Ceramic Matrix Composites Market Research- 2026

The global ceramic matrix composites market size was valued at US$ 4,857.6 million in 2018 and is projected to reach US$ 11,516.1 million by 2026, growing at a CAGR of 11.4% from 2019 to 2026. Ceramic matrix composites (CMCs) are defined as a group of composite materials consisting of ceramic fibers embedded in a ceramic matrix. Ceramic materials are inorganic and nonmetallic solids, which are crystalline in nature. CMCs exhibit improved crack resistance and do not rupture easily under heavy loads as compared to conventional technical ceramics.

Rapid growth in automotive sector across developing economies such as India and China and increase in demand for ceramic matrix composites owing to their low weight, high friction, and temperature-resistant properties are the key factor that fuel of the ceramic matrix composites market growth. In addition, surge in demand for lightweight and fuel-efficient vehicles has increased the need for ceramic matrix composites in the automotive industry, thereby driving the market growth. However, factors such as high cost of CMCs as compared to other metal alloys is expected to restrain the growth of the global ceramic matrix composite market. On the contrary, incorporation of low-cost production technologies is anticipated to provide lucrative opportunities for the market expansion.

The global ceramic matrix composites market is segmented based on composite type, fiber type, fiber material, application, and region. Depending on composite type, the market is classified into silicon carbide reinforced silicon carbide (SIC/SIC), carbon reinforced carbon (C/C), oxide–oxide (OX/OX) and others (Silicon Carbide and Carbon (SIC/C)). By fiber type, it is fragmented into short fiber and continuous fiber. On the basis of fiber material, it is classified into alumina fibers, amorphous ceramic fibers (RCF), silicon carbide fibers (SiC), and others. As per application, it is segregated into aerospace & defense, automotive, energy & power, electricals & electronics, and others. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, UK, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

The major key players operating in the global ceramic matrix composites market include Rolls-Royce Plc., Coi Ceramics INC., SGL Group, United Technologies, Ceramtec, Lancer Systems, Coorstek Inc., Applied Thin Films, Ultramet, and Composites Horizons. Other players operating in this market include Pyromeral Systems, Precision Castparts Corp., Zircar Zirconia, Inc., United Composites B.V., and Plasan North America. These major key players are adopting different strategies such as acquisition, business expansion, and collaboration to stay competitive in the global market.

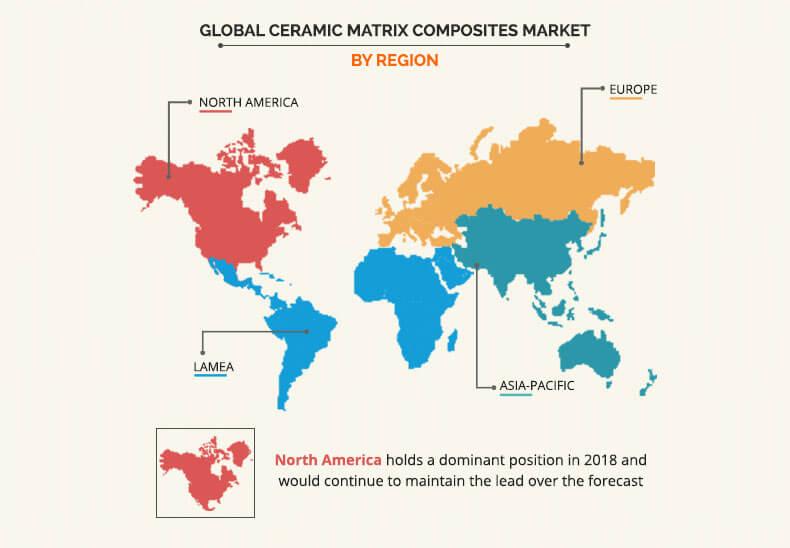

Global Ceramic Matrix Composites Market, By Region

North America accounted for the major share in 2018 in the global ceramic matrix composites market, owing to increase in consumption of these composites in the automotive, aerospace & defense, and electrical & electronics industries. In addition, increase in investments by major market players for R&D activities and expansion of their production capabilities & product portfolios are anticipated to boost the growth of the North America ceramic matrix composite market.

Global Ceramic Matrix Composites Market Size, By Composite Type

Based on composite type, the silicon carbide reinforced silicon carbide (SIC/SIC) segment held the major share in 2018. SIC/SIC is widely used in high-temperature application, owing to its properties such as resistance to high temperature and oxidation. Due to increase in production and export of aerospace and defense equipment like fighter jets from countries such as the U.S., Germany, France, and the UK to developing countries has increased the demand for SIC/SIC.

