Chemical, Biological, Radiological, And Nuclear (CBRN) Security Market Research, 2033

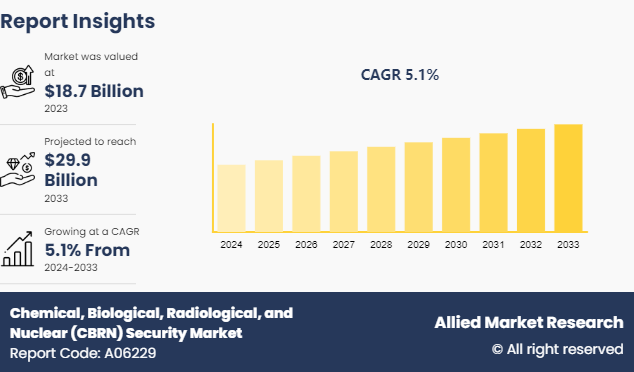

The global chemical, biological, radiological, and nuclear security (CBRN) market size was valued at $18.7 billion in 2023, and is projected to reach $29.9 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033. Chemical, Biological, Radiological, and Nuclear (CBRN) Security refers to measures and protocols designed to prevent, detect, respond to, and recover from incidents involving the deliberate or accidental release of hazardous chemical, biological, radiological, or nuclear materials. These incidents can have severe consequences, including mass casualties, environmental contamination, and long-term health and economic impacts. CBRN security encompasses a wide range of activities and strategies aimed at mitigating these risks.

The chemical, biological, radiological, and nuclear security (CBRN) market includes detection and monitoring systems, protective gear, decontamination equipment, and training services, catering to military, law enforcement, emergency responders, and civilian agencies. The demand for CBRN security is driven by factors such as increasing geopolitical tensions, terrorist threats, advancements in technology, and the need for robust disaster preparedness and response mechanisms. The market aims to mitigate the risks associated with CBRN incidents through enhanced safety measures, comprehensive response strategies, and the development of advanced protective technologies.

Key Takeaways

The Chemical, Biological, Radiological, and Nuclear (CBRN) Security market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Chemical, Biological, Radiological, and Nuclear (CBRN) Security industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In October 2023, Thales and Bertin strengthened their partnership in CBRN defense by successfully testing biological sampling and identification capabilities for the PIABC PELICAN project. This partnership leverages the strengths of both companies to develop innovative solutions for detecting and managing CBRN threats.

In December 2021, Teledyne FLIR secures a development contract valued at up to $15.7 million with the U.S. Defense Threat Reduction Agency’s Joint Science and Technology Office (DTRA JSTO) to create innovative battlefield threat mapping and visualization tools, enabling digital mapping of hazardous material threats from sensor data and real-time visualization through mixed reality on mobile devices, tablets, and Heads-Up Displays (HUDs).

Key Market Dynamics

The increase in global threat demand is a significant driver of the chemical, biological, radiological, and nuclear security (CBRN) market size. The threat of terrorist organizations obtaining and deploying CBRN materials for malicious purposes has become a major concern for governments and security agencies worldwide. This threat amplifies the need for robust chemical, biological, radiological, and nuclear security (CBRN) market forecast security measures to prevent, detect, and respond to potential attacks. Furthermore, government initiatives and funds, and changing global geopolitical situation have driven the demand for the chemical, biological, radiological, and nuclear security (CBRN) market share.

However, high cost involved in installation and maintenance hampered the growth of the chemical, biological, radiological, and nuclear security (CBRN) market growth. The upfront costs of acquiring and installing CBRN detection, monitoring, and protection systems can be substantial. This initial investment may deter organizations, particularly smaller businesses or governments with limited budgets, from adopting comprehensive CBRN security solutions. Moreover, complexity of threats, and public perception and privacy concern are major factors that hamper the growth of the chemical, biological, radiological, and nuclear security (CBRN) market trends.

On the contrary, increase in focus on biosecurity presents a significant and lucrative opportunity for the Chemical, Biological, Radiological, and Nuclear (CBRN) Security market. Advances in biotechnology, genomics, and molecular diagnostics are driving the development of innovative solutions for biosecurity. chemical, biological, radiological, and nuclear security (CBRN) market players can capitalize on these technological advancements by offering cutting-edge detection, monitoring, and protection systems tailored to address biological threats effectively.

