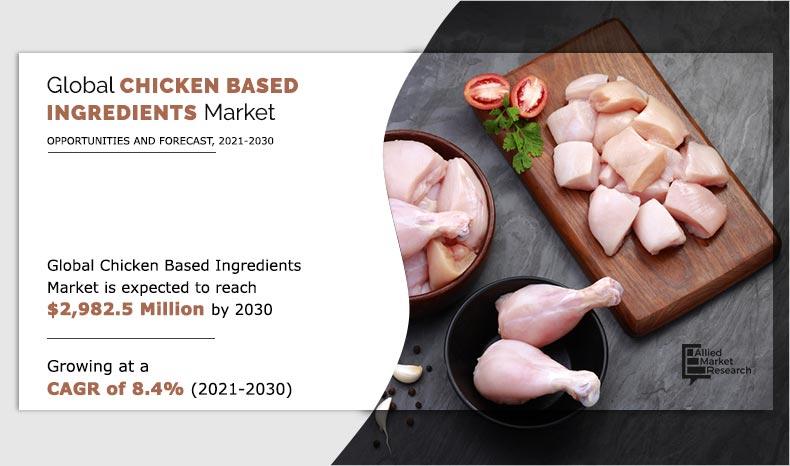

The global chicken based ingredients market size was valued at $1,364.7 million in 2020, and is estimated to reach $2,982.5 million by 2030, registering a CAGR of 8.4% from 2021 to 2030.

Chicken based ingredients are derived from chickens through a variety of processes. These ingredients are widely used in the food & beverage industries, as well as the pharmaceutical, animal feed, and pet food industries. Some of the ingredients are also used as food or dietary supplements by fitness enthusiasts. Chicken protein powder, which is used as a food supplement, is made by rendering the chicken.

The changes in diet trends, chicken based ingredients market developments, and R&D initiatives undertaken by major food companies are expected to drive the market growth, resulting in economic growth in the industry. Over the next few years, product demand is expected to be driven by rise in health consciousness and increased consumption of protein-rich diets.

The increase in consumers purchasing power contributes toward chicken based ingredients market expansion. There is a greater shift from conventional food to packaged food products because of the accelerated pace of life in both developing and developed countries, resulting in a greater demand for chicken based ingredients. Furthermore, as consumers become aware of the importance of eating nutritious foods, there is an increase in demand for chicken protein globally, boosting the market growth for chicken based ingredients.

The surge in demand for additional healthy products among athletes and bodybuilders to improve performance, general fitness, and overall health provide manufacturers with a promising market outlook. Persuading health benefits such as improved digestive health, immunity, and soft tissue recovery are the major factors driving the growth of the chicken based ingredients market.

There is an increase in the demand for chicken-based ingredients due to changes in social and economic patterns, as well as increased food & beverage expenditure, awareness about healthy food, changes in meal patterns, and a desire to try new products.

Rise in technological developments, such as digitalized industrial processes and automation for specialty food manufacturing, will have a positive impact on the overall chicken based ingredients market scenario. It is expected that the poultry processing industries will modernize their production lines to produce additive-free ingredients. To gain a competitive advantage, manufacturers are expected to invest in new technologies and expand their existing production capacity.

However, increased health concerns such as heart disease and obesity as a result of excessive consumption of chicken fats and oils, rise in quality standards, strict government food safety regulations, and surge in environmental concerns hinder the growth of the chicken based ingredients market in the near future.

The COVID-19 pandemic has resulted in travel restrictions and the closure of manufacturing units, offices, and marketplaces by governments all over the world. As a result of such restrictions, value chains all over the world have been disrupted. This had a negative impact on the supply of raw materials used to make chicken based ingredients. The global manufacturing plants have been shut down, potentially reducing the use of chicken based ingredients because of the pandemic outbreak.

The surge in demand for health and wellness foods & beverages around the world is the primary driver of market expansion. There are numerous reasons to include chicken based ingredients in diet. Gelatin, a hydrophilic colloid, is found in chicken bone broth. It attracts and holds liquids, including digestive juices, and thus aids in digestion. Ingredients derived from chicken are high in calcium, magnesium, and other nutrients that aid in bone formation. The shift in consumer preferences toward vegan and cruelty-free foods is the major barrier to chicken-based ingredients market growth.

By Type

Fat segment is expected to grow at highest CAGR of 9.6% during the forecast period

According to chicken based ingredients market analysis, the chicken based ingredients market is segmented on the basis of type, application, distribution channel, and region. On the basis of type, it is categorized into oil, broth, fat, and protein. As per application, it is divided into food & beverage, animal feed, biodiesel, and food supplement. According to distribution channel, it is fragmented into hypermarkets & supermarkets, convenience stores, specialty stores, and online sales channel. Region-wise, the chicken based ingredients market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the fat segment garnered the highest market share in 2020 due to rise in demand for chicken fat in the food & beverage, biodiesel, and animal feed industries. On the basis of application, the food & beverage segment is anticipated to dominate with the highest chicken based ingredients market share during the forecast period. This is attributed to increase in consumption of chicken based ingredients in countries such as North America and Europe.

By Application

Food & Beverage segment is expected to grow at highest CAGR of 9.4% during the forecast period.