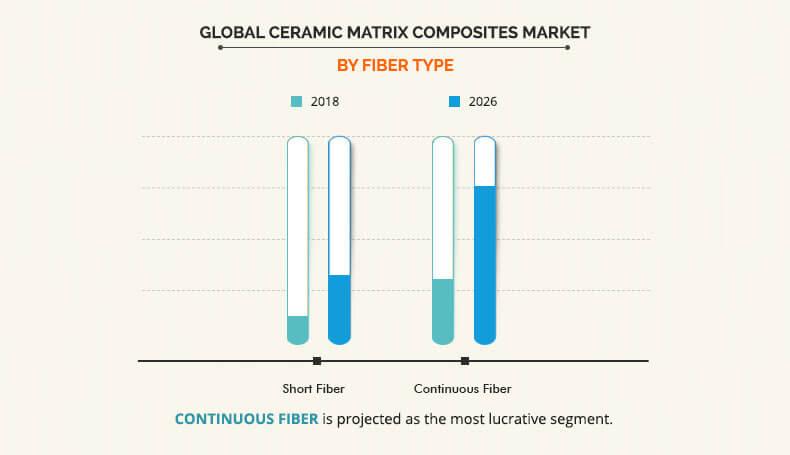

Global Ceramic Matrix Composites Share, By Fiber Type

Depending on fiber type, the continuous fiber segment garnered the major share in 2018, due to increase in use of continuous fiber in gas turbines required in manufacturing of fighter jet engines, attributable to their properties such as high temperature capability, enhanced toughness, and prolonged durability. Development of the aerospace & defense industry and increase in production & export of military aircrafts across developed and developing countries such as the U.S., the UK, France, China, and Russia boost the demand for continuous fiber, which in turn is expected to fuel the growth of the ceramic matrix composites market.

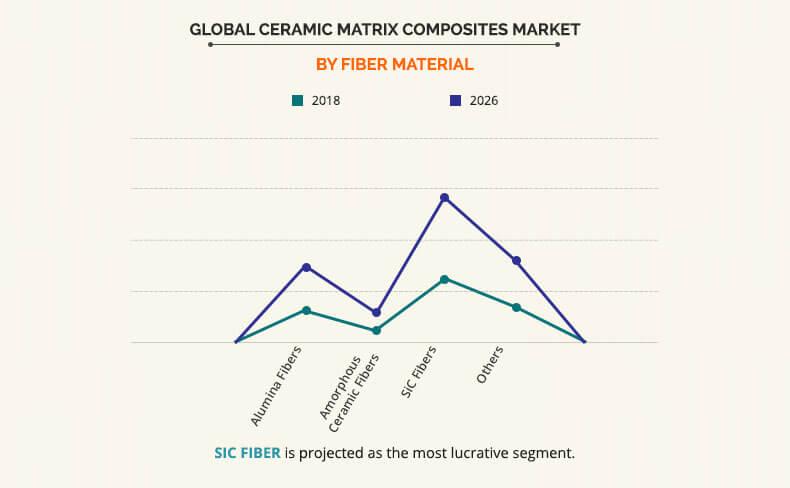

Global Ceramic Matrix Composites Market, By Fiber Material

As per fiber material, the SIC fiber segment accounted for the major share in 2018. This is attributed to the fact that silicon carbide fiber offers high stiffness, high chemical resistance, high temperature tolerance, and low weight as well as thermal expansion. Due to all these benefits, silicon carbide fibers are the clear choice for hot section components in the next generation of gas turbines. This in turn is anticipated to fuel the growth of the ceramic matrix composites market.

Global Ceramic Matrix Composites Market, By Application

As per application, the aerospace & defense segment held the major share in 2018. Ceramic matrix composites are increasingly being utilized in aerospace & defense equipment, owing to their properties such as lightweight, enhanced fuel efficiency, and prolonged durability. In addition, increase in R&D activities in aerospace & defense technologies and rise in production of military aircrafts have led to increase in demand for ceramic matrix composites, thus driving the growth of the ceramic matrix composites market.

Key Benefits for Ceramic Matrix Composites Market:

- The ceramic matrix composites market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- The report outlines the current market trends and future scenario of the ceramic matrix composites market Forecast from 2018 to 2026 to understand the prevailing opportunities and potential investment pockets.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and ceramic matrix composites market trends opportunities and their detailed impact analysis is elucidated in the study.

Ceramic Matrix Composites Market Report Highlights

| Aspects | Details |

| By Composite Type |

|

| By Fiber Type |

|

| By Fiber Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | COI Ceramics, Inc., Ultramet, CoorsTek Inc., Rolls-Royce plc, Applied Thin Films Inc., SPECIALTY MATERIALS, INC., SGL Carbon, CeramTec GmbH, Composites Horizons, Lancer Systems |

Analyst Review

The ceramic matrix composites market is expected to witness substantial growth during the forecast period, owing to various factors such as development of the automotive and aerospace & defense industries. These composites are witnessing outstanding acceptance due to their properties like low weight, high friction, toughness, and durability. Unlike the usual technical ceramic coatings used in the automotive components, the ceramic matrix components have high temperature resistance that protects the components from oxidation. Furthermore, development of composites technology over the years has resulted in a significant increase in its usage in various end-use industries, including automotive, aerospace & defense, energy & power, electricals & electronics, and others.

Automotive and aerospace & defense industries serve as the most attractive end-use industries in the U.S., Germany and China and are expected to be the first preference for new entrants, owing to increase in usage of these coatings for protection of metal and its alloys.

Loading Table Of Content...