Ceramic Capacitor Market Research, 2033

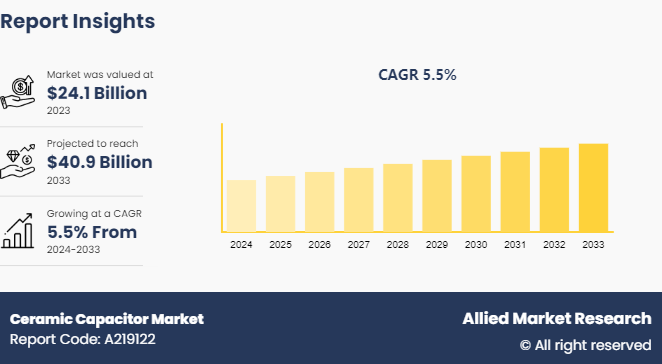

The global ceramic capacitor market size was valued at $24.1 billion in 2023, and is projected to reach $40.9 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

Market Introduction and Definition

Ceramic capacitors are fundamental components in electrical and electronic circuits, widely used for their reliability, stability, and capacitance range. In electronic circuits, ceramic capacitors serve multiple crucial roles, primarily as energy storage devices and for filtering purposes. Their ability to store electrical energy temporarily and release it as needed makes them essential in smoothing voltage fluctuations, reducing noise, and stabilizing circuit operation. This capability is particularly valuable in power supplies, where ceramic capacitors are used for decoupling and bypassing to ensure stable power delivery to sensitive components like integrated circuits (ICs) and microcontrollers.

The automotive industry relies heavily on ceramic capacitors for their robustness and compact size. In vehicles, these capacitors are integral to electronics and control systems, providing reliable operation across varying temperatures and environments. They contribute to safety systems, engine control units (ECUs) , infotainment systems, and sensors, ensuring consistent performance under demanding conditions.

Telecommunications infrastructure extensively utilizes ceramic capacitors for their efficiency and durability. They are crucial components in base stations, antennas, and network equipment, where they support signal processing, data transmission, and network reliability. Ceramic capacitors enable the miniaturization of telecommunications devices while maintaining high performance in terms of signal integrity and interference suppression.

Key Takeaways

- The ceramic capacitor industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global ceramic capacitor market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the ceramic capacitor market report.

- The ceramic capacitor market share is highly fragmented, with several players including Murata Manufacturing Co., Ltd, Holy Stone International, KYOCERA AVX Components Corporation., Vishay Intertechnology, Inc., High Energy Corp., TDK Corporation, TAIYO YUDEN CO., LTD., SAMSUNG ELECTRO-MECHANICS, YAGEO Group, and Würth Elektronik eiSos GmbH & Co. KG. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the ceramic capacitor market growth.

Segment Overview

The ceramic capacitor market is segmented into type, end-use, and region. On the basis of type, the market is divided into ceramic disc capacitor, multilayer ceramic capacitors (MLCCs) , feedthrough ceramic capacitor, and ceramic power capacitor. On the basis of end-use, the market is segmented into consumer electronics, telecommunication, automotive, industrial, energy & power and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Increase in demand for electronic devices is expected to drive the growth of the ceramic capacitor market during the forecast period. The surge in demand is primarily fueled by advancements in technology, growing consumer preferences for smart devices, and the integration of electronics into various facets of everyday life. As a critical component in electronic circuits, ceramic capacitors play a pivotal role in ensuring the reliable operation and performance of these devices. In the automotive sector, the proliferation of electric vehicles (EVs) and advancements in vehicle electrification are significant drivers of ceramic capacitor demand. EVs require sophisticated electronic systems for battery management, power distribution, and control units, all of which rely heavily on capacitors for energy storage and signal filtering.

Moreover, the trend towards autonomous driving capabilities further boosts the need for high-performance electronic components, including ceramic capacitors that can withstand harsh automotive environments. In telecommunications, ceramic capacitors are indispensable in electronic devices such as smartphones, base stations, and networking equipment. These capacitors facilitate efficient power management, signal processing, and data transmission, contributing to the seamless operation and reliability of communication networks. As telecommunications networks expand to accommodate the increasing demand for data and connectivity, the demand for ceramic capacitors continues to grow. According to a study by Qualcomm, 5G will generate more than USD 2.4 trillion across the automotive industry by 2035. As millions of vehicles leverage mobile technology for real-time navigation, emergency services, connected infotainment, etc., the advent of 5G will spawn a new range of applications such as Vehicle-2-Vehicle, Vehicle-2-Network (V2N) , Vehicle-2-Infrastructure (V2I) , and Vehicle-2-Pedestrian (V2P) communications. Thus, the increase in demand for automotive electronics is expected to drive the growth of ceramic capacitor market.