Rapid Response Capability for the Chemical, Biological, Radiological, and Nuclear (CBRN) Security Market

A Rapid Response Capability (RRC) for the chemical, biological, radiological, and nuclear security industry refers to the ability to quickly and effectively respond to CBRN incidents or threats as they occur. Rapid response begins with the timely detection of CBRN agents. Advanced detection systems, including sensors, detectors, and monitoring networks, are essential for quickly identifying the presence of hazardous materials in the environment. Furthermore, efficient communication and information sharing mechanisms are crucial for coordinating response efforts among relevant stakeholders, including emergency responders, law enforcement agencies, public health authorities, and government agencies. Real-time data exchange and situational awareness tools enable rapid decision-making and resource allocation.

Training programs and exercises are essential for ensuring that personnel are adequately prepared to respond to CBRN incidents. This includes training on proper use of protective equipment, decontamination procedures, response protocols, and coordination with other response agencies. Moreover, rapid response capabilities require mobile and deployable assets that can be quickly deployed to the site of an incident. This may include mobile laboratories, field deployable detection systems, decontamination units, and medical treatment facilities.

Comprehensive and integrated response plans are essential for coordinating multi-agency response efforts and ensuring a cohesive approach to CBRN incidents. These plans should outline roles and responsibilities, command structures, communication protocols, and resource allocation mechanisms.

Market Segmentation

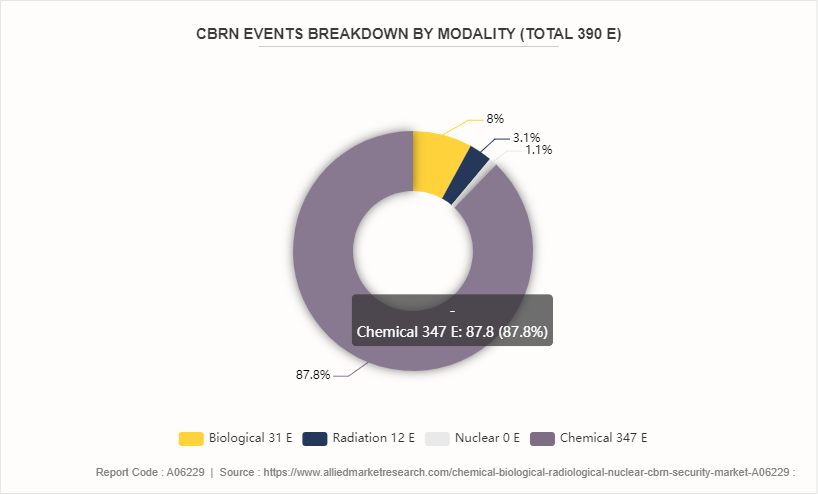

The Chemical, Biological, Radiological, and Nuclear (CBRN) Security market is segmented into type, function, application and region. On the basis of type, the market is segmented into chemical security, biological security, radiological security, and nuclear security. As per function, the market is segregated into decontamination, protection, detection, and simulation. On the basis of application, the market is divided into military, law enforcement, commercial and industrial, healthcare. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America, particularly the United States, has robust regulatory frameworks and standards mandating the implementation of CBRN security measures across various sectors, including defense, homeland security, healthcare, and critical infrastructure. Compliance with these regulations drives the demand for CBRN security solutions in the region. Furthermore, the region is home to a significant number of leading CBRN security technology companies, research institutions, and innovation hubs. Ongoing technological advancements in detection, monitoring, and protection systems, as well as the development of advanced response capabilities, contribute to the region's dominance in the CBRN security market.

The Asia-Pacific region faces increasing threats from terrorism, geopolitical tensions, and the proliferation of CBRN materials. Heightened concerns about regional security drive the demand for CBRN security solutions to mitigate potential risks and enhance preparedness. Moreover, many countries in the Asia-Pacific region are ramping up their defense and homeland security budgets to address evolving security challenges.

furthermore, increased government spending on defense modernization, border security, critical infrastructure protection, and emergency preparedness fuels the demand for CBRN security technologies and services. The Asia-Pacific region is experiencing rapid economic growth, urbanization, and industrialization, leading to increased investments in critical infrastructure such as transportation, energy, healthcare, and telecommunications. The need to protect these assets from CBRN threats drives the adoption of security solutions in the region.

In addition, the North America faces diverse and evolving CBRN threats, including terrorism, industrial accidents, and natural disasters. The region's high threat perception drives investment in CBRN security solutions to enhance preparedness, response, and resilience against potential incidents.

