Check Cashing Services Market Research, 2032

The global check cashing services market was valued at $27.5 billion in 2022, and is projected to reach $65.8 billion by 2032, growing at a CAGR of 9.4% from 2023 to 2032.

Check cashing services are financial facilities that enable individuals and businesses to convert paper checks into cash without having to deposit them into a traditional bank account. This service is particularly beneficial for those who may not have a bank account or need immediate access to funds without waiting for the typical clearance process. Check cashing services operate by charging a fee, usually a percentage of the total amount on the cheque, in exchange for providing instant cash. This fee is the primary source of revenue for check cashing businesses.

The increasing focus on regulatory compliance is a key driver for the growth of the check cashing services market. Regulatory focus necessitates that check cashing services adhere to legal requirements and compliance standards. Businesses operating in this sector are compelled to implement robust compliance measures, ensuring that their practices align with existing financial regulations and standards. Moreover, regulatory pressures have led check cashing services to enhance their customer verification processes. Implementing stringent identity verification measures ensures that transactions are conducted with legitimate individuals, contributing to a more secure financial ecosystem. In addition, the surge in adoption of digital technologies and the rapid disbursement of funds are the major driving factors for the check cashing services market.

However, high cost of fees and fraud concerns are major factors that hamper the growth of the check cashing services market. The fees associated with check cashing services are often perceived as relatively high compared to traditional banking options. Customers may find themselves paying a significant percentage of their check's value as a fee for the convenience of immediate cash access. This high cost can deter potential users, especially those seeking cost-effective financial solutions. Contrarily, continuous improvements in KYC policy presents a significant opportunity for the check cashing services industry. Continuous improvements in KYC policies enable check cashing services to stay abreast of evolving regulatory requirements. By aligning with stringent compliance standards, these services can enhance their legitimacy and build trust among customers and regulatory bodies. Moreover, advancements in KYC policies can contribute to a more seamless customer onboarding process. Thus, these factors will provice lucrative opportunities for check cashing services market.

The report focuses on growth prospects, restraints, and trends of the check cashing services market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the check cashing services market.

Segment Review

The check cashing services market is segmented on the basis of service provider, type, end user, and region. On the basis of service provider, it is categorized into banks, credit unions, and others. On the basis of type, it is categorized into pre-printed checks, payroll checks, government checks, tax checks, and others. On the basis of end user, it is bifurcated into commercial, and personal. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

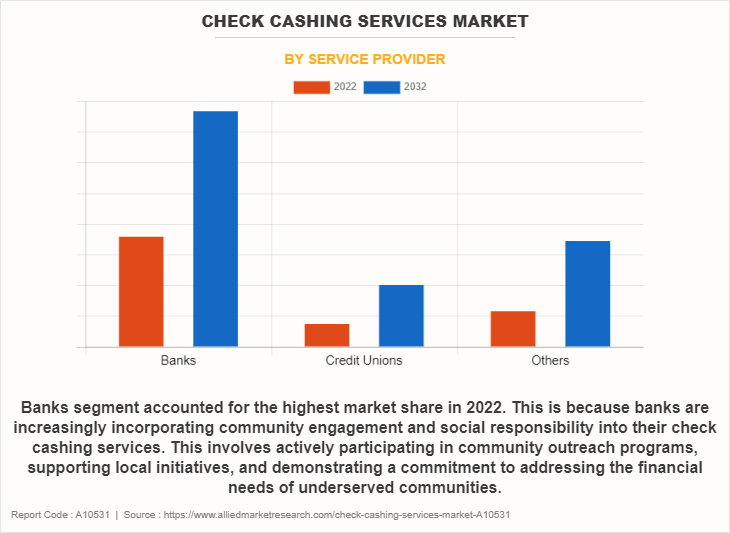

On the basis of service provider, the banks segment attained the highest check cashing services market size in 2022. This is because banks are increasingly incorporating community engagement and social responsibility into their check cashing services. This involves actively participating in community outreach programs, supporting local initiatives, and demonstrating a commitment to addressing the financial needs of underserved communities.

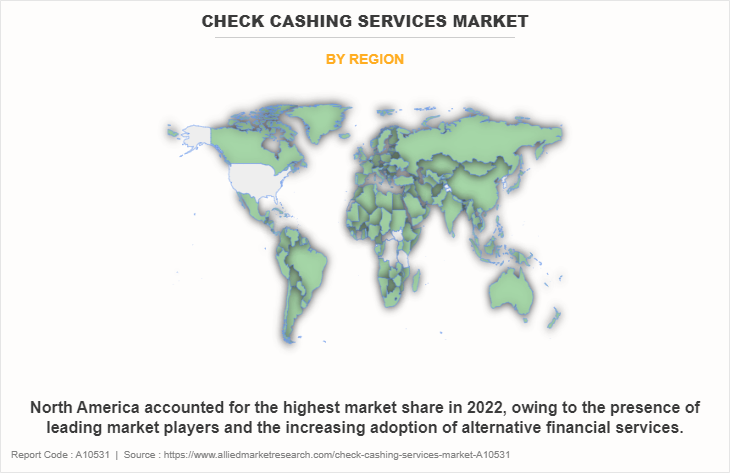

On the basis of region, North America held the highest check cashing services market share in 2022, owing to the presence of leading market players and the increasing adoption of alternative financial services.