However, fluctuations in the prices of raw materials used in ceramic capacitors is expected to restrain the growth of the ceramic capacitor market during the forecast period. Price volatility in the ceramic capacitor industry is significantly influenced by fluctuations in the prices of raw materials essential for their production, including ceramic powders and precious metals. These materials are integral to the manufacturing process, where ceramic powders are used as the base material for capacitor dielectrics, and precious metals like palladium, silver, and others are employed for electrodes and internal coatings. The prices of ceramic powders can fluctuate due to factors such as changes in supply and demand dynamics, geopolitical events impacting production or transportation, and shifts in global economic conditions. Variations in the availability of raw materials or disruptions in their supply chain can lead to sudden price spikes, affecting manufacturing costs for ceramic capacitors. Manufacturers often rely on stable and consistent access to these materials to maintain production schedules and pricing predictability.

Furthermore, increase in adoption of ceramic capacitors in emerging applications such as renewable energy systems, electric vehicles (EVs) , and 5G infrastructure presents significant growth opportunities in the ceramic capacitor market forecast. In renewable energy systems, ceramic capacitors are crucial for energy storage and conversion applications. They are used in inverters, charge controllers, and energy storage systems to manage and regulate electrical energy efficiently. As the global shift towards renewable energy sources accelerates, driven by environmental concerns and energy independence goals, the demand for ceramic capacitors capable of withstanding high voltages and temperatures continues to rise. Electric vehicles (EVs) are another rapidly growing market for ceramic capacitors. These vehicles rely on complex electronic systems for propulsion, battery management, and onboard charging, all of which require capacitors that can handle high power densities and operate reliably in automotive environments. The trend towards electric mobility, supported by government incentives and technological advancements, is driving increased integration of ceramic capacitors in EV power electronics and energy storage systems. As per the International Energy Agency, almost 14 million new electric cars1 were registered globally in 2023, bringing their total number on the roads to 40 million, closely tracking the sales forecast from the 2023. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase.

Competitive Analysis

Key market players in the ceramic capacitor market include Murata Manufacturing Co., Ltd, Holy Stone International, KYOCERA AVX Components Corporation., Vishay Intertechnology, Inc., High Energy Corp., TDK Corporation, TAIYO YUDEN CO., LTD., SAMSUNG ELECTRO-MECHANICS, YAGEO Group, and Würth Elektronik eiSos GmbH & Co. KG.

Regional Market Outlook

In North America, ceramic capacitors are widely used in various industries, including consumer electronics, automotive, telecommunications, and industrial applications. The robust growth of the electronics sector, driven by high consumer demand for smartphones, laptops, and other smart devices, significantly contributes to the demand for ceramic capacitors. Additionally, the automotive industry's shift towards electric and hybrid vehicles has increased the need for these capacitors, given their role in power management systems, infotainment, and advanced driver-assistance systems (ADAS) .

Europe sees substantial usage of ceramic capacitors across its diverse industrial landscape, including automotive, aerospace, defense, and consumer electronics. The region's leadership in automotive technology, especially in the development of electric vehicles (EVs) and hybrid electric vehicles (HEVs) , drives significant demand for ceramic capacitors, which are essential for powertrain electronics and various safety systems.

The Asia-Pacific region dominates the ceramic capacitor market, fueled by the rapid expansion of its electronics manufacturing sector. Countries like China, Japan, South Korea, and Taiwan are major hubs for the production of consumer electronics, automotive components, and industrial machinery, all of which heavily rely on ceramic capacitors. The proliferation of smartphones, tablets, and other portable devices in these countries significantly boosts the demand for high-capacitor and miniaturized capacitors. Additionally, the region's growing automotive industry, particularly the increasing production of electric vehicles, further accelerates the need for these components.

Industry Trends

- In February 2023, Samsung Electro-Mechanics (SEMCO) revealed plans to enhance its manufacturing capacity for high-performance automotive multilayer ceramic capacitors (MLCCs) . This strategic move aims to narrow the market share difference with its main competitors. SEMCO will focus its investment in production facilities, including Tianjin, China, redirecting resources due to decreased demand for essential IT products like smartphones amid recent economic challenges. Leveraging its expertise in advanced IT MLCC development, SEMCO intends to prioritize the production of highly dependable automotive components.

- In April 2023, Kyocera Corporation introduced an innovative capacitor, part of their KGM03 series, which sets a new standard in compactness and capacitor for MLCCs (Multilayer Ceramic Capacitors) . With dimensions of just 0.6 mm x 0.3 mm (EIA 0201 standard) , this capacitor boasts an impressive maximum capacitance of 10 microfarads. This breakthrough is particularly significant for smartphones and wearable devices, where space efficiency is critical. Designers can now meet system requirements with fewer components and minimal space, thanks to Kyocera's advanced technology in miniaturization and capacitance enhancement.

- In September 2023, TDK Corporation introduced an innovative addition to its CN series of multilayer ceramic capacitors (MLCCs) . Unlike traditional soft termination MLCCs where resin layers fully cover terminal electrodes, this new design features resin layers covering only the side mounted to the board. This unique configuration enables electrical current to flow outside these layers, thereby reducing electrical resistance. Notably, TDK's soft termination product with this groundbreaking structure represents an industry first. Additionally, TDK expanded its lineup to include the CNA series for automotive applications and the CNC series for commercial use, catering to growing market demands for high-capacity solutions.

- In May 2024, Samsung-Electro Mechanics, a prominent electronic components manufacturer under Samsung Electronics, has established an ambitious sales target of 1 trillion won ($736 million) for its flagship Multi-Layer Ceramic Capacitor (MLCC) products this fiscal year. Their strategic focus is on penetrating the automotive sector. MLCCs play a critical role in circuitry by managing current flow and mitigating electromagnetic interference among components within electronic devices. These capacitors come in various sizes, ranging from as compact as 0.4 mm by 0.2 mm to larger formats such as 5.7 mm by 5 mm.

Historic Trends of Ceramic Capacitor

- In 1926, the first ceramic capacitors is developed and used in porcelain (a type of ceramic) as the dielectric material. These capacitors are primarily used in early radio technology.

- In 1940s, Ceramic capacitors started to be used in military applications due to their stability and reliability. The technology was refined further during World War II. The development of the multilayer ceramic capacitor (MLCC) began. This technology allowed for increased capacitance in a smaller package by stacking multiple layers of ceramic and metal electrodes.

- In the 1950s, the commercialization of MLCCs (Multilayer Ceramic Capacitors) began, driven by American companies. These capacitors quickly became popular in various electronic devices due to their compact size and high capacitance. They were widely used in applications such as television sets and radios.

- In 1965, the introduction of Class II and Class III dielectric materials marked a significant advancement in capacitor technology. These materials provided varied combinations of capacitance, stability, and temperature characteristics, enabling more customized capacitor designs to meet specific application requirements.

- In 1995, lead-free ceramic capacitors were introduced, reflecting both environmental regulations and a growing industry shift towards sustainable electronic components.

Key Sources Referred

- U.S. Department of Energy

- International Energy Agency

- U.S. Energy Information Administration

- ETech Group, LLC

- U.S. Food and Drug Administration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ceramic capacitor market analysis from 2024 to 2033 to identify the prevailing ceramic capacitor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ceramic capacitor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ceramic capacitor market trends, key players, market segments, application areas, and market growth strategies.

Ceramic Capacitor Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 40.9 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Murata Manufacturing Co., Ltd, Würth Elektronik eiSos GmbH & Co. KG, KYOCERA AVX Components Corporation., TDK Corporation, Vishay Intertechnology, Inc., High Energy Corp., Holy Stone International, YAGEO Group, SAMSUNG ELECTRO-MECHANICS, TAIYO YUDEN CO., LTD. |

The global ceramic capacitor market was valued at $24.1 billion in 2023, and is projected to reach $40.9 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

Key market players in the ceramic capacitors market include Murata Manufacturing Co., Ltd, Holy Stone International, KYOCERA AVX Components Corporation., Vishay Intertechnology, Inc., High Energy Corp., TDK Corporation, TAIYO YUDEN CO., LTD., SAMSUNG ELECTRO-MECHANICS, YAGEO Group, and Würth Elektronik eiSos GmbH & Co. KG.

Multilayer ceramic capacitors (MLCCs) is the leading application of ceramic Capacitor market.

Asia-Pacific is the largest regional market for ceramic Capacitor.

Increase in adoption of ceramic capacitors in emerging applications are the upcoming trends of ceramic Capacitor market in the globe.

Loading Table Of Content...