The global chemical warehousing market size was valued at $15.8 billion in 2022, and is projected to reach $22.4 billion by 2032, growing at a CAGR of 3.7% from 2023 to 2032.

Report Key Highlighters:

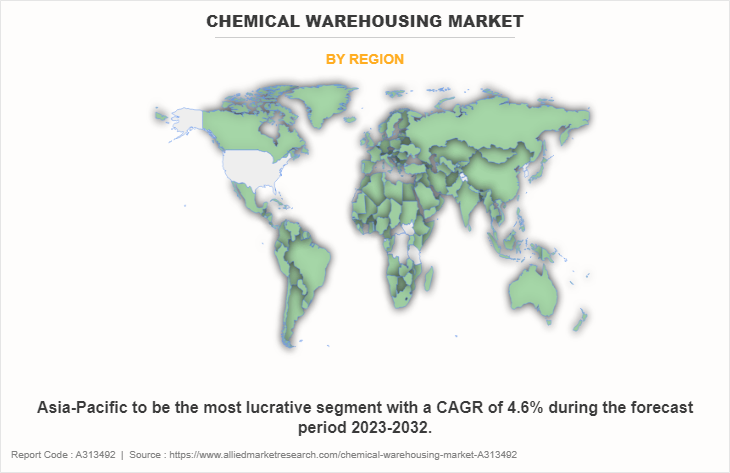

- The chemical warehousing market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The chemical warehousing market share is highly fragmented, into several players including Odyssey Logistics & Technology Corporation, Univar Solutions LLC, Rinchem Company, LLC, Anchor 3PL, BRENNTAG, Broekman Logistics, Commonwealth Inc., DHL, RSA TALKE, KEMITO B.V. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Chemical warehousing is the management of specialized storage and handling of chemical products and related products in dedicated facilities, which are specifically designed to meet safety standards protocols associated with chemical storage. These warehouses play an important role in the chemical supply chain by ensuring safe, secure, and compatible storage of various chemical substances before they are distributed to end users. Chemical warehousing necessitates specific procedures and infrastructure to handle the diverse and hazardous nature of chemicals.

The chemical warehousing market trends is growing due to increase in chemical production, increase in demand for warehousing and distribution logistics in the e-commerce industry, and rise in the need to handle and distribute dangerous chemicals. However, lack of control of manufacturers is hampering the market growth. Furthermore, introduction of blockchain technology in warehouse management is anticipated to create lucrative market growth opportunities for the companies operating in the market.

Production of various chemicals has been on the rise in recent years, owing to growing demand from various end-use industries. After the COVID-19 pandemic, major chemical manufacturers shifted tier focus away from China and diversified their manufacturing facilities in other parts of the worlds, majorly in Asia and Latin America regions. In recent years, India also emerged as a major chemical producing country driven by strong government focus, low labor wages, strong geopolitical location, global trade reach, and increase in import and export activities. India currently manufactures around 80,000 different chemicals, which are used in various industries such as clothing, automotive, farming, packaging, medications, health care, construction, and technology.

The country also exports a huge portion of its manufactured chemicals that need to be safely stored, which, in turn, is anticipated to boost the growth of the global chemical warehousing market in the future. Thus, increase in chemical production for various end-use industries is anticipated to propel growth of the market during the forecast period.

In addition, the introduction of blockchain technology has witnessed significant growth and is poised to offer compelling opportunities in the coming years. Technological advancement such as block-chain enables enhanced chemical management, tracking and transparency of the overall lifecycle of chemicals. The leading market players of the chemical warehousing industry have begun testing and deploying blockchain technology for augmenting their efficient chemical warehouse management.

For instance, in November 2023, Allcargo Logistics, an integrated logistics solutions company with a presence in over 180 countries, provided end-to-end services across various segments of the supply chain. The company unveiled its new manufacturing facility in Uran, Navi Mumbai, India. The new hi-tech facility is specifically developed with advanced cold storage technology to maintain an optimum temperature of 25 degree Celsius. The facility also has modern infrastructure and an advanced warehouse management system (WMS), which improves the process of transporting and storing goods while complying with all required regulations. The supply chain leaders are also implementing a combination of block-chain strategies for managing product lifecycles such as recycling, and disposal. The evolution of advanced blockchain technology presents an opportunity for the growth of the chemical warehousing market.