The report analyzes the profiles of key players operating in the check cashing services market such as Anfield Cheque Cashing Centre, Encore Capital Group, PHH Mortgage Corporation, Oaktree Capital Group, LLC, Ocwen Financial Corporation, QCHI, Currency Exchange International Corp, Navient Corporation, Secure Check Cashing, Inc, and National Money Mart Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the check cashing services market.

Market Landscape and Trends

The check cashing services industry is undergoing a digital transformation, with an increasing number of providers offering online and mobile solutions. Digital check cashing apps allow users to capture an image of their checks using a smartphone, facilitating quick and convenient transactions. This trend aligns with the broader digitization efforts within the BFSI sector. Moreover, there is a growing emphasis on regulatory compliance and consumer protection within the check cashing services industry. Regulatory bodies are scrutinizing practices to ensure fair and transparent fee structures, adequate consumer disclosures, and compliance with anti-money laundering (AML) regulations. Check cashing services market players are investing in robust compliance frameworks to navigate evolving regulatory landscapes. In addition, the integration of digital and mobile solutions into the check cashing services landscape is driving growth. Mobile check cashing apps allow users to deposit checks remotely, offering a seamless and efficient experience. This technological advancement attracts a tech-savvy consumer base and contributes to market expansion. These are the major trends in the check cashing services market.

Top Impacting Factors

Surge in Adoption of Digital Technologies

Check cashing services have adapted to the digital era by incorporating online and mobile functionalities. This hybrid approach allows customers to initiate check cashing transactions through digital channels while still enjoying the speed and convenience of physical locations for cash disbursement. In addition, economic disparities contribute to the continued reliance on check cashing services. Individuals with lower incomes or irregular employment may face challenges in maintaining bank accounts or adopting digital payment methods. Check cashing services become a practical solution for these individuals to access their funds without navigating the complexities of traditional banking. Furthermore, while digital payment methods have gained widespread popularity, a significant portion of the population remains unbanked or underbanked. These individuals may not have access to traditional banking services or face challenges in adopting digital payment methods. Check cashing services bridge this gap by providing a tangible and accessible means for individuals to convert checks into cash. Therefore, these factors foster the check cashing services market growth.

Increase in Focus on Regulatory Compliance

Regulatory focus necessitates that check cashing services adhere to legal requirements and compliance standards. Businesses operating in this sector are compelled to implement robust compliance measures, ensuring that their practices align with existing financial regulations and standards. Moreover, regulatory pressures have led check cashing services to enhance their customer verification processes. Implementing stringent identity verification measures ensures that transactions are conducted with legitimate individuals, contributing to a more secure financial ecosystem. In addition, the growing focus on regulatory compliance has led to the adoption of technological solutions within the check cashing services market. Automated compliance tools and software help streamline processes, reduce errors, and ensure that regulatory requirements are consistently met. Therefore, these factors are driving the growth of the check cashing services market.

High Speed of Transactions

One of the primary advantages of check cashing services is the rapid disbursement of funds. Customers can quickly convert their checks into cash, gaining immediate access to their money without the delays often associated with traditional banking processes. The fast-paced nature of check cashing services caters to individuals with urgent financial needs. Whether it is covering essential expenses, emergency situations, or unexpected bills, the high speed of transactions aligns with the immediacy required in such financial scenarios. In addition, check cashing services streamline their verification processes to expedite transactions. This includes efficient identity verification and check authentication procedures, minimizing the time customers spend in the transaction process. Further, check cashing services are designed to minimize administrative delays associated with traditional banking procedures. The simplified nature of these transactions contributes to a faster and more streamlined customer experience. Therefore, these factors foster the growth of the check cashing services market.

High Cost of Fees and Fraud Concerns

The fees associated with check cashing services are often perceived as relatively high compared to traditional banking options. Customers may find themselves paying a significant percentage of their check's value as a fee for the convenience of immediate cash access. This high cost can deter potential users, especially those seeking cost-effective financial solutions. Moreover, low-income individuals, who may rely more heavily on check cashing services, can be disproportionately affected by high fees. For these individuals, the cost of fees can represent a substantial portion of their income, limiting their financial resources. In addition, the physical nature of checks makes them susceptible to forgery and counterfeiting. Fraudulent activities may involve altering or creating counterfeit checks, leading to financial losses for both the check cashing services and the individuals or businesses involved in the transactions. Therefore, these factors are anticipated to restrict the growth of the check cashing services market.