In February 2024, Avon Protection, renowned for its pioneering CBRN personal protective equipment, introduced the EXOSKIN-S1 CBRN protective suit, a crucial addition to its lineup of protective wear, signifying a notable advancement in safeguarding individuals operating in CBRN threat environments globally.

In June 2023, The European Union (EU) and India have enhanced security cooperation through Chemical, Biological, Radiological, and Nuclear (CBRN) training initiatives. This collaboration aims to strengthen preparedness and response capabilities against CBRN threats through knowledge exchange, capacity-building, and joint training exercises.

Competitive Landscape

The report analyzes the profiles of key players operating in the chemical, biological, radiological, and nuclear (CBRN) security market such as AirBoss of America Corp, Argon Electronics, Avon Rubber PLC., BioFire Defense, LLC, Blucher GmbH, Bruker Corporation, FLIR Systems, Inc., HDT Global, MSA Safety Incorporated, and Thales Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the chemical, biological, radiological, and nuclear (CBRN) security market.

Industry Trends

- In May 2024, V2X, Inc. has secured $75 million in new and follow-on contracts to advance next-generation threat detection and response capabilities for Chemical, Biological, Radiological, and Nuclear (CBRN) hazards, marking a significant enhancement in global security and operational readiness against evolving threats.

- In April 2024, The NNSA’s Office of Nuclear Incident Policy and Cooperation (NIPC), along with the NATO Joint Chemical, Biological, Radiological and Nuclear (CBRN) Defence Centre of Excellence and the German CBRN Defence, Safety, and Environmental Protection School, collaborated to provide emergency preparedness and response training to German military and civilian responders in Sonthofen, Germany.

- In April 2024, Biomedical Advanced Research and Development Authority (BARDA), as the lead center within HHS, is responsible for the advanced research and development (AR&D) and procurement of medical countermeasures (MCMs) to protect the American civilian population from CBRN threats, aiding in the Nation's preparedness, response, and recovery from public health emergencies. Through AR&D, BARDA supports the development of promising MCM candidates from preclinical stages to FDA approval, while utilizing Project BioShield (PBS) authorities to procure these MCMs to save lives and safeguard Americans against 21st-century health security threats.

- In October 2023, the U.S. Department of Homeland Security (DHS) is intensifying its efforts to mitigate the risks posed by the convergence of Artificial Intelligence (AI) and Chemical, Biological, Radiological, and Nuclear (CBRN) threats. This initiative recognizes that while AI offers significant benefits in terms of efficiency, predictive capabilities, and response times, it also introduces new vulnerabilities and complexities in managing CBRN threats.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the Chemical, Biological, Radiological, and Nuclear (CBRN) Security market segments, current trends, estimations, and dynamics of the Chemical, Biological, Radiological, and Nuclear (CBRN) Security market analysis from 2022 to 2032 to identify the prevailing chemical, biological, radiological, and nuclear security (CBRN) market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Chemical, Biological, Radiological, and Nuclear (CBRN) Security market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global Chemical, Biological, Radiological, and Nuclear (CBRN) Security market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global Chemical, Biological, Radiological, and Nuclear (CBRN) Security market trends, key players, market segments, application areas, and market growth strategies.

Chemical, Biological, Radiological, and Nuclear (CBRN) Security Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 29.9 Billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 488 |

| By Type |

|

| By Function |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bruker Corporation, Argon Electronics Ltd., BioFire Defense, LLC, HDT Global, LLC, Thales Group, Blucher GmbH, AirBoss of America Corp, FLIR Systems, Inc., MSA Safety Incorporated, Avon Rubber plc |

The upcoming trends in the Chemical, Biological, Radiological, and Nuclear (CBRN) Security Market globally include the increased use of advanced detection and monitoring technologies, integration of artificial intelligence and machine learning for threat assessment, enhanced personal protective equipment (PPE) for first responders, and the development of unmanned systems and robotics for hazardous material handling.

Military is the leading application of chemical, biological, radiological, and nuclear (CBRN) security market.

North America is the largest regional market for chemical, biological, radiological, and nuclear (CBRN) security

29.9 billion is the estimated industry size of chemical, biological, radiological, and nuclear (CBRN) security

AirBoss of America Corp, Argon Electronics, Avon Rubber PLC., BioFire Defense, LLC, Blucher GmbH, Bruker Corporation, FLIR Systems, Inc., HDT Global, MSA Safety Incorporated, and Thales Group are the top companies to hold the market share in Chemical, Biological, Radiological, and Nuclear (CBRN) Security

Loading Table Of Content...