However, chemical manufacturers and retailers are completely dependent on reliability, competency, and honesty of warehousing service providers. Thus, the manufacturing or retailing company is reliant on the chemical warehousing management and logistics companies, which results in lack of direct control. In addition, the manufacturer is not able to monitor the operations at the warehouse, which is a serious threat to the quality of products.

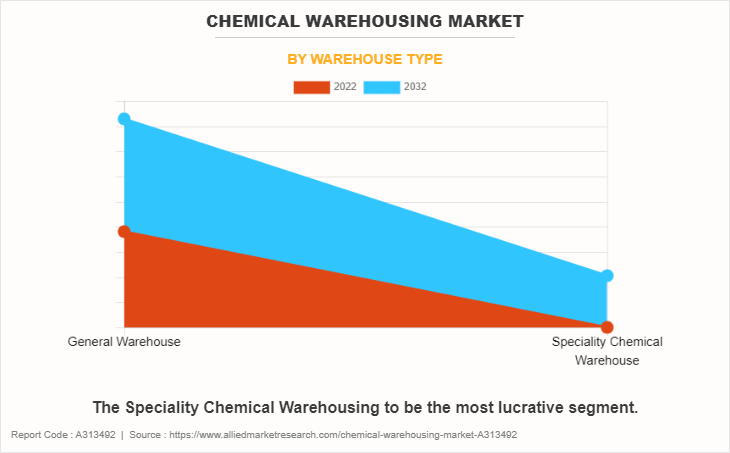

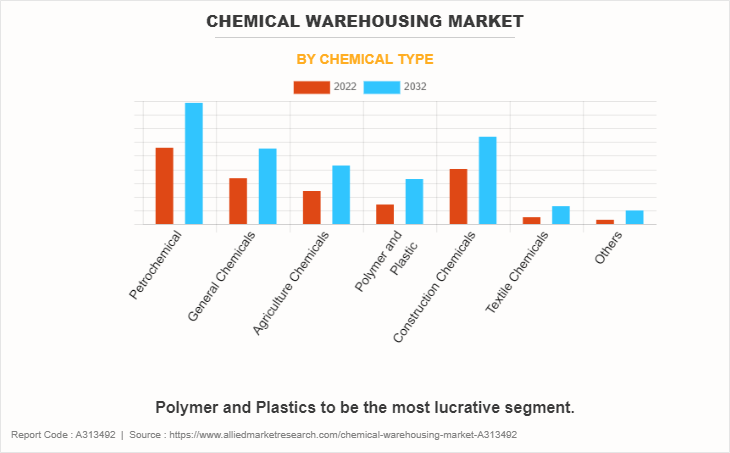

The global chemical warehousing market is segmented on the basis of warehouse type, chemical type, and region. On the basis of warehouse type, the market is bifurcated into general warehouse and speciality chemical warehouse. On the basis of chemical type, the market is segmented into petrochemical, general chemicals, agriculture chemicals, polymer and plastic, construction chemicals, textile chemicals, and others.

Key Developments in Chemical Warehousing Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On November 13, 2023, Odyssey Logistics & Technology Corporation announced its transition as an unified Odyssey brand. It centralized all its offerings under four core divisions, such as transport & warehouse, intermodal, integrated marine logistics, and managed services. This strategy has enabled the company to offer all its services in a more transparent and streamlined way.

- On April 13, 2023, Odyssey Logistics & Technology Corporation announced that it has sold its bulk tank transport subsidiary, Linden Bulk Transportation LLC to Boasso Global. The Linden sale is consistent with Odyssey's strategy of providing neutral transport solutions, allowing the company to leverage the entire range of carriers for the benefit of its customers.

- On September 5, 2023, Univar Solutions LLC. acquired FloChem Ltd., a Canada-based bulk liquid chemicals distribution company. The acquisition will help Univar Solutions LLC increase its market penetration, particularly in the Eastern Canada region and enhance its product portfolio.

- On June 7, 2023, Rinchem Company, LLC opened its new HAZMAT warehousing facility in Cornelius, Oregon. The new facility is consistent with the company's business strategy of expanding its network of chemical storage facilities throughout the county and serving a diverse range of customers.

Rise in Need to Handle and Distribute Dangerous Chemicals

Several chemical warehousing companies are indulged in handling various toxic and dangerous finished chemical products that are used in several industries such as oil & gas, pharmaceuticals, and process industries. Manufacturers and warehouse service providing companies are adopting federal and state safety regulations while handling dangerous goods to minimize the risk involved. For instance, major third-party logistics providers are offering sophisticated chemical shipments, specifically for hazardous and toxic chemicals that include services such as efficient management and storage of these chemicals throughout the entire supply chain, resulting in managing the manufactured chemicals in an enhanced manner. Thus, rise in need for handling and distribution of dangerous chemical products drives the chemical warehousing market growth.

Poor Infrastructure and High Cost

Chemical warehousing providers demand good infrastructure, strong supply chain, and trade facilitation. Without these, chemical manufacturers may face deterioration of chemical products. Before reaching the warehouse, the chemicals are transported through networks of railways, roads, airways, and seaways. Thus, there are several complexities involved during transportation of goods such as oversaturated rail network, uncertain transit time, and improper flexibility in transport of chemicals with different specifications, which hamper the chemicals. Furthermore, freight transport by railway and roadways can take longer time, and owing to uncertainty in transit time, many chemical logistical companies end up carrying excess stock with improper safety to avoid losing sales. Similarly, improper handling and storage of chemicals inside the warehouse hampers the overall market growth.

Technological Growth in the Chemical Warehousing Sector

Rise in demand for automation and modernized green warehouses in the chemical industry for sustainable business operations propels the market growth. With rise in concerns regarding energy conservation and environment protection, chemical warehouse service providers are increasingly investing in cost-effective warehousing solutions that combine green practices and smart technology, such as the Internet of Things (IoT), smart sensors, and robotics. In addition, vendors also provide digital tools to automate chemical warehousing and process data with enhanced productivity, efficiency, and convenience. Moreover, growth in use of artificial intelligence (AI), machine learning, radio-frequency identification (RFID), and Bluetooth is further helping to improve chemical warehouse operations. Therefore, growth in technological advancements in the logistics industry offers lucrative growth opportunities for market growth.

Russia-Ukraine War Impact Analysis on Chemical Warehousing Industry

The Russia-Ukraine has an enormous impact on the overall chemical warehousing market. However, the Russia-Ukraine war has potentially impacted the markets beyond its geographical area. For instance, the impact on trade due to Russia-Ukraine war disrupted the of exports of chemicals from the war prone region. Russia and Ukraine are among a major exporter of chemicals globally. These chemicals are extensively used in different end-use industries, such as agriculture, petroleum, construction, textile, and others. The war resulted in trade containment policies. Countries have implemented sanctions and trade restrictions on Russia, affecting global trade dynamics. These measures have disrupted established trade relationships and supply chains, leading to a decline in trade volumes, thus resulting in a minor decline in demand for chemical warehousing.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the chemical warehousing market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Chemical Warehousing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 22.4 billion |

| Growth Rate | CAGR of 3.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 189 |

| By Warehouse Type |

|

| By Chemical Type |

|

| By Region |

|

| Key Market Players | Brenntag SE, Commonwealth Inc., KEMITO, Broekman Logistics, Univar Solutions LLC, Rinchem Company, LLC, Odyssey Logistics & Technology Corporation, Anchor 3PL, DHL GROUP, RSA TALKE |

Specialty chemical warehousing is the upcoming trend in the market.

Safe and secure chemical storage is the leading application of chemical warehousing.

Asia-Pacific is the largest region for the chemical warehousing market.

The chemical warehousing market was valued at $ 15,804.9 million in 2022.

Odyssey Logistics & Technology Corporation., DHL, Univar Solutions LLC. and RSA TALKE are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...