By distribution channel, the specialty stores segment led the market in 2020 for chicken based ingredients market size. This is due to the fact that specialty stores provide options such as discounts and the convenience of instant gratification. Region-wise, North America is expected to dominate the market according to chicken based ingredients market forecast. Surge in demand for pet food and food supplements drives the growth of the chicken based ingredients market in North America.

The emergence of fortified food preferences in Europe and North America is expected to fuel the region's chicken based ingredients market growth. Asia-Pacific and Latin America are anticipated to experience significant growth rates during the forecast period, owing to rise in chicken based ingredients’ demand in the region. The Middle East and Africa region is expected to generate a healthy demand for chicken based ingredients during the forecast period owing to rise in urban population.

By Distribution Channel

Specialty Stores segment is expected to grow at highest CAGR of 9.6% during the forecast period.

Manufacturers have numerous market opportunities as a result of rise in demand for chicken based ingredients. The e-commerce industry provides enormous opportunities to manufacturers of chicken based ingredients because of its global reach to consumers at the same time. Market opportunities are experiencing growth as a result of significant rise in the overall food & beverage industry. People are willing to spend more money on quality and taste because of the increase in per capita income around the world. People are incorporating chicken based ingredients into their daily diets, providing manufacturers with significant market opportunity.

By Regions

North America dominates the market and is expected to grow at highest CAGR of 9.3% during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of current chicken based ingredients market trends, estimations, and dynamics of the global chicken based ingredients market from 2021 to 2030 to identify the prevailing chicken based ingredients market opportunities.

- Porter’s five forces analysis highlights the potency of the buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global chicken based ingredients industry. The market player positioning segment facilitates benchmarking while providing a clear understanding of the present position of the key market players.

- The report includes analyses of the regional as well as global market, key players, market segments, application areas, and growth strategies.

Chicken based ingredients Market Report Highlights

| Aspects | Details |

| By Type |

|

| By APPLICATION |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | Epic Provisions, Proliver, Sanimax, International Dehydrated Foods, Inc., Piermen B.V., Lonolife Inc, Borough Broth, Bare Bones, Pacific Foods of Oregon LLC, Kettle and Fire Inc. |

Analyst Review

According to the insights of CXOs of leading companies, chicken based ingredients include oil, broth, protein, and fat. Fats and oils have a wide range of fatty acid compositions. Chicken fat matrices differ significantly from vegetable fat oil matrices.

Chicken consumption and production have increased rapidly over the last few decades. Chicken based ingredients are used to change the attributes and properties of food as well as to add flavor.

The market is being driven by demand from the North America region. The respective food sectors of these countries, which are supported by rise in living standards and population growth drive the demand for chicken based ingredients. Surge in focus on biofuels, such as biodiesel made from chicken oils and fats, is increases the demand for chicken based ingredients.

The key players in the market for chicken based ingredients have been expanding into new markets through acquisitions, new product development, agreements, and certifications. New trans-fatty acid labelling requirements are putting pressure on manufacturers to use alternative methods for producing hydrogenated oils, which increases the demand for chicken oil with high trans-fat levels.

Chicken processing technology is expected to help improve the quality of heavily extended chicken based ingredient products. The stringent regulations imposed by the Food and Drug Administration (FDA) and other regulatory bodies in the developed markets impede the growth of processed foods, particularly processed meat and poultry. This is expected to have a direct impact on the market growth.

The global chicken based ingredients market size was valued at $1,364.7 million in 2020, and is estimated to reach $2,982.5 million by 2030, registering a CAGR of 8.4% from 2021 to 2030.

The CAGR of chicken based ingredients market is 8.4% from 2021 to 2030.

The sample report of chicken based ingredients market is available on the website of Allied Market Research website on request.

The forecast period in the chicken based ingredients market report is 2021-2030.

The top companies operating in the global chicken based ingredients market are Bare Bones, Borough Broth, Brodo, Broth of Life, Epic Provisions, International Dehydrated Foods Inc., Kettle and Fire Inc., Lonolife, Manischewitz, Pacific Foods of Oregon LLC, Piermen B.V., Proliver, Sanimax, Stara Foods and Symrise AG.

The increased demand for chicken based ingredients in the food & beverage, and animal feed industries is driving the market. Chicken based ingredients are used to make biodiesel because they are less expensive alternatives to oils such as soybean and canola, and they are readily available from butcher shops and food processing companies. Due to its low cost and high yield potential, chicken based ingredients have proven to be a favorable raw material. Furthermore, because they are high in essential fatty acids and thus boost the nutritional value of the feed, they are widely used in the production of animal feed and pet meals, fueling the market expansion.

The global chicken based ingredients market is segmented on the basis of type, application, distribution channel, and region. On the basis of type, the market is categorized into oil, broth, fat, and protein. As per application, it is divided into food & beverage, animal feed, biodiesel, and food supplement. According to distribution channel, the chicken based ingredients market is fragmented into hypermarkets & supermarkets, convenience stores, specialty stores, and online sales channel. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, France, the Netherlands, Germany, Turkey, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, the UAE, and the rest of LAMEA).

North America holds the maximum market share of the chicken based ingredients market.

Chicken based ingredients are widely used in a variety of applications such as food supplements, biodiesel, and animal feed. Furthermore, due to its high consumption in the production of pharmaceutical products, demand for chicken based ingredients has remained stable around the world. The outbreak of COVID-19 disease increased consumer demand for pharmaceutical products because people were concerned about their health.

Loading Table Of Content...