Continuous Improvements in KYC Policy

Continuous improvements in KYC policies enable check cashing services to stay abreast of evolving regulatory requirements. By aligning with stringent compliance standards, these services can enhance their legitimacy and build trust among customers and regulatory bodies. Moreover, advancements in KYC policies can contribute to a more seamless customer onboarding process. By leveraging technology to expedite identity verification without compromising security, check cashing services can offer a faster and more convenient experience for customers, aligning with the market's demand for high-speed transactions. In addition, the continuous improvements in KYC policy led to prevent money laundering as well as other anti-social activities. It also brings investments along with stability to the country and makes the financial framework less risky and more trustworthy. Additionally, there is a decrease in uncertainty, which allows institutions to lend more to customers by increasing their profits. Furthermore, launches of new & advanced software for cashing systems are estimated to provide huge opportunities in the check cashing services market during the forecast period.

Increased Collaboration of Key Players with Banks

Collaboration with banks provides check cashing services with access to the existing banking infrastructure. This access allows them to leverage the banking network for various financial services, facilitating smoother transactions and enhancing the overall efficiency of their operations. Moreover, partnering with banks enhances the credibility and trustworthiness of check cashing services. The association with established financial institutions can alleviate concerns related to the legitimacy of these services, contributing to increased trust among consumers. In addition, banks often have an extensive network of branches and ATMs. Collaborating with banks allows check cashing services to expand their geographic reach without the need to establish a large physical presence. This can be particularly beneficial for reaching underserved or remote areas. Therefore, these trends are projected to further drive the growth of the check cashing services market during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the check cashing services market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of check cashing services market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the check cashing services market segmentation assists in determining the prevailing check cashing services market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global check cashing services market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the check cashing services market players.

- The report includes an analysis of the regional as well as global check cashing services market trends, key players, market segments, application areas, and market growth strategies.

Check Cashing Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 65.8 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 377 |

| By Service Provider |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Navient Corporation, Encore Capital Group, Anfield Cheque Cashing Centre, Secure Check Cashing, Inc, QCHI, Oaktree Capital Group, LLC, National Money Mart Company, PHH Mortgage Corporation, Ocwen Financial Corporation, Currency Exchange International Corp |

Analyst Review

The adoption of digital solutions and mobile apps for check cashing is a significant trend. Consumers increasingly prefer the convenience of mobile transactions, and providers offering seamless digital experiences gain a competitive edge. This trend aligns with broader digital transformations within the financial industry. Moreover, some check cashing services are exploring the integration of blockchain technology and cryptocurrencies. This trend reflects a broader interest in leveraging decentralized technologies for secure and efficient financial transactions. Exploring the implications of blockchain in the check cashing sector is essential for market researchers. In addition, check cashing providers are diversifying their services beyond traditional check cashing. Offering additional financial services such as prepaid cards, money transfers, and bill payments is a trending strategy. This diversification caters to changing consumer needs and preferences. These driving factors collectively contribute to the continued growth and importance of the check cashing services market.

The CXOs further added that market players have adopted strategies such as integration for enhancing their services in the market and improving customer satisfaction. For instance, in December 2022, Money Mart implemented its mobile check cashing service, powered by Alogent’s Mobile Deposit Services (MDS) offering, a fully hosted mobile check acquisition and processing platform. Money Mart, a U.S.-based financial services group, is one of the largest providers of alternative financial solutions in North America and provides accessible solutions to underbanked and credit challenged consumers. By expanding funding services that were previously only available in its 700 retail locations, Money Mart is now enabling over one million customers in the U.S. and Canada to cash checks directly from their mobile devices and deposit the funds to a bank account or debit card. Therefore, such strategies are expected to boost the growth of the check cashing services market in the upcoming years.

Moreover, some of the key players profiled in the report are Anfield Cheque Cashing Centre, Encore Capital Group, PHH Mortgage Corporation, Oaktree Capital Group, LLC, Ocwen Financial Corporation, QCHI, Currency Exchange International Corp, Navient Corporation, Secure Check Cashing, Inc, and National Money Mart Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The check cashing services market is estimated to grow at a CAGR of 9.4% from 2023 to 2032.

The check cashing services market is projected to reach $65.8 billion by 2032.

The key growth strategies of check cashing services players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

The key players profiled in the report include check cashing services market analysis includes top companies operating in the market such as Anfield Cheque Cashing Centre, Encore Capital Group, PHH Mortgage Corporation, Oaktree Capital Group, LLC, Ocwen Financial Corporation, QCHI, Currency Exchange International Corp, Navient Corporation, Secure Check Cashing, Inc, and National Money Mart Company.

Surge in adoption of digital technologies, increase in focus on regulatory compliance, and high speed of transactions contribute towards the growth of the market.

Loading Table Of Content...

Loading Research Methodology...