 (COVID-19), a novel human coronavirus responsible for about 300,000 deaths worldwide. Till date, there is no confirmed treatment or vaccine prevention strategy against COVID-19. Hence, owing to urgent need for effective treatment, drug repurposing is regarded as the immediate option. Potential drugs can be identified via silico drug screening experiments. Thereby, in vitro and in vivo studies are going on to evaluate the potential of generations of cephalosporin for COVID-19.

The global cephalosporin market is experiencing growth, owing to surge in prevalence of infectious diseases, increase in R&D activities for development of combination drugs, and rise in funding for development of antibiotics. In addition, rise in demand for antibacterial drugs further drives growth of the global cephalosporin market. However, side effects associated with cephalosporin, uncertain regulatory reforms, antibiotic resistance to cephalosporin, and less drugs in pipeline are projected to impede the cephalosporin market growth. On the contrary, discovery of advanced prospect molecules and introduction of novel combination therapies to treat antibiotic-resistant microbial infections are expected to offer remunerative opportunities for the market players.

Cephalosporin Market Segmentation

The global cephalosporin market is segmented on the basis of generation, type, route of drug administration, application, and region. On the basis of generation, the market is divided into first-generation cephalosporin, second-generation cephalosporin, third-generation cephalosporin, fourth-generation cephalosporin, and fifth-generation cephalosporin. By type, it is bifurcated into branded and generic. Depending on route of administration, it is classified into intravenous and oral. Applications covered in the study include respiratory tract infection, skin infection, ear infection, urinary tract infection, sexually transmitted infection, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Generation

Third-generation Cephalosporin holds the dominant position in 2019 and would continue to maintain the lead over the forecast period.

Generation Segment Review

On the basis of generation, the third-generation cephalosporin segment generated the highest revenue in 2019, and is anticipated to maintain its dominance throughout the forecast period, as these are used for treatment of gram-negative bacillary meningitis, serious infections of enterobacteriaceae, otitis media, pyelonephritis, skin & soft tissue infections, Lyme disease, and gonorrhea. However, the fifth-generation cephalosporin segment is expected to register highest CAGR during the forecast period, as these drugs possess strong activity against aerobic gram-negative bacteria and exceptional activity against aerobic gram-positive bacteria.

By Type

Branded is projected as one of the most lucrative segments.

Type Segment Review

By type, the generic cephalosporin drugs segment is projected to exhibit highest growth during the forecast period, as these drugs are available at a much lower cost as compared to branded drugs. Moreover, pharmacological effects of generic drugs are exactly same as those of their brand-name counterparts.

By Region

Asia-Pacific would exhibit the highest CAGR of 3.6% during 2019-2027.

Region Segment Review

Region wise, the antibiotics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the market in 2019, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to increase in consumption of cephalosporin, easier availability, and rise in demand for over-the-counter drugs, and increase in bacterial infection in the region.

The report provides a comprehensive analysis of the key players operating in the global cephalosporin industry, namely, Allergan Plc., Bristol-Myers Squibb Company, F.Hoffmann-La Roche Ltd., GlaxoSmithKline Plc, Lupin Limited (Lupin Pharmaceuticals, Inc.), Merck & Co. Inc., Novartis International AG, Pfizer Inc., Sanofi, and Teva Pharmaceutical Industries Ltd. The other players in the value chain include Eli Lilly and Company, Bayer HealthCare, Sun Pharmaceutical, and Shionogi.

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current cephalosporin market trends and cephalosporin market forecast estimations from 2019 to 2027, which assists to identify the prevailing cephalosporin market opportunities.

- An in-depth cephalosporin market analysis includes analysis of various regions is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the global cephalosporin market is provided.

- Region-wise and country-wise cephalosporin market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2019 to 2027 in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the cephalosporin market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of global cephalosporin market.

Cephalosporin Market Report Highlights

| Aspects | Details |

| By Generation |

|

| By Type |

|

| By Route Of Administration |

|

| By Application |

|

| By Region |

|

| Key Market Players | GLAXOSMITHKLINE PLC, TEVA PHARMACEUTICAL INDUSTRIES LTD., F. HOFFMANN-LA ROCHE LTD., PFIZER INC., SANOFI, MERCK & CO., INC., NOVARTIS INTERNATIONAL AG (SANDOZ), BRISTOL-MYERS SQUIBB COMPANY, ABBVIE INC. (ALLERGAN PLC.), LUPIN LIMITED (LUPIN PHARMACEUTICALS, INC.) |

Analyst Review

Rise in global prevalence of pneumonia, tonsillitis, bronchitis, and gonorrhea constitutes a major proportion of health and economic burden. Therefore, the adoption of cephalosporin is expected to increase in the near future. Moreover, increase in R&D activities for the development of combination drugs and rise in funding for the development of antibiotics further drives the market growth. Fifth-generation and fourth-generation of cephalosporin are expected to provide lucrative opportunities to market players, owing to the surge in prevalence of bacterial infectious diseases and increasing antimicrobial resistance.

Asia-Pacific is expected to grow at the highest CAGR during the study period. This is attributable to easy obtainability of cephalosporin over the counter and no obligation on their usage in this region. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to the key players during the forecast period, due to high prevalence of infectious diseases and rise in demand for cephalosporin.

The market value of Global Cephalosporin market was $13.69 billion in 2019.

The forecast period is from 2019 to 2027.

The market value of Global Cephalosporin market in 2020 is $14.86 billion.

The Global Cephalosporin market is expected to exhibit significant growth during the forecast period, owing to surge in prevalence of infectious diseases, increase in R&D activities for development of combination drugs, and rise in funding for development of antibiotics

The base year is 2019 in Global Cephalosporin market

Based on generation, the third-generation cephalosporin segment held a major share in the Global Cephalosporin market in 2019 and is expected to continue the trend in the forecasting period.

Loading Table Of